Intro

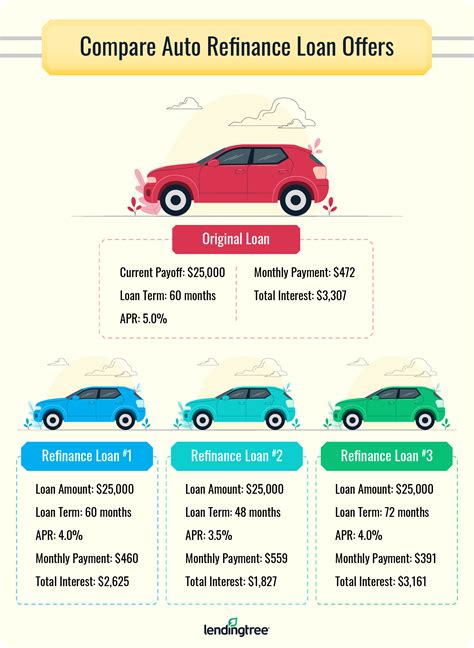

Discover 5 ways to take over car payments, including assumption, lease transfer, and refinancing, to lower monthly auto loan payments and escape bad car deals with flexible payment options.

Taking over car payments can be a viable option for individuals who want to acquire a vehicle without going through the traditional buying process. This approach can be beneficial for both the buyer and the seller, as it allows the seller to get out of their car loan while the buyer can drive away in a new vehicle. In this article, we will explore five ways to take over car payments, including the benefits and drawbacks of each method.

When considering taking over car payments, it's essential to understand the process and the potential risks involved. The buyer must take on the remaining balance of the car loan, which can be a significant financial commitment. However, with the right approach, taking over car payments can be a smart move for those who want to own a vehicle without breaking the bank. Whether you're a buyer or a seller, it's crucial to approach this process with caution and carefully evaluate the terms of the loan.

The concept of taking over car payments has gained popularity in recent years, as more people are looking for alternative ways to acquire vehicles. This method can be particularly appealing to those who have poor credit or cannot afford a down payment. By taking over car payments, buyers can get behind the wheel of a car they might not have been able to afford otherwise. Moreover, sellers can benefit from this arrangement by getting out of their car loan and avoiding the hassle of selling their vehicle.

Understanding the Process of Taking Over Car Payments

Benefits of Taking Over Car Payments

Taking over car payments can be a win-win situation for both the buyer and the seller. The benefits of this approach include: * Lower upfront costs: Buyers can acquire a vehicle without having to pay a large down payment. * Reduced debt: Sellers can get out of their car loan and avoid the hassle of selling their vehicle. * Flexibility: Buyers can choose from a variety of vehicles, including models that may not be available for purchase through traditional means. * Convenience: The process of taking over car payments can be faster than buying a vehicle through a dealership.5 Ways to Take Over Car Payments

Drawbacks of Taking Over Car Payments

While taking over car payments can be a smart move, there are some drawbacks to consider: * **High Monthly Payments**: The buyer may be responsible for making high monthly payments, which can be a significant financial burden. * **Limited Flexibility**: The buyer may be locked into a loan with unfavorable terms, which can limit their flexibility. * **Risk of Default**: If the buyer defaults on the loan, they may face penalties and damage to their credit score. * **Hidden Fees**: The buyer may be responsible for paying hidden fees, such as transfer fees or documentation fees.Tips for Taking Over Car Payments

Common Mistakes to Avoid

When taking over car payments, there are some common mistakes to avoid: * **Not researching the vehicle**: Failing to research the vehicle's history and condition can lead to unexpected repairs and maintenance costs. * **Not reviewing the loan terms**: Failing to carefully review the loan terms can lead to unexpected fees and penalties. * **Not negotiating with the seller**: Failing to negotiate with the seller can result in a higher purchase price or less favorable loan terms. * **Not working with the lender**: Failing to work with the lender can lead to delays or complications in the transfer of the loan.Conclusion and Next Steps

Gallery of Taking Over Car Payments

What are the benefits of taking over car payments?

+The benefits of taking over car payments include lower upfront costs, reduced debt, flexibility, and convenience.

What are the drawbacks of taking over car payments?

+The drawbacks of taking over car payments include high monthly payments, limited flexibility, risk of default, and hidden fees.

How do I take over car payments?

+To take over car payments, you can assume the loan, take over a lease, transfer the car loan, buy from a private party, or use car sharing services.

What should I consider when taking over car payments?

+When taking over car payments, consider the vehicle's history and condition, review the loan terms, negotiate with the seller, and work with the lender.

Can I take over car payments with bad credit?

+It may be more challenging to take over car payments with bad credit, but it's not impossible. You may need to work with a lender that specializes in subprime loans or consider alternative options.

We hope this article has provided you with valuable insights into the process of taking over car payments. Whether you're a buyer or a seller, it's essential to approach this process with caution and carefully evaluate the terms of the loan. If you have any further questions or would like to share your experiences, please don't hesitate to comment below. Additionally, feel free to share this article with others who may be interested in taking over car payments.