Intro

Streamline church finances with 5 free budget templates, featuring expense tracking, donation management, and financial reporting, ideal for church administrators and pastors seeking efficient budgeting and accounting solutions.

Managing finances is a crucial aspect of running a church, as it ensures the organization can fulfill its mission and provide for its community. A well-structured budget is essential for achieving financial stability and making informed decisions. In this article, we will explore the importance of budgeting for churches and provide five free church budget templates to help you get started.

Creating a budget for a church can be a daunting task, especially for those with little experience in financial management. However, with the right tools and resources, it can be a straightforward process. A budget helps churches allocate their resources effectively, prioritize their spending, and make conscious decisions about how to use their funds. By having a clear understanding of their income and expenses, churches can ensure they are using their resources to maximum effect and achieving their goals.

Effective budgeting also enables churches to plan for the future, whether it's saving for a new building, funding community programs, or supporting missionaries. By prioritizing their spending and making smart financial decisions, churches can build a strong foundation for long-term sustainability and growth. In addition, a well-managed budget can help churches build trust with their congregation and stakeholders, demonstrating transparency and accountability in their financial dealings.

Understanding Church Budgeting

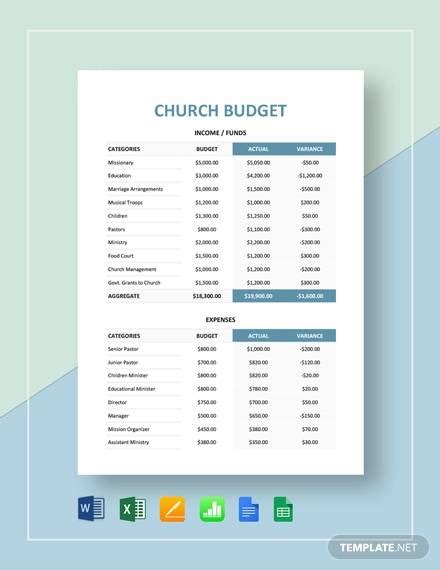

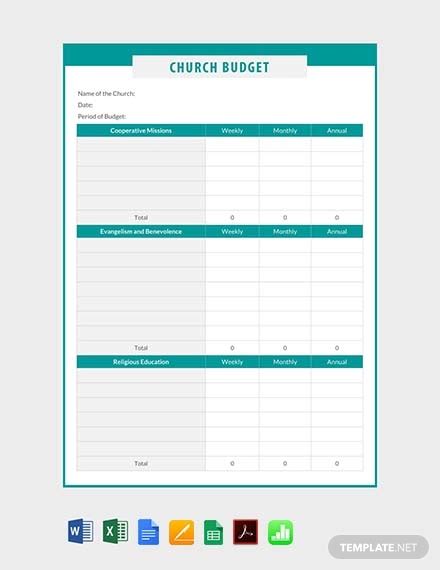

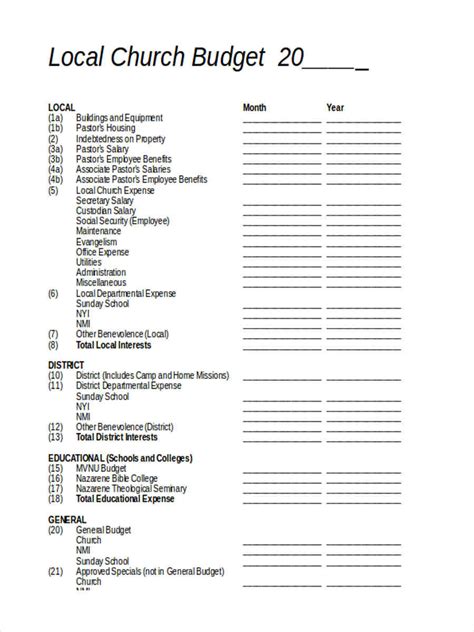

Before we dive into the free church budget templates, it's essential to understand the basics of church budgeting. A church budget typically consists of several key components, including income, expenses, and savings. Income includes all the money the church receives, such as donations, tithes, and fundraising events. Expenses, on the other hand, include all the costs associated with running the church, such as salaries, utilities, and maintenance.

Key Components of a Church Budget

When creating a church budget, there are several key components to consider: * Income: This includes all the money the church receives, such as donations, tithes, and fundraising events. * Expenses: This includes all the costs associated with running the church, such as salaries, utilities, and maintenance. * Savings: This includes any money the church sets aside for future projects or emergencies. * Debt repayment: This includes any money the church owes, such as loans or mortgages.Free Church Budget Templates

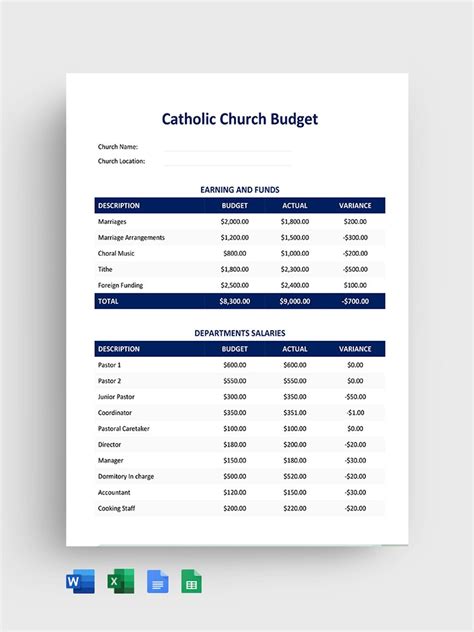

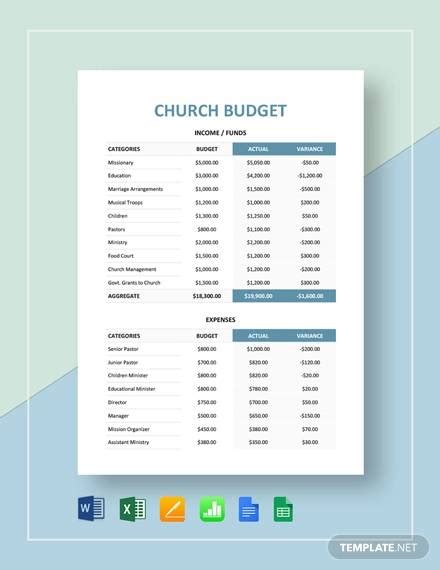

Here are five free church budget templates to help you get started:

- Simple Church Budget Template: This template provides a basic outline for creating a church budget, including income, expenses, and savings.

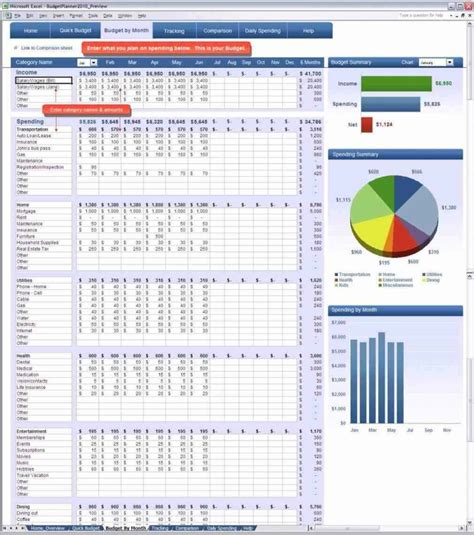

- Detailed Church Budget Template: This template provides a more detailed breakdown of income and expenses, including categories for salaries, utilities, and maintenance.

- Church Budget Template with Fundraising: This template includes a section for tracking fundraising events and campaigns, helping you to stay on top of your fundraising efforts.

- Church Budget Template with Debt Repayment: This template includes a section for tracking debt repayment, helping you to stay on top of your loans and mortgages.

- Church Budget Template with Savings Goals: This template includes a section for setting savings goals, helping you to plan for future projects and emergencies.

Benefits of Using a Church Budget Template

Using a church budget template can have several benefits, including: * Simplifying the budgeting process: A template can provide a clear outline for creating a budget, making it easier to get started. * Improving financial transparency: A template can help you to track your income and expenses, providing a clear picture of your church's financial situation. * Enhancing financial planning: A template can help you to plan for the future, whether it's saving for a new building or funding community programs.How to Use a Church Budget Template

Using a church budget template is straightforward. Simply download the template, fill in the relevant information, and review your budget regularly. Here are some steps to follow:

- Download the template: Choose a template that suits your needs and download it to your computer.

- Fill in the relevant information: Enter your church's income, expenses, and savings into the template.

- Review your budget: Regularly review your budget to ensure you are on track to meet your financial goals.

- Make adjustments: Make adjustments to your budget as needed, whether it's to reflect changes in income or expenses.

Tips for Creating a Church Budget

Here are some tips for creating a church budget: * Start with a clear understanding of your church's mission and goals. * Gather all relevant financial information, including income, expenses, and savings. * Prioritize your spending, focusing on essential expenses such as salaries and utilities. * Set savings goals, whether it's for future projects or emergencies.Common Challenges in Church Budgeting

Church budgeting can be challenging, especially for those with little experience in financial management. Here are some common challenges to watch out for:

- Lack of financial transparency: Failing to track income and expenses can make it difficult to create an accurate budget.

- Insufficient savings: Failing to set aside enough money for savings can leave the church vulnerable to financial shocks.

- Inadequate planning: Failing to plan for the future can make it difficult to achieve long-term goals.

Overcoming Common Challenges

Here are some tips for overcoming common challenges in church budgeting: * **Improve financial transparency**: Use a budget template to track income and expenses, providing a clear picture of your church's financial situation. * **Increase savings**: Set aside a portion of your income each month, whether it's for future projects or emergencies. * **Develop a long-term plan**: Create a plan that outlines your church's goals and objectives, helping you to stay focused on what's important.Best Practices for Church Budgeting

Here are some best practices for church budgeting:

- Create a budget that aligns with your mission: Ensure that your budget reflects your church's mission and goals.

- Prioritize your spending: Focus on essential expenses such as salaries and utilities.

- Set savings goals: Set aside a portion of your income each month, whether it's for future projects or emergencies.

Conclusion and Next Steps

Creating a church budget can be a challenging task, but with the right tools and resources, it can be a straightforward process. By using a church budget template and following best practices, you can create a budget that helps your church achieve its mission and goals. Remember to review your budget regularly, make adjustments as needed, and prioritize your spending. With a well-managed budget, your church can build a strong foundation for long-term sustainability and growth.Church Budgeting Image Gallery

What is a church budget template?

+A church budget template is a tool used to help churches create a budget that aligns with their mission and goals.

Why is church budgeting important?

+Church budgeting is important because it helps churches manage their finances effectively, prioritize their spending, and make informed decisions about how to use their resources.

How do I create a church budget?

+To create a church budget, start by gathering all relevant financial information, including income, expenses, and savings. Then, use a budget template to help you prioritize your spending and make informed decisions about how to use your resources.

What are some common challenges in church budgeting?

+Some common challenges in church budgeting include lack of financial transparency, insufficient savings, and inadequate planning.

How can I overcome common challenges in church budgeting?

+To overcome common challenges in church budgeting, improve financial transparency by using a budget template, increase savings by setting aside a portion of your income each month, and develop a long-term plan that outlines your church's goals and objectives.

We hope this article has provided you with a comprehensive understanding of church budgeting and the importance of using a church budget template. By following the tips and best practices outlined in this article, you can create a budget that helps your church achieve its mission and goals. Remember to review your budget regularly, make adjustments as needed, and prioritize your spending. With a well-managed budget, your church can build a strong foundation for long-term sustainability and growth. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from learning about church budgeting, and take the first step towards creating a budget that aligns with your church's mission and goals.