Intro

Discover 5 ways an amortization schedule simplifies loan management, including mortgage amortization, debt repayment, and interest calculation, to help borrowers understand loan terms and repayment strategies.

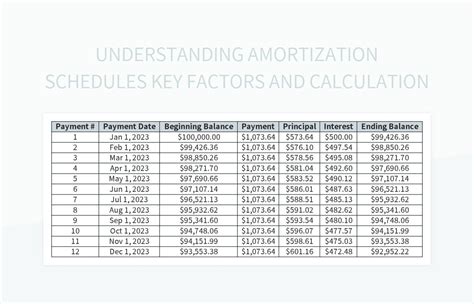

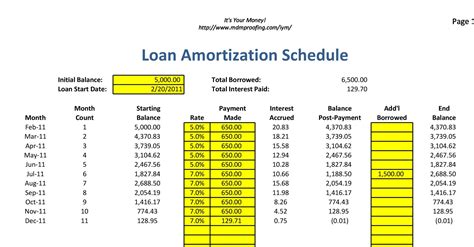

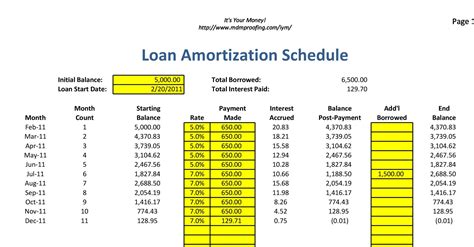

Amortization is a fundamental concept in finance that refers to the process of gradually paying off a debt, such as a mortgage or a car loan, through regular payments. An amortization schedule is a table that outlines the amount of each payment that goes towards interest and principal, as well as the remaining balance after each payment. Understanding how an amortization schedule works is crucial for managing debt effectively. In this article, we will explore five ways an amortization schedule can help individuals and businesses make informed decisions about their loans.

Initially, it's essential to recognize the importance of amortization schedules in personal finance. By breaking down the total cost of a loan into manageable monthly payments, individuals can better plan their expenses and avoid financial strain. Moreover, amortization schedules provide a clear picture of how much of each payment goes towards interest and principal, allowing borrowers to make informed decisions about their debt. For instance, a borrower may choose to make extra payments towards the principal to reduce the overall interest paid over the life of the loan. This strategy can save thousands of dollars in interest payments and help borrowers pay off their loans faster.

Understanding Amortization Schedules

Benefits of Amortization Schedules

Creating an Amortization Schedule

Using Amortization Schedules to Make Informed Decisions

Common Mistakes to Avoid When Using Amortization Schedules

Amortization Schedule Image Gallery

What is an amortization schedule?

+An amortization schedule is a table that outlines the amount of each payment that goes towards interest and principal, as well as the remaining balance after each payment.

How is an amortization schedule calculated?

+An amortization schedule is calculated using a formula that takes into account the loan amount, interest rate, and repayment term.

What are the benefits of using an amortization schedule?

+The benefits of using an amortization schedule include transparency and clarity on loan repayments, as well as the ability to make informed decisions about loans.

Can I create my own amortization schedule?

+Yes, you can create your own amortization schedule using a spreadsheet or a financial calculator.

Why is it important to review an amortization schedule carefully?

+It is essential to review an amortization schedule carefully to ensure that you understand the total cost of the loan, including interest payments, and the repayment term.

In conclusion, amortization schedules are a powerful tool for managing debt and making informed decisions about loans. By understanding how an amortization schedule works and using it to make informed decisions, borrowers can save thousands of dollars in interest payments and pay off their loans faster. Whether you're a homeowner, a business owner, or an individual with debt, an amortization schedule can help you take control of your finances and achieve your goals. We invite you to share your thoughts and experiences with amortization schedules in the comments below, and to share this article with anyone who may benefit from it.