Intro

Boost savings with the 52 Week Money Challenge, a simple savings plan using weekly deposits, budgeting strategies, and financial discipline to reach yearly goals.

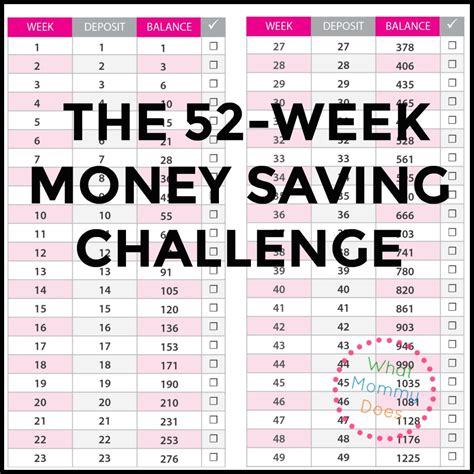

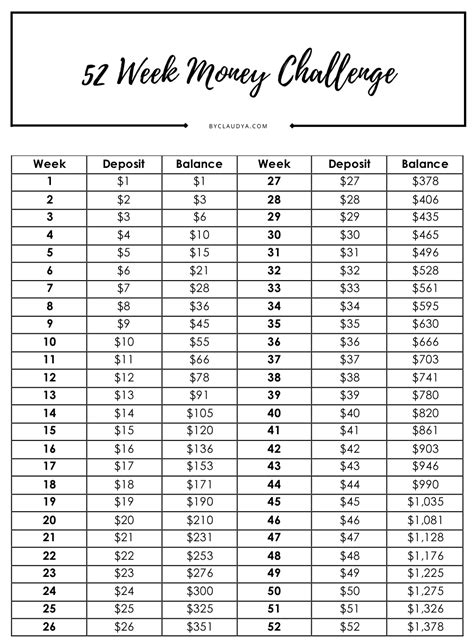

Saving money can be a daunting task, especially when you're trying to make ends meet. However, having a solid savings plan in place can help alleviate financial stress and provide a sense of security. One popular savings strategy that has gained traction in recent years is the 52 Week Money Challenge. This challenge is designed to help individuals save money by depositing an amount equal to the number of the week into their savings account. For example, during week one, you would deposit $1, during week two, you would deposit $2, and so on. By the end of the 52-week period, you will have saved a significant amount of money.

The 52 Week Money Challenge is an excellent way to develop a savings habit, as it requires you to set aside a small amount of money each week. This challenge is ideal for individuals who are new to saving or those who want to supplement their existing savings plan. The best part about this challenge is that it's flexible and can be adapted to fit your financial needs. You can start the challenge at any time and adjust the amount you save each week based on your income and expenses. Additionally, you can also involve your family and friends in the challenge, making it a fun and interactive way to save money.

The 52 Week Money Challenge has gained popularity due to its simplicity and effectiveness. It's a great way to save money without feeling overwhelmed, as the weekly deposits are relatively small. By the end of the challenge, you will have saved over $1,300, which can be used to pay off debt, build an emergency fund, or achieve a long-term financial goal. The challenge also helps you develop a savings mindset, which is essential for achieving financial stability. By prioritizing savings and making it a habit, you'll be more likely to make smart financial decisions and avoid unnecessary expenses.

How the 52 Week Money Challenge Works

The 52 Week Money Challenge is a straightforward savings plan that requires you to deposit a specific amount of money into your savings account each week. The amount you deposit corresponds to the number of the week. For example, during week one, you deposit $1, during week two, you deposit $2, and so on. The challenge continues for 52 weeks, and by the end of the period, you will have saved a total of $1,378. The challenge can be started at any time, and you can adjust the amount you save each week based on your financial situation.

Benefits of the 52 Week Money Challenge

The 52 Week Money Challenge offers several benefits, including: * Developing a savings habit: The challenge helps you prioritize savings and make it a habit. * Building an emergency fund: The challenge can help you build a cushion in case of unexpected expenses or financial setbacks. * Paying off debt: The challenge can provide you with the funds needed to pay off high-interest debt or loans. * Achieving long-term financial goals: The challenge can help you save for long-term goals, such as buying a house, retirement, or a big purchase.Tips for Success

To succeed in the 52 Week Money Challenge, consider the following tips:

- Start small: Begin with a manageable amount and gradually increase it as you become more comfortable with saving.

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Track your progress: Keep a record of your savings to monitor your progress and stay motivated.

- Avoid dipping into your savings: Treat your savings as untouchable and avoid using it for non-essential expenses.

- Involve others: Share the challenge with friends and family to make it more engaging and fun.

Overcoming Obstacles

While the 52 Week Money Challenge is a great way to save money, you may encounter obstacles along the way. Here are some common challenges and how to overcome them: * Lack of motivation: Remind yourself of your financial goals and the benefits of saving. * Limited income: Start with a smaller amount and gradually increase it as your income grows. * Emergency expenses: Use the 50/30/20 rule to allocate your income towards essential expenses, savings, and discretionary spending.Variations of the 52 Week Money Challenge

The 52 Week Money Challenge can be adapted to fit your financial needs and goals. Here are some variations:

- Reverse challenge: Start with the highest amount and decrease it each week.

- Double challenge: Deposit double the amount each week.

- Team challenge: Involve friends and family to make it a team effort.

- Percentage challenge: Deposit a percentage of your income each week.

Common Mistakes to Avoid

While the 52 Week Money Challenge is a great way to save money, there are common mistakes to avoid: * Not starting: Procrastination can hinder your progress, so start the challenge as soon as possible. * Not being consistent: Missing a week or two can derail your progress, so make sure to deposit the required amount each week. * Not tracking progress: Failing to monitor your progress can lead to a lack of motivation, so keep a record of your savings.Real-Life Examples

The 52 Week Money Challenge has helped many individuals achieve their financial goals. Here are some real-life examples:

- Sarah, a freelance writer, used the challenge to save for a down payment on a house. She started with $1 and increased her deposit by $1 each week. By the end of the challenge, she had saved over $1,300.

- John, a college student, used the challenge to pay off his student loans. He started with $5 and increased his deposit by $5 each week. By the end of the challenge, he had paid off over $2,500 of his debt.

Conclusion and Next Steps

The 52 Week Money Challenge is a simple yet effective way to save money and develop a savings habit. By following the challenge and avoiding common mistakes, you can achieve your financial goals and improve your overall financial well-being. Remember to start small, make it automatic, and track your progress. With persistence and dedication, you can succeed in the challenge and achieve financial stability.52 Week Money Challenge Image Gallery

What is the 52 Week Money Challenge?

+The 52 Week Money Challenge is a savings plan that requires you to deposit an amount equal to the number of the week into your savings account.

How much money will I save with the 52 Week Money Challenge?

+You will save a total of $1,378 by the end of the 52-week period.

Can I start the 52 Week Money Challenge at any time?

+Yes, you can start the challenge at any time and adjust the amount you save each week based on your financial situation.

We hope this article has provided you with a comprehensive guide to the 52 Week Money Challenge. Whether you're looking to save for a specific goal or simply want to develop a savings habit, this challenge is an excellent way to get started. Remember to stay consistent, track your progress, and avoid dipping into your savings. With persistence and dedication, you can achieve financial stability and improve your overall well-being. Share your experience with the 52 Week Money Challenge in the comments below, and don't forget to share this article with your friends and family to help them achieve their financial goals.