Intro

Discover 5 ways free invoice templates simplify billing, invoicing, and payment tracking, using online invoicing tools and software for efficient financial management and organization.

In today's fast-paced business world, efficient invoicing is crucial for maintaining a healthy cash flow and building strong relationships with clients. One of the most effective ways to achieve this is by utilizing free invoice templates and tools. These resources not only save businesses money but also streamline the invoicing process, making it easier to manage finances and focus on growth. Whether you're a freelancer, small business owner, or entrepreneur, leveraging free invoice solutions can significantly impact your bottom line and productivity.

The importance of invoicing cannot be overstated. It's a critical step in the payment process that ensures businesses receive compensation for their goods and services. However, creating invoices from scratch can be time-consuming and may lead to errors if not done properly. This is where free invoice templates come into play, offering a convenient and professional way to bill clients. With the rise of digital technology, there are now numerous free invoice tools and templates available online, catering to various business needs and preferences.

For businesses looking to simplify their invoicing process, exploring the different types of free invoice templates and tools is essential. From basic templates for simple transactions to more advanced software for complex billing needs, the options are vast. Moreover, many of these tools are designed with user experience in mind, making it easy for anyone to create, send, and track invoices without needing extensive accounting knowledge. By adopting these solutions, businesses can reduce administrative burdens, minimize delays in payment, and enhance their overall financial management.

Benefits of Using Free Invoice Templates

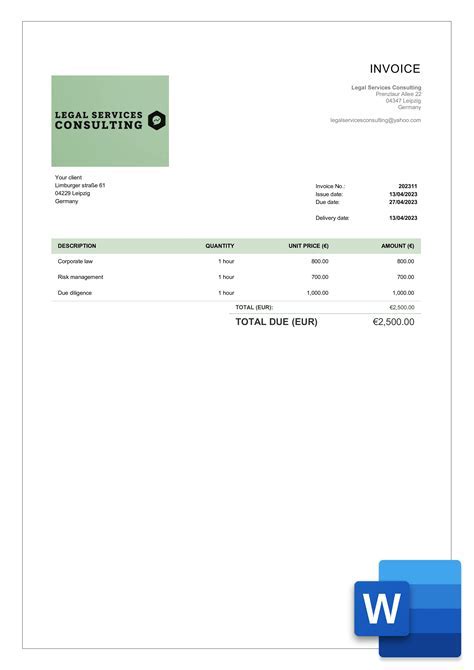

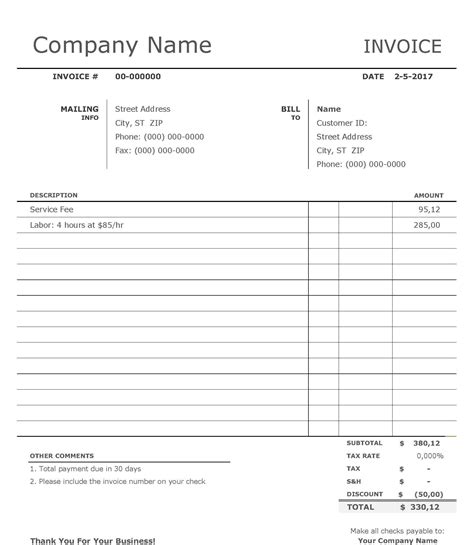

Using free invoice templates offers several benefits to businesses. Firstly, they provide a professional appearance without the need for extensive design experience. These templates are often customizable, allowing businesses to add their logo, color scheme, and other branding elements to create a consistent and recognizable invoice. Secondly, free invoice templates help in organizing the billing information in a clear and concise manner, reducing the likelihood of errors and ensuring that all necessary details are included. This clarity is crucial for avoiding misunderstandings with clients and facilitating prompt payments.

Furthermore, many free invoice templates are designed to be compatible with popular accounting software and spreadsheet programs, making it easy to integrate them into existing financial systems. This compatibility not only streamlines the invoicing process but also aids in record-keeping and tax preparation. Additionally, some templates and tools offer features such as automatic calculations, tax rates, and currency conversions, which can be particularly useful for businesses that operate internationally or have complex pricing structures.

Key Features of Free Invoice Tools

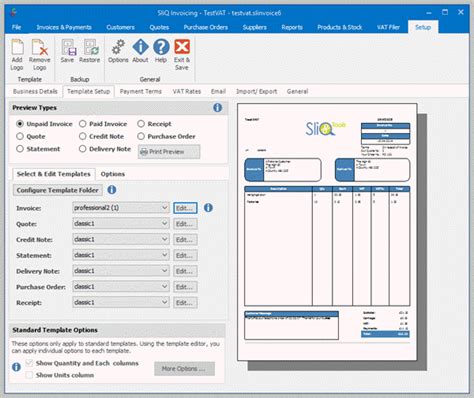

When selecting free invoice tools, there are several key features to consider. One of the most important is ease of use. The tool should have an intuitive interface that allows users to quickly create and customize invoices without needing a lot of technical knowledge. Another critical feature is the ability to send invoices directly to clients via email, which can help expedite the payment process. Some tools also offer tracking features, enabling businesses to monitor the status of their invoices and follow up with clients as needed.

Security is another vital aspect to consider. Free invoice tools should provide a secure way to create, store, and send invoices, protecting sensitive business and client information from unauthorized access. Compatibility with various devices and operating systems is also essential, ensuring that businesses can access and manage their invoices from anywhere. Lastly, the ability to generate reports and analyze invoicing data can be highly beneficial, offering insights into cash flow, payment trends, and areas for improvement.

Steps to Create a Free Invoice

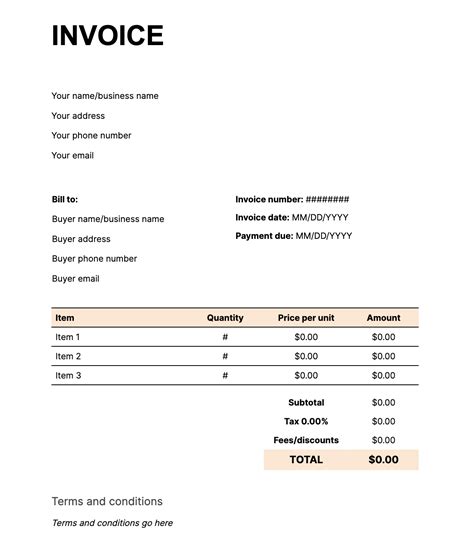

Creating a free invoice involves several straightforward steps. The first step is to choose a suitable template or tool that meets your business needs. This might involve browsing through various options online, reading reviews, and comparing features. Once you've selected a template or tool, you'll need to customize it with your business information, including your company name, address, and contact details.

The next step is to fill in the invoice details, such as the client's information, the date, invoice number, and a description of the goods or services provided. You'll also need to calculate the total cost, including any taxes or discounts. Many free invoice tools will perform these calculations automatically, but it's essential to double-check for accuracy.

After completing the invoice, you can save it in a preferred format, such as PDF, and send it to your client via email or post. Keeping a record of all invoices is crucial for accounting and tax purposes, so ensure you have a system in place for organizing and storing them.

Best Practices for Invoicing

Following best practices for invoicing can significantly improve the efficiency of your billing process and enhance your relationships with clients. One of the most critical practices is to be timely with your invoices, sending them to clients as soon as possible after the delivery of goods or services. This promptness helps to avoid delays in payment and ensures that your business maintains a healthy cash flow.

Another best practice is to ensure clarity and accuracy in your invoices. This includes providing a detailed description of the goods or services, specifying the payment terms clearly, and including all relevant contact information. Transparency in invoicing builds trust with clients and reduces the likelihood of disputes over payments.

Regularly reviewing and updating your invoicing process is also advisable. This might involve seeking feedback from clients, adopting new technologies, or adjusting your payment terms to better suit your business needs and client preferences. By continually improving your invoicing practices, you can minimize administrative burdens, maximize revenue, and focus on the growth and development of your business.

Common Mistakes in Invoicing

Despite the importance of accurate and timely invoicing, many businesses make mistakes that can lead to delays in payment, damaged client relationships, and financial losses. One of the most common mistakes is incorrect or incomplete client information. This can lead to invoices being sent to the wrong address or not being received at all, resulting in significant delays.

Another mistake is failing to specify clear payment terms, including the due date, payment methods, and any late payment fees. Ambiguity in payment terms can confuse clients and lead to misunderstandings, ultimately affecting cash flow. Additionally, not keeping accurate records of invoices and payments can lead to accounting errors and make it difficult to track the status of client payments.

Using outdated or unprofessional invoice templates can also harm a business's reputation and credibility. Invoices are often the last point of contact with a client, and their quality can leave a lasting impression. Therefore, it's essential to invest time in creating or selecting high-quality, customizable templates that reflect the business's brand and professionalism.

Future of Invoicing

The future of invoicing is likely to be shaped by technological advancements and changing business needs. One of the key trends is the adoption of digital and automated invoicing systems, which can streamline the billing process, reduce errors, and enhance security. These systems often integrate with existing accounting software, providing a seamless and efficient way to manage finances.

Another trend is the use of mobile invoicing apps, which enable businesses to create and send invoices on the go. This mobility is particularly beneficial for freelancers and small business owners who may not always have access to a desktop computer. Moreover, the rise of cloud-based invoicing solutions is expected to continue, offering businesses the flexibility to access and manage their invoices from anywhere, at any time.

The integration of artificial intelligence (AI) and machine learning (ML) into invoicing tools is also anticipated, with the potential to automate tasks such as data entry, invoice matching, and payment forecasting. These technologies can help businesses predict cash flow more accurately, identify trends, and make informed financial decisions.

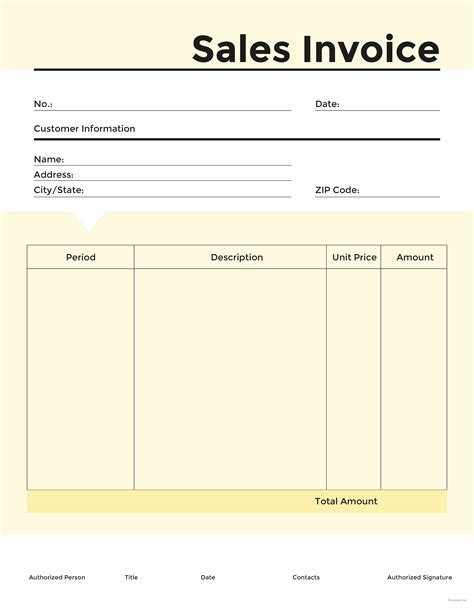

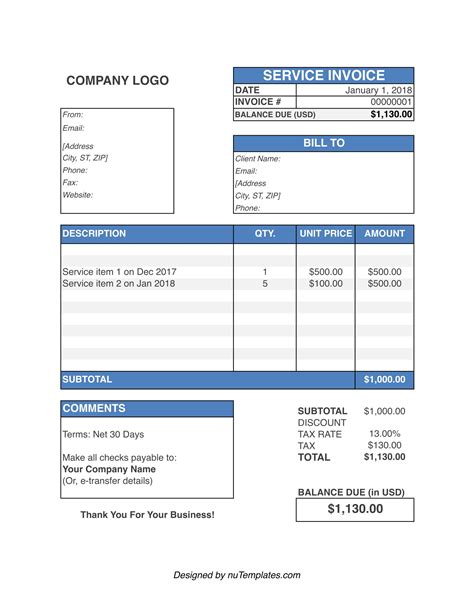

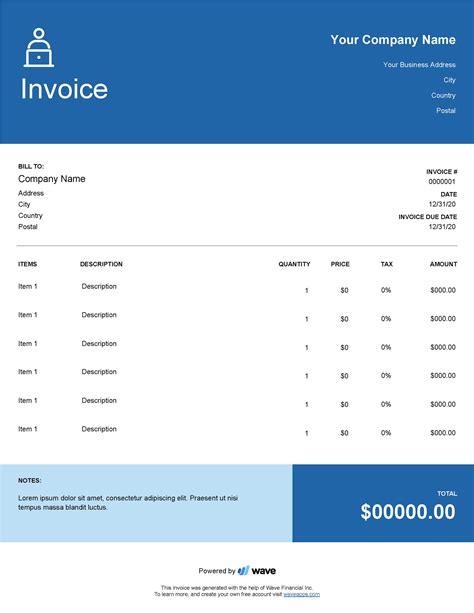

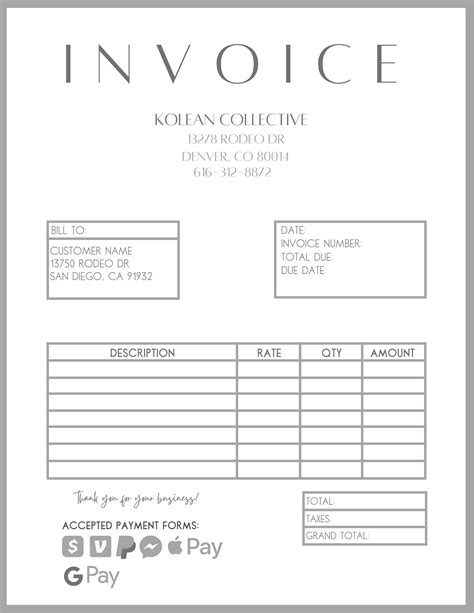

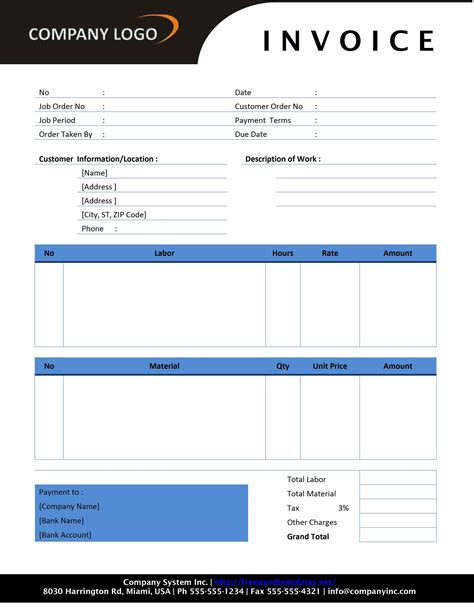

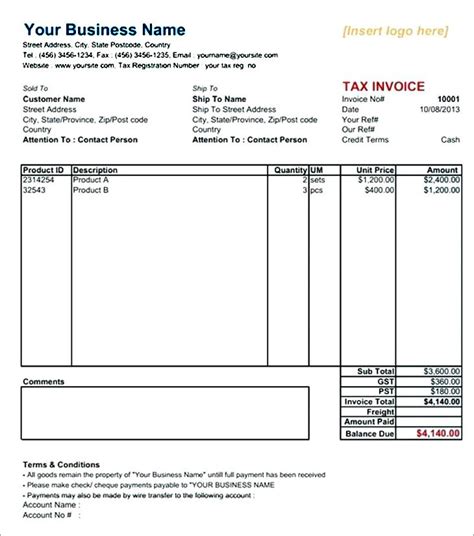

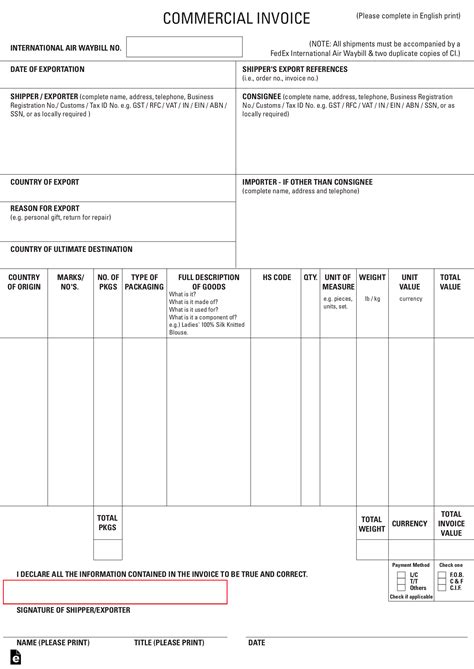

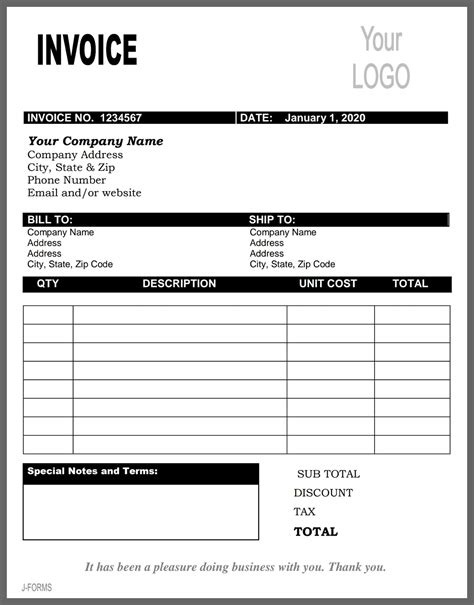

Gallery of Free Invoice Templates

Free Invoice Templates Gallery

Frequently Asked Questions

What is the purpose of an invoice?

+The purpose of an invoice is to provide a detailed record of a transaction between a buyer and a seller, outlining the goods or services provided, the cost, and the payment terms.

How do I create a professional-looking invoice?

+To create a professional-looking invoice, use a high-quality template, include all necessary details such as your business information, client information, and a clear description of the goods or services, and ensure the design is clean and easy to read.

What information should be included in an invoice?

+An invoice should include your business name and contact information, the client's name and contact information, a unique invoice number, the date of the invoice, a detailed description of the goods or services provided, the quantity and rate of each item, the subtotal, tax, and total cost, and the payment terms and methods.

How can I send invoices to my clients efficiently?

+You can send invoices to your clients efficiently by using digital invoicing tools that allow you to create, send, and track invoices electronically. Many of these tools also enable clients to pay invoices online, streamlining the payment process.

What are the benefits of using free invoice templates?

+The benefits of using free invoice templates include saving time and money, professional appearance, ease of use, customization options, and compatibility with various accounting software and spreadsheet programs.

In conclusion, leveraging free invoice templates and tools is a strategic move for businesses aiming to enhance their invoicing process, reduce costs, and improve client relationships. By understanding the benefits, key features, and best practices associated with free invoicing solutions, businesses can make informed decisions that support their financial health and growth. Whether you're a seasoned entrepreneur or just starting out, embracing the efficiency and professionalism that free invoice templates offer can be a pivotal step towards achieving your business goals. We invite you to explore the world of free invoicing, share your experiences, and contribute to the conversation on how to make the most out of these valuable resources.