Intro

Discover 5 owner finance contract templates, including seller financing agreements, lease options, and wraparound mortgages, to securely facilitate private property sales with installment land contracts and promissory notes.

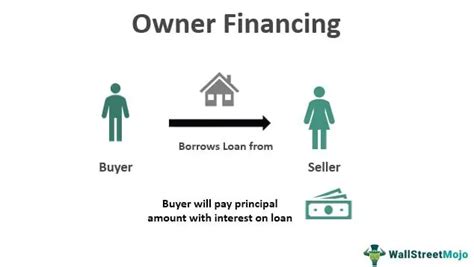

Owner financing, also known as seller financing, is a type of financing where the seller of a property finances the purchase of the property for the buyer. This type of financing is often used when the buyer is unable to secure traditional financing from a bank or other lender. In an owner finance contract, the seller acts as the lender, and the buyer makes payments directly to the seller. This type of arrangement can be beneficial for both parties, as it allows the seller to sell the property quickly and the buyer to purchase the property without having to go through the traditional lending process.

Owner finance contracts can be complex and should be carefully reviewed by both parties before signing. It's essential to include all the necessary terms and conditions in the contract to avoid any disputes or misunderstandings. A well-drafted owner finance contract should include the purchase price, interest rate, payment terms, and any other conditions or requirements. Here are some key elements to consider when creating an owner finance contract:

- Purchase price: The purchase price of the property should be clearly stated in the contract.

- Interest rate: The interest rate should be specified in the contract, as well as how it will be calculated and paid.

- Payment terms: The payment terms, including the amount and frequency of payments, should be outlined in the contract.

- Default and late payment provisions: The contract should include provisions for what happens if the buyer defaults on payments or makes late payments.

- Security: The contract should specify what security the seller will have in case the buyer defaults on payments.

Benefits of Owner Finance Contracts

Owner finance contracts offer several benefits to both buyers and sellers. For buyers, owner finance contracts can provide an alternative to traditional financing, which can be difficult to secure. Owner finance contracts can also offer more flexible payment terms and lower interest rates than traditional loans. For sellers, owner finance contracts can provide a way to sell a property quickly and earn a steady income stream from the buyer's payments.

Some of the benefits of owner finance contracts include:

- Flexible payment terms: Owner finance contracts can offer flexible payment terms, such as interest-only payments or balloon payments.

- Lower interest rates: Owner finance contracts can offer lower interest rates than traditional loans, which can save the buyer money over the life of the loan.

- Faster closing: Owner finance contracts can allow for a faster closing process, as there is no need to wait for traditional financing to be approved.

- Increased selling price: Owner finance contracts can allow the seller to sell the property for a higher price, as the buyer is willing to pay a premium for the flexibility and convenience of owner financing.

Types of Owner Finance Contracts

There are several types of owner finance contracts, each with its own unique features and benefits. Some common types of owner finance contracts include:

- Lease option: A lease option is a type of owner finance contract that allows the buyer to lease the property with the option to purchase it in the future.

- Lease purchase: A lease purchase is a type of owner finance contract that requires the buyer to lease the property for a specified period before purchasing it.

- Wraparound mortgage: A wraparound mortgage is a type of owner finance contract that allows the buyer to purchase the property subject to an existing mortgage.

- Contract for deed: A contract for deed is a type of owner finance contract that allows the buyer to purchase the property over time, with the seller retaining title to the property until the purchase price is paid in full.

Owner Finance Contract Templates

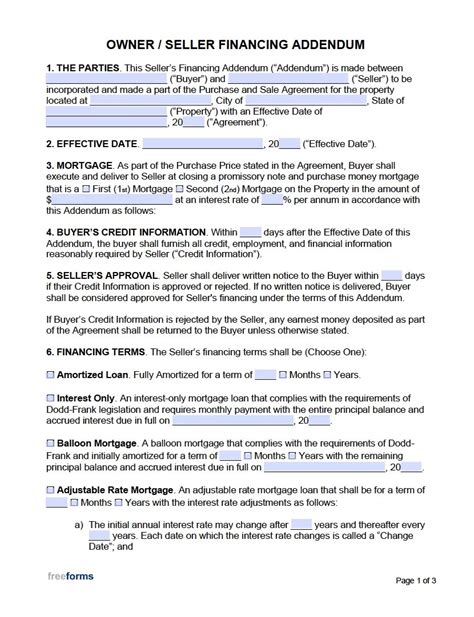

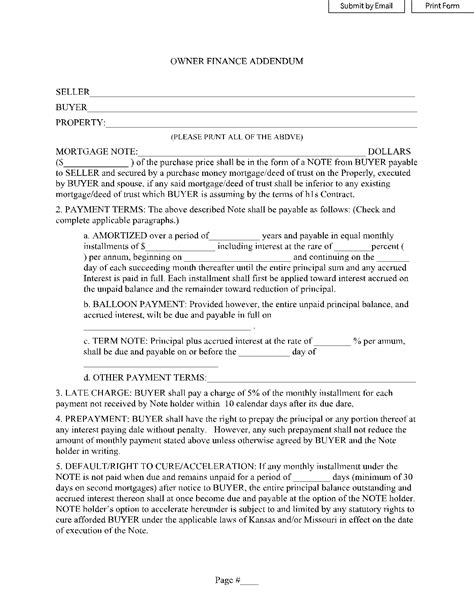

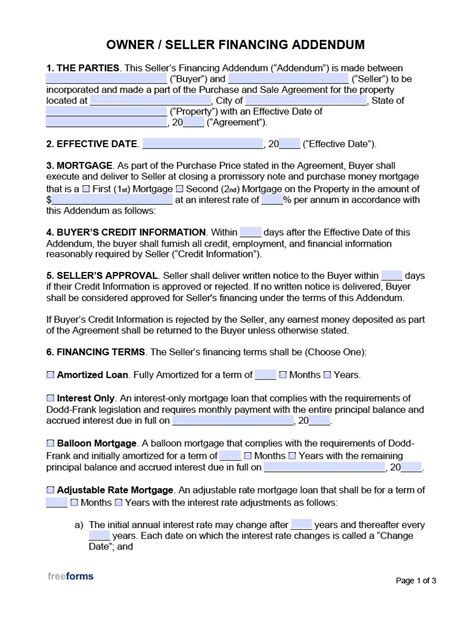

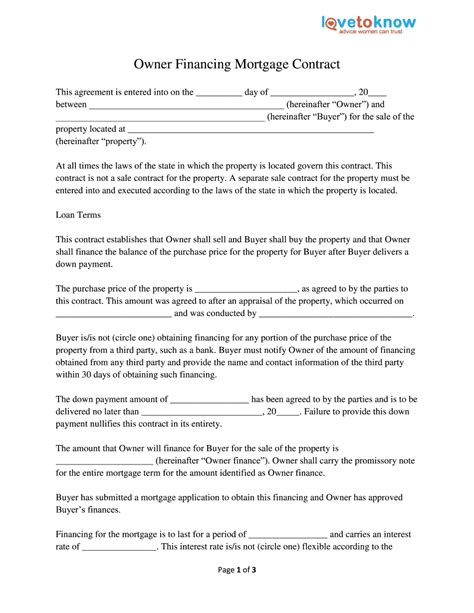

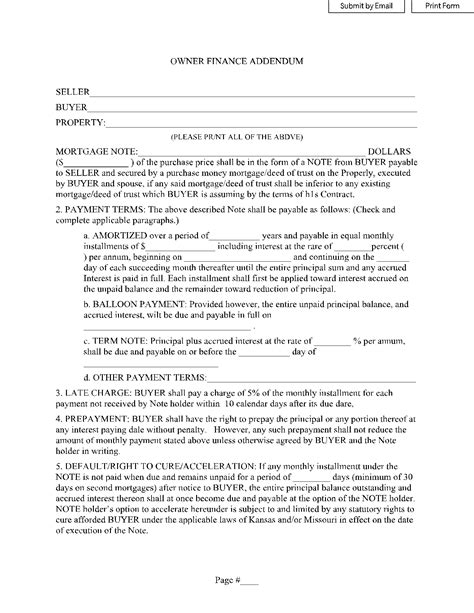

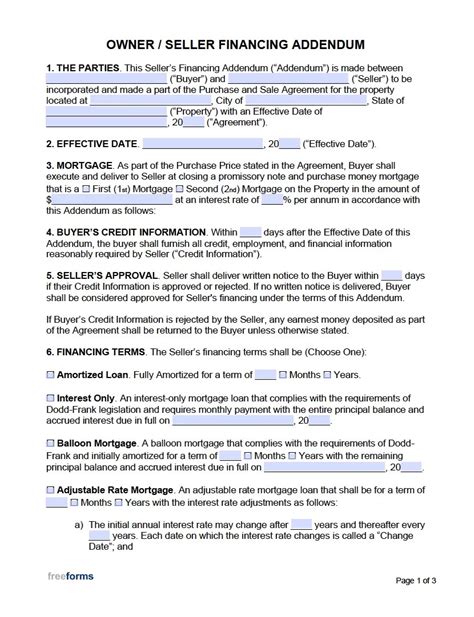

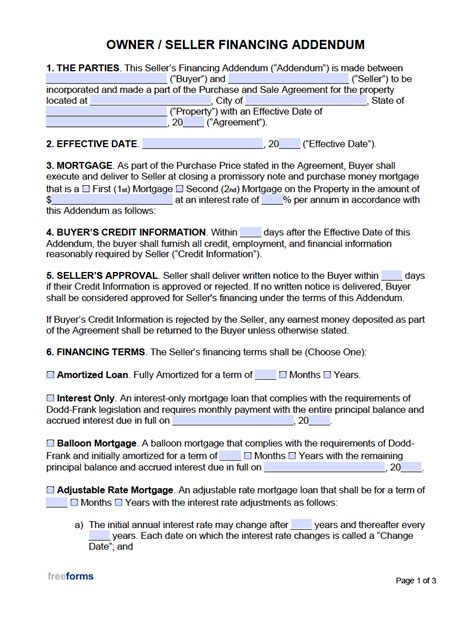

Here are five owner finance contract templates that can be used as a starting point for creating an owner finance contract:

- Basic Owner Finance Contract: This template includes the basic terms and conditions of an owner finance contract, including the purchase price, interest rate, and payment terms.

- Lease Option Owner Finance Contract: This template includes the terms and conditions of a lease option owner finance contract, including the lease term, option fee, and purchase price.

- Wraparound Mortgage Owner Finance Contract: This template includes the terms and conditions of a wraparound mortgage owner finance contract, including the existing mortgage balance, interest rate, and payment terms.

- Contract for Deed Owner Finance Contract: This template includes the terms and conditions of a contract for deed owner finance contract, including the purchase price, interest rate, and payment terms.

- Owner Finance Contract with Balloon Payment: This template includes the terms and conditions of an owner finance contract with a balloon payment, including the purchase price, interest rate, and payment terms.

Key Elements of an Owner Finance Contract

When creating an owner finance contract, there are several key elements to include: * Purchase price: The purchase price of the property should be clearly stated in the contract. * Interest rate: The interest rate should be specified in the contract, as well as how it will be calculated and paid. * Payment terms: The payment terms, including the amount and frequency of payments, should be outlined in the contract. * Default and late payment provisions: The contract should include provisions for what happens if the buyer defaults on payments or makes late payments. * Security: The contract should specify what security the seller will have in case the buyer defaults on payments.How to Create an Owner Finance Contract

Creating an owner finance contract can be a complex process, and it's essential to include all the necessary terms and conditions to avoid any disputes or misunderstandings. Here are the steps to follow when creating an owner finance contract:

- Determine the purchase price: The purchase price of the property should be clearly stated in the contract.

- Determine the interest rate: The interest rate should be specified in the contract, as well as how it will be calculated and paid.

- Determine the payment terms: The payment terms, including the amount and frequency of payments, should be outlined in the contract.

- Include default and late payment provisions: The contract should include provisions for what happens if the buyer defaults on payments or makes late payments.

- Specify the security: The contract should specify what security the seller will have in case the buyer defaults on payments.

Owner Finance Contract Laws and Regulations

Owner finance contracts are subject to various laws and regulations, which can vary by state. It's essential to familiarize yourself with the laws and regulations in your state before creating an owner finance contract. Some of the key laws and regulations to consider include:

- Usury laws: Usury laws regulate the maximum interest rate that can be charged on a loan.

- Truth in Lending Act: The Truth in Lending Act requires lenders to disclose the terms and conditions of a loan, including the interest rate and payment terms.

- Real Estate Settlement Procedures Act: The Real Estate Settlement Procedures Act regulates the settlement process for real estate transactions.

Owner Finance Contract Image Gallery

What is an owner finance contract?

+An owner finance contract is a type of financing where the seller of a property finances the purchase of the property for the buyer.

What are the benefits of an owner finance contract?

+The benefits of an owner finance contract include flexible payment terms, lower interest rates, and a faster closing process.

What are the different types of owner finance contracts?

+There are several types of owner finance contracts, including lease option, lease purchase, wraparound mortgage, and contract for deed.

How do I create an owner finance contract?

+To create an owner finance contract, you should determine the purchase price, interest rate, and payment terms, and include default and late payment provisions and security.

What laws and regulations apply to owner finance contracts?

+Owner finance contracts are subject to various laws and regulations, including usury laws, the Truth in Lending Act, and the Real Estate Settlement Procedures Act.

In conclusion, owner finance contracts can be a beneficial alternative to traditional financing for both buyers and sellers. By understanding the benefits, types, and laws and regulations surrounding owner finance contracts, you can make an informed decision about whether this type of financing is right for you. Remember to carefully review and negotiate the terms of the contract to ensure that it meets your needs and protects your interests. With the right owner finance contract, you can achieve your goals and secure the financing you need to purchase or sell a property. We encourage you to share your thoughts and experiences with owner finance contracts in the comments below, and to share this article with anyone who may be interested in learning more about this topic.