Intro

Master personal finance with 5 free money worksheets, featuring budgeting templates, expense trackers, and savings plans to manage finances effectively.

Managing finances effectively is a crucial life skill that benefits individuals of all ages. Understanding how money works, how to save, and how to make smart financial decisions can significantly impact one's quality of life and future security. For children, learning about money management early on can set them up for a lifetime of financial literacy and responsibility. One of the most effective ways to teach kids about money is through interactive and engaging activities, such as money worksheets. These tools can help children develop a solid understanding of financial concepts in a fun and accessible way. Here, we'll explore the importance of teaching financial literacy to kids and provide five free money worksheets designed to help them learn valuable money management skills.

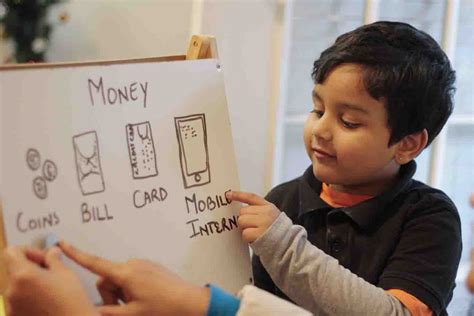

Teaching children about money is not just about showing them how to count coins and bills; it's about instilling in them a deeper understanding of the value of money, the importance of saving, and how to make responsible financial decisions. Financial literacy is a skill that can benefit children throughout their lives, from making smart purchasing decisions as teenagers to managing their finances effectively as adults. By introducing these concepts early, parents and educators can help children develop healthy financial habits and a positive relationship with money.

Moreover, financial literacy is not just a practical skill; it also has a significant impact on one's mental and emotional well-being. Financial stress can be a major source of anxiety and tension, and individuals who are equipped with the knowledge and skills to manage their finances effectively are better positioned to navigate life's financial challenges with confidence and peace of mind. Therefore, it's essential to provide children with the tools and resources they need to develop a strong foundation in financial literacy.

Introduction to Money Management

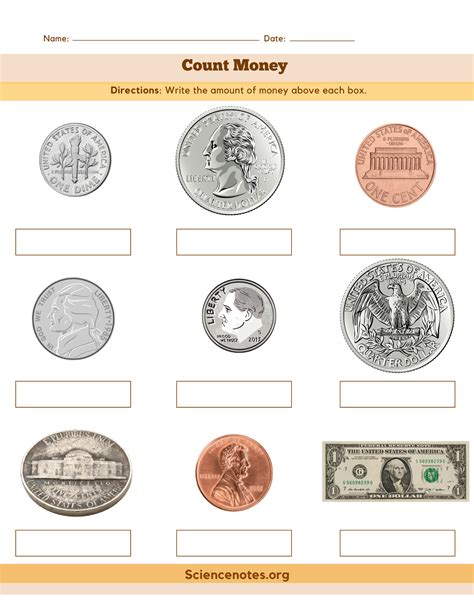

Understanding the basics of money management is the first step towards financial literacy. This includes knowing the different denominations of coins and bills, how to count money, and the concept of saving versus spending. For young children, it's essential to start with simple, interactive lessons that make learning fun. Using real-life examples, such as saving for a toy or counting money in a piggy bank, can help children connect the abstract concepts of money to their everyday experiences.

Benefits of Early Financial Education

The benefits of teaching financial literacy to children are numerous. Early education can help children develop good financial habits, understand the value of money, and make informed decisions about spending and saving. It also prepares them for independence, teaching them how to manage their finances effectively as they grow older. Furthermore, financial literacy can reduce financial stress and anxiety, promoting a healthier and more secure financial future.Money Worksheets for Kids

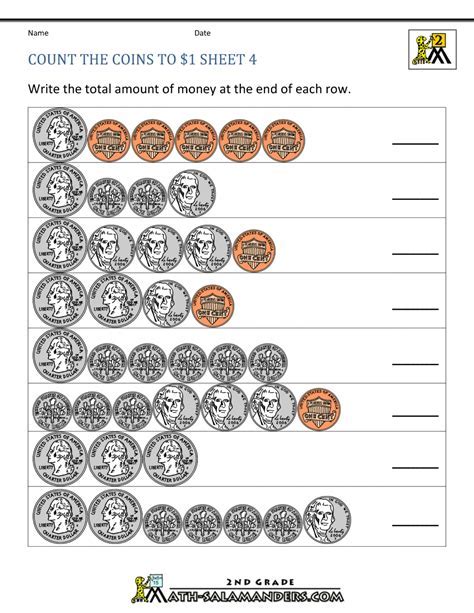

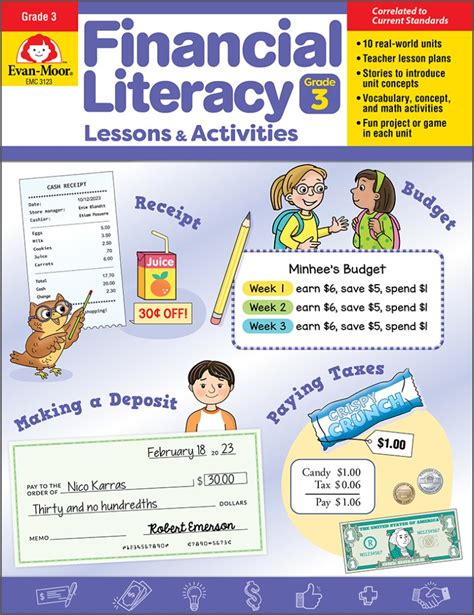

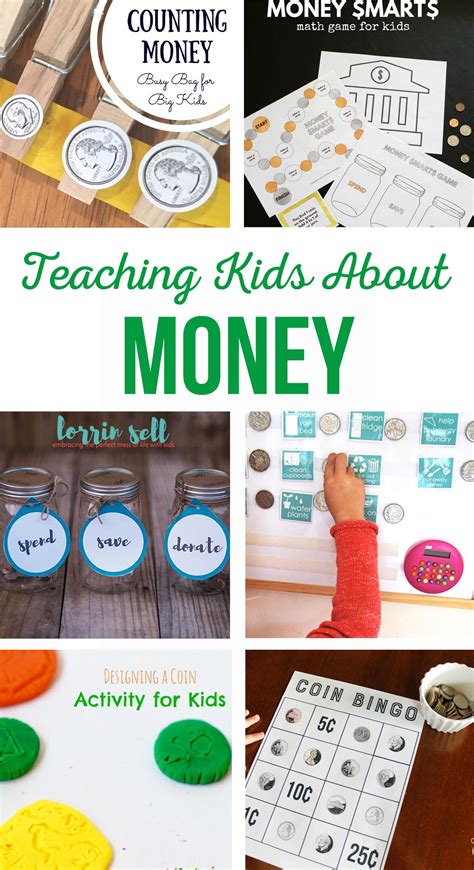

Money worksheets are an excellent resource for teaching children about money. They offer a variety of activities designed to engage kids and help them learn about different financial concepts. From simple exercises like counting coins to more complex lessons on budgeting and saving, money worksheets can be tailored to suit the age and skill level of the child. Here are five free money worksheets that parents and educators can use to teach kids about money management:

- Coin Counting Worksheet: This worksheet is designed for younger children and focuses on teaching them to identify and count different coins. It includes pictures of coins and spaces for children to practice counting and basic addition skills related to money.

- Budgeting for Kids: Older children can benefit from learning about budgeting, which involves allocating money into different categories such as saving, spending, and giving. This worksheet provides a simple budget template that kids can use to practice dividing their money into these categories.

- Price Comparison: This worksheet teaches children how to compare prices of different items to make smart purchasing decisions. It includes scenarios where kids have to decide which item to buy based on price and value.

- Savings Goal Worksheet: Setting savings goals is an essential part of money management. This worksheet helps children set and work towards their savings goals by calculating how much they need to save each week or month to reach their target.

- Money Word Search: For a fun twist on learning about money, this word search includes vocabulary related to financial literacy. It's a great way to introduce kids to key terms and concepts in a engaging and interactive way.

Implementing Money Worksheets

Implementing money worksheets into a child's learning routine can be straightforward. Parents and educators can start by identifying the child's current level of understanding about money and selecting worksheets that match their skill level. It's also important to make learning fun and interactive, using real-life examples and discussions to reinforce the concepts learned through the worksheets.Additional Resources for Financial Literacy

Beyond money worksheets, there are numerous resources available for teaching financial literacy to children. These include books, games, and online tools that can provide a comprehensive and engaging learning experience. Some popular resources include:

- Books: There are many children's books that deal with money and financial literacy in a way that's relatable and easy to understand.

- Games: Board games and video games that focus on money management can make learning about finances fun and interactive.

- Online Tools: Websites and apps designed for kids offer interactive lessons, quizzes, and games that teach financial literacy.

Encouraging Financial Responsibility

Encouraging financial responsibility in children requires a consistent and supportive approach. Parents and educators should lead by example, demonstrating good financial habits and discussing money management openly. By providing children with the tools and knowledge they need, and by fostering an environment that promotes learning and responsibility, we can help them develop into financially literate adults.Conclusion and Next Steps

In conclusion, teaching children about money and financial literacy is a vital part of their education and development. By using tools like money worksheets and engaging in open discussions about money, parents and educators can help children develop the skills and knowledge they need to manage their finances effectively. As children grow and learn, it's essential to continue reinforcing these lessons, adapting the approach as needed to meet their evolving understanding of financial concepts.

Financial Literacy Image Gallery

Why is it important to teach children about money?

+Teaching children about money is important because it helps them develop financial literacy, understand the value of money, and make smart financial decisions. It sets them up for a lifetime of financial responsibility and security.

At what age should children start learning about money?

+Children can start learning about money as early as preschool, beginning with simple concepts like identifying coins and bills and gradually moving on to more complex topics like saving and budgeting.

How can parents make learning about money fun for kids?

+Parents can make learning about money fun by using interactive tools like money worksheets, playing games that involve money management, and involving kids in real-life financial decisions, such as budgeting for a family outing.

We invite you to share your thoughts and experiences on teaching financial literacy to children. How do you approach this topic with your kids or students? What resources have you found most helpful? Your insights can help others navigate the important task of educating the next generation about money and financial responsibility. Share this article with friends and family who might benefit from these resources, and let's work together to promote financial literacy and security for all.