Intro

Discover 5 free IRS WISP templates, simplifying Wireless Internet Service Provider compliance with IRS regulations, featuring risk assessment, security policies, and incident response plans.

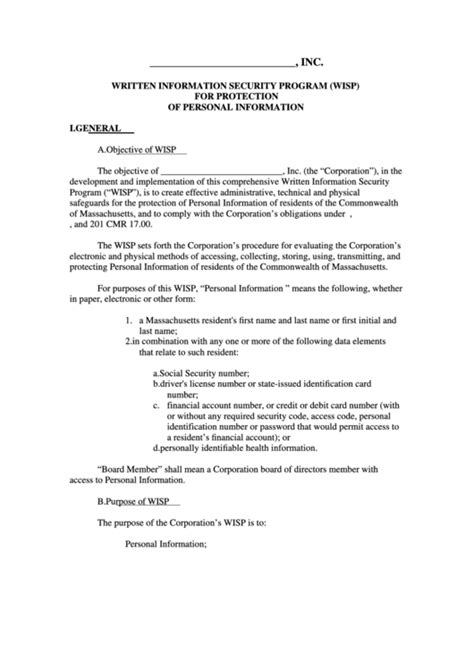

The importance of well-structured IRS WISP (Written Information Security Program) templates cannot be overstated, especially for businesses and organizations seeking to comply with regulatory requirements and protect sensitive information. A comprehensive WISP outlines the policies and procedures for handling, storing, and transmitting sensitive information, thereby safeguarding against unauthorized access, use, disclosure, modification, or destruction. In today's digital age, where data breaches and cyberattacks are on the rise, having a robust WISP in place is not just a best practice but a necessity.

Implementing an effective WISP requires careful consideration of various factors, including the type of sensitive information handled by the organization, the risks associated with its storage and transmission, and the measures needed to mitigate these risks. While developing a WISP from scratch can be a daunting task, especially for small to medium-sized businesses or those without extensive IT resources, utilizing free IRS WISP templates can significantly simplify the process. These templates provide a foundational structure that can be tailored to meet the specific needs of an organization, ensuring compliance with relevant regulations and standards.

For organizations looking to enhance their information security posture, leveraging free IRS WISP templates can be a strategic first step. These templates are designed to guide the development of a comprehensive information security program, covering essential aspects such as risk assessment, security policies, incident response planning, and employee training. By utilizing these resources, businesses can ensure they are taking proactive steps to protect sensitive information, thereby safeguarding their reputation, customer trust, and ultimately, their bottom line.

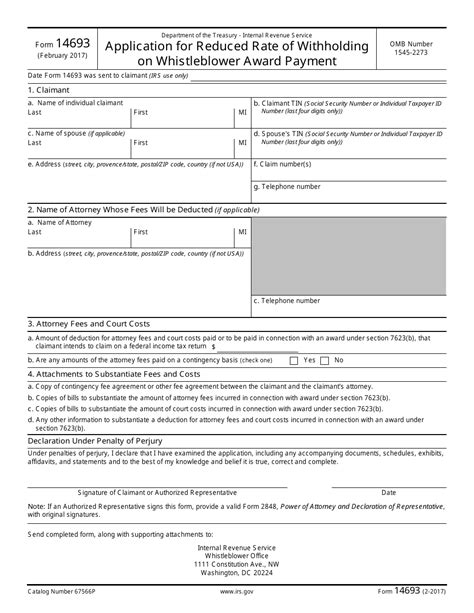

Introduction to IRS WISP Templates

IRS WISP templates are pre-designed documents that outline the necessary components of a Written Information Security Program. These templates are invaluable for organizations aiming to create a robust information security framework without starting from scratch. By providing a structured approach to information security, IRS WISP templates help ensure that no critical aspect of security is overlooked, from the initial risk assessment through to the implementation of security controls and ongoing monitoring.

Benefits of Using Free IRS WISP Templates

The benefits of utilizing free IRS WISP templates are multifaceted. Firstly, they offer a cost-effective solution for organizations seeking to comply with information security regulations without incurring the expense of developing a program from the ground up. Secondly, these templates provide a framework that is already aligned with regulatory requirements, reducing the risk of non-compliance. Additionally, free IRS WISP templates can save time, as they eliminate the need for extensive research and drafting, allowing organizations to focus on implementing their information security program rather than creating it.

Key Components of IRS WISP Templates

Effective IRS WISP templates should include several key components to ensure they provide a comprehensive foundation for an organization's information security program. These components typically encompass:

- Risk Assessment: A methodical process to identify, assess, and prioritize risks to the confidentiality, integrity, and availability of sensitive information.

- Security Policies: Clear, concise policies that outline the organization's stance on information security, including acceptable use, data classification, and access control.

- Incident Response Plan: A detailed plan outlining the steps to be taken in the event of a security incident, ensuring timely and effective response to minimize impact.

- Employee Training: A program to educate employees on information security best practices, their roles in protecting sensitive information, and the procedures for reporting security incidents.

- Monitoring and Review: Processes for regularly monitoring the effectiveness of the information security program and reviewing its policies and procedures to ensure they remain relevant and effective.

Steps to Implement an IRS WISP Template

Implementing an IRS WISP template involves several steps:

- Customization: Tailor the template to fit the organization's specific needs, including its size, industry, and the type of sensitive information it handles.

- Risk Assessment: Conduct a thorough risk assessment to identify potential vulnerabilities and threats to sensitive information.

- Policy Development: Develop and implement security policies based on the risk assessment and the organization's specific security needs.

- Training and Awareness: Provide comprehensive training to all employees on the new policies, procedures, and their roles in information security.

- Monitoring and Review: Regularly monitor the effectiveness of the WISP and review its policies and procedures to ensure they remain up-to-date and effective.

Best Practices for Utilizing IRS WISP Templates

When utilizing IRS WISP templates, several best practices should be observed:

- Regular Updates: Ensure the template is updated regularly to reflect changes in regulatory requirements and emerging threats.

- Customization: Avoid using templates as-is; customize them to fit the organization's unique security needs and environment.

- Employee Involvement: Involve employees in the development and implementation process to foster a culture of security awareness.

- Continuous Monitoring: Regularly monitor and assess the effectiveness of the WISP to identify areas for improvement.

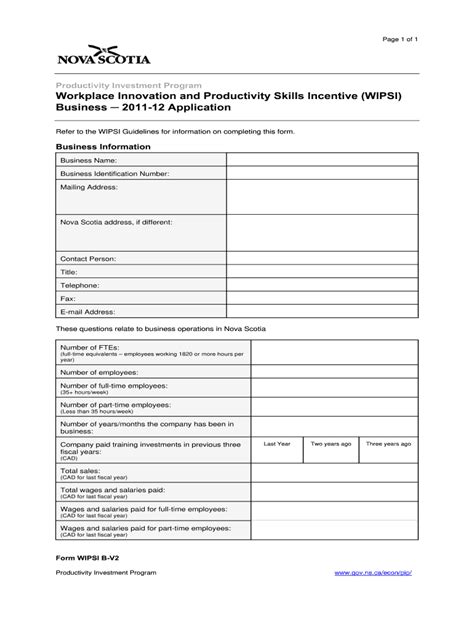

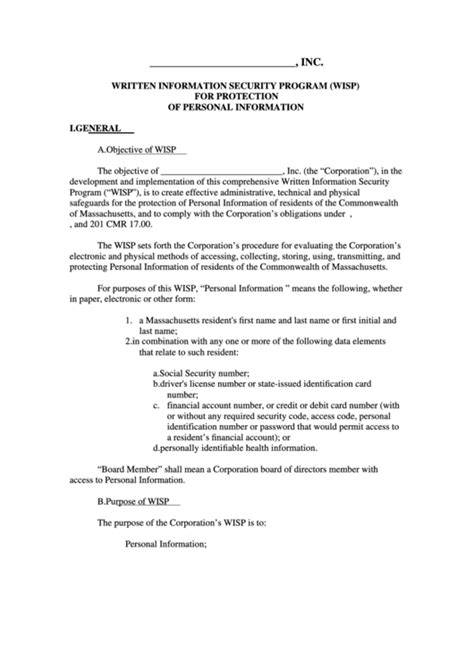

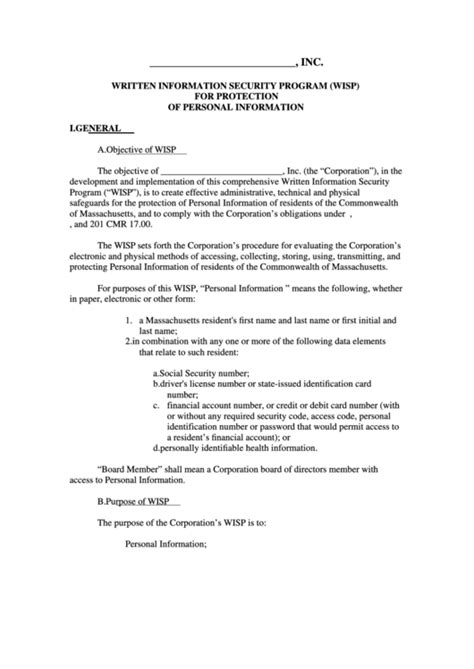

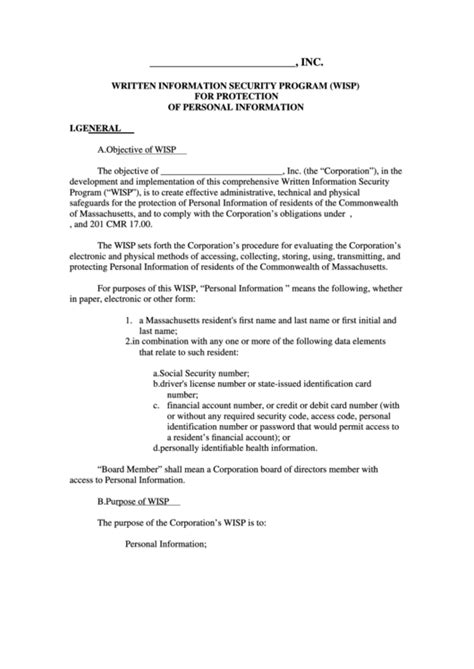

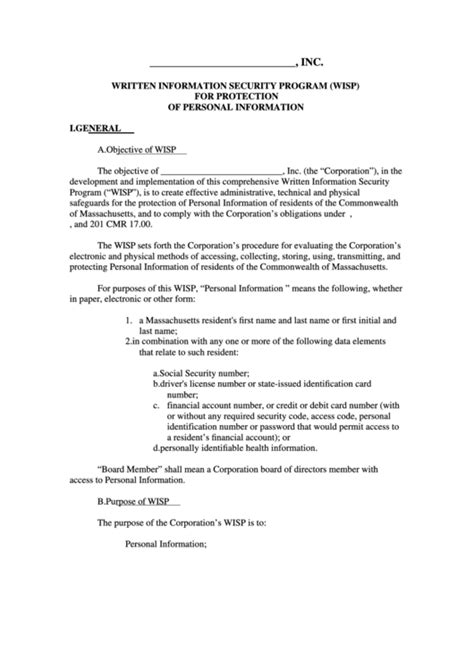

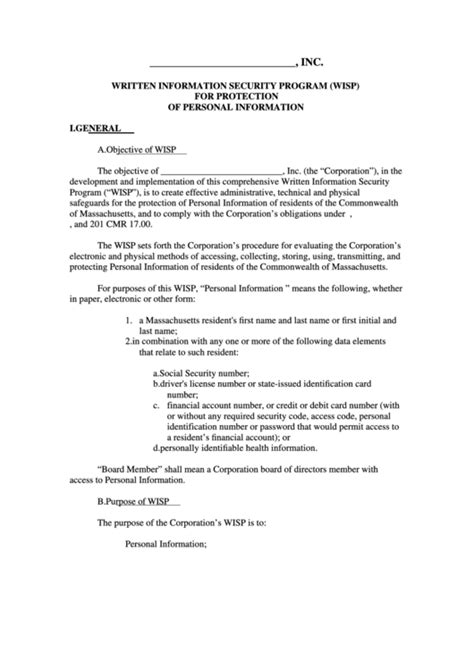

Gallery of IRS WISP Templates

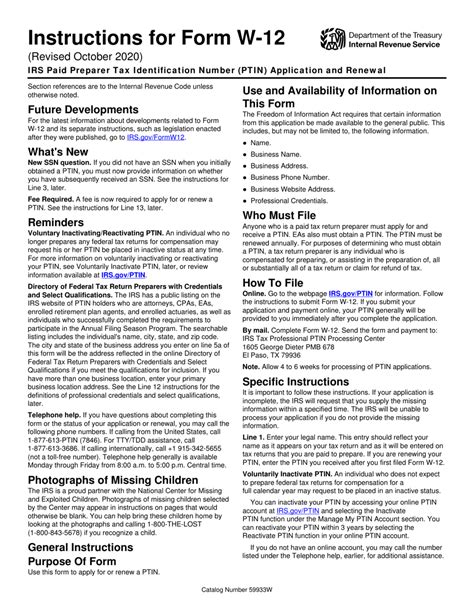

IRS WISP Templates Gallery

Frequently Asked Questions About IRS WISP Templates

What is an IRS WISP Template?

+An IRS WISP template is a pre-designed document that outlines the necessary components of a Written Information Security Program, helping organizations comply with regulatory requirements and protect sensitive information.

Why Use Free IRS WISP Templates?

+Free IRS WISP templates offer a cost-effective and efficient way to develop a comprehensive information security program, saving time and resources while ensuring compliance with regulatory standards.

How to Customize an IRS WISP Template?

+To customize an IRS WISP template, organizations should assess their specific security needs, conduct a risk assessment, and then tailor the template to fit their unique environment and requirements.

What are the Key Components of an IRS WISP Template?

+The key components include risk assessment, security policies, incident response planning, employee training, and ongoing monitoring and review to ensure the program's effectiveness.

How Often Should an IRS WISP Template be Updated?

+An IRS WISP template should be updated regularly to reflect changes in regulatory requirements, emerging threats, and the organization's evolving security needs.

In conclusion, free IRS WISP templates are invaluable resources for organizations seeking to enhance their information security posture and comply with regulatory requirements. By understanding the importance of these templates, their benefits, and how to implement them effectively, businesses can take significant strides in protecting sensitive information and safeguarding against cyber threats. We invite readers to share their experiences with IRS WISP templates, ask questions, and explore how these resources can be tailored to meet the unique security needs of their organizations. Together, we can foster a community committed to robust information security practices.