Intro

Get 5 free credit templates to manage finances effectively, including credit reports, scores, and dispute letters, with customizable templates for credit repair and monitoring.

The importance of credit templates cannot be overstated, especially for individuals and businesses looking to manage their financial transactions efficiently. A well-structured credit template can help in organizing credit information, ensuring that all necessary details are included, and facilitating the credit process. Whether you are a lender looking to provide credit to customers or a borrower seeking to understand the terms of a credit agreement, having the right template can make a significant difference. In this article, we will delve into the world of free credit templates, exploring their benefits, types, and how to use them effectively.

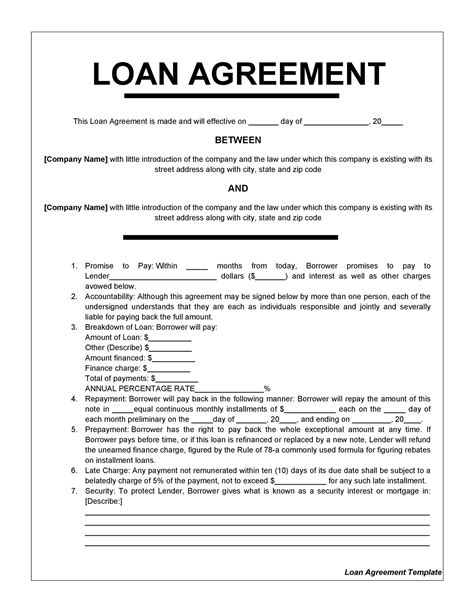

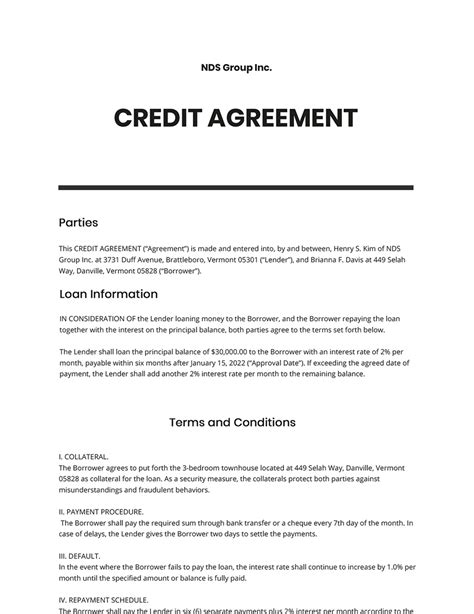

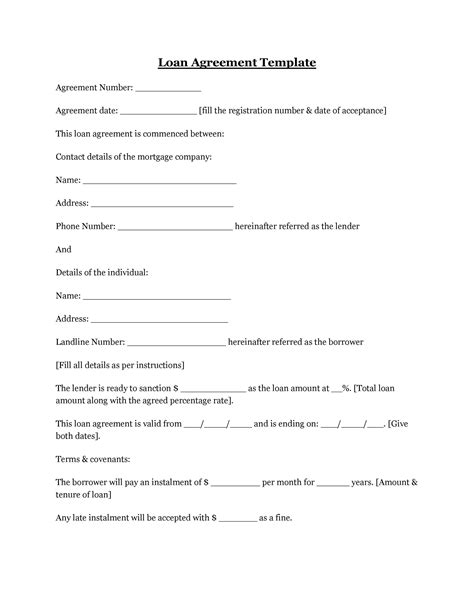

For those who are new to the concept of credit templates, it's essential to understand that these are pre-designed documents that outline the terms and conditions of a credit agreement. They can be customized to fit the specific needs of the lender and the borrower, making them versatile and useful for a wide range of financial transactions. From personal loans to business credit lines, the right template can help ensure that all parties are on the same page, reducing the risk of misunderstandings and disputes.

The use of credit templates is not limited to financial institutions; individuals can also benefit from using them. For instance, if you are lending money to a friend or family member, a credit template can help you formalize the agreement, specifying the amount borrowed, the interest rate, and the repayment terms. This can help prevent misunderstandings and ensure that the loan is repaid as agreed. Moreover, credit templates can be useful for businesses, enabling them to manage their credit operations more efficiently and reduce the risk of bad debt.

Benefits of Using Free Credit Templates

Using free credit templates offers several benefits, including saving time and money. Instead of hiring a lawyer to draft a credit agreement from scratch, you can use a pre-designed template, customizing it to fit your needs. This not only saves you money but also speeds up the process, allowing you to finalize the credit agreement quickly. Additionally, free credit templates can help reduce the risk of errors, as they are designed to include all the necessary clauses and terms.

Another significant advantage of using free credit templates is that they provide a professional touch to your credit agreements. Whether you are a lender or a borrower, using a well-structured template can give you peace of mind, knowing that the agreement is comprehensive and legally binding. Furthermore, credit templates can help you stay organized, keeping track of all your credit transactions in one place.

Types of Free Credit Templates

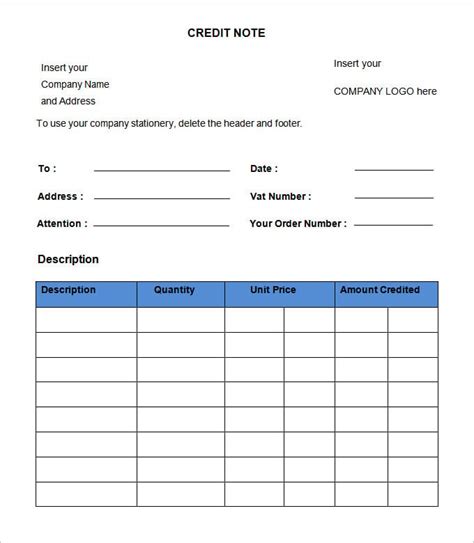

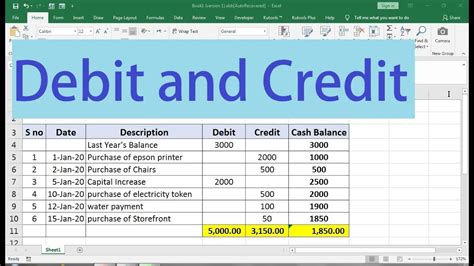

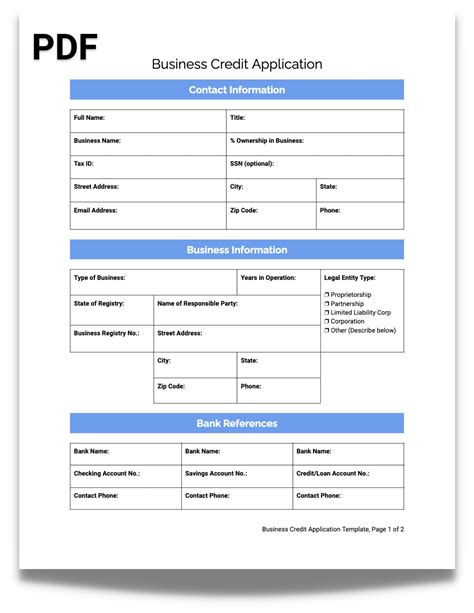

There are various types of free credit templates available, each designed to cater to specific needs. Some of the most common types include personal loan templates, business credit templates, and credit line templates. Personal loan templates are ideal for individuals who want to lend or borrow money, while business credit templates are designed for companies looking to manage their credit operations. Credit line templates, on the other hand, are useful for establishing a line of credit, specifying the terms and conditions of the agreement.How to Use Free Credit Templates Effectively

To use free credit templates effectively, it's essential to understand the key components of a credit agreement. This includes the amount borrowed, the interest rate, the repayment terms, and any collateral or security required. You should also ensure that the template is customized to fit your specific needs, including any unique terms or conditions.

When selecting a free credit template, consider the following factors:

- The template should be easy to understand and customize.

- It should include all the necessary clauses and terms.

- It should be legally binding and enforceable.

- It should provide a clear outline of the credit agreement, including the rights and obligations of both parties.

Customizing Your Free Credit Template

Customizing your free credit template is crucial to ensuring that it meets your specific needs. This involves filling in the necessary details, such as the amount borrowed, the interest rate, and the repayment terms. You should also review the template carefully, ensuring that it includes all the necessary clauses and terms.Some key elements to consider when customizing your template include:

- The credit amount and interest rate

- The repayment terms, including the frequency and amount of payments

- Any collateral or security required

- The default terms, including the consequences of late payment or non-payment

- The dispute resolution process, including any arbitration or mediation clauses

Top 5 Free Credit Templates

Here are five free credit templates that you can use for your personal or business needs:

- Personal Loan Template: This template is ideal for individuals who want to lend or borrow money. It includes all the necessary clauses and terms, including the credit amount, interest rate, and repayment terms.

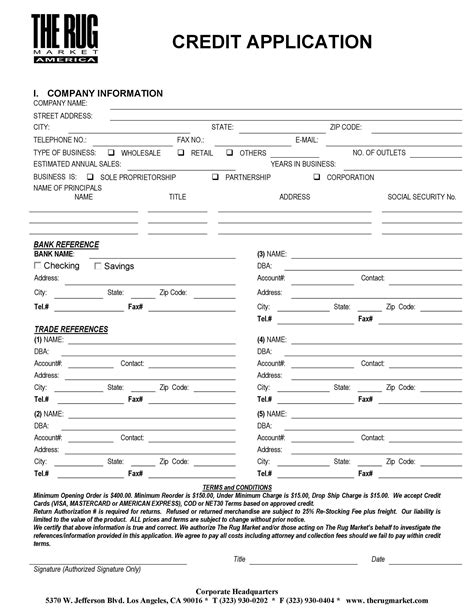

- Business Credit Template: This template is designed for companies looking to manage their credit operations. It includes sections for credit limits, interest rates, and repayment terms, as well as any collateral or security required.

- Credit Line Template: This template is useful for establishing a line of credit, specifying the terms and conditions of the agreement. It includes sections for the credit limit, interest rate, and repayment terms, as well as any fees or charges associated with the credit line.

- Mortgage Credit Template: This template is designed for individuals who want to purchase a home or refinance an existing mortgage. It includes sections for the loan amount, interest rate, and repayment terms, as well as any collateral or security required.

- Credit Card Template: This template is ideal for individuals who want to apply for a credit card or manage their existing credit card accounts. It includes sections for the credit limit, interest rate, and repayment terms, as well as any fees or charges associated with the credit card.

Conclusion and Next Steps

In conclusion, free credit templates can be a valuable resource for individuals and businesses looking to manage their financial transactions efficiently. By understanding the benefits and types of credit templates, as well as how to use them effectively, you can ensure that your credit agreements are comprehensive, legally binding, and tailored to your specific needs.Free Credit Templates Image Gallery

What is a credit template?

+A credit template is a pre-designed document that outlines the terms and conditions of a credit agreement.

Why do I need a credit template?

+You need a credit template to ensure that your credit agreements are comprehensive, legally binding, and tailored to your specific needs.

How do I customize a credit template?

+You can customize a credit template by filling in the necessary details, such as the amount borrowed, the interest rate, and the repayment terms.

What are the benefits of using free credit templates?

+The benefits of using free credit templates include saving time and money, reducing the risk of errors, and providing a professional touch to your credit agreements.

Where can I find free credit templates?

+You can find free credit templates online, by searching for keywords such as "free credit templates" or "credit agreement templates".

We hope this article has provided you with valuable insights into the world of free credit templates. Whether you are a lender or a borrower, using the right template can make a significant difference in managing your financial transactions efficiently. Feel free to share your thoughts and experiences with credit templates in the comments section below. If you found this article helpful, please share it with others who may benefit from it. Remember to always use credit templates wisely and responsibly, ensuring that your credit agreements are fair, transparent, and legally binding.