Intro

Get 5 free 1099 templates for independent contractors, freelancers, and small businesses, including IRS-compliant forms for tax reporting, income statements, and expense tracking, to simplify financial management and tax preparation.

The world of freelancing and independent contracting has grown exponentially over the past decade, with more individuals opting for the flexibility and autonomy that comes with being their own bosses. As a result, the demand for efficient and accurate tax reporting has increased, making 1099 templates an essential tool for freelancers, small business owners, and accounting professionals. In this article, we will delve into the importance of 1099 templates, their benefits, and provide five free templates that can be used for various purposes.

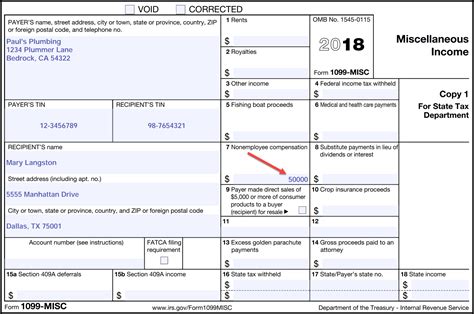

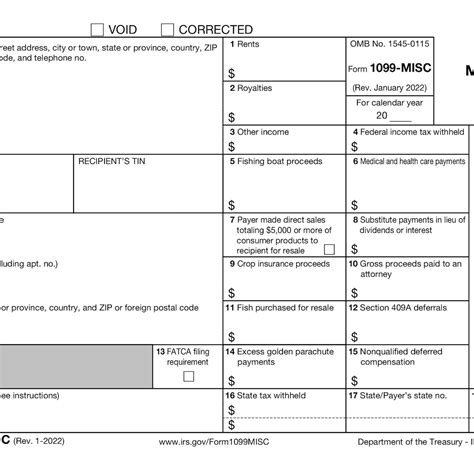

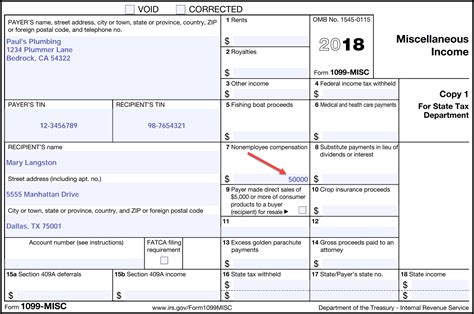

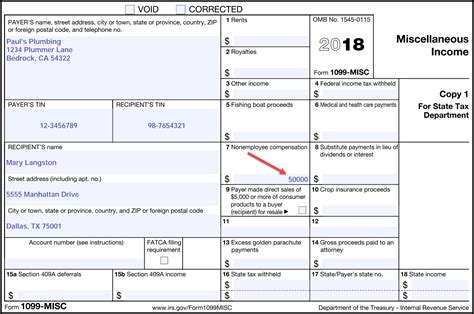

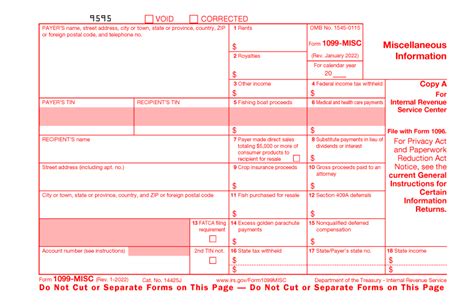

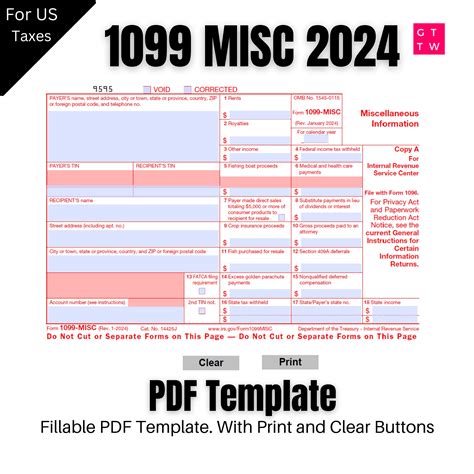

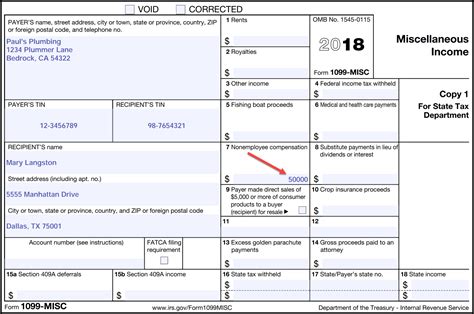

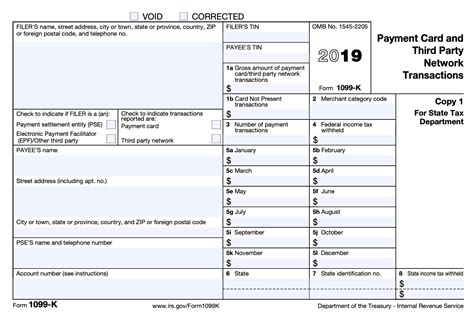

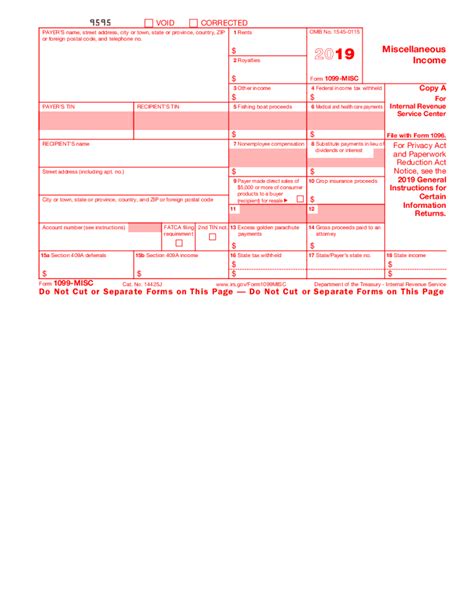

The Internal Revenue Service (IRS) requires businesses to report payments made to independent contractors and freelancers using Form 1099-MISC. This form is used to report miscellaneous income, such as freelance work, consulting fees, and rent payments. The deadline for filing Form 1099-MISC is typically January 31st of each year, and failure to comply can result in penalties and fines. Therefore, it is crucial to have a reliable and efficient system in place for generating and tracking 1099 forms.

Using 1099 templates can simplify the process of creating and filing these forms. These templates provide a standardized format for reporting income and can help reduce errors and inconsistencies. Moreover, 1099 templates can be easily customized to suit the specific needs of a business or individual, making them a versatile and practical solution for tax reporting.

Benefits of Using 1099 Templates

The benefits of using 1099 templates are numerous. Firstly, they save time and effort by providing a pre-designed format for reporting income. This can be particularly useful for small businesses or individuals who may not have the resources or expertise to create their own forms from scratch. Secondly, 1099 templates can help reduce errors and inconsistencies, which can lead to delays or penalties in the filing process. Finally, these templates can be easily customized to suit the specific needs of a business or individual, making them a versatile and practical solution for tax reporting.

Some of the key benefits of using 1099 templates include:

- Saving time and effort in creating and filing forms

- Reducing errors and inconsistencies

- Providing a standardized format for reporting income

- Being easily customizable to suit specific needs

- Helping to ensure compliance with IRS regulations

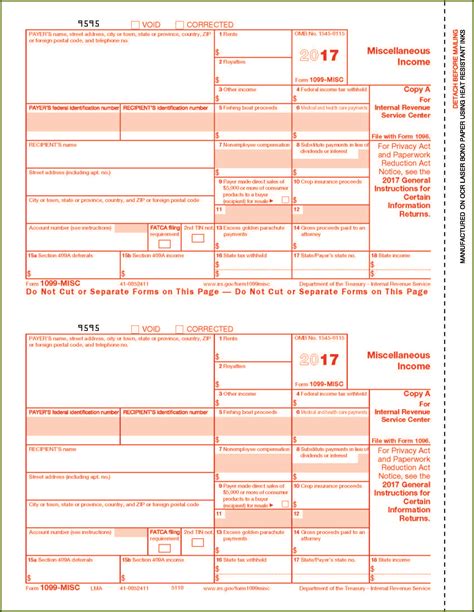

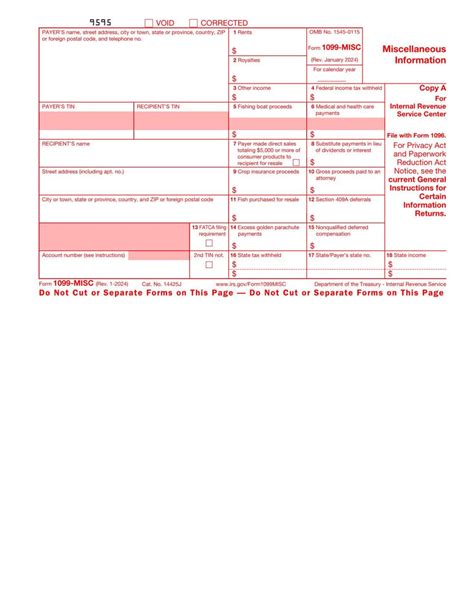

5 Free 1099 Templates

Here are five free 1099 templates that can be used for various purposes:

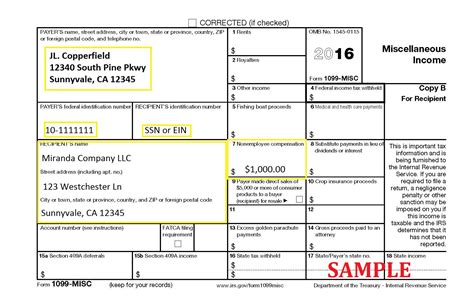

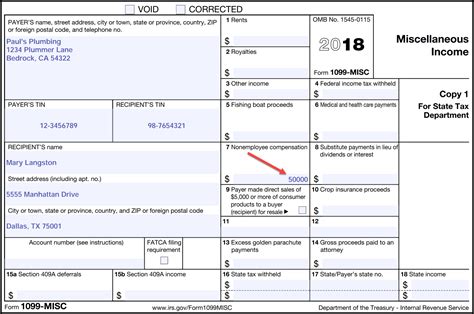

- Basic 1099-MISC Template: This template provides a simple and straightforward format for reporting miscellaneous income. It includes fields for the payer's and recipient's information, as well as the amount of income paid.

- Freelance 1099 Template: This template is designed specifically for freelancers and independent contractors. It includes fields for the freelancer's name, address, and tax identification number, as well as the amount of income earned.

- Small Business 1099 Template: This template is designed for small businesses that need to report income paid to independent contractors or freelancers. It includes fields for the business's name, address, and tax identification number, as well as the amount of income paid.

- Rent 1099 Template: This template is designed for landlords and property managers who need to report rent payments. It includes fields for the landlord's name, address, and tax identification number, as well as the amount of rent paid.

- Consulting 1099 Template: This template is designed for consultants and professionals who need to report income earned from consulting services. It includes fields for the consultant's name, address, and tax identification number, as well as the amount of income earned.

How to Use 1099 Templates

Using 1099 templates is a straightforward process. Here are the steps to follow:

- Download the template: Choose the template that best suits your needs and download it to your computer.

- Fill in the fields: Enter the required information, such as the payer's and recipient's names, addresses, and tax identification numbers.

- Calculate the income: Calculate the amount of income paid or earned and enter it into the template.

- Review and edit: Review the template for accuracy and completeness, and edit as necessary.

- Print and file: Print the completed template and file it with the IRS by the deadline.

Tips for Filing 1099 Forms

Here are some tips for filing 1099 forms:

- File on time: The deadline for filing Form 1099-MISC is typically January 31st of each year. Failure to file on time can result in penalties and fines.

- Use the correct form: Make sure to use the correct form for the type of income being reported. For example, use Form 1099-MISC for miscellaneous income, and Form 1099-INT for interest income.

- Double-check for errors: Review the form for accuracy and completeness before filing.

- Keep records: Keep a copy of the filed form and any supporting documentation for at least three years in case of an audit.

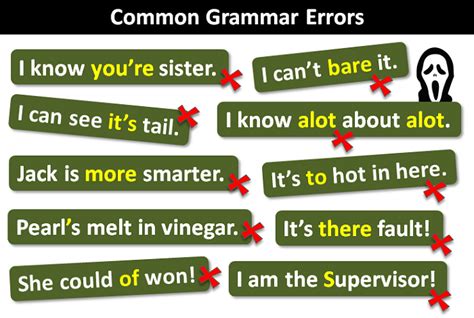

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing 1099 forms:

- Filing late: Filing the form after the deadline can result in penalties and fines.

- Using the wrong form: Using the wrong form for the type of income being reported can lead to delays or rejection of the form.

- Incomplete or inaccurate information: Failing to provide complete or accurate information can lead to delays or rejection of the form.

- Not keeping records: Failing to keep a copy of the filed form and any supporting documentation can make it difficult to respond to an audit.

Conclusion and Next Steps

In conclusion, 1099 templates are an essential tool for freelancers, small business owners, and accounting professionals. They provide a standardized format for reporting income and can help reduce errors and inconsistencies. By using the five free 1099 templates provided in this article, individuals and businesses can simplify the process of creating and filing these forms. Remember to file on time, use the correct form, and keep records to avoid common mistakes and ensure compliance with IRS regulations.

1099 Templates Image Gallery

What is a 1099 template?

+A 1099 template is a pre-designed form used to report income paid to independent contractors, freelancers, and other individuals who are not employees.

Why do I need to use a 1099 template?

+You need to use a 1099 template to report income paid to independent contractors, freelancers, and other individuals who are not employees. The template provides a standardized format for reporting income and can help reduce errors and inconsistencies.

How do I fill out a 1099 template?

+To fill out a 1099 template, you will need to enter the required information, such as the payer's and recipient's names, addresses, and tax identification numbers. You will also need to calculate the amount of income paid and enter it into the template.

What is the deadline for filing 1099 forms?

+The deadline for filing Form 1099-MISC is typically January 31st of each year. Failure to file on time can result in penalties and fines.

Can I use a 1099 template for all types of income?

+No, you cannot use a 1099 template for all types of income. You will need to use the correct form for the type of income being reported. For example, use Form 1099-MISC for miscellaneous income, and Form 1099-INT for interest income.

We hope this article has provided you with a comprehensive understanding of 1099 templates and their importance in tax reporting. If you have any further questions or need assistance with filling out a 1099 template, please do not hesitate to reach out. Remember to file on time, use the correct form, and keep records to avoid common mistakes and ensure compliance with IRS regulations. Share this article with others who may benefit from this information, and take the first step towards simplifying your tax reporting process.