Intro

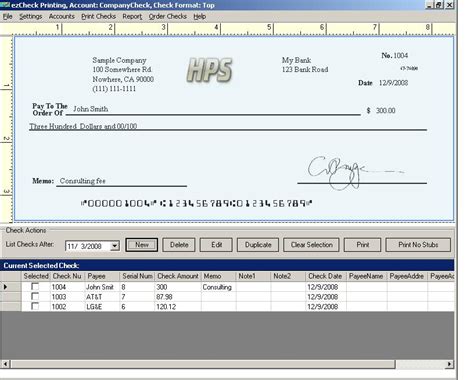

Streamline payroll processing with 5 customizable payroll check templates, featuring payroll software integration, salary slip formats, and employee pay stubs for efficient payroll management and accounting.

Payroll check templates are essential tools for businesses to manage their employee compensation effectively. These templates help streamline the payroll process, ensuring that employees receive their salaries on time and with accurate calculations. In today's digital age, utilizing payroll check templates can significantly reduce administrative burdens, minimize errors, and enhance the overall efficiency of payroll management.

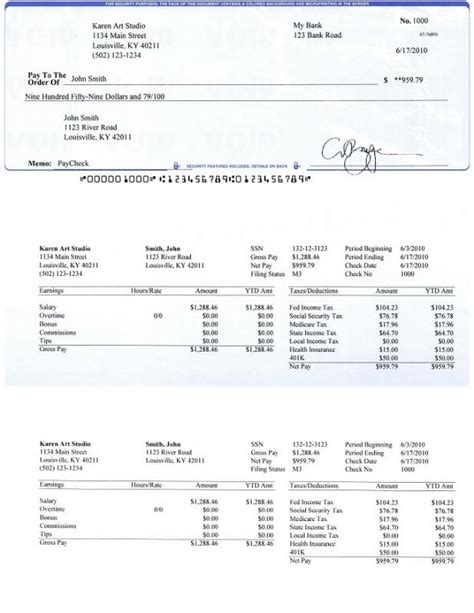

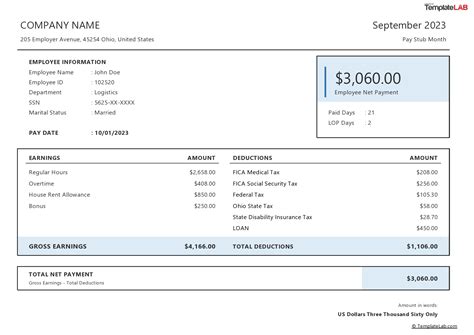

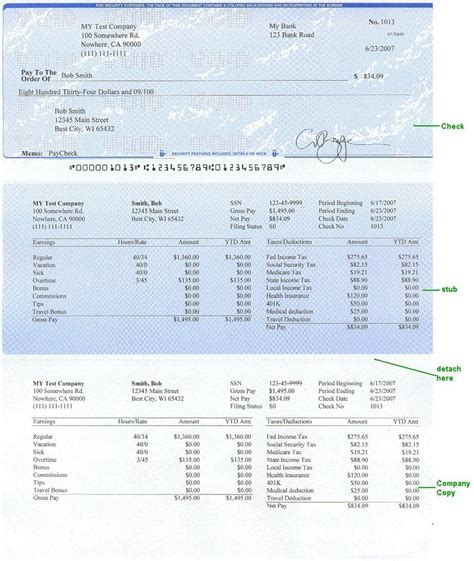

The importance of payroll check templates cannot be overstated. They provide a structured format for calculating and presenting employee compensation, including gross pay, deductions, and net pay. This not only helps in maintaining transparency and clarity in payroll transactions but also aids in compliance with legal and regulatory requirements. Furthermore, payroll check templates can be customized to fit the specific needs of a business, allowing for flexibility and adaptability in payroll management.

For businesses looking to optimize their payroll processes, exploring different payroll check templates is a crucial step. These templates can be found in various formats, including Excel, Word, and PDF, making them accessible to a wide range of users. Whether a business is small, medium, or large, there is a payroll check template available to suit its needs. From basic templates that cover essential payroll information to more advanced ones that include benefits, taxes, and other deductions, the variety of payroll check templates ensures that every business can find a suitable solution for its payroll management needs.

Introduction to Payroll Check Templates

Payroll check templates are designed to simplify the payroll process, making it easier for businesses to manage employee compensation. These templates typically include fields for employee information, pay rates, hours worked, deductions, and net pay, among other details. By using a payroll check template, businesses can ensure consistency and accuracy in their payroll calculations, reducing the risk of errors and disputes.

Benefits of Using Payroll Check Templates

The benefits of using payroll check templates are numerous. They include: - Enhanced accuracy and consistency in payroll calculations - Reduced administrative time and effort - Improved compliance with legal and regulatory requirements - Increased transparency and clarity in payroll transactions - Customization options to fit the specific needs of a businessTypes of Payroll Check Templates

There are various types of payroll check templates available, catering to different business needs and preferences. Some common types include:

- Basic Payroll Template: Suitable for small businesses or those with straightforward payroll needs, this template covers essential payroll information such as employee details, pay rates, and deductions.

- Advanced Payroll Template: Designed for businesses with more complex payroll requirements, this template includes additional fields for benefits, taxes, and other deductions.

- Customizable Payroll Template: This template allows businesses to tailor their payroll checks to their specific needs, including adding or removing fields as necessary.

- Digital Payroll Template: Ideal for businesses embracing digital transformation, this template enables electronic payroll management, including online payments and digital receipts.

- Manual Payroll Template: Suitable for businesses that prefer traditional methods or have limited access to digital tools, this template provides a physical format for calculating and recording payroll information.

How to Choose the Right Payroll Check Template

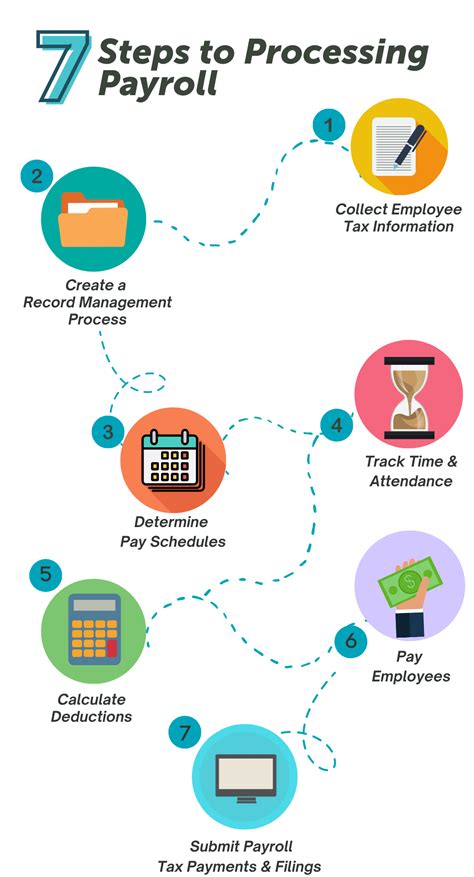

Choosing the right payroll check template depends on several factors, including the size and type of business, the complexity of payroll needs, and the preferred method of payroll management. Businesses should consider the following steps when selecting a payroll check template: - Assess the business's payroll needs and complexity - Evaluate the available types of payroll check templates - Consider the ease of use and customization options - Ensure compliance with legal and regulatory requirements - Review feedback and recommendations from other usersCreating a Payroll Check Template

Creating a payroll check template can be a straightforward process, especially with the availability of template examples and software tools. The key steps include:

- Determine the Template Fields: Identify the essential information that needs to be included in the payroll check template, such as employee details, pay rates, and deductions.

- Choose a Template Format: Decide on the format of the template, whether it be Excel, Word, or another software tool.

- Design the Template Layout: Arrange the template fields in a clear and logical manner, ensuring ease of use and readability.

- Include Calculation Formulas: Add formulas to automate payroll calculations, such as gross pay, deductions, and net pay.

- Test and Refine the Template: Pilot test the template with sample data to ensure accuracy and functionality, making adjustments as necessary.

Best Practices for Using Payroll Check Templates

To maximize the benefits of payroll check templates, businesses should adhere to best practices, including: - Regularly updating the template to reflect changes in payroll laws and regulations - Ensuring accuracy and consistency in payroll data entry - Maintaining secure and confidential storage of payroll information - Providing clear and transparent communication to employees regarding their payroll details - Continuously reviewing and improving the payroll process to enhance efficiency and complianceCommon Challenges with Payroll Check Templates

Despite the advantages of payroll check templates, businesses may encounter challenges, including:

- Error in Calculations: Inaccurate formulas or data entry can lead to incorrect payroll calculations.

- Compliance Issues: Failure to update templates in line with changing laws and regulations can result in non-compliance.

- Security Risks: Inadequate storage and protection of payroll information can expose businesses to data breaches and cyber attacks.

- User Resistance: Employees may resist changes in payroll management, requiring effective communication and training.

Solutions to Overcome Challenges

To overcome these challenges, businesses can: - Implement regular audits and reviews of payroll calculations - Stay informed about updates in payroll laws and regulations - Invest in secure and reliable payroll software - Provide comprehensive training and support to employeesFuture of Payroll Check Templates

The future of payroll check templates is likely to be shaped by technological advancements and evolving business needs. Trends may include:

- Increased Digitalization: More businesses are expected to adopt digital payroll templates and management systems.

- Advanced Automation: Payroll templates may incorporate more sophisticated automation, including AI and machine learning, to enhance accuracy and efficiency.

- Enhanced Security: There will be a greater emphasis on security measures to protect payroll data, including encryption and two-factor authentication.

- Customization and Flexibility: Payroll check templates will need to be highly customizable to accommodate the diverse and changing needs of businesses and employees.

Preparing for the Future

To prepare for these future trends, businesses should: - Invest in digital payroll solutions - Stay updated with the latest in payroll technology and best practices - Prioritize payroll data security - Foster a culture of flexibility and adaptability in payroll managementPayroll Check Templates Image Gallery

What are payroll check templates used for?

+Payroll check templates are used to simplify the payroll process, ensuring accuracy and consistency in payroll calculations and presentations.

How do I choose the right payroll check template for my business?

+Choose a payroll check template that fits your business size, type, and complexity of payroll needs. Consider factors such as ease of use, customization options, and compliance with legal requirements.

Can payroll check templates be customized?

+Yes, payroll check templates can be customized to fit the specific needs of a business, including adding or removing fields as necessary.

In conclusion, payroll check templates are indispensable tools for effective payroll management. By understanding the importance, benefits, and types of payroll check templates, businesses can make informed decisions to optimize their payroll processes. As payroll management continues to evolve with technological advancements and changing business needs, the role of payroll check templates will remain vital in ensuring accuracy, efficiency, and compliance. We invite you to share your experiences and insights regarding payroll check templates, and we look forward to your comments and feedback on this article.