Intro

Discover 5 ways to track stocks, including real-time monitoring, stock screeners, and market analysis, to make informed investment decisions and maximize portfolio performance with stock tracking tools and market trends.

Investing in the stock market can be a lucrative venture, but it requires careful planning, research, and monitoring. One of the most critical aspects of stock market investing is tracking stocks. With the numerous tools and techniques available, it can be overwhelming for beginners to choose the best method. In this article, we will explore five ways to track stocks, providing you with a comprehensive understanding of the options available.

Tracking stocks is essential to make informed investment decisions. It helps you stay up-to-date with market trends, identify potential opportunities, and mitigate risks. By monitoring stock prices, trading volumes, and other market indicators, you can adjust your investment strategy to maximize returns. Whether you are a seasoned investor or just starting out, tracking stocks is a crucial step in achieving your financial goals.

The stock market is constantly evolving, with new technologies and tools emerging to help investors track stocks. From traditional methods like financial news and stock tickers to modern approaches like mobile apps and social media, there are numerous ways to stay informed about the market. In this article, we will delve into five effective ways to track stocks, providing you with a detailed understanding of each method.

Understanding Stock Tracking

Technical Analysis

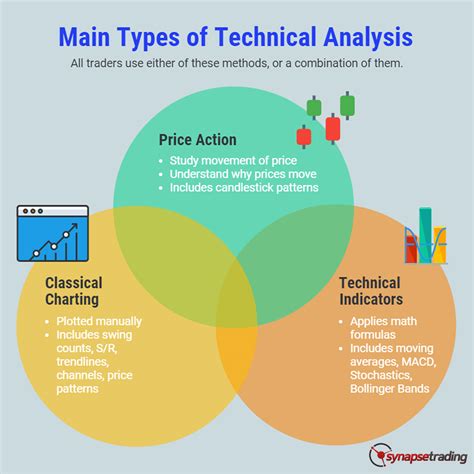

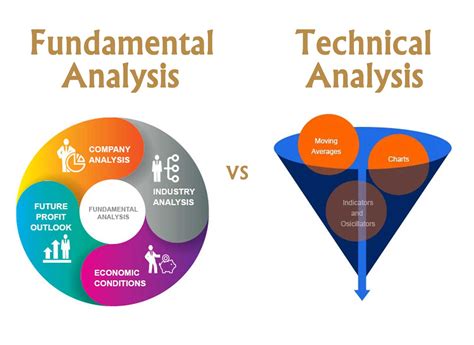

Technical analysis involves studying charts and patterns to predict future price movements. It's a crucial aspect of stock tracking, as it helps investors identify trends and make informed decisions. Technical analysis involves various techniques, including trend analysis, chart patterns, and indicators. By applying these techniques, investors can gain insights into market trends and make informed decisions.5 Ways to Track Stocks

- Financial News: Financial news is a traditional method of tracking stocks. It involves staying up-to-date with market news, trends, and analysis. Financial news can be found in various sources, including newspapers, magazines, and online portals. By following financial news, investors can gain insights into market trends and make informed decisions.

- Stock Tickers: Stock tickers are another traditional method of tracking stocks. They provide real-time updates on stock prices, trading volumes, and other market indicators. Stock tickers can be found on various platforms, including financial websites, mobile apps, and television channels.

- Mobile Apps: Mobile apps are a modern approach to tracking stocks. They provide real-time updates on stock prices, trading volumes, and other market indicators. Mobile apps also offer various tools and features, including technical analysis, fundamental analysis, and portfolio management.

- Social Media: Social media is a relatively new method of tracking stocks. It involves following financial experts, analysts, and investors on social media platforms. Social media provides real-time updates on market trends, news, and analysis. By following the right people, investors can gain insights into market trends and make informed decisions.

- Online Portals: Online portals are a comprehensive method of tracking stocks. They provide real-time updates on stock prices, trading volumes, and other market indicators. Online portals also offer various tools and features, including technical analysis, fundamental analysis, and portfolio management.

Benefits of Stock Tracking

Stock tracking offers numerous benefits, including:- Informed Decision-Making: Stock tracking provides investors with the information they need to make informed decisions. By monitoring stock prices, trading volumes, and other market indicators, investors can adjust their investment strategy to maximize returns.

- Risk Mitigation: Stock tracking helps investors mitigate risks by identifying potential threats and opportunities. By monitoring market trends and economic indicators, investors can adjust their investment strategy to minimize losses.

- Maximized Returns: Stock tracking helps investors maximize returns by identifying potential opportunities. By monitoring stock prices, trading volumes, and other market indicators, investors can adjust their investment strategy to maximize returns.

Tools and Techniques

- Technical Analysis Software: Technical analysis software is a tool used to analyze charts and patterns. It provides investors with insights into market trends and helps them make informed decisions.

- Fundamental Analysis Tools: Fundamental analysis tools are used to analyze a company's financial statements, management team, and industry trends. They provide investors with insights into a company's potential for growth and profitability.

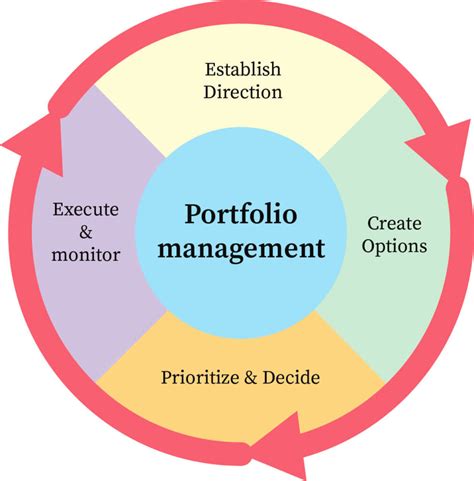

- Portfolio Management Software: Portfolio management software is a tool used to manage investment portfolios. It provides investors with a comprehensive view of their investments, including stock prices, trading volumes, and other market indicators.

Best Practices

Stock tracking involves various best practices, including:- Regular Monitoring: Regular monitoring is essential to stock tracking. It involves monitoring stock prices, trading volumes, and other market indicators on a regular basis.

- Diversification: Diversification is a best practice that involves spreading investments across various asset classes. It helps investors mitigate risks and maximize returns.

- Risk Management: Risk management is a best practice that involves identifying and mitigating potential risks. It involves monitoring market trends and economic indicators, as well as adjusting investment strategies to minimize losses.

Conclusion and Next Steps

Stock Market Image Gallery

What is stock tracking?

+Stock tracking involves monitoring stock prices, trading volumes, and other market indicators to make informed investment decisions.

Why is stock tracking important?

+Stock tracking is important because it helps investors make informed decisions, mitigate risks, and maximize returns.

What are the best methods for tracking stocks?

+The best methods for tracking stocks include financial news, stock tickers, mobile apps, social media, and online portals.

We hope this article has provided you with a comprehensive understanding of stock tracking and its importance in investing in the stock market. Remember to always follow best practices and use the right tools and techniques to make informed decisions. If you have any questions or comments, please feel free to share them below.