Intro

Discover 5 ways Excel payment calculator simplifies loan management, amortization, and financial planning with formulas, templates, and spreadsheet tools for efficient cash flow analysis and debt repayment strategies.

In today's fast-paced world, managing finances effectively is crucial for individuals and businesses alike. One of the most powerful tools for financial management is Microsoft Excel, which offers a wide range of functions and formulas to calculate payments, interests, and more. An Excel payment calculator is a simple yet powerful tool that can help you determine the monthly payments on a loan, the total interest paid over the life of the loan, and even the payoff period. Here are 5 ways an Excel payment calculator can benefit you, along with step-by-step instructions on how to create one.

The importance of having a clear understanding of loan payments cannot be overstated. Whether you're buying a house, a car, or financing a business venture, knowing exactly how much you'll be paying each month and over the life of the loan is essential for budgeting and financial planning. Excel, with its intuitive interface and powerful calculation capabilities, is the perfect tool for creating a payment calculator tailored to your specific needs.

Understanding how to use Excel for financial calculations can seem daunting at first, but with a little practice, you'll be creating complex financial models in no time. The key is to start with the basics and build from there. For a payment calculator, you'll need to know the loan amount, the interest rate, and the loan term. With these pieces of information, you can calculate the monthly payment, the total interest paid, and even explore different scenarios to see how changes in the interest rate or loan term affect your payments.

Introduction to Excel Payment Calculators

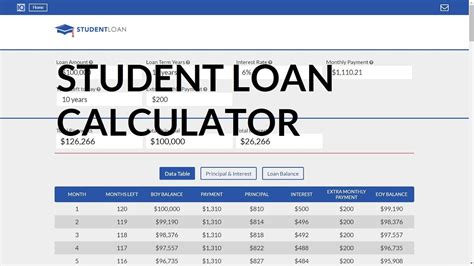

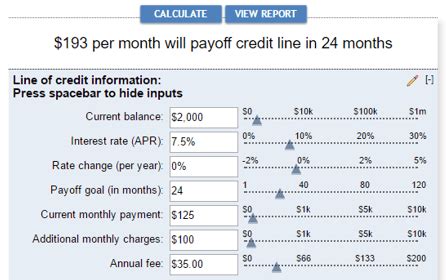

Excel payment calculators are essentially spreadsheets set up to perform specific financial calculations. They can be as simple or as complex as needed, depending on the user's requirements. For instance, a basic calculator might only calculate the monthly payment based on the loan amount, interest rate, and loan term. A more advanced calculator, however, could include features like the ability to calculate the payoff period if you make extra payments or to compare the costs of different loan options.

Benefits of Using an Excel Payment Calculator

There are several benefits to using an Excel payment calculator:

- Flexibility: Excel allows you to easily change variables like the interest rate or loan term to see how they affect your payments.

- Accuracy: By using formulas, you can ensure that your calculations are accurate and consistent.

- Customization: You can tailor your calculator to fit your specific needs, whether that's calculating payments for a mortgage, car loan, or business loan.

- Scalability: Whether you're managing personal finances or overseeing a large business, Excel can handle complex financial models with ease.

- Cost-Effective: Once you've created your calculator, you can use it repeatedly without incurring additional costs.

Step-by-Step Guide to Creating an Excel Payment Calculator

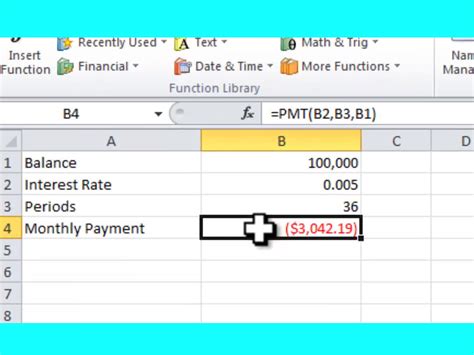

To create a basic Excel payment calculator, follow these steps: 1. Open Excel and create a new spreadsheet. 2. Set up your input cells for the loan amount, interest rate (as a decimal), and loan term (in years). 3. Use the PMT function to calculate the monthly payment. The formula is `=PMT(rate, nper, pv, [fv], [type])`, where: - `rate` is the monthly interest rate (annual rate divided by 12). - `nper` is the total number of payments (loan term in years multiplied by 12). - `pv` is the present value (the loan amount). - `[fv]` and `[type]` are optional and can be omitted for a basic calculation. 4. Calculate the total interest paid over the life of the loan by multiplying the monthly payment by the total number of payments and then subtracting the loan amount. 5. Experiment with different scenarios by changing the input values and observing how the calculations change.Advanced Features for Your Excel Payment Calculator

For those looking to take their Excel payment calculator to the next level, there are several advanced features you can incorporate:

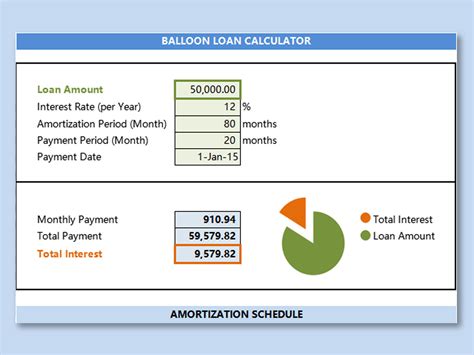

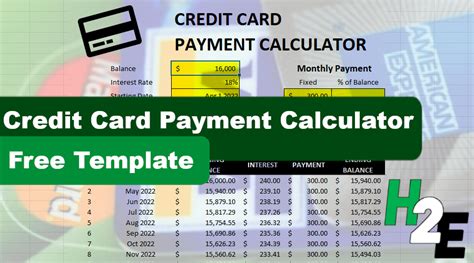

- Amortization Schedule: Create a table that shows each payment, the amount of interest paid, the amount applied to the principal, and the remaining balance.

- Extra Payments: Calculate how making extra payments can reduce the payoff period and total interest paid.

- Comparison Tool: Set up a section of your spreadsheet to compare different loan options, such as fixed vs. variable interest rates or different loan terms.

Real-World Applications of Excel Payment Calculators

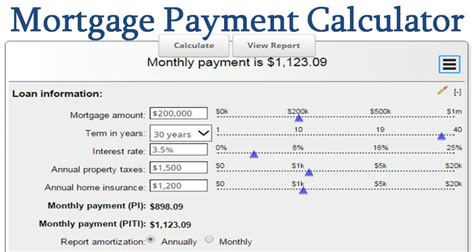

Excel payment calculators have numerous real-world applications: - **Mortgage Planning**: Determine the monthly payments for a house and explore how different interest rates or down payments affect those payments. - **Car Financing**: Calculate the monthly payments for a car loan and compare the costs of financing through different lenders. - **Business Loans**: Use an Excel payment calculator to determine the feasibility of different loan options for business expansion or investment.Gallery of Excel Payment Calculator Examples

Excel Payment Calculator Image Gallery

Frequently Asked Questions About Excel Payment Calculators

What is an Excel payment calculator?

+An Excel payment calculator is a spreadsheet designed to calculate loan payments, including monthly payments and total interest paid over the life of the loan.

How do I create a basic payment calculator in Excel?

+To create a basic payment calculator, use the PMT function, which requires the interest rate, number of payments, and the present value (loan amount) as inputs.

Can I use an Excel payment calculator for different types of loans?

+Yes, Excel payment calculators can be used for various types of loans, including mortgages, car loans, personal loans, and business loans, by adjusting the inputs accordingly.

How accurate are Excel payment calculators?

+Excel payment calculators are highly accurate if the inputs are correct and the formulas are set up properly. They can provide precise calculations for loan payments and total interest paid.

Can I customize my Excel payment calculator?

+Yes, one of the advantages of using an Excel payment calculator is its customizability. You can add features like amortization schedules, extra payment calculations, and loan comparisons to suit your needs.

In conclusion, Excel payment calculators are invaluable tools for anyone dealing with loans, whether personal or professional. By understanding how to create and use these calculators, you can make informed financial decisions and plan your finances more effectively. Don't hesitate to reach out with any questions or to share your experiences with using Excel for financial calculations. Share this article with someone who might benefit from learning about the power of Excel payment calculators, and consider exploring other ways Excel can help you manage your finances and achieve your goals.