Intro

Discover 5 ways to create a budget template, including expense tracking, financial planning, and money management tools to optimize your personal finance and achieve fiscal stability with effective budgeting strategies.

Creating a budget is a crucial step in managing one's finances effectively. It helps individuals and businesses alike to track their income and expenses, make informed financial decisions, and achieve their financial goals. A budget template is a tool that simplifies the budgeting process by providing a structured format for organizing financial data. In this article, we will explore five ways a budget template can benefit individuals and businesses, and provide guidance on how to create and use a budget template effectively.

Budgeting is essential for achieving financial stability and security. Without a budget, it's easy to overspend and accumulate debt, which can lead to financial stress and anxiety. A budget template helps to avoid these pitfalls by providing a clear picture of one's financial situation and enabling individuals to make conscious decisions about how to allocate their resources. By using a budget template, individuals can identify areas where they can cut back on unnecessary expenses, prioritize their spending, and make progress towards their financial goals.

Effective budgeting also involves tracking expenses and staying on top of financial obligations. A budget template makes it easy to monitor income and expenses, identify trends and patterns, and make adjustments as needed. By regularly reviewing and updating their budget, individuals can stay on track with their financial goals and make adjustments to their spending habits to ensure they are living within their means. Whether you're looking to save money, pay off debt, or build wealth, a budget template is an essential tool for achieving financial success.

Benefits of Using a Budget Template

Using a budget template offers numerous benefits, including increased financial awareness, improved money management, and reduced financial stress. A budget template helps individuals to prioritize their spending, make informed financial decisions, and achieve their financial goals. By providing a structured format for organizing financial data, a budget template makes it easy to track income and expenses, identify areas for improvement, and make adjustments to spending habits. With a budget template, individuals can take control of their finances, reduce debt, and build wealth over time.

Some of the key benefits of using a budget template include:

- Increased financial awareness: A budget template helps individuals to understand where their money is going and make informed decisions about how to allocate their resources.

- Improved money management: By tracking income and expenses, individuals can identify areas where they can cut back on unnecessary expenses and prioritize their spending.

- Reduced financial stress: A budget template helps individuals to stay on top of their financial obligations, avoid debt, and achieve financial stability.

- Improved savings: By prioritizing savings and investing, individuals can build wealth over time and achieve their long-term financial goals.

- Enhanced financial flexibility: A budget template enables individuals to respond to changes in their financial situation, such as a job loss or unexpected expense, and make adjustments to their spending habits as needed.

Types of Budget Templates

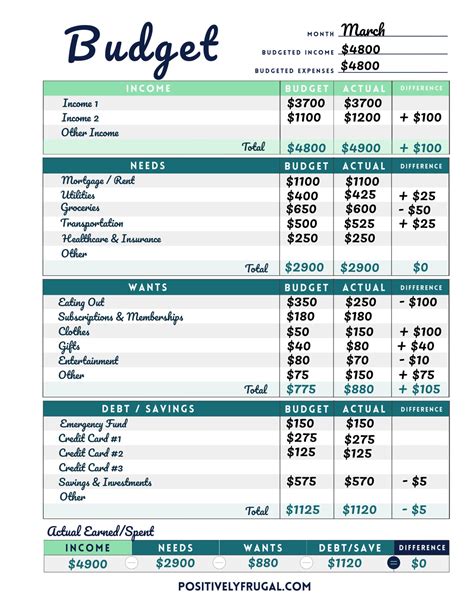

There are several types of budget templates available, each designed to meet the unique needs of individuals and businesses. Some common types of budget templates include:

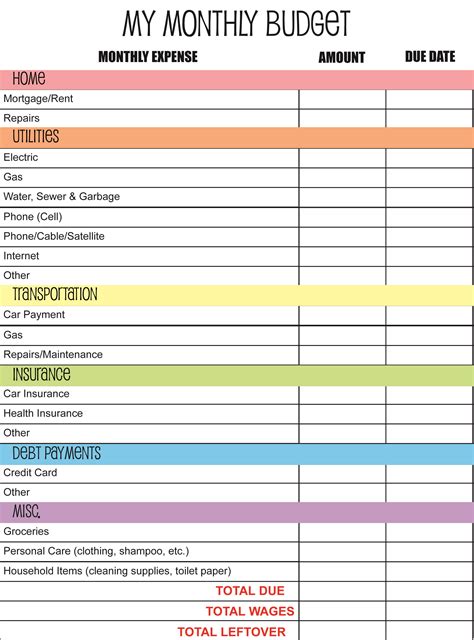

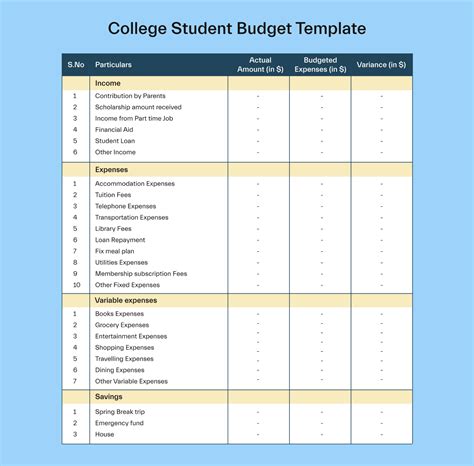

- Personal budget templates: Designed for individuals, these templates help to track personal income and expenses, such as rent, utilities, and groceries.

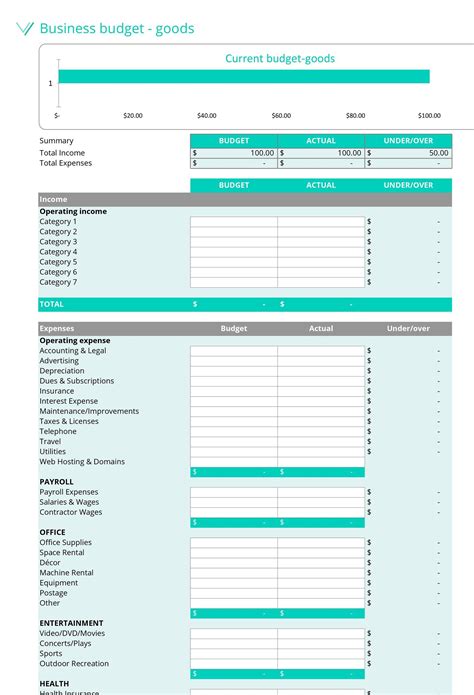

- Business budget templates: Designed for businesses, these templates help to track revenue and expenses, such as salaries, equipment, and marketing costs.

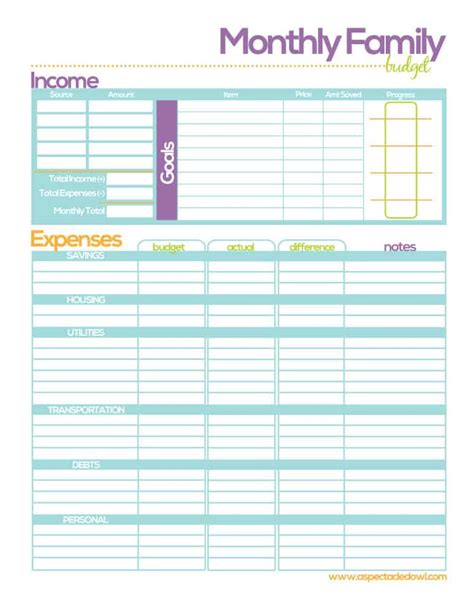

- Household budget templates: Designed for families, these templates help to track household income and expenses, such as mortgage payments, car loans, and insurance premiums.

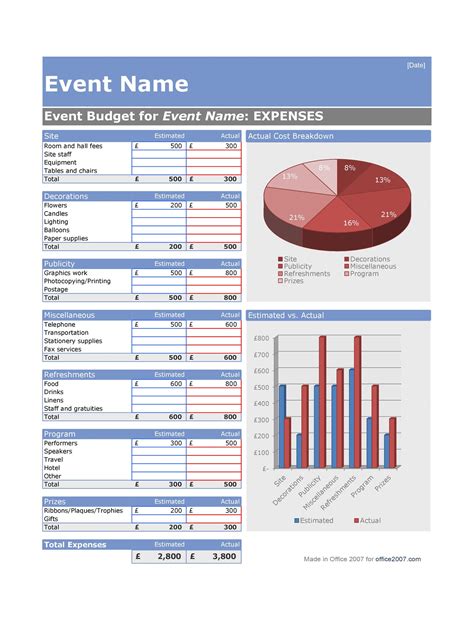

- Event budget templates: Designed for special events, such as weddings or parties, these templates help to track expenses, such as venue rental, catering, and decorations.

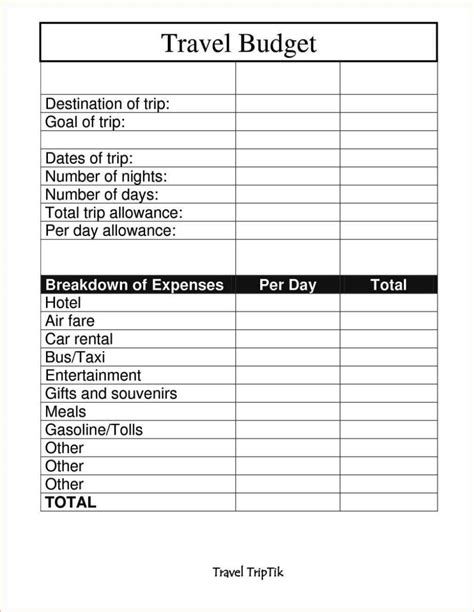

- Travel budget templates: Designed for trips and vacations, these templates help to track expenses, such as transportation, accommodation, and food.

How to Create a Budget Template

Creating a budget template is a straightforward process that involves identifying income and expenses, categorizing expenses, and setting financial goals. Here are the steps to create a budget template:

- Identify income: Start by identifying all sources of income, including salary, investments, and any side hustles.

- Identify expenses: Next, identify all expenses, including fixed expenses, such as rent and utilities, and variable expenses, such as groceries and entertainment.

- Categorize expenses: Categorize expenses into different groups, such as housing, transportation, and food.

- Set financial goals: Determine what you want to achieve with your budget, such as saving for a down payment on a house or paying off debt.

- Choose a budgeting method: Choose a budgeting method, such as the 50/30/20 rule, which allocates 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Using a Budget Template Effectively

Using a budget template effectively involves regularly reviewing and updating the budget, tracking expenses, and making adjustments as needed. Here are some tips for using a budget template effectively:

- Review and update the budget regularly: Regularly review the budget to ensure it is accurate and up-to-date.

- Track expenses: Track expenses to ensure they are aligned with the budget and make adjustments as needed.

- Make adjustments: Make adjustments to the budget as needed to ensure it is working effectively.

- Prioritize needs over wants: Prioritize necessary expenses over discretionary spending to ensure the budget is working effectively.

- Automate savings: Automate savings by setting up automatic transfers from checking to savings or investment accounts.

Common Budgeting Mistakes to Avoid

There are several common budgeting mistakes to avoid, including:

- Not tracking expenses: Failing to track expenses can lead to overspending and a lack of financial awareness.

- Not prioritizing needs over wants: Failing to prioritize necessary expenses over discretionary spending can lead to financial stress and instability.

- Not saving for emergencies: Failing to save for emergencies can lead to financial stress and instability.

- Not reviewing and updating the budget: Failing to regularly review and update the budget can lead to a lack of financial awareness and ineffective budgeting.

- Not automating savings: Failing to automate savings can lead to a lack of savings and financial instability.

Budget Template Image Gallery

What is a budget template?

+A budget template is a tool that helps individuals and businesses to track their income and expenses, make informed financial decisions, and achieve their financial goals.

Why is budgeting important?

+Budgeting is important because it helps individuals and businesses to manage their finances effectively, achieve financial stability, and make progress towards their financial goals.

How do I create a budget template?

+To create a budget template, identify your income and expenses, categorize your expenses, and set financial goals. Choose a budgeting method, such as the 50/30/20 rule, and regularly review and update your budget.

What are some common budgeting mistakes to avoid?

+Some common budgeting mistakes to avoid include not tracking expenses, not prioritizing needs over wants, not saving for emergencies, not reviewing and updating the budget, and not automating savings.

How can I use a budget template effectively?

+To use a budget template effectively, regularly review and update the budget, track expenses, and make adjustments as needed. Prioritize needs over wants, automate savings, and make progress towards your financial goals.

In conclusion, a budget template is a powerful tool for managing finances effectively. By providing a structured format for organizing financial data, a budget template helps individuals and businesses to track their income and expenses, make informed financial decisions, and achieve their financial goals. Whether you're looking to save money, pay off debt, or build wealth, a budget template is an essential tool for achieving financial success. We encourage you to share your thoughts and experiences with budget templates in the comments section below. Have you used a budget template before? What benefits have you experienced? Do you have any tips for using a budget template effectively? Share your story and help others to achieve financial success.