Intro

Create a personalized budget with an Excel budget template, as recommended on Reddit. Track expenses, income, and savings with ease, using budgeting worksheets and financial planning tools for effective money management and budgeting strategies.

Creating and managing a budget can be a daunting task, but with the right tools, it can be made much simpler. One such tool is an Excel budget template, and the Reddit community has a wealth of information and resources on this topic. Budgeting is essential for anyone looking to track their expenses, save money, and achieve financial stability. By using an Excel budget template, individuals can easily monitor their income and expenses, identify areas where they can cut back, and make informed financial decisions.

Effective budgeting is crucial for achieving financial goals, whether it's paying off debt, building savings, or investing in the future. A well-structured budget helps individuals prioritize their spending, ensure they have enough money for essential expenses, and make progress towards their long-term financial objectives. The importance of budgeting cannot be overstated, and using an Excel budget template is an excellent way to get started. With its flexibility, customization options, and ease of use, Excel is an ideal platform for creating a personalized budget that meets individual needs.

The Reddit community is a great resource for finding and sharing Excel budget templates, as well as getting tips and advice on how to use them effectively. Many users share their own templates, which can be downloaded and customized to suit individual needs. Additionally, the community provides a platform for discussing budgeting strategies, sharing experiences, and learning from others. By leveraging the collective knowledge and expertise of the Reddit community, individuals can create a budget that works for them and helps them achieve their financial goals.

Benefits of Using an Excel Budget Template

Using an Excel budget template offers numerous benefits, including ease of use, flexibility, and customization options. Excel is a widely used spreadsheet software that is readily available, making it an ideal choice for creating a budget. With an Excel budget template, individuals can easily track their income and expenses, create charts and graphs to visualize their data, and make adjustments as needed. The template can be customized to suit individual needs, allowing users to add or remove categories, create formulas, and format the template to their liking.

Some of the key benefits of using an Excel budget template include:

- Easy to use and navigate

- Customizable to suit individual needs

- Allows for easy tracking of income and expenses

- Enables creation of charts and graphs to visualize data

- Can be used to set financial goals and track progress

- Helps identify areas where costs can be reduced

How to Create an Excel Budget Template

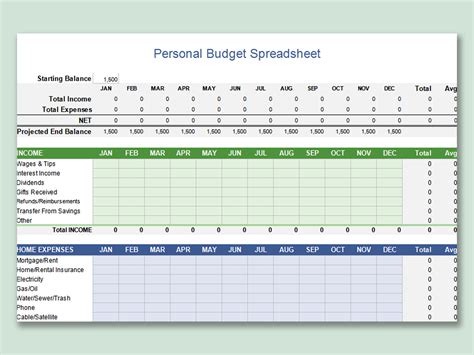

Creating an Excel budget template is a straightforward process that can be completed in a few steps. First, open a new Excel spreadsheet and set up the basic structure of the template, including columns for income, fixed expenses, variable expenses, and savings. Next, create formulas to calculate totals and percentages, and format the template to make it easy to read and understand. Finally, customize the template to suit individual needs, adding or removing categories as necessary.

Here are the steps to create an Excel budget template:

- Open a new Excel spreadsheet and set up the basic structure

- Create columns for income, fixed expenses, variable expenses, and savings

- Create formulas to calculate totals and percentages

- Format the template to make it easy to read and understand

- Customize the template to suit individual needs

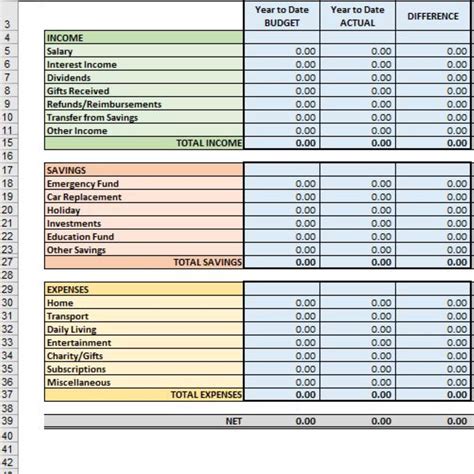

Excel Budget Template Examples

There are many examples of Excel budget templates available online, each with its own unique features and benefits. Some templates are simple and straightforward, while others are more complex and detailed. The key is to find a template that meets individual needs and is easy to use. Some popular examples of Excel budget templates include:

- The 50/30/20 budget template, which allocates 50% of income towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment

- The zero-based budget template, which requires users to account for every dollar of income and make conscious decisions about how to allocate funds

- The envelope budget template, which uses a system of virtual envelopes to categorize and track expenses

Reddit Community Resources

The Reddit community is a valuable resource for finding and sharing Excel budget templates, as well as getting tips and advice on how to use them effectively. Many users share their own templates, which can be downloaded and customized to suit individual needs. Additionally, the community provides a platform for discussing budgeting strategies, sharing experiences, and learning from others. Some popular subreddits for budgeting and personal finance include:

- r/personalfinance, which has over 15 million subscribers and features a wide range of topics related to personal finance

- r/budgeting, which is dedicated to discussing budgeting strategies and sharing resources

- r/excel, which is a community of Excel users who share tips, tricks, and resources for using the software

Tips for Using an Excel Budget Template

Using an Excel budget template can be a powerful tool for managing finances, but it requires some effort and dedication to get the most out of it. Here are some tips for using an Excel budget template effectively:

- Start by tracking income and expenses to get a clear picture of where money is going

- Set financial goals and use the template to track progress

- Regularly review and update the template to ensure it remains accurate and relevant

- Use formulas and charts to visualize data and make informed decisions

- Consider sharing the template with a partner or financial advisor to get additional feedback and support

Common Mistakes to Avoid

When using an Excel budget template, there are several common mistakes to avoid. These include:

- Failing to track income and expenses accurately

- Not regularly reviewing and updating the template

- Not setting clear financial goals

- Not using formulas and charts to visualize data

- Not seeking feedback and support from others

Conclusion and Next Steps

In conclusion, using an Excel budget template is a powerful tool for managing finances and achieving financial stability. By following the tips and strategies outlined in this article, individuals can create a personalized budget that meets their needs and helps them achieve their financial goals. Remember to regularly review and update the template, seek feedback and support from others, and use formulas and charts to visualize data.

Excel Budget Template Image Gallery

What is an Excel budget template?

+An Excel budget template is a pre-designed spreadsheet that helps individuals track their income and expenses, create a budget, and make informed financial decisions.

How do I create an Excel budget template?

+To create an Excel budget template, start by setting up the basic structure of the template, including columns for income, fixed expenses, variable expenses, and savings. Then, create formulas to calculate totals and percentages, and format the template to make it easy to read and understand.

What are the benefits of using an Excel budget template?

+The benefits of using an Excel budget template include ease of use, flexibility, and customization options. It also helps individuals track their income and expenses, create a budget, and make informed financial decisions.

Where can I find Excel budget templates?

+Excel budget templates can be found online, including on the Reddit community, where users share their own templates and provide tips and advice on how to use them effectively.

How often should I review and update my Excel budget template?

+It's recommended to review and update your Excel budget template regularly, ideally every month, to ensure it remains accurate and relevant. This will help you stay on track with your financial goals and make adjustments as needed.

We hope this article has provided you with a comprehensive guide to using an Excel budget template. If you have any further questions or would like to share your own experiences with using Excel budget templates, please don't hesitate to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from it. By working together and sharing our knowledge and expertise, we can all achieve financial stability and success.