Intro

Boost investment returns with 5 Equity Roll Tips, leveraging stock options, hedging strategies, and risk management to maximize portfolio value and minimize losses, optimizing equity rolls for success.

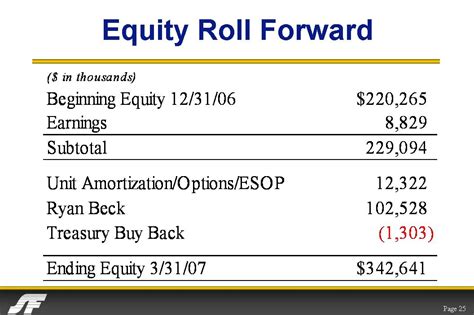

The concept of equity rolls is crucial for investors, particularly those involved in options trading. Understanding how to navigate these rolls effectively can significantly impact the profitability and risk management of an investment portfolio. Equity rolls refer to the process of closing an existing options position and simultaneously opening a new one, typically with a different strike price or expiration date, to adjust the position's risk profile or to capitalize on changing market conditions. This strategy is widely used by investors to manage their exposure to the market, adjust their investment thesis, or simply to extend their investment horizon.

For those who are new to equity rolls, the process might seem daunting, but with the right guidance, it can become a powerful tool in managing investment risks and maximizing returns. It's essential to approach equity rolls with a clear understanding of the underlying market dynamics, the specific goals of the investment, and a well-thought-out strategy. Whether you're a seasoned investor or just starting out, mastering the art of equity rolls can elevate your investment game and provide a competitive edge in the financial markets.

Equity rolls are not just about managing existing positions; they are also about adapting to market changes, exploiting new opportunities, and ensuring that your investment portfolio remains aligned with your financial goals and risk tolerance. As the financial markets are inherently volatile and subject to rapid changes, the ability to adjust and evolve your investment strategy through equity rolls can be invaluable. This adaptability is key to navigating the complexities of the market and to making informed decisions that support long-term financial success.

Understanding Equity Rolls

To effectively utilize equity rolls, it's crucial to have a deep understanding of the options market, including the factors that influence option prices such as volatility, time decay, and the underlying asset's price movement. Each of these factors can significantly impact the profitability of an equity roll, and understanding how they interact can help investors make more informed decisions. Moreover, being aware of the costs associated with equity rolls, such as commissions and slippage, is essential for maximizing returns.

Key Considerations for Equity Rolls

When considering an equity roll, several key factors come into play. These include the current market conditions, the performance of the underlying asset, the investor's risk tolerance, and the overall investment strategy. It's also important to consider the time value of the options, as this can significantly impact the decision to roll a position. Investors must weigh the potential benefits of extending their investment horizon against the costs of doing so, including the potential for increased volatility and time decay.Benefits of Equity Rolls

The benefits of equity rolls are multifaceted. They can provide investors with the flexibility to adjust their investment strategy in response to changing market conditions, allowing for more dynamic risk management. By rolling positions, investors can also potentially increase their returns by taking advantage of more favorable market conditions or by extending the life of profitable trades. Furthermore, equity rolls can be used to reduce risk by adjusting the strike price or expiration date of an option, thereby aligning the investment more closely with the investor's risk tolerance and financial goals.

Strategies for Successful Equity Rolls

Implementing successful equity rolls requires a combination of market insight, strategic planning, and timely execution. Investors should always have a clear rationale for rolling a position, whether it's to capitalize on a shift in market sentiment, to mitigate potential losses, or to enhance potential gains. It's also crucial to monitor the market continuously and be prepared to adjust the strategy as conditions change. This might involve rolling positions more frequently or making adjustments to the size of the position to manage risk more effectively.Common Mistakes in Equity Rolls

Despite the potential benefits of equity rolls, there are common mistakes that investors should be aware of to avoid. One of the most significant errors is failing to have a clear strategy or rationale for rolling a position. Without a well-defined plan, investors may end up making emotional decisions based on short-term market fluctuations rather than long-term investment goals. Another mistake is underestimating the costs associated with equity rolls, including transaction fees and the potential for slippage. These costs can erode the profitability of the trade and should be carefully considered as part of the overall strategy.

Best Practices for Equity Rolls

To maximize the effectiveness of equity rolls, investors should adhere to best practices that prioritize strategic planning, risk management, and disciplined execution. This includes setting clear investment objectives, continuously monitoring market conditions, and being prepared to adjust the strategy as needed. It's also essential to maintain a disciplined approach to risk management, ensuring that the potential for losses is always balanced against the potential for gains. By following these best practices, investors can harness the power of equity rolls to enhance their investment performance and achieve their long-term financial goals.Conclusion and Future Outlook

In conclusion, equity rolls are a powerful tool in the arsenal of investors, offering the flexibility to adapt to changing market conditions, manage risk, and potentially enhance returns. As the financial markets continue to evolve, the importance of equity rolls in investment strategies is likely to grow. By understanding the mechanics of equity rolls, being aware of the potential pitfalls, and adhering to best practices, investors can navigate the complexities of the options market with confidence and precision. Whether you're a seasoned investor or just beginning your investment journey, mastering the art of equity rolls can be a key factor in achieving long-term financial success.

Final Thoughts on Equity Rolls

As investors look to the future, the ability to adapt and evolve investment strategies will be critical. Equity rolls offer a dynamic way to manage investments, providing the flexibility to respond to market changes and capitalize on new opportunities. By embracing this strategy and continuously refining their approach, investors can position themselves for success in an ever-changing financial landscape.Equity Rolls Image Gallery

What are equity rolls in options trading?

+Equity rolls refer to the process of closing an existing options position and simultaneously opening a new one, typically with a different strike price or expiration date, to adjust the position's risk profile or to capitalize on changing market conditions.

Why are equity rolls important for investors?

+Equity rolls are important because they provide investors with the flexibility to adapt to changing market conditions, manage risk, and potentially enhance returns. They are a key strategy in navigating the complexities of the options market.

What are some common mistakes to avoid when implementing equity rolls?

+Common mistakes include failing to have a clear strategy or rationale for rolling a position, underestimating the costs associated with equity rolls, and not continuously monitoring market conditions to adjust the strategy as needed.

We invite you to share your thoughts and experiences with equity rolls in the comments below. Whether you're a seasoned investor or just starting to explore the world of options trading, your insights can provide valuable lessons for others. Additionally, if you found this article informative and helpful, please consider sharing it with your network to help spread knowledge and education on investment strategies. By engaging with our content and sharing your perspectives, you contribute to a community of investors dedicated to learning, growing, and achieving financial success together.