Intro

Unlock successful equity buyouts with 5 expert tips, covering leveraged finance, private equity investments, and mergers and acquisitions strategies.

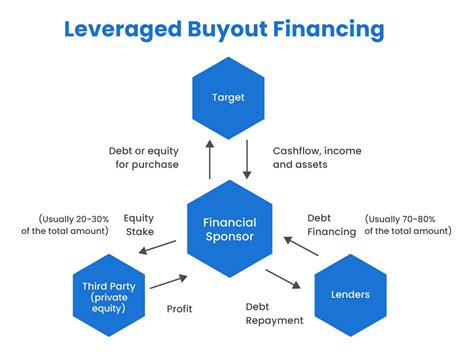

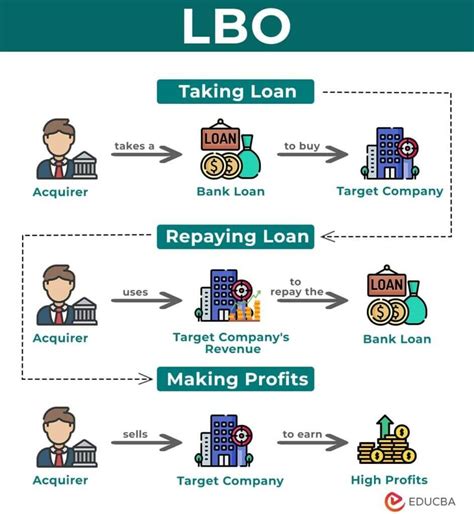

The concept of equity buyout has become increasingly popular in recent years, particularly among businesses and investors looking to restructure their ownership or capitalize on new opportunities. An equity buyout, also known as a leveraged buyout, is a transaction where a company or a group of investors acquires a majority stake in a business using a combination of debt and equity. This financial strategy can offer numerous benefits, including increased control, improved financial performance, and enhanced growth prospects. However, navigating the complexities of an equity buyout requires careful planning, strategic thinking, and a deep understanding of the underlying mechanics. For those considering an equity buyout, here are five key tips to ensure a successful transaction.

Equity buyouts can be highly beneficial for companies seeking to restructure their ownership, improve their financial health, or transition to new leadership. By acquiring a majority stake in a business, investors can gain greater control over operations, make strategic decisions, and drive growth initiatives. Moreover, equity buyouts can provide existing shareholders with an opportunity to exit their investment, realize returns, and allocate capital to other ventures. However, the process of executing an equity buyout is intricate and demands meticulous attention to detail, thorough financial analysis, and effective negotiation skills.

The first step in pursuing an equity buyout is to conduct a comprehensive review of the target company's financial performance, market position, and growth prospects. This involves analyzing historical financial statements, assessing the competitive landscape, and evaluating the management team's capabilities. Investors should also consider the company's industry trends, regulatory environment, and potential risks or challenges that may impact its future performance. By gaining a deep understanding of the business, investors can develop a robust investment thesis, identify areas for improvement, and create a compelling case for the equity buyout.

Understanding the Equity Buyout Process

Key Considerations for Equity Buyouts

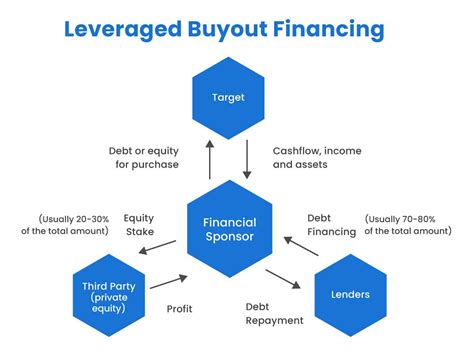

When evaluating an equity buyout opportunity, investors should consider several key factors, including the company's financial performance, growth prospects, and market position. They should also assess the management team's capabilities, the competitive landscape, and potential risks or challenges that may impact the business. Additionally, investors should evaluate the financing options available, including debt and equity capital, and consider the terms and conditions of the proposed transaction. By carefully weighing these factors, investors can make informed decisions, mitigate risks, and create value for all stakeholders involved.Financing Options for Equity Buyouts

Structuring the Equity Buyout Deal

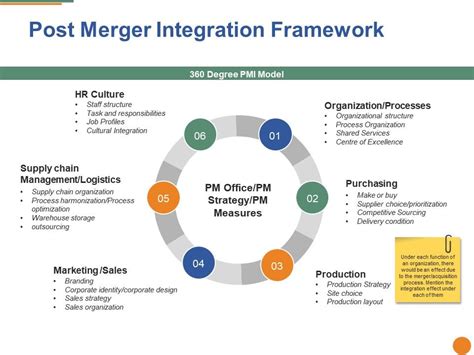

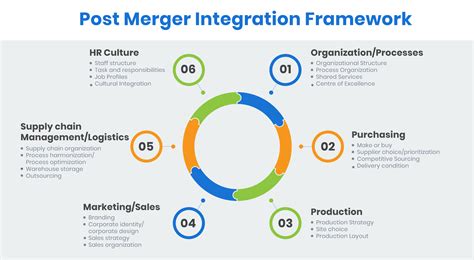

Structuring the equity buyout deal requires careful consideration of several factors, including the purchase price, financing terms, and ownership structure. Investors should negotiate a fair purchase price, secure favorable financing terms, and establish a clear ownership structure that aligns with their investment objectives. They should also consider the tax implications, regulatory requirements, and potential risks or liabilities associated with the transaction. By structuring the deal effectively, investors can create value, minimize risks, and ensure a successful outcome for all stakeholders involved.Managing Post-Acquisition Integration

Monitoring and Evaluating Performance

After the equity buyout, investors should continuously monitor and evaluate the performance of the acquired business to ensure that it is meeting the expected targets and achieving the desired outcomes. This involves tracking financial metrics, such as revenue growth, profitability, and cash flow, as well as non-financial metrics, such as customer satisfaction, employee engagement, and market share. By regularly assessing performance, investors can identify areas for improvement, make adjustments to the strategy, and optimize the business to achieve long-term success.Common Challenges in Equity Buyouts

Best Practices for Equity Buyouts

To ensure a successful equity buyout, investors should follow best practices, including conducting thorough due diligence, developing a robust investment thesis, and structuring the deal effectively. They should also engage experienced advisors, negotiate favorable terms, and manage the post-acquisition integration process carefully. By following these best practices, investors can create value, minimize risks, and achieve long-term success.Conclusion and Future Outlook

Final Thoughts

Equity buyouts offer a unique opportunity for investors to acquire a majority stake in a business, drive growth, and create value. By understanding the equity buyout process, considering key factors, and following best practices, investors can achieve a successful outcome and realize their investment objectives. As the private equity market continues to grow and evolve, it is essential for investors to stay informed, adapt to changing trends, and develop innovative strategies to succeed in this competitive landscape.Equity Buyout Image Gallery

What is an equity buyout?

+An equity buyout is a transaction where a company or a group of investors acquires a majority stake in a business using a combination of debt and equity.

What are the benefits of an equity buyout?

+The benefits of an equity buyout include increased control, improved financial performance, and enhanced growth prospects.

How do I finance an equity buyout?

+Equity buyouts can be financed through a combination of debt and equity capital, including senior loans, subordinated debt, and mezzanine financing.

What are the common challenges in equity buyouts?

+Common challenges in equity buyouts include negotiating with existing shareholders, securing financing, and integrating the acquired business into the existing operations.

How do I structure an equity buyout deal?

+Structuring an equity buyout deal requires careful consideration of several factors, including the purchase price, financing terms, and ownership structure.

We hope this article has provided valuable insights and practical tips for investors considering an equity buyout. Whether you are a seasoned private equity professional or an individual investor, understanding the complexities of the equity buyout process is essential for achieving success in this competitive landscape. By following the guidelines outlined in this article, you can navigate the challenges of an equity buyout, create value, and realize your investment objectives. If you have any further questions or would like to share your experiences with equity buyouts, please do not hesitate to comment below. Your feedback is invaluable in helping us create informative and engaging content that supports your investment goals.