Intro

Get 5 free save templates to boost productivity, featuring budget savers, expense trackers, and financial planners, helping you manage savings goals and track expenses efficiently with customizable templates.

The importance of saving cannot be overstated, as it provides a sense of security and freedom to pursue one's goals and dreams. Saving is a crucial aspect of personal finance, and having a clear plan in place can make all the difference. With the numerous benefits of saving, it's essential to have a system that works for you. In this article, we will explore the world of saving templates, focusing on five free save templates that can help you achieve your financial goals.

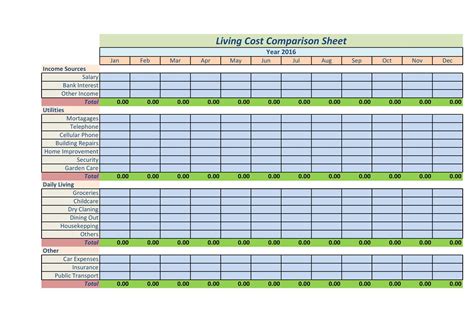

Saving is a habit that needs to be cultivated, and having the right tools can make it easier to stick to your goals. A save template is a pre-designed document that helps you track your income, expenses, and savings. It's a simple yet effective way to monitor your finances and make informed decisions. With a save template, you can set realistic targets, prioritize your spending, and make the most of your hard-earned money.

In today's fast-paced world, it's easy to get caught up in the hustle and bustle of daily life and forget about saving. However, with a save template, you can stay on top of your finances and ensure that you're making progress towards your goals. Whether you're saving for a short-term goal, such as a vacation, or a long-term goal, such as retirement, a save template can help you stay focused and motivated. With the numerous benefits of saving, it's essential to find a system that works for you and stick to it.

Introduction to Save Templates

Benefits of Using Save Templates

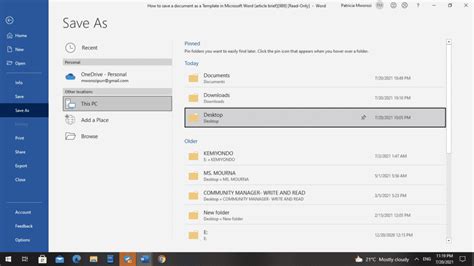

5 Free Save Templates

How to Use Save Templates

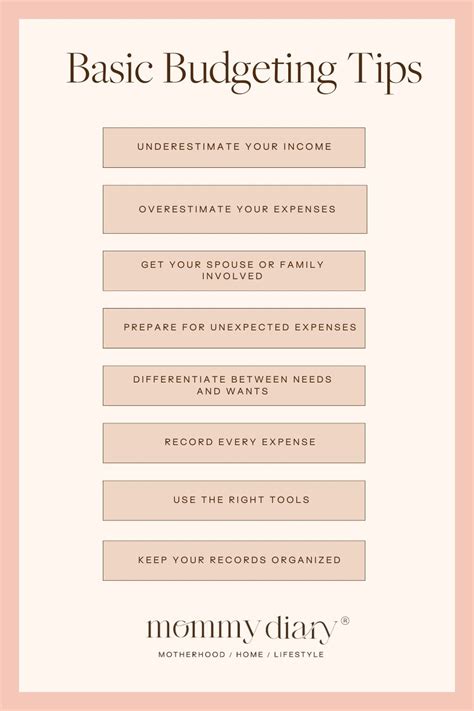

Tips for Saving Success

Common Saving Mistakes to Avoid

Gallery of Save Templates:

Save Template Image Gallery

What is a save template?

+A save template is a pre-designed document that helps you track your income, expenses, and savings.

How do I use a save template?

+Choose a template that suits your needs, fill in your income, expenses, and savings goals, and track your spending.

What are the benefits of using save templates?

+The benefits of using save templates include simplified budgeting, increased savings, reduced stress, and improved financial awareness.

Can I customize a save template to suit my needs?

+Yes, most save templates are customizable, allowing you to tailor them to your specific financial goals and needs.

Are save templates available for free?

+Yes, there are many free save templates available online, including the five templates mentioned in this article.

In conclusion, saving is a crucial aspect of personal finance, and having the right tools can make all the difference. With the five free save templates mentioned in this article, you can take control of your finances, achieve your goals, and enjoy a more secure financial future. Remember to stay focused, motivated, and patient, and don't hesitate to reach out if you have any questions or need further guidance. Share your thoughts on saving and budgeting in the comments below, and don't forget to share this article with your friends and family who may benefit from these valuable tips and resources.