Intro

Unlock investment insights with a DCF model Excel template, utilizing discounted cash flow analysis, financial modeling, and valuation techniques to estimate stock prices and predict future growth.

The Discounted Cash Flow (DCF) model is a widely used valuation technique in finance that estimates the present value of future cash flows using a discount rate. In this article, we will delve into the world of DCF modeling, exploring its importance, benefits, and providing a comprehensive guide on how to create a DCF model Excel template.

The DCF model is a crucial tool for investors, analysts, and businesses to evaluate investment opportunities, determine the value of a company, and make informed decisions. By understanding the DCF model and its application, individuals can gain a deeper insight into the world of finance and make more informed investment choices. In this article, we will provide a detailed explanation of the DCF model, its benefits, and a step-by-step guide on how to create a DCF model Excel template.

Introduction to DCF Modeling

Benefits of DCF Modeling

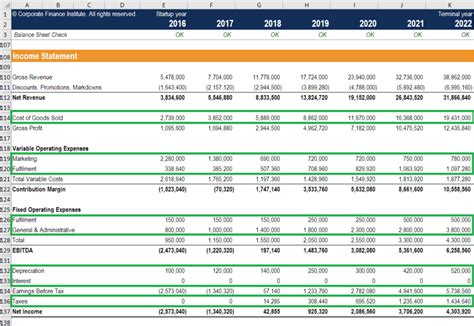

Step-by-Step Guide to Creating a DCF Model Excel Template

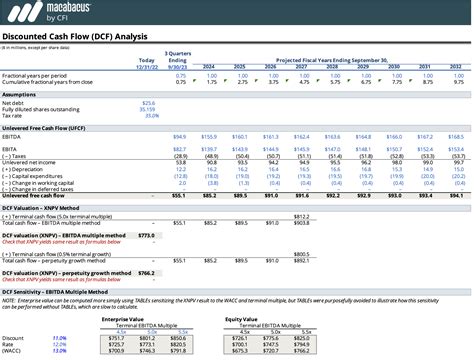

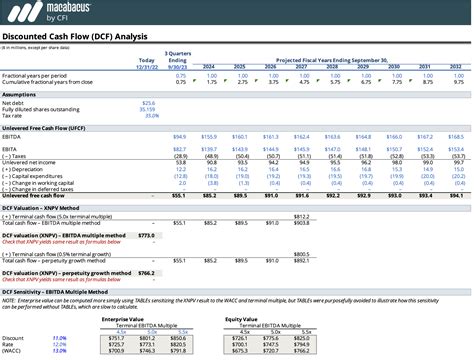

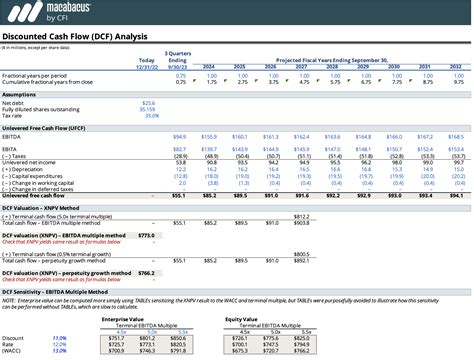

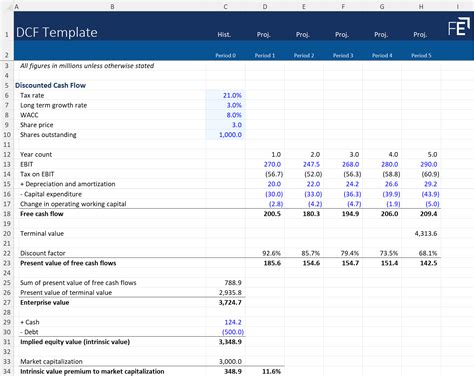

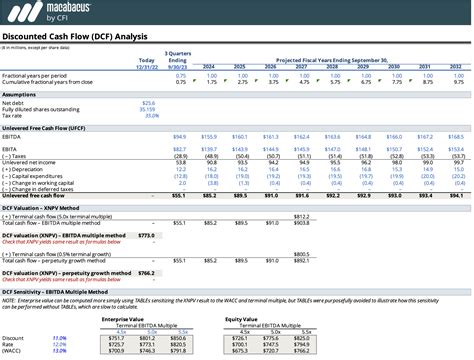

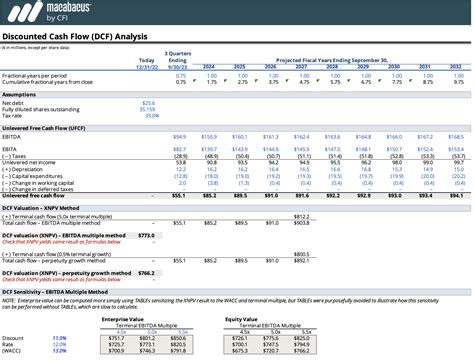

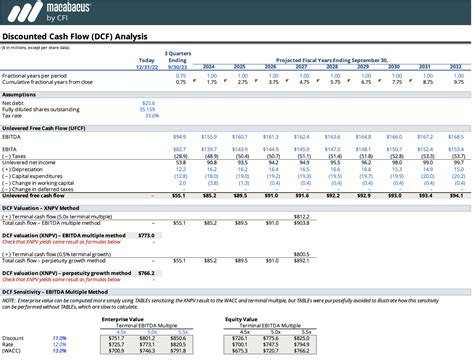

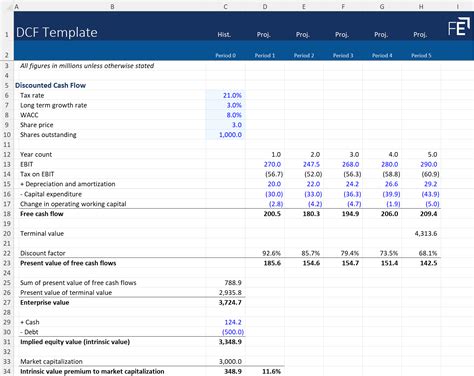

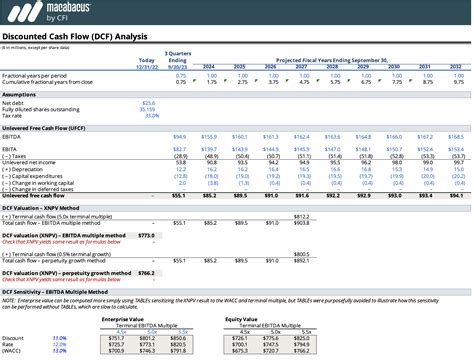

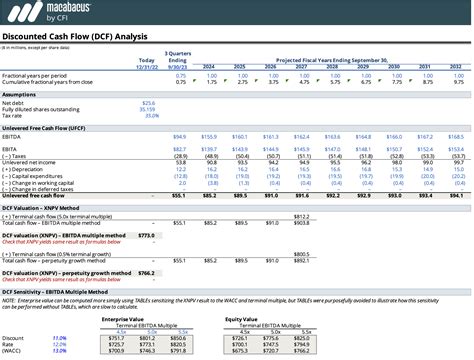

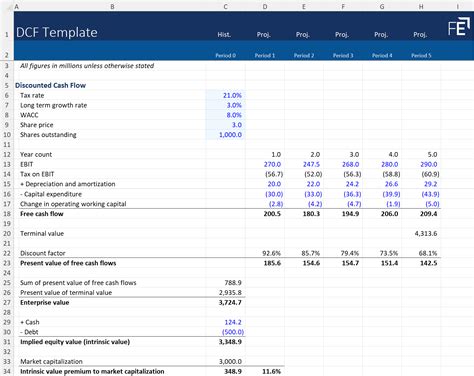

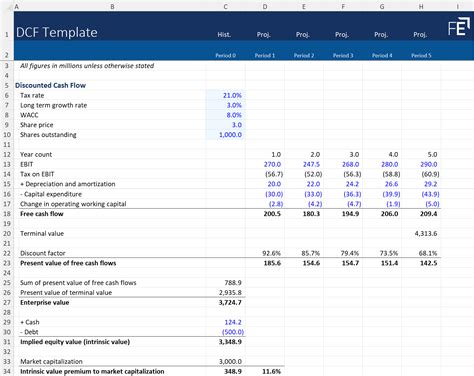

Estimating Future Cash Flows

Estimating future cash flows is a critical step in creating a DCF model Excel template. This involves forecasting the company's future financial performance, including revenue, expenses, and capital expenditures. The forecast period is typically 5-10 years, and the cash flows are estimated using a combination of historical data, industry trends, and management's guidance.Determining the Discount Rate

The discount rate is a critical input in the DCF model, as it reflects the risk and opportunity cost of the investment. The discount rate is typically estimated using the weighted average cost of capital (WACC) formula, which takes into account the cost of debt and equity.Calculating the Present Value of Future Cash Flows

Once the future cash flows and discount rate are estimated, the present value of future cash flows can be calculated using the DCF formula. The formula involves discounting each cash flow using the discount rate and summing up the present values.Estimating the Terminal Value

The terminal value represents the present value of all future cash flows beyond the forecast period. The terminal value is typically estimated using the perpetuity growth model or the exit multiple approach.Calculating the Equity Value

The equity value is calculated by subtracting the debt and other non-equity claims from the enterprise value. The enterprise value is calculated by adding the present value of future cash flows and the terminal value.DCF Model Image Gallery

DCF Model Excel Template Example

What is the purpose of a DCF model?

+The purpose of a DCF model is to estimate the present value of future cash flows using a discount rate, which reflects the risk and opportunity cost of the investment.

How do I estimate the discount rate?

+The discount rate is typically estimated using the weighted average cost of capital (WACC) formula, which takes into account the cost of debt and equity.

What is the terminal value?

+The terminal value represents the present value of all future cash flows beyond the forecast period, typically estimated using the perpetuity growth model or the exit multiple approach.

In conclusion, the DCF model is a powerful tool for evaluating investment opportunities and determining the value of a company. By following the steps outlined in this article and using a DCF model Excel template, individuals can create a comprehensive and accurate valuation model. We encourage readers to share their thoughts and experiences with DCF modeling in the comments section below, and to explore the many resources available online for further learning. Whether you are an investor, analyst, or business professional, understanding the DCF model and its application can help you make more informed decisions and achieve your financial goals.