Intro

Master 5 DCF Excel tips for accurate valuation, including discounted cash flow modeling, financial forecasting, and investment analysis techniques.

The Discounted Cash Flow (DCF) model is a widely used valuation technique in finance that estimates the present value of future cash flows. Excel is a popular tool for building DCF models due to its flexibility and ease of use. However, creating an accurate and reliable DCF model in Excel can be challenging, especially for those without extensive financial modeling experience. In this article, we will explore five essential DCF Excel tips to help you build robust and accurate models.

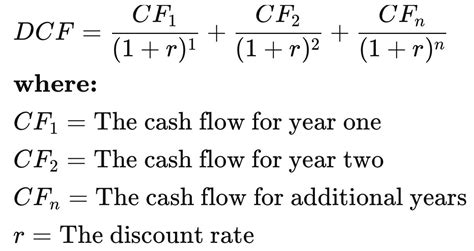

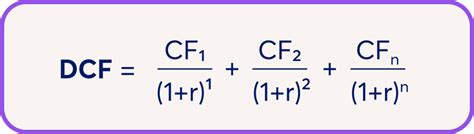

To begin with, it's crucial to understand the basics of the DCF model and how it works. The DCF model calculates the present value of future cash flows by discounting them using a discount rate, which reflects the time value of money and the risk associated with the investment. The present value of these cash flows is then added to the present value of the terminal value, which represents the value of the company beyond the forecast period. By following best practices and using the right tools, you can create a DCF model that provides a reliable estimate of a company's intrinsic value.

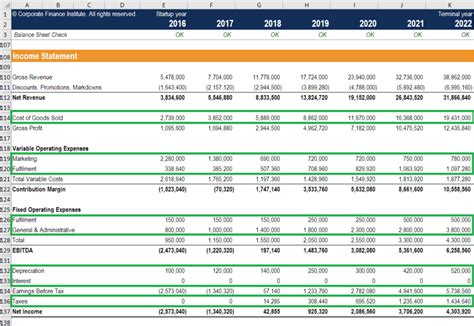

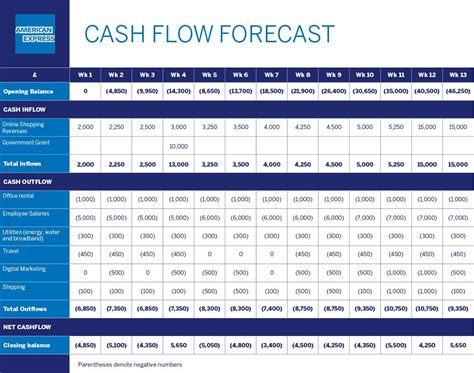

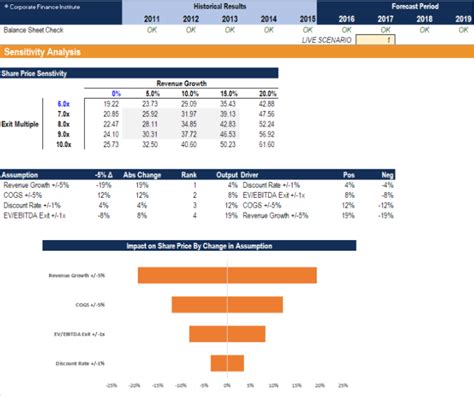

Building a DCF model in Excel requires careful planning and attention to detail. One of the most critical aspects of a DCF model is the estimation of future cash flows, which involves forecasting revenue, expenses, and capital expenditures. To ensure accuracy, it's essential to use historical data and industry trends to inform your forecasts. Additionally, you should consider using sensitivity analysis to test the robustness of your model and identify areas where the valuation is most sensitive to changes in assumptions.

Understanding the DCF Formula

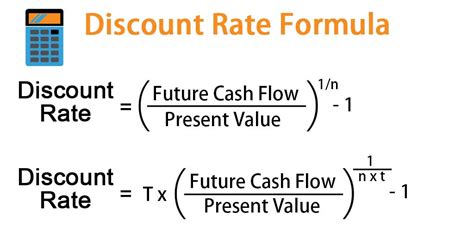

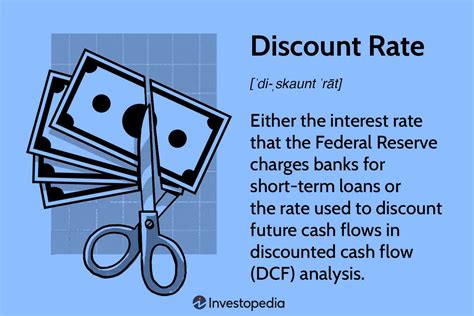

Estimating the Discount Rate

Forecasting Cash Flows

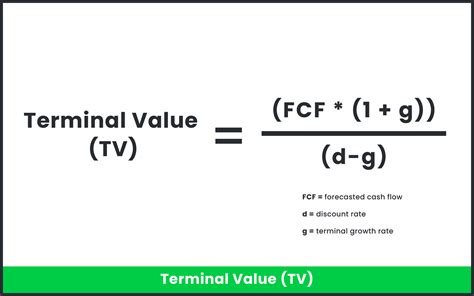

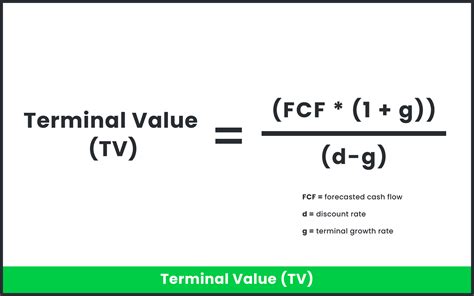

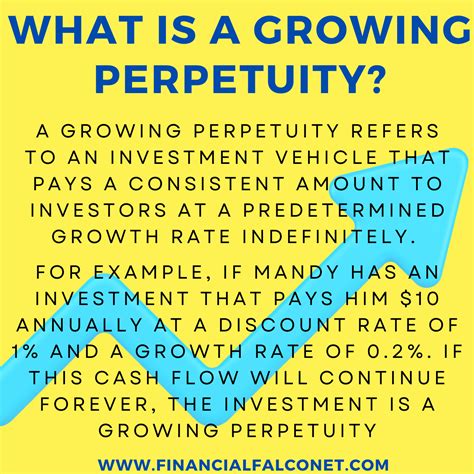

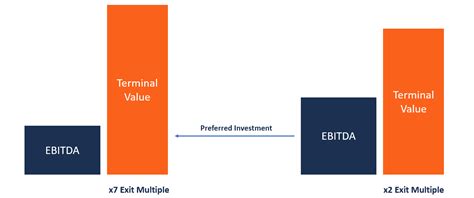

Calculating the Terminal Value

Using Sensitivity Analysis

Some key benefits of using DCF models in Excel include:

- Flexibility: DCF models can be easily customized to fit the specific needs of your company or project.

- Accuracy: DCF models provide a reliable estimate of a company's intrinsic value by calculating the present value of future cash flows.

- Transparency: DCF models are transparent and easy to understand, making it simple to communicate the results to stakeholders.

- Scalability: DCF models can be used for small and large companies, as well as for projects with varying levels of complexity.

However, there are also some potential drawbacks to using DCF models in Excel, including:

- Complexity: DCF models can be complex and difficult to build, especially for those without extensive financial modeling experience.

- Assumptions: DCF models rely on assumptions about future cash flows, discount rates, and terminal values, which can be subject to error.

- Sensitivity: DCF models can be sensitive to changes in assumptions, which can affect the accuracy of the valuation.

To get the most out of your DCF model, it's essential to follow best practices and use the right tools. Some tips for building a robust DCF model include:

- Use historical data and industry trends to inform your forecasts.

- Consider using sensitivity analysis to test the robustness of your model.

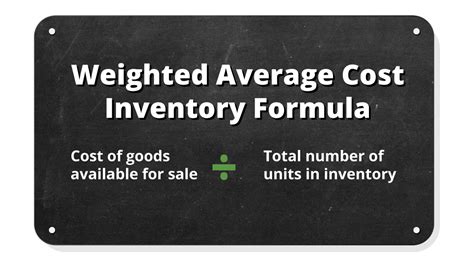

- Use the weighted average cost of capital (WACC) formula to estimate the discount rate.

- Calculate the terminal value using the perpetuity growth model or the exit multiple method.

DCF Model Image Gallery

What is a DCF model?

+A DCF model is a valuation technique that estimates the present value of future cash flows.

How do I estimate the discount rate?

+You can estimate the discount rate using the weighted average cost of capital (WACC) formula.

What is the terminal value?

+The terminal value represents the value of the company beyond the forecast period.

How do I perform sensitivity analysis?

+You can perform sensitivity analysis using Excel's built-in tools, such as the Scenario Manager or the Sensitivity Analysis add-in.

What are the benefits of using DCF models in Excel?

+The benefits of using DCF models in Excel include flexibility, accuracy, transparency, and scalability.

In