Intro

Streamline payments with a deposit invoice template Excel, featuring 5 essential tips for efficient billing, payment tracking, and invoice management, including customizable templates and automated calculations.

Creating and managing invoices is a crucial aspect of running a business, as it directly impacts cash flow and financial stability. Among the various tools and software available for invoice management, Excel stands out due to its versatility, accessibility, and the ability to customize templates according to specific business needs. A deposit invoice template in Excel can be particularly useful for businesses that require partial payments before delivering goods or services. Here are five tips for creating and utilizing a deposit invoice template in Excel:

Effective use of deposit invoices can streamline financial operations, improve customer communication, and reduce the risk of late or missed payments. By incorporating a deposit invoice template into your billing process, you can ensure that your business maintains a healthy cash flow and builds strong relationships with clients.

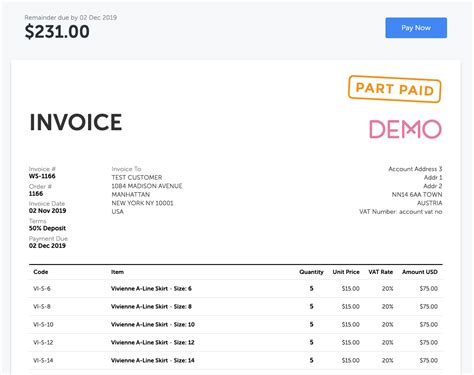

The importance of having a well-structured and easily understandable invoice cannot be overstated. It not only helps in avoiding confusion and disputes with clients but also simplifies the accounting process. A deposit invoice, in particular, serves as a legally binding agreement between the business and the client, outlining the terms of the partial payment and the expected delivery of goods or services.

To maximize the benefits of using a deposit invoice template in Excel, it's essential to understand the key elements that should be included and how to customize the template to fit your business's specific requirements. This involves not only adding your company's logo and contact information but also ensuring that the template is structured in a way that clearly communicates the deposit details and the balance due.

Understanding the Basics of a Deposit Invoice Template

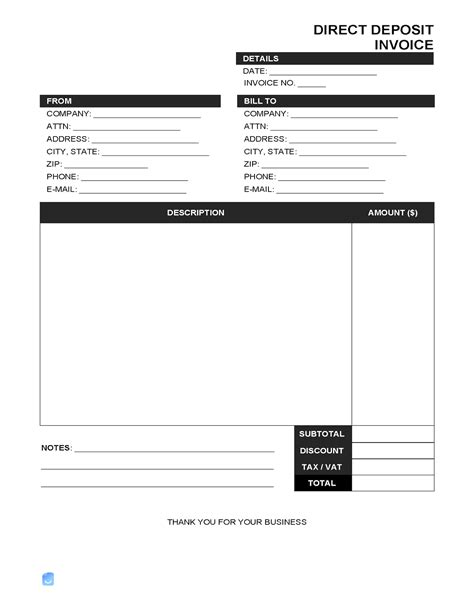

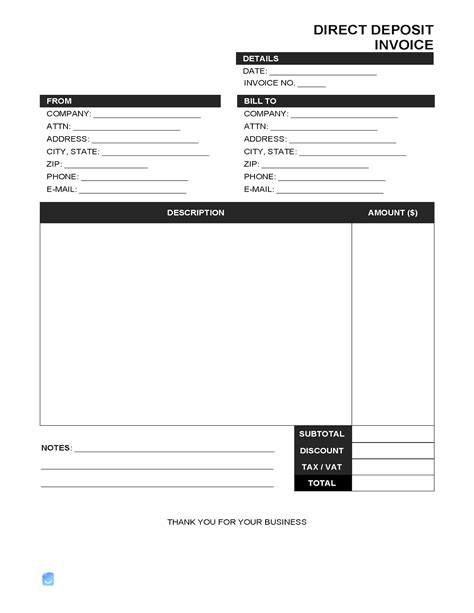

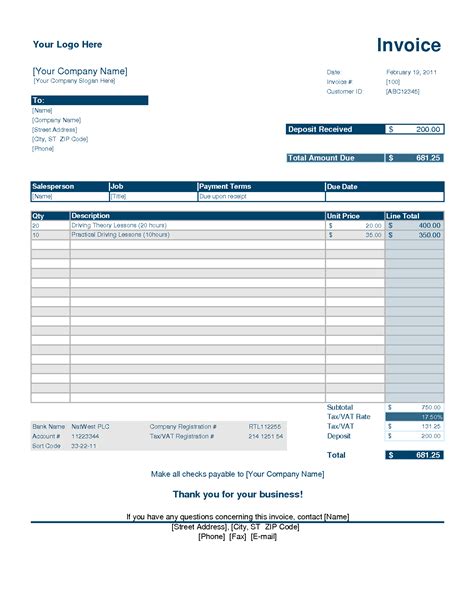

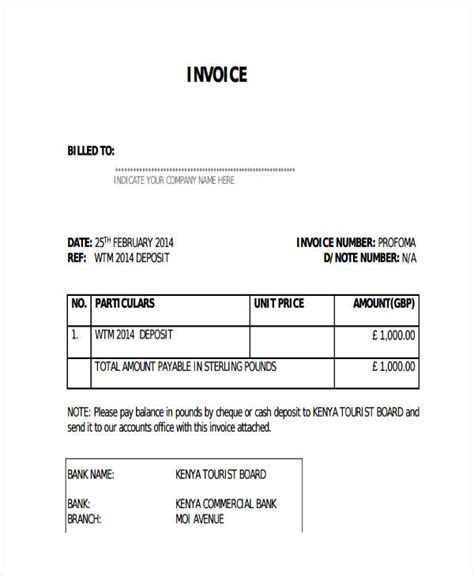

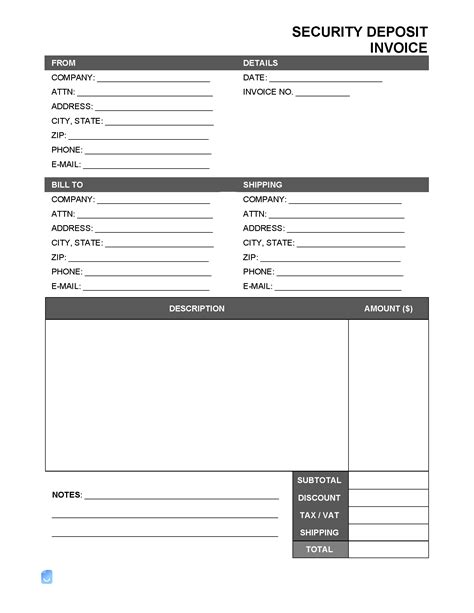

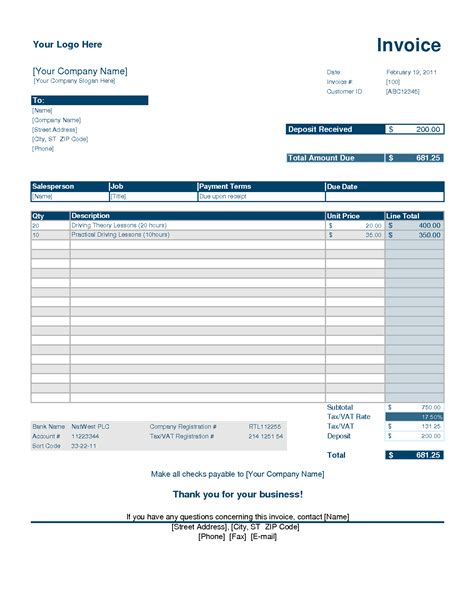

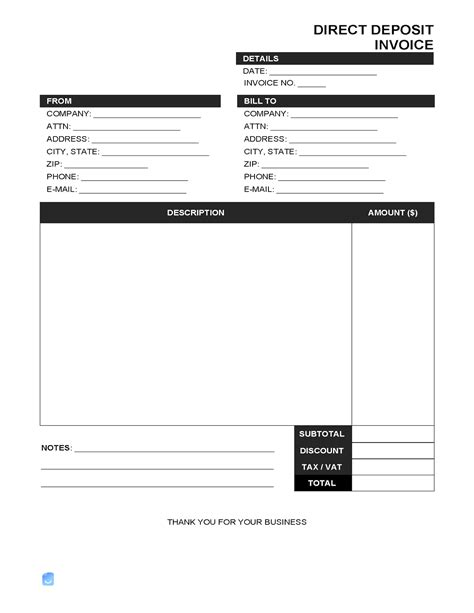

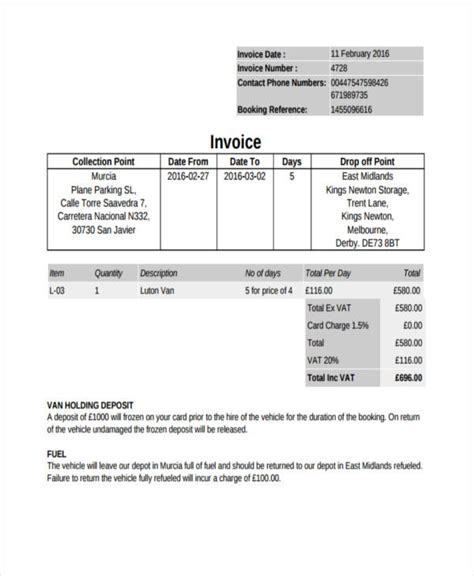

Before diving into the customization and utilization of a deposit invoice template, it's crucial to understand the basic components that should be included. A typical deposit invoice template in Excel would comprise fields for the invoice number, date, client information, description of goods or services, deposit amount, balance due, and payment terms. Ensuring that these elements are clearly outlined and easily editable will make the template more effective and efficient for your billing needs.

Customizing Your Deposit Invoice Template

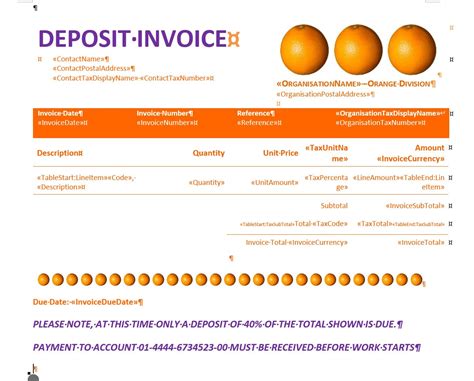

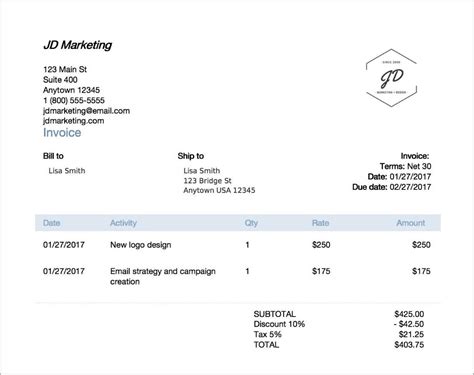

Customization is key when it comes to making the most out of your deposit invoice template in Excel. This involves more than just adding your company's branding; it's about tailoring the template to align with your business's unique invoicing requirements. For instance, you might need to add specific fields for tax rates, shipping costs, or detailed descriptions of the goods or services being provided. Excel's flexibility allows you to add, remove, or modify columns and rows as needed, ensuring that your deposit invoice template is both comprehensive and user-friendly.

Benefits of Using a Deposit Invoice Template in Excel

Utilizing a deposit invoice template in Excel offers several benefits for businesses. It enhances professionalism by providing a standardized and polished format for all invoices. The template also simplifies the invoicing process, saving time and reducing the likelihood of errors. Additionally, it improves client communication by clearly outlining the payment terms and expectations, which can help in building trust and avoiding potential disputes.

Steps to Create a Deposit Invoice Template in Excel

Creating a deposit invoice template in Excel involves several steps:

- Open Excel and Start with a Blank Workbook: Begin by opening Excel and selecting a blank workbook. This will give you a clean slate to design your template.

- Set Up the Template Structure: Decide on the layout and the fields you want to include in your template. Typical fields include invoice number, date, client information, goods or services description, deposit amount, and balance due.

- Add Formulas for Calculations: Use Excel formulas to automate calculations such as subtotal, tax, and total. This will make it easier to generate invoices and reduce errors.

- Format the Template for Readability: Ensure that your template is easy to read by using clear headings, appropriate font sizes, and sufficient spacing between sections.

- Save the Template: Once you've designed your template, save it in a location that's easy to access. You can also consider saving it as a template file (.xltx) in Excel to make it easier to create new invoices based on your design.

Best Practices for Managing Deposit Invoices

Effective management of deposit invoices is crucial for maintaining a healthy cash flow and ensuring that projects or orders are fulfilled as expected. This involves keeping track of all deposit invoices, following up with clients on pending payments, and updating the invoice status accordingly. Implementing a systematic approach to managing deposit invoices can help in reducing administrative burdens and improving overall business efficiency.

Common Mistakes to Avoid with Deposit Invoices

When using deposit invoices, there are several common mistakes that businesses should avoid. These include not clearly outlining the payment terms, failing to provide a detailed description of the goods or services, and not keeping accurate records of deposit invoices and payments. Avoiding these mistakes can help in preventing misunderstandings with clients and ensuring that the invoicing process runs smoothly.

Utilizing Deposit Invoice Templates for Different Business Needs

Deposit invoice templates can be adapted for various business needs, from small-scale operations to large enterprises. The key is to identify the specific requirements of your business and customize the template accordingly. For instance, a construction company might need to include fields for project details and milestones, while a retail business might require fields for product descriptions and quantities. By tailoring the deposit invoice template to your business's unique needs, you can enhance the efficiency of your billing process and improve client satisfaction.

Future of Deposit Invoicing and Digital Payments

The future of deposit invoicing is closely tied to the advancement of digital payment systems and online invoicing tools. As technology continues to evolve, businesses can expect more streamlined and automated processes for creating, sending, and managing deposit invoices. The integration of artificial intelligence, blockchain, and other emerging technologies is likely to enhance the security, speed, and efficiency of financial transactions, including deposit invoicing.

Deposit Invoice Template Image Gallery

What is a deposit invoice, and how does it work?

+A deposit invoice is a request for a partial payment for goods or services before they are delivered. It works by outlining the terms of the payment, including the amount due and the expected delivery date, providing a legally binding agreement between the business and the client.

How do I create a deposit invoice template in Excel?

+To create a deposit invoice template in Excel, start with a blank workbook, set up the template structure with necessary fields, add formulas for calculations, format the template for readability, and save it as a template file for future use.

What are the benefits of using a deposit invoice template in Excel?

+The benefits include enhanced professionalism, simplified invoicing process, improved client communication, and the ability to customize the template according to specific business needs, leading to increased efficiency and reduced errors.

In conclusion, a well-designed deposit invoice template in Excel can be a valuable tool for businesses, offering a professional, efficient, and customizable solution for managing partial payments. By understanding the basics of deposit invoices, customizing the template to fit specific needs, and avoiding common mistakes, businesses can improve their cash flow, enhance client relationships, and streamline their financial operations. As the landscape of digital payments and invoicing continues to evolve, embracing innovative solutions and best practices will be crucial for businesses to remain competitive and thrive in their respective markets. We invite you to share your thoughts on how deposit invoice templates have impacted your business operations and what features you consider essential for an effective invoicing process. Your feedback and experiences can provide valuable insights for others looking to optimize their billing and payment processes.