Intro

Get 5 essential FSA babysitter receipt tips for stress-free reimbursement, covering eligible childcare expenses, receipt requirements, and dependent care FSA claims.

As a babysitter, it's essential to keep track of your expenses, especially if you're planning to claim them on your taxes. One way to do this is by using a Flexible Spending Account (FSA) to reimburse yourself for qualified childcare expenses. However, to take advantage of this benefit, you'll need to provide proper documentation, including receipts. Here are 5 FSA babysitter receipt tips to help you navigate the process.

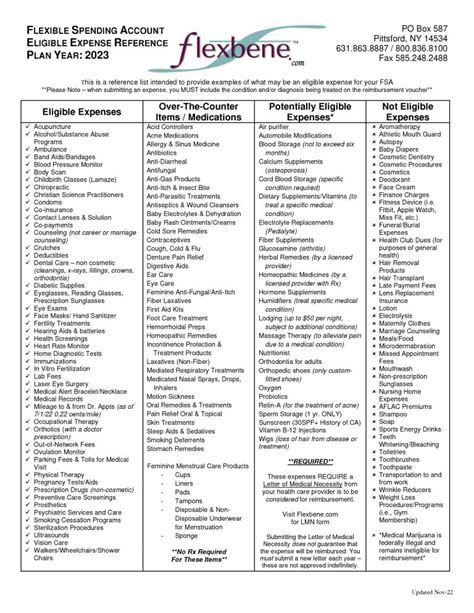

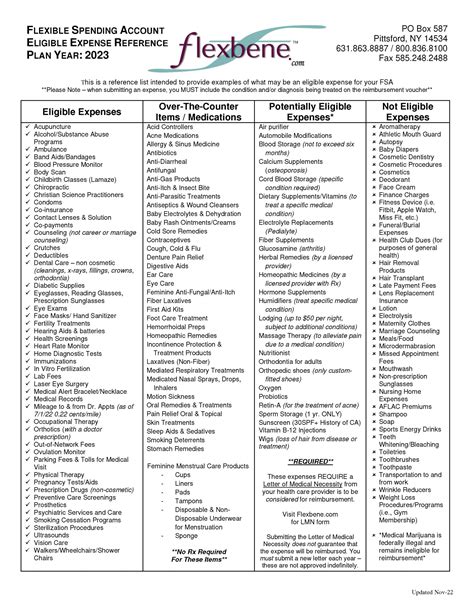

When it comes to childcare expenses, it's crucial to understand what qualifies as a legitimate expense. The Internal Revenue Service (IRS) has specific guidelines on what expenses are eligible for reimbursement under an FSA. Generally, expenses related to childcare, such as babysitting fees, daycare costs, and after-school programs, are eligible. However, expenses related to education, such as tuition, are not eligible.

To ensure you're taking advantage of your FSA benefits, it's essential to keep accurate records of your expenses. This includes saving receipts for all qualified childcare expenses, including babysitting fees. When saving receipts, make sure they include the date, amount, and type of expense, as well as the name and address of the provider.

Understanding FSA Eligible Expenses

Some examples of FSA eligible expenses include:

- Babysitting fees

- Daycare expenses

- After-school program costs

- Summer camp fees

- Expenses related to caring for a disabled dependent

It's essential to note that not all childcare expenses are eligible for reimbursement under an FSA. For example, expenses related to education, such as tuition, are not eligible. Additionally, expenses related to entertainment, such as movie tickets or theme park admission, are also not eligible.

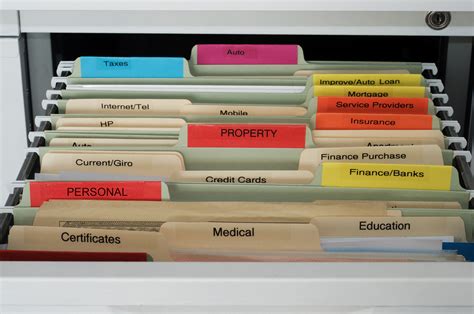

Importance of Accurate Record-Keeping

It's also essential to keep receipts organized and easily accessible. Consider using a file folder or digital storage system to keep track of your receipts. This will make it easier to locate the receipts you need when it's time to file your taxes or submit a claim to your FSA provider.

In addition to saving receipts, it's also important to keep track of your expenses throughout the year. Consider using a spreadsheet or budgeting app to track your expenses and ensure you're staying within your FSA limits.

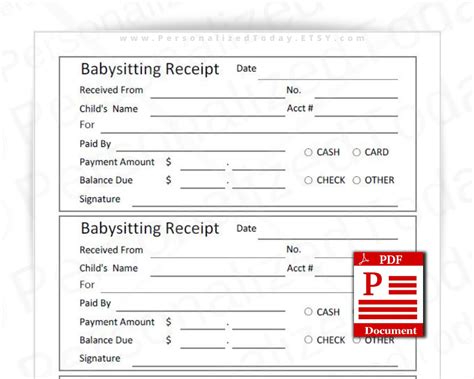

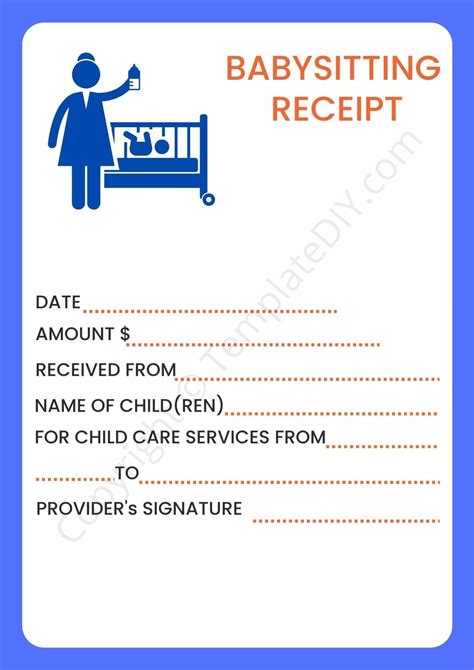

Creating a Babysitter Receipt Template

You can create a babysitter receipt template using a word processing program or by downloading a template from the internet. Consider adding your name and contact information to the template, as well as any other relevant details.

When using a babysitter receipt template, make sure to fill it out accurately and completely. This will help ensure you're providing the necessary documentation to support your FSA claims.

Tips for Submitting FSA Claims

Additionally, consider the following tips when submitting FSA claims:

- Make sure you're submitting claims for eligible expenses only

- Keep track of your FSA balance and ensure you're not exceeding your limits

- Consider setting up automatic reimbursements to make it easier to receive your FSA funds

Common Mistakes to Avoid

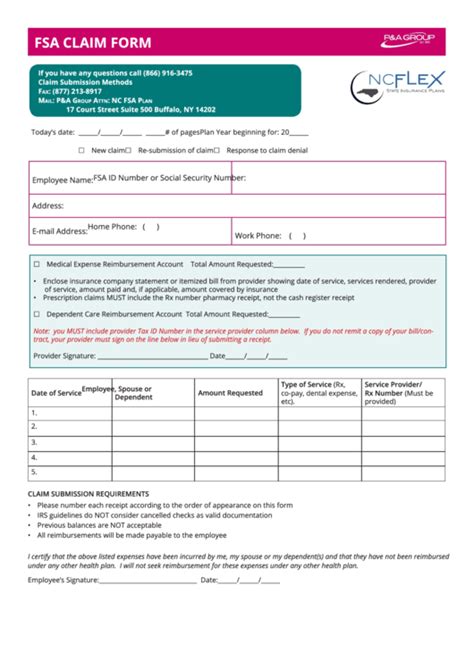

To avoid these mistakes, make sure you understand what expenses are eligible for reimbursement under your FSA. Keep accurate records of your expenses, including receipts and a completed claim form. Submit your claims promptly and follow up with your FSA provider if you haven't received reimbursement within a few weeks.

Additionally, consider the following tips to avoid common mistakes:

- Keep track of your FSA balance and ensure you're not exceeding your limits

- Consider setting up automatic reimbursements to make it easier to receive your FSA funds

- Review your FSA plan documents to understand what expenses are eligible for reimbursement

Gallery of FSA Babysitter Receipts

FSA Babysitter Receipts Image Gallery

What expenses are eligible for reimbursement under an FSA?

+Expenses related to childcare, such as babysitting fees, daycare costs, and after-school programs, are eligible for reimbursement under an FSA.

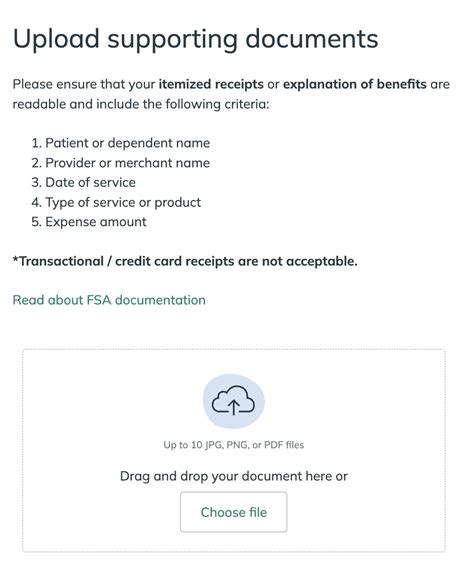

How do I submit a claim to my FSA provider?

+To submit a claim to your FSA provider, you'll need to complete a claim form and provide supporting documentation, such as receipts. You can usually find claim forms on your FSA provider's website or by contacting their customer service department.

What is the deadline for submitting FSA claims?

+The deadline for submitting FSA claims varies depending on your FSA provider and plan. Be sure to check your plan documents or contact your FSA provider to determine the deadline for submitting claims.

By following these 5 FSA babysitter receipt tips, you can ensure you're taking advantage of your FSA benefits and receiving the reimbursement you're eligible for. Remember to keep accurate records, submit claims promptly, and avoid common mistakes. With a little planning and organization, you can make the most of your FSA and enjoy the peace of mind that comes with knowing you're prepared for childcare expenses. We hope you found this article helpful and informative. If you have any further questions or would like to share your experiences with FSA babysitter receipts, please don't hesitate to comment below. Additionally, feel free to share this article with others who may benefit from this information.