Intro

Get debt-free with 5 essential charts, tracking budgets, expenses, and savings to achieve financial freedom, using debt management tools and strategies for a debt-free lifestyle.

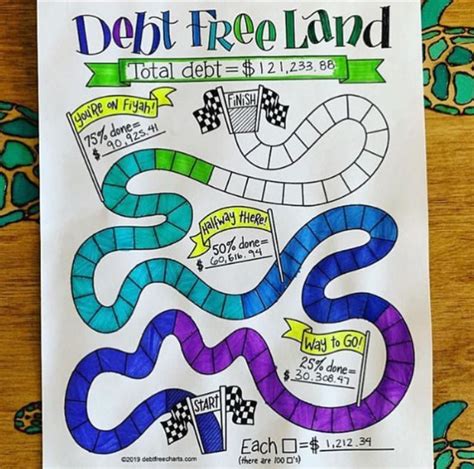

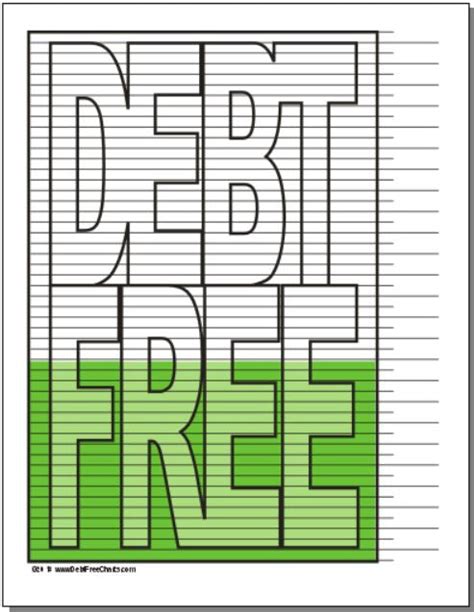

Debt can be overwhelming, making it difficult to know where to start when trying to pay it off. Having a clear plan and tracking progress can make a significant difference in becoming debt-free. Utilizing debt-free charts can be an effective way to visualize debt, create a strategy, and stay motivated throughout the journey. These charts can help individuals understand their financial situation, prioritize debts, and make informed decisions about their money.

Managing debt requires discipline, patience, and the right tools. Debt-free charts are among the most useful tools for anyone looking to take control of their finances. They provide a straightforward way to break down complex financial information into manageable parts, allowing individuals to focus on one debt at a time. By using these charts, people can see how much they owe, to whom, and how much they need to pay each month to become debt-free.

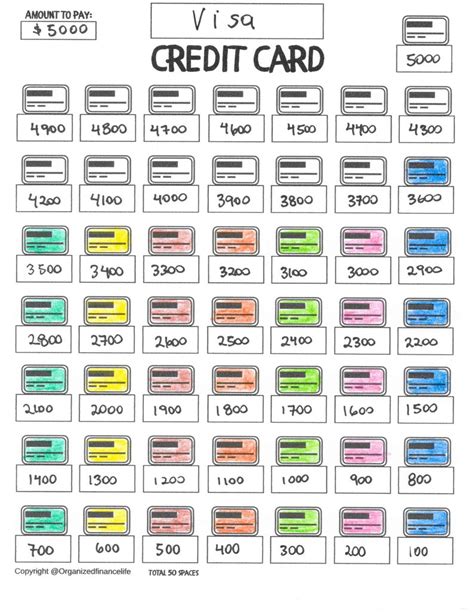

The process of becoming debt-free starts with understanding the current financial situation. This involves listing all debts, including credit cards, loans, and mortgages, along with their balances and interest rates. Debt-free charts can be customized to fit individual needs, making them versatile tools for managing debt. They can be as simple as a handwritten list or as complex as a spreadsheet, depending on the user's preference and the complexity of their financial situation.

Types of Debt Free Charts

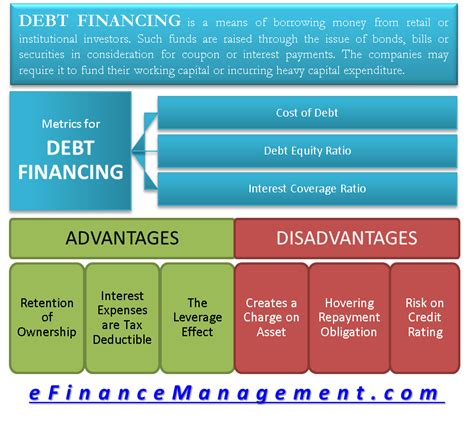

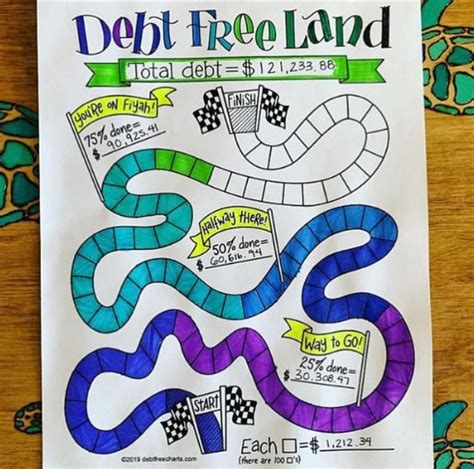

There are several types of debt-free charts that individuals can use, each serving a different purpose. The debt snowball chart, for example, is used to prioritize debts based on their balances, starting with the smallest first. This method provides a psychological boost as debts are paid off quickly, one by one. On the other hand, the debt avalanche chart prioritizes debts based on their interest rates, focusing on the highest rate first to save money on interest over time.

Debt Snowball Method

The debt snowball method, popularized by financial expert Dave Ramsey, involves listing all debts from smallest to largest, regardless of interest rate. The idea is to pay the minimum on all debts except the smallest one, which should be paid off as aggressively as possible. Once the smallest debt is paid off, the money that was going towards it is then applied to the next smallest debt, and so on. This method provides a sense of accomplishment as each debt is quickly eliminated.Benefits of Using Debt Free Charts

Using debt-free charts offers several benefits. Firstly, they provide a clear picture of one's financial situation, making it easier to create a realistic plan for becoming debt-free. Secondly, they help in prioritizing debts, whether it's by balance or interest rate, ensuring that the most critical debts are addressed first. Lastly, tracking progress on these charts can be highly motivating, as individuals can see how far they've come and how close they are to their goal.

Customizing Debt Free Charts

Customizing debt-free charts to fit individual needs is crucial for their effectiveness. This can involve adding personal financial goals, such as saving for a emergency fund or planning for retirement. It's also important to regularly update the charts to reflect any changes in debt balances, interest rates, or income. This ensures that the debt repayment strategy remains relevant and effective.Steps to Create a Debt Free Chart

Creating a debt-free chart involves several steps:

- List all debts, including their balances and interest rates.

- Decide on a method for prioritizing debts, such as the debt snowball or debt avalanche.

- Calculate how much can be realistically paid towards debts each month.

- Set a goal for when each debt should be paid off.

- Regularly review and update the chart to track progress and make adjustments as necessary.

Using Technology for Debt Free Charts

In today's digital age, there are numerous apps and software programs available that can help create and manage debt-free charts. These tools often provide additional features such as automated budgeting, bill tracking, and investment advice. They can also offer a more visually engaging way to view debt progress, with charts and graphs that update in real-time.Common Challenges and Solutions

One of the common challenges people face when using debt-free charts is staying motivated over time. It's easy to get discouraged if progress seems slow, especially with high-balance or high-interest debts. A solution to this is to celebrate small victories along the way, such as paying off a credit card or reaching a milestone in debt reduction. Another challenge is dealing with unexpected expenses that can derail debt repayment plans. Having an emergency fund in place can help mitigate this risk.

Maintaining Discipline

Maintaining discipline is key to successfully using debt-free charts. This involves sticking to the debt repayment plan even when it's tempting to spend money on other things. It's also important to avoid taking on new debt while trying to pay off existing debts. Creating a budget and regularly tracking expenses can help ensure that money is being used wisely and that progress towards becoming debt-free is consistent.Conclusion and Next Steps

In conclusion, debt-free charts are powerful tools for managing and eliminating debt. By understanding the different types of charts, their benefits, and how to customize them, individuals can create a personalized plan for becoming debt-free. Staying motivated, maintaining discipline, and being prepared for challenges are crucial for success. With the right mindset and tools, anyone can overcome debt and achieve financial freedom.

Final Thoughts

Finally, becoming debt-free is a journey that requires patience, persistence, and the right strategies. Debt-free charts are among the most effective tools for visualizing debt, creating a plan, and tracking progress. Whether using a traditional paper chart or a digital app, the key is to find a method that works and to stick with it. With dedication and the right tools, achieving a debt-free life is within reach.Debt Free Charts Image Gallery

What is a debt-free chart?

+A debt-free chart is a tool used to visualize and manage debt, helping individuals create a plan to become debt-free.

How do I create a debt-free chart?

+To create a debt-free chart, list all your debts, decide on a method for prioritizing them, calculate your monthly payments, and set a goal for when each debt should be paid off.

What are the benefits of using debt-free charts?

+The benefits include a clear picture of your financial situation, a personalized plan for becoming debt-free, and the motivation that comes from tracking your progress.

We hope this comprehensive guide to debt-free charts has been informative and helpful. Whether you're just starting your journey to becoming debt-free or are looking for ways to enhance your current strategy, remember that staying informed, motivated, and disciplined are key to achieving your financial goals. Share your experiences with debt-free charts in the comments below, and don't hesitate to reach out if you have any questions or need further guidance.