Intro

Download a free DCF Excel template to simplify valuation calculations, featuring discounted cash flow analysis, financial modeling, and investment appraisal tools.

The world of finance and investment is complex and multifaceted, requiring a deep understanding of various tools and techniques to make informed decisions. One such tool that has gained popularity among investors and financial analysts is the Discounted Cash Flow (DCF) model. The DCF model is a valuation technique used to estimate the present value of future cash flows of a company, project, or investment. In this article, we will delve into the world of DCF models, exploring their importance, benefits, and how to use them effectively.

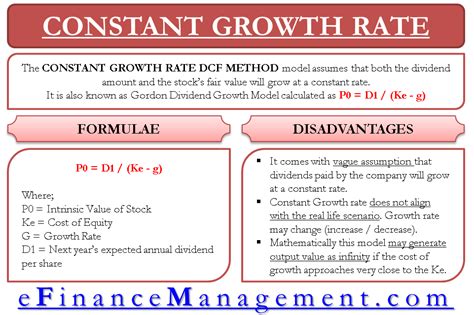

The DCF model is a powerful tool that helps investors and financial analysts to evaluate the potential of an investment by estimating its future cash flows and discounting them to their present value. This technique is widely used in the finance industry, as it provides a comprehensive framework for evaluating investment opportunities. The DCF model takes into account various factors, including the expected cash flows, discount rate, and terminal value, to estimate the present value of an investment.

One of the key benefits of using a DCF model is that it allows investors to evaluate investment opportunities based on their expected future cash flows, rather than relying on historical data. This approach helps investors to make more informed decisions, as it takes into account the expected growth and profitability of an investment. Additionally, the DCF model provides a flexible framework that can be adapted to various investment scenarios, making it a valuable tool for investors and financial analysts.

Introduction to DCF Models

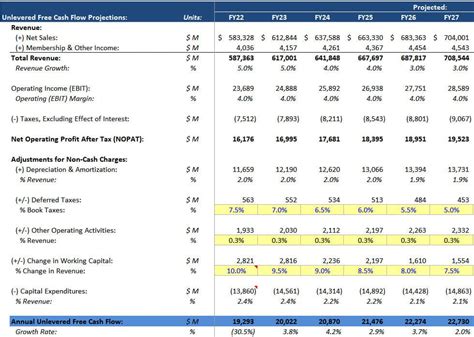

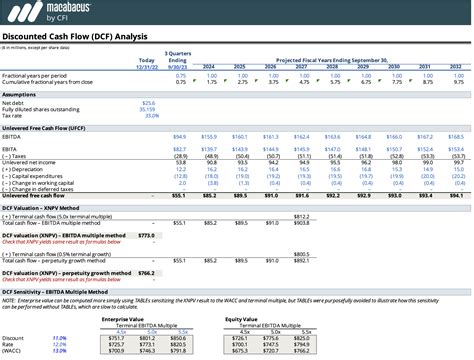

To create a DCF model, investors and financial analysts need to estimate the expected future cash flows of an investment, discount them to their present value, and calculate the terminal value. The expected future cash flows are typically estimated using historical data, industry trends, and financial forecasts. The discount rate is used to calculate the present value of the expected future cash flows, and it reflects the risk-free rate, market risk premium, and company-specific risk premium.

Benefits of Using a DCF Model

The benefits of using a DCF model are numerous, and they include:

- Evaluating investment opportunities based on expected future cash flows

- Providing a comprehensive framework for evaluating investment opportunities

- Allowing investors to make more informed decisions

- Providing a flexible framework that can be adapted to various investment scenarios

- Helping investors to estimate the present value of an investment

How to Create a DCF Model

To create a DCF model, investors and financial analysts need to follow these steps:

- Estimate the expected future cash flows of an investment

- Calculate the discount rate

- Calculate the present value of the expected future cash flows

- Calculate the terminal value

- Estimate the present value of the investment

DCF Model Template

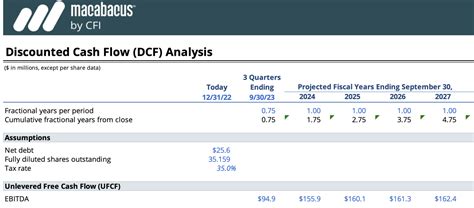

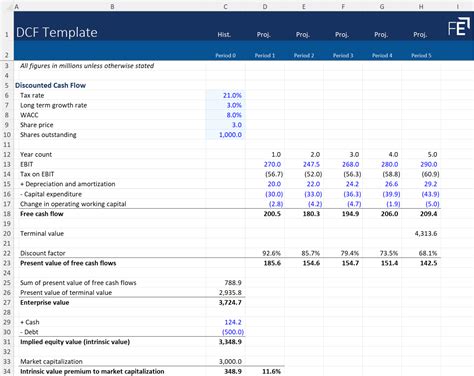

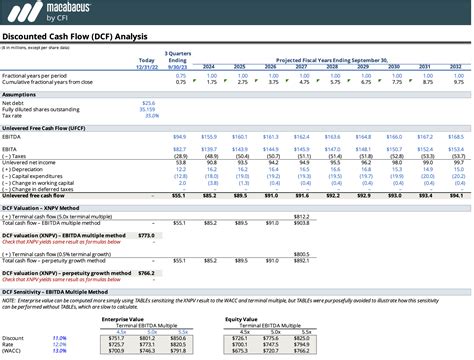

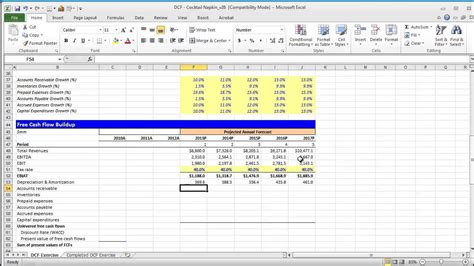

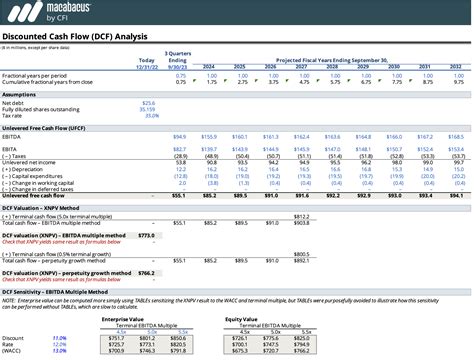

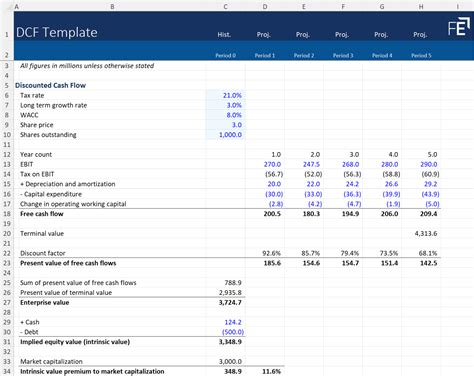

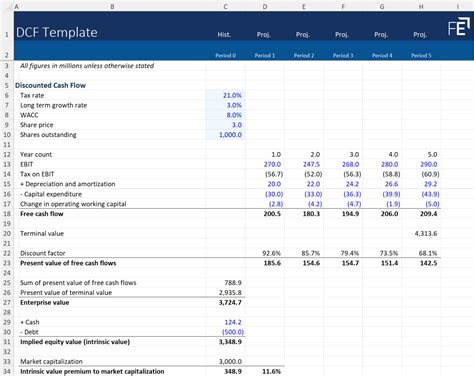

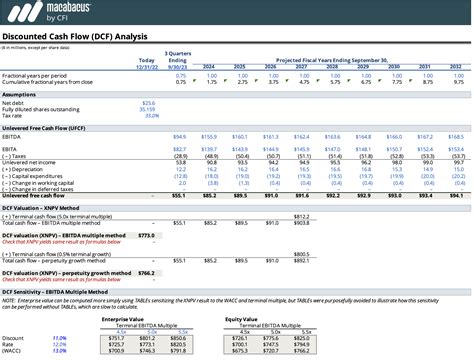

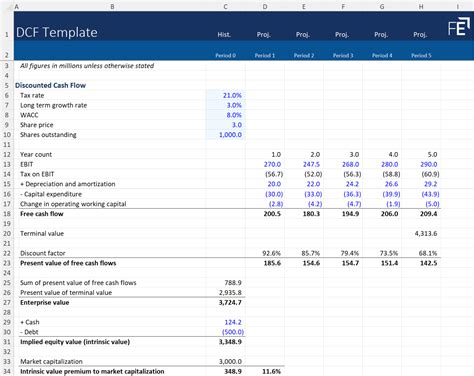

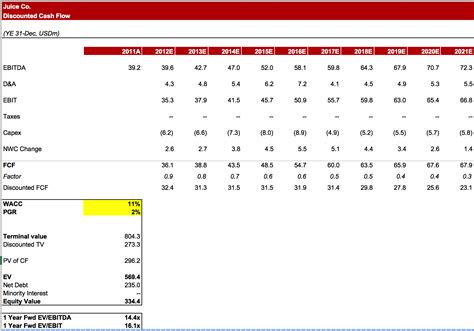

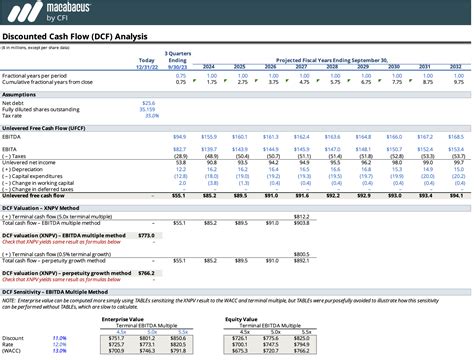

A DCF model template is a pre-designed spreadsheet that helps investors and financial analysts to create a DCF model quickly and easily. The template typically includes the following components:

- Input sheet: This sheet is used to input the expected future cash flows, discount rate, and other assumptions

- Calculation sheet: This sheet is used to calculate the present value of the expected future cash flows and the terminal value

- Output sheet: This sheet is used to display the results of the DCF model, including the present value of the investment

Free DCF Excel Template Download

There are many free DCF Excel templates available for download, and they can be found on various websites, including investment websites, financial websites, and template websites. These templates are designed to help investors and financial analysts create a DCF model quickly and easily, and they typically include the following features:

- Pre-designed input sheet

- Pre-designed calculation sheet

- Pre-designed output sheet

- Automatic calculations

- Flexible assumptions

Using a DCF Model Template

To use a DCF model template, investors and financial analysts need to follow these steps:

- Download the template

- Input the expected future cash flows and other assumptions

- Calculate the present value of the expected future cash flows and the terminal value

- Estimate the present value of the investment

- Analyze the results and make informed decisions

Common Mistakes to Avoid When Using a DCF Model

When using a DCF model, investors and financial analysts need to avoid the following common mistakes:

- Overestimating the expected future cash flows

- Underestimating the discount rate

- Failing to consider the terminal value

- Failing to analyze the results and make informed decisions

Best Practices for Using a DCF Model

To get the most out of a DCF model, investors and financial analysts need to follow these best practices:

- Use realistic assumptions

- Consider multiple scenarios

- Analyze the results and make informed decisions

- Use the DCF model in conjunction with other valuation techniques

- Continuously monitor and update the DCF model

Gallery of DCF Model Templates

DCF Model Template Image Gallery

What is a DCF model?

+A DCF model is a valuation technique used to estimate the present value of future cash flows of a company, project, or investment.

How do I create a DCF model?

+To create a DCF model, you need to estimate the expected future cash flows, calculate the discount rate, calculate the present value of the expected future cash flows, and calculate the terminal value.

What are the benefits of using a DCF model?

+The benefits of using a DCF model include evaluating investment opportunities based on expected future cash flows, providing a comprehensive framework for evaluating investment opportunities, and allowing investors to make more informed decisions.

In conclusion, a DCF model is a powerful tool that helps investors and financial analysts to evaluate investment opportunities based on their expected future cash flows. By using a DCF model template, investors and financial analysts can create a DCF model quickly and easily, and make more informed decisions. We hope that this article has provided you with a comprehensive understanding of DCF models and how to use them effectively. If you have any questions or comments, please do not hesitate to reach out to us. Additionally, we invite you to share this article with your friends and colleagues, and to explore our website for more informative articles and resources on finance and investment.