Intro

Discover 7 budget tips to manage finances effectively, including cost-cutting strategies, expense tracking, and savings plans, to achieve financial stability and security.

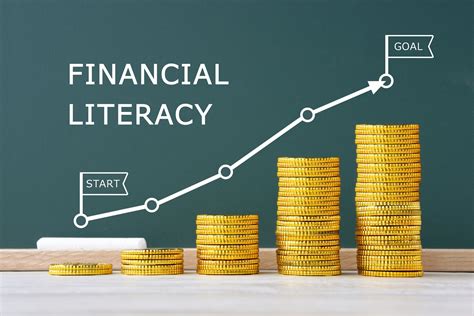

Creating and sticking to a budget is one of the most effective ways to manage your finances, achieve financial stability, and secure your future. Budgeting helps you understand where your money is going, prioritize your spending, and make conscious financial decisions. Whether you're trying to pay off debt, save for a big purchase, or simply live within your means, having a budget is essential. In this article, we will delve into the importance of budgeting, discuss common budgeting challenges, and provide practical tips to help you manage your finances effectively.

Budgeting is not just about cutting back on expenses or depriving yourself of things you enjoy; it's about making the most of your money and achieving your financial goals. By tracking your income and expenses, you can identify areas where you can cut back, make adjustments, and allocate your resources more efficiently. Moreover, budgeting helps you develop healthy financial habits, such as saving regularly, avoiding debt, and investing in your future. With a budget, you can take control of your finances, reduce financial stress, and improve your overall well-being.

In today's fast-paced world, it's easy to get caught up in the cycle of earning and spending without giving much thought to the future. However, neglecting your finances can have serious consequences, such as accumulating debt, missing out on investment opportunities, and struggling to make ends meet. By prioritizing budgeting and making it a part of your daily routine, you can avoid these pitfalls and set yourself up for long-term financial success. Whether you're a student, a working professional, or a retiree, budgeting is an essential skill that can help you navigate the complexities of personal finance and achieve your goals.

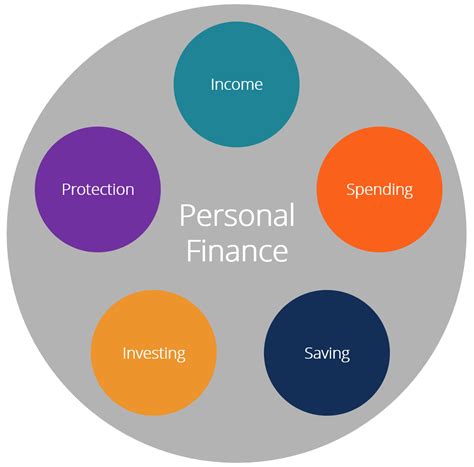

Understanding Your Financial Situation

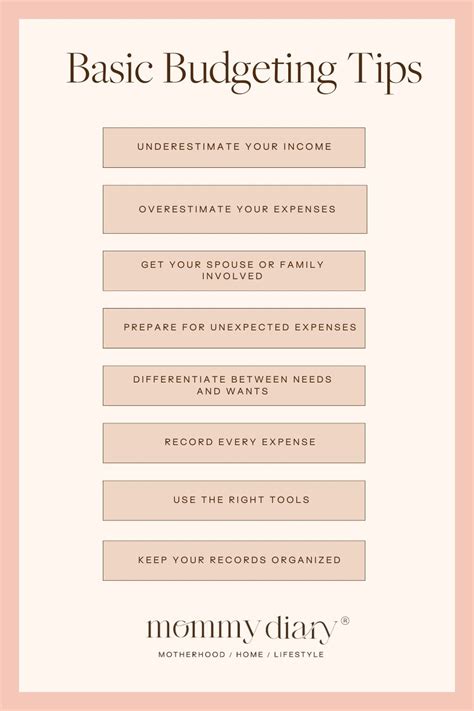

To create an effective budget, you need to understand your financial situation. This involves tracking your income and expenses, identifying your financial goals, and assessing your spending habits. Start by gathering all your financial documents, including pay stubs, bank statements, and credit card bills. Next, categorize your expenses into needs (housing, food, transportation), wants (entertainment, hobbies), and debts (credit cards, loans). This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

Assessing Your Income

Assessing your income is a critical step in budgeting. Your income determines how much you can afford to spend, save, and invest. Start by calculating your net income, which is your take-home pay after taxes and other deductions. If you have a variable income, such as freelance work or commissions, you may need to estimate your average monthly income. Be sure to include all sources of income, such as investments, rental properties, or side hustles.Setting Financial Goals

Setting financial goals is an essential part of budgeting. Your goals will help you determine how to allocate your resources and make financial decisions. Start by identifying your short-term and long-term goals. Short-term goals may include paying off debt, building an emergency fund, or saving for a big purchase. Long-term goals may include retirement, buying a home, or funding your children's education. Be specific, measurable, achievable, relevant, and time-bound (SMART) when setting your goals. This will help you stay focused and motivated.

Prioritizing Expenses

Prioritizing expenses is crucial when creating a budget. You need to distinguish between essential and non-essential expenses. Essential expenses include needs such as housing, food, and transportation. Non-essential expenses include wants such as entertainment, hobbies, and travel. Prioritize your essential expenses first, and then allocate funds to your non-essential expenses. Be sure to include a category for savings and debt repayment.Creating a Budget Plan

Creating a budget plan involves allocating your income to different expense categories. Start by assigning a percentage of your income to each category based on your priorities. A common rule of thumb is to allocate 50% of your income to essential expenses, 30% to non-essential expenses, and 20% to savings and debt repayment. Be sure to review and adjust your budget regularly to ensure you're on track to meet your financial goals.

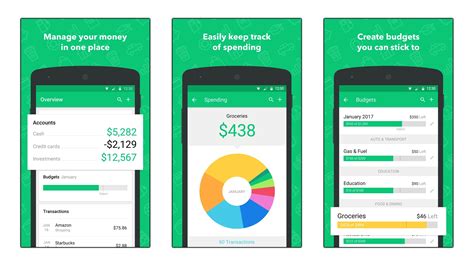

Tracking Expenses

Tracking expenses is an essential part of budgeting. You need to monitor your spending to ensure you're staying within your budget. Start by using a budgeting app, spreadsheet, or notebook to track your expenses. Categorize your expenses and assign a budget to each category. Regularly review your expenses to identify areas where you can cut back and make adjustments.Implementing Budget Tips

Implementing budget tips can help you manage your finances effectively. Here are some budget tips to consider:

- Use the 50/30/20 rule to allocate your income to essential expenses, non-essential expenses, and savings.

- Prioritize needs over wants.

- Use cash instead of credit cards for discretionary spending.

- Avoid impulse purchases.

- Take advantage of sales and discounts.

- Consider used or refurbished items instead of new ones.

- Use public transportation or walk/bike when possible.

- Cook at home instead of eating out.

- Avoid subscription services you don't use.

Avoiding Budgeting Mistakes

Avoiding budgeting mistakes is crucial to achieving financial success. Common budgeting mistakes include: * Not tracking expenses. * Not prioritizing needs over wants. * Not having an emergency fund. * Not paying off high-interest debt. * Not saving for retirement. * Not reviewing and adjusting the budget regularly.Maintaining Financial Discipline

Maintaining financial discipline is essential to achieving long-term financial success. This involves staying committed to your budget, avoiding financial pitfalls, and continuously improving your financial knowledge. Start by setting reminders to review your budget regularly. Avoid temptations to overspend, and stay focused on your financial goals. Continuously educate yourself on personal finance, and seek advice from financial experts when needed.

Overcoming Financial Challenges

Overcoming financial challenges is an essential part of budgeting. Financial challenges may include unexpected expenses, job loss, or medical emergencies. Start by having an emergency fund in place to cover 3-6 months of living expenses. Prioritize needs over wants, and cut back on non-essential expenses. Consider seeking assistance from financial experts or credit counseling services.Budgeting Image Gallery

What is the 50/30/20 rule?

+The 50/30/20 rule is a budgeting guideline that allocates 50% of your income to essential expenses, 30% to non-essential expenses, and 20% to savings and debt repayment.

How do I track my expenses?

+You can track your expenses using a budgeting app, spreadsheet, or notebook. Categorize your expenses and assign a budget to each category. Regularly review your expenses to identify areas where you can cut back and make adjustments.

What is an emergency fund?

+An emergency fund is a savings account that covers 3-6 months of living expenses in case of unexpected events such as job loss, medical emergencies, or car repairs.

How do I prioritize my expenses?

+Prioritize your expenses by distinguishing between essential and non-essential expenses. Essential expenses include needs such as housing, food, and transportation. Non-essential expenses include wants such as entertainment, hobbies, and travel.

What are some common budgeting mistakes?

+Common budgeting mistakes include not tracking expenses, not prioritizing needs over wants, not having an emergency fund, not paying off high-interest debt, and not saving for retirement.

In