Intro

Create a budget with Dave Ramseys Excel template, utilizing debt snowball, envelope system, and expense tracking to achieve financial freedom and money management success.

Creating a budget is an essential step in managing your finances effectively, and using a template can make the process easier and more efficient. The Dave Ramsey budget Excel template is a popular tool for individuals and families looking to take control of their financial lives. In this article, we will explore the importance of budgeting, the benefits of using a Dave Ramsey budget Excel template, and provide a step-by-step guide on how to create and use this template.

Budgeting is a crucial aspect of personal finance, as it allows you to track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your resources. By creating a budget, you can achieve financial stability, reduce debt, and build wealth over time. A budget also helps you prioritize your spending, ensuring that you are allocating your money towards the things that are most important to you.

The Dave Ramsey budget Excel template is a useful tool for creating a budget, as it is based on the principles outlined in Dave Ramsey's Financial Peace University. This template is designed to help you track your income and expenses, create a plan for getting out of debt, and build wealth over time. The template is easy to use and can be customized to fit your individual needs.

Benefits of Using a Dave Ramsey Budget Excel Template

There are several benefits to using a Dave Ramsey budget Excel template. One of the main advantages is that it is easy to use and understand, even for those who are not familiar with budgeting or Excel. The template is also customizable, allowing you to tailor it to your individual needs and financial goals. Additionally, the template is based on the principles outlined in Dave Ramsey's Financial Peace University, which provides a proven framework for achieving financial stability and building wealth.

Another benefit of using a Dave Ramsey budget Excel template is that it helps you track your income and expenses, identifying areas where you can cut back and make adjustments. The template also allows you to create a plan for getting out of debt, which is a critical step in achieving financial stability. By using the template, you can prioritize your spending, ensure that you are allocating your money towards the things that are most important to you, and make progress towards your long-term financial goals.

How to Create a Dave Ramsey Budget Excel Template

Creating a Dave Ramsey budget Excel template is a straightforward process that can be completed in a few steps. To start, you will need to open a new Excel spreadsheet and set up the following columns: income, fixed expenses, variable expenses, debt repayment, and savings. You can then fill in the columns with your income and expenses, using the 50/30/20 rule as a guideline. This rule suggests that 50% of your income should go towards fixed expenses, 30% towards variable expenses, and 20% towards debt repayment and savings.

Once you have filled in the columns, you can use formulas to calculate your total income and expenses, as well as your debt repayment and savings goals. You can also use charts and graphs to visualize your data and track your progress over time. It is a good idea to review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals.

Step-by-Step Guide to Creating a Dave Ramsey Budget Excel Template

To create a Dave Ramsey budget Excel template, follow these steps: * Open a new Excel spreadsheet and set up the following columns: income, fixed expenses, variable expenses, debt repayment, and savings. * Fill in the columns with your income and expenses, using the 50/30/20 rule as a guideline. * Use formulas to calculate your total income and expenses, as well as your debt repayment and savings goals. * Use charts and graphs to visualize your data and track your progress over time. * Review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals.Using the Dave Ramsey Budget Excel Template

Using the Dave Ramsey budget Excel template is a straightforward process that can help you achieve financial stability and build wealth over time. To get started, simply fill in the columns with your income and expenses, and use the formulas to calculate your total income and expenses. You can then use the template to track your progress over time, making adjustments as needed to ensure that you are on track to meet your financial goals.

One of the key benefits of using the Dave Ramsey budget Excel template is that it helps you prioritize your spending, ensuring that you are allocating your money towards the things that are most important to you. The template also allows you to create a plan for getting out of debt, which is a critical step in achieving financial stability. By using the template, you can make progress towards your long-term financial goals, such as saving for retirement or paying off your mortgage.

Tips for Getting the Most Out of the Dave Ramsey Budget Excel Template

To get the most out of the Dave Ramsey budget Excel template, follow these tips: * Review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals. * Use the template to track your progress over time, making adjustments as needed to stay on track. * Prioritize your spending, ensuring that you are allocating your money towards the things that are most important to you. * Use the template to create a plan for getting out of debt, and make progress towards your long-term financial goals.Common Mistakes to Avoid When Using a Dave Ramsey Budget Excel Template

When using a Dave Ramsey budget Excel template, there are several common mistakes to avoid. One of the most common mistakes is failing to review and update your budget regularly, which can lead to overspending and financial instability. Another mistake is failing to prioritize your spending, which can lead to allocating your money towards things that are not important to you.

To avoid these mistakes, it is a good idea to review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals. You should also prioritize your spending, ensuring that you are allocating your money towards the things that are most important to you. By avoiding these common mistakes, you can get the most out of the Dave Ramsey budget Excel template and achieve financial stability and build wealth over time.

How to Avoid Common Mistakes When Using a Dave Ramsey Budget Excel Template

To avoid common mistakes when using a Dave Ramsey budget Excel template, follow these tips: * Review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals. * Prioritize your spending, ensuring that you are allocating your money towards the things that are most important to you. * Use the template to track your progress over time, making adjustments as needed to stay on track. * Avoid overspending and financial instability by regularly reviewing and updating your budget.Conclusion and Next Steps

In conclusion, the Dave Ramsey budget Excel template is a useful tool for creating a budget and achieving financial stability. By following the steps outlined in this article, you can create and use a Dave Ramsey budget Excel template to track your income and expenses, prioritize your spending, and make progress towards your long-term financial goals. Remember to review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals.

To take the next step, start by creating a Dave Ramsey budget Excel template and filling in the columns with your income and expenses. Use the formulas to calculate your total income and expenses, and track your progress over time. By using the template and following the tips outlined in this article, you can achieve financial stability and build wealth over time.

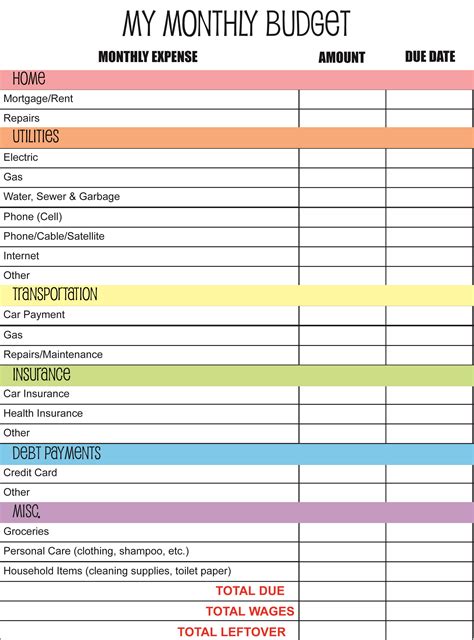

Dave Ramsey Budget Excel Template Image Gallery

What is a Dave Ramsey budget Excel template?

+A Dave Ramsey budget Excel template is a tool used to create a budget and track income and expenses. It is based on the principles outlined in Dave Ramsey's Financial Peace University and is designed to help individuals and families achieve financial stability and build wealth over time.

How do I create a Dave Ramsey budget Excel template?

+To create a Dave Ramsey budget Excel template, start by opening a new Excel spreadsheet and setting up the following columns: income, fixed expenses, variable expenses, debt repayment, and savings. Fill in the columns with your income and expenses, using the 50/30/20 rule as a guideline. Use formulas to calculate your total income and expenses, and track your progress over time.

What are the benefits of using a Dave Ramsey budget Excel template?

+The benefits of using a Dave Ramsey budget Excel template include tracking income and expenses, prioritizing spending, creating a plan for getting out of debt, and building wealth over time. The template is also easy to use and understand, and can be customized to fit individual needs and financial goals.

How often should I review and update my budget?

+It is a good idea to review and update your budget regularly, making adjustments as needed to ensure that you are on track to meet your financial goals. This can be done monthly, quarterly, or annually, depending on your individual needs and financial situation.

What are some common mistakes to avoid when using a Dave Ramsey budget Excel template?

+Some common mistakes to avoid when using a Dave Ramsey budget Excel template include failing to review and update your budget regularly, failing to prioritize your spending, and overspending. To avoid these mistakes, it is a good idea to regularly review and update your budget, prioritize your spending, and use the template to track your progress over time.

We hope this article has provided you with a comprehensive understanding of the Dave Ramsey budget Excel template and how to use it to achieve financial stability and build wealth over time. If you have any further questions or would like to share your experiences with using a Dave Ramsey budget Excel template, please leave a comment below. Additionally, if you found this article helpful, please share it with others who may benefit from using a Dave Ramsey budget Excel template.