Intro

Discover 5 ways to reconcile cash, ensuring accurate accounting and financial management by verifying transactions, balancing books, and detecting discrepancies with cash flow analysis and statement reconciliation techniques.

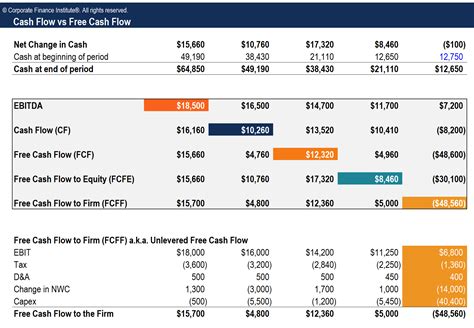

Reconciling cash is a crucial aspect of financial management, ensuring that an individual's or business's financial records are accurate and up-to-date. It involves comparing internal financial records against external statements, such as bank statements, to identify and rectify any discrepancies. This process is essential for maintaining the integrity of financial data, preventing fraud, and making informed financial decisions. In this article, we will delve into the importance of reconciling cash and explore five effective ways to achieve this.

The importance of reconciling cash cannot be overstated. It helps in detecting errors or fraudulent activities, such as unauthorized transactions or misappropriation of funds. By regularly reconciling cash, individuals and businesses can ensure that their financial records reflect their true financial position, which is vital for budgeting, forecasting, and strategic planning. Furthermore, reconciling cash on a regular basis can help in identifying and resolving discrepancies promptly, reducing the risk of financial losses and improving overall financial health.

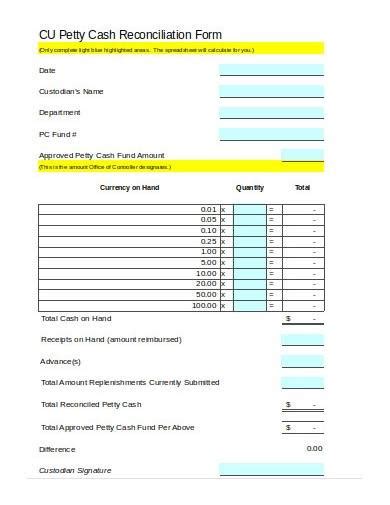

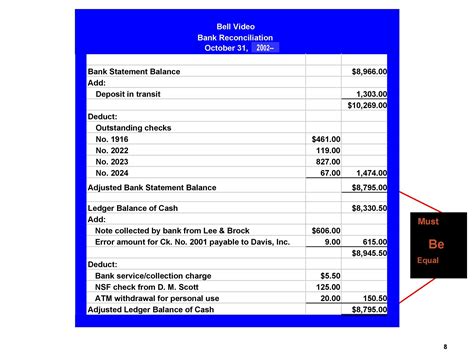

Reconciling cash is a straightforward process that involves a few simple steps. First, gather all relevant financial documents, including bank statements, check registers, and any other records of transactions. Next, compare these internal records against the external bank statement to identify any discrepancies. Finally, investigate and resolve any differences found, ensuring that all transactions are accounted for and accurately recorded. While this process may seem tedious, it is a critical component of financial management and can be simplified through the use of accounting software and other tools.

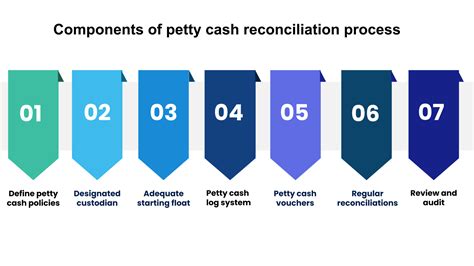

Understanding the Basics of Cash Reconciliation

Benefits of Regular Cash Reconciliation

Regular cash reconciliation offers numerous benefits, including improved financial accuracy, enhanced fraud detection, and better financial decision-making. By ensuring that financial records are accurate and up-to-date, individuals and businesses can make informed decisions about investments, funding, and other financial matters. Additionally, regular cash reconciliation can help identify areas for improvement in financial management, such as streamlining processes or reducing costs.5 Effective Ways to Reconcile Cash

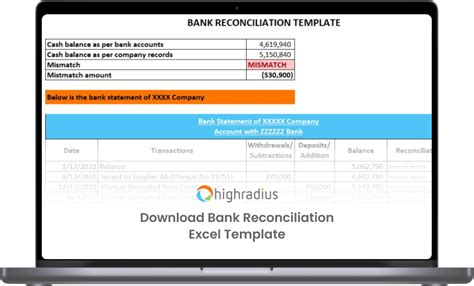

- Manual Reconciliation: This involves manually comparing internal financial records against external bank statements to identify any discrepancies. While this method can be time-consuming and prone to errors, it provides a thorough understanding of financial transactions and can be effective for small businesses or individuals with simple financial records.

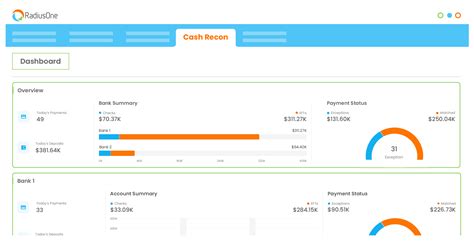

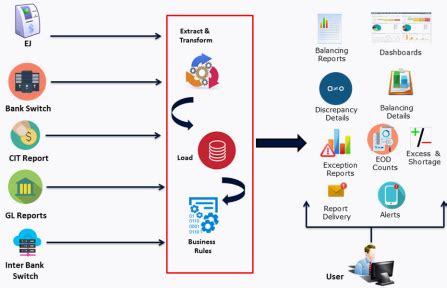

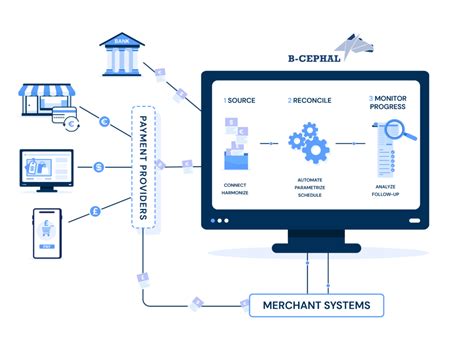

- Automated Reconciliation: This method involves using accounting software or other tools to automate the reconciliation process. Automated reconciliation can significantly reduce the time and effort required for reconciliation, minimize errors, and improve accuracy. However, it may require an initial investment in software and training.

- Reconciliation Software: Specialized reconciliation software can be used to streamline the reconciliation process, providing advanced features such as automatic transaction matching, discrepancy identification, and reporting. This method offers improved efficiency, accuracy, and scalability, making it suitable for large businesses or complex financial records.

- Outsourced Reconciliation: This involves outsourcing the reconciliation process to a third-party provider, such as an accounting firm or financial services company. Outsourced reconciliation can provide expertise, reduce costs, and improve efficiency, but may require careful selection of a reliable service provider.

- Hybrid Reconciliation: This method combines manual and automated reconciliation techniques, offering a balanced approach that leverages the benefits of both. Hybrid reconciliation can provide flexibility, improved accuracy, and cost-effectiveness, making it suitable for businesses with varying financial record complexity.

Best Practices for Cash Reconciliation

To ensure effective cash reconciliation, several best practices should be followed. These include: * Reconciling cash regularly, such as monthly or quarterly * Using accounting software or other tools to automate the reconciliation process * Maintaining accurate and up-to-date financial records * Investigating and resolving discrepancies promptly * Reviewing and verifying reconciliation results for accuracyCommon Challenges in Cash Reconciliation

Overcoming Cash Reconciliation Challenges

To overcome these challenges, individuals and businesses can take several steps. These include: * Implementing robust accounting software and tools * Providing training and expertise in reconciliation techniques * Allocating sufficient resources, such as time and personnel * Establishing clear policies and procedures for reconciliation * Regularly reviewing and verifying reconciliation results for accuracyConclusion and Next Steps

To take the next steps in cash reconciliation, consider the following:

- Review your current reconciliation process and identify areas for improvement

- Implement automated reconciliation software or tools

- Provide training and expertise in reconciliation techniques

- Establish clear policies and procedures for reconciliation

- Regularly review and verify reconciliation results for accuracy

Cash Reconciliation Image Gallery

What is cash reconciliation?

+Cash reconciliation is the process of comparing internal financial records against external statements to ensure accuracy and identify any discrepancies.

Why is cash reconciliation important?

+Cash reconciliation is important because it ensures the accuracy of financial records, detects fraud, and informs financial decision-making.

What are the common challenges in cash reconciliation?

+Common challenges in cash reconciliation include inaccurate or incomplete financial records, complex financial transactions, limited resources, lack of expertise, and inadequate accounting software or tools.

How can I overcome cash reconciliation challenges?

+To overcome cash reconciliation challenges, consider implementing robust accounting software and tools, providing training and expertise, allocating sufficient resources, establishing clear policies and procedures, and regularly reviewing and verifying reconciliation results for accuracy.

What are the best practices for cash reconciliation?

+Best practices for cash reconciliation include reconciling cash regularly, using accounting software or other tools, maintaining accurate and up-to-date financial records, investigating and resolving discrepancies promptly, and reviewing and verifying reconciliation results for accuracy.

We hope this article has provided valuable insights into the importance of cash reconciliation and effective ways to achieve it. By following the best practices and overcoming common challenges, individuals and businesses can ensure the integrity of their financial records and make informed decisions about their financial resources. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from this information.