Intro

Discover 5 ways a bill organizer simplifies financial management, reducing debt and late payments with budgeting tools, expense tracking, and payment reminders, promoting financial stability and stress-free bill management.

The importance of staying on top of bills and payments cannot be overstated. With the numerous financial obligations that individuals and households face, it's easy to get overwhelmed and miss payments, leading to late fees, penalties, and a negative impact on credit scores. However, with the right tools and strategies, managing bills can become a much more manageable and stress-free task. One such tool is a bill organizer, which can help individuals keep track of their bills, due dates, and payments. In this article, we will explore the concept of a bill organizer and provide 5 ways to use one effectively.

Effective bill management is crucial for maintaining good financial health. It helps individuals avoid late payments, reduce debt, and improve their credit scores. A bill organizer is a simple yet powerful tool that can help individuals achieve these goals. By using a bill organizer, individuals can keep track of their bills, due dates, and payments in one place, making it easier to stay on top of their financial obligations.

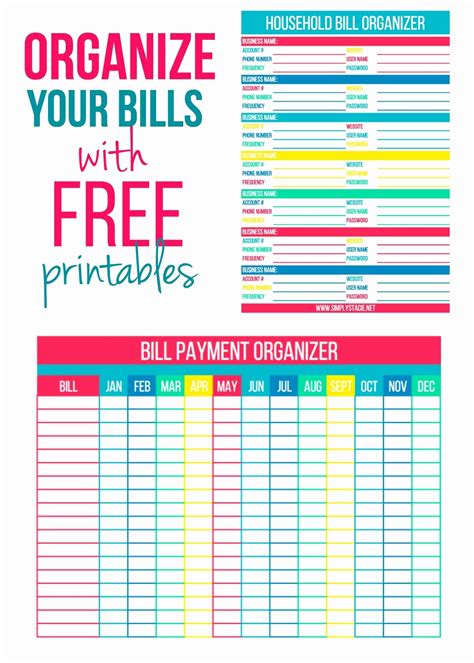

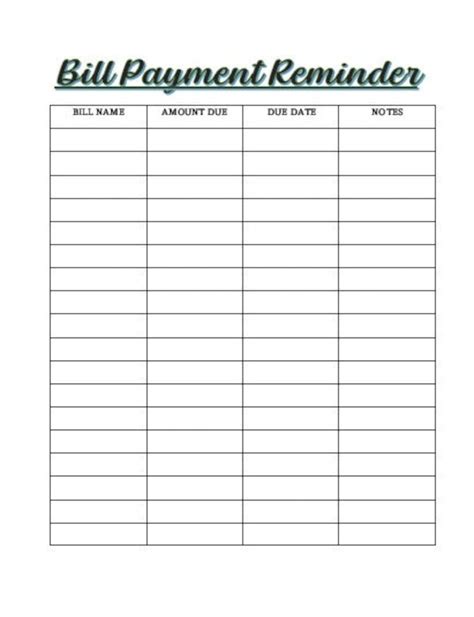

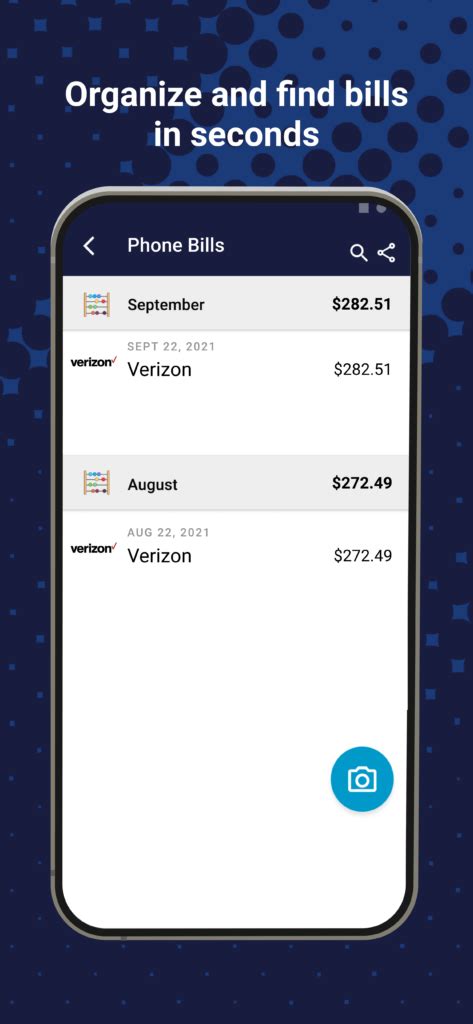

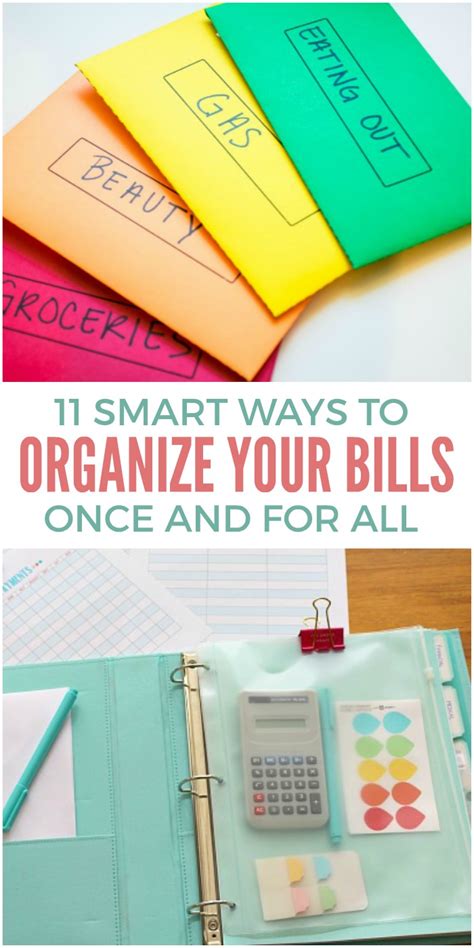

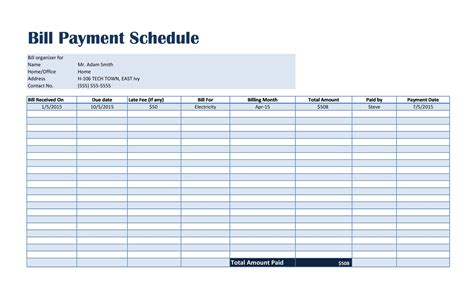

A bill organizer can be a physical notebook, a spreadsheet, or a mobile app, depending on personal preferences. The key is to find a system that works and stick to it. With a bill organizer, individuals can record all their bills, including the due dates, payment amounts, and payment methods. This information can be used to create a budget, prioritize payments, and avoid late fees. In the following sections, we will explore 5 ways to use a bill organizer effectively.

Understanding the Importance of Bill Organization

Before we dive into the 5 ways to use a bill organizer, it's essential to understand the importance of bill organization. Bill organization is the process of managing and keeping track of bills, due dates, and payments. It involves creating a system that works for individuals, whether it's a physical notebook, a spreadsheet, or a mobile app. Effective bill organization helps individuals avoid late payments, reduce debt, and improve their credit scores. It also helps individuals create a budget, prioritize payments, and make informed financial decisions.

5 Ways to Use a Bill Organizer

Now that we understand the importance of bill organization, let's explore 5 ways to use a bill organizer effectively. These ways include:

- Creating a budget: A bill organizer can help individuals create a budget by tracking income and expenses. By recording all bills, due dates, and payment amounts, individuals can identify areas where they can cut back and allocate funds more efficiently.

- Prioritizing payments: A bill organizer can help individuals prioritize payments by identifying the most critical bills, such as rent/mortgage, utilities, and credit cards. By prioritizing payments, individuals can ensure that they pay the most important bills on time.

- Avoiding late fees: A bill organizer can help individuals avoid late fees by tracking due dates and payment amounts. By setting reminders and notifications, individuals can ensure that they pay their bills on time, avoiding late fees and penalties.

- Improving credit scores: A bill organizer can help individuals improve their credit scores by tracking payment history and credit utilization. By making on-time payments and keeping credit utilization low, individuals can improve their credit scores over time.

- Reducing stress: A bill organizer can help individuals reduce stress by providing a clear picture of their financial obligations. By keeping track of bills, due dates, and payments, individuals can feel more in control of their finances, reducing stress and anxiety.

Benefits of Using a Bill Organizer

The benefits of using a bill organizer are numerous. Some of the most significant benefits include:- Reduced stress and anxiety: By keeping track of bills, due dates, and payments, individuals can feel more in control of their finances, reducing stress and anxiety.

- Improved credit scores: By making on-time payments and keeping credit utilization low, individuals can improve their credit scores over time.

- Increased financial awareness: A bill organizer can help individuals understand their financial situation better, making it easier to make informed financial decisions.

- Better budgeting: A bill organizer can help individuals create a budget by tracking income and expenses, making it easier to allocate funds more efficiently.

Types of Bill Organizers

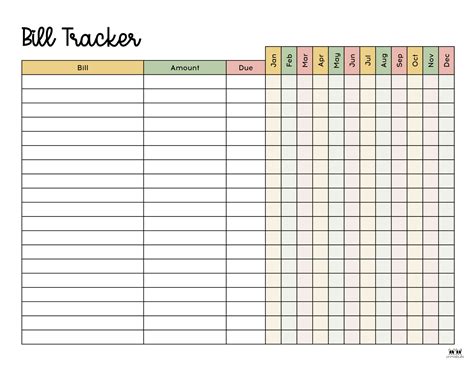

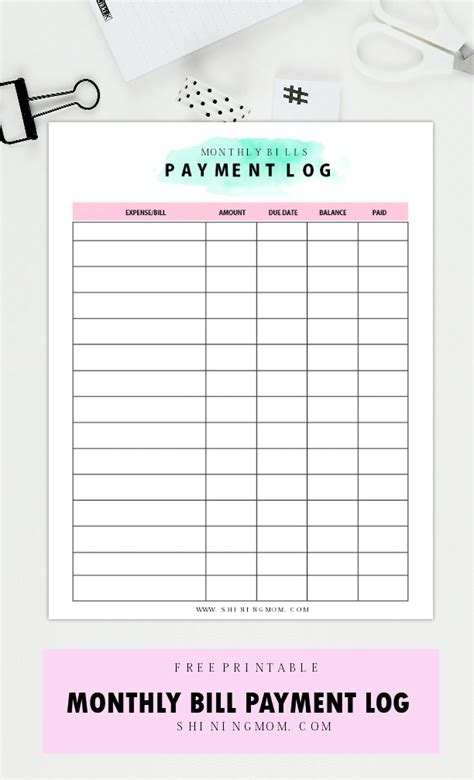

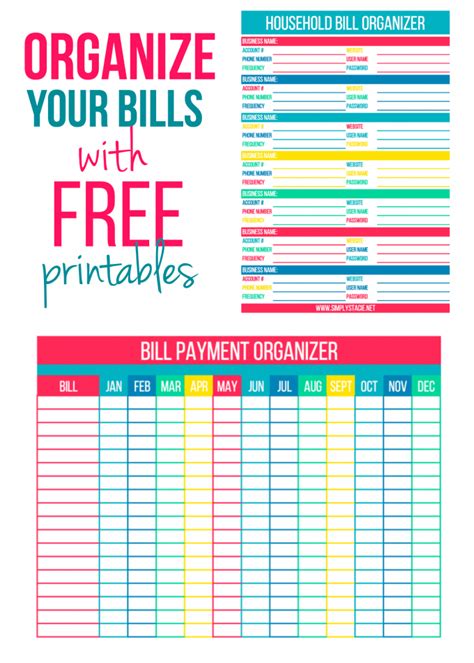

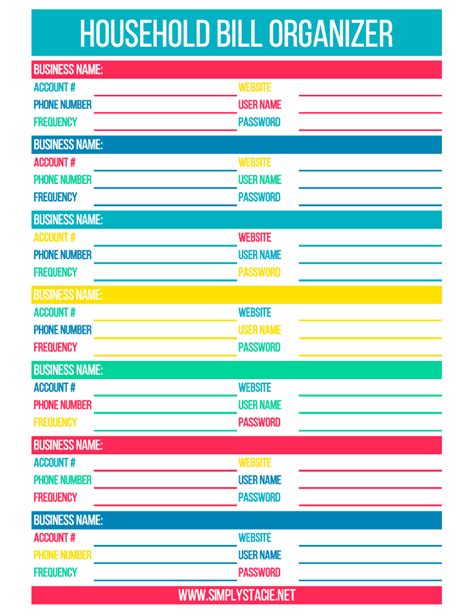

There are several types of bill organizers available, including physical notebooks, spreadsheets, and mobile apps. Each type has its advantages and disadvantages, and the choice ultimately depends on personal preferences. Physical notebooks are a simple and low-cost option, while spreadsheets offer more flexibility and customization. Mobile apps, on the other hand, offer convenience and accessibility, making it easier to track bills and payments on-the-go.

Features of a Good Bill Organizer

A good bill organizer should have several key features, including:- Ease of use: A bill organizer should be easy to use, with a simple and intuitive interface.

- Customization: A bill organizer should offer customization options, allowing individuals to tailor the system to their needs.

- Reminders and notifications: A bill organizer should offer reminders and notifications, ensuring that individuals never miss a payment.

- Budgeting tools: A bill organizer should offer budgeting tools, making it easier to track income and expenses.

- Security: A bill organizer should offer robust security features, protecting sensitive financial information.

Best Practices for Using a Bill Organizer

To get the most out of a bill organizer, individuals should follow best practices, including:

- Setting reminders and notifications: Reminders and notifications can help individuals stay on track, ensuring that they never miss a payment.

- Reviewing and updating regularly: Individuals should review and update their bill organizer regularly, ensuring that the information is accurate and up-to-date.

- Prioritizing payments: Individuals should prioritize payments, ensuring that the most critical bills are paid first.

- Using budgeting tools: Individuals should use budgeting tools to track income and expenses, making it easier to allocate funds more efficiently.

- Keeping sensitive information secure: Individuals should keep sensitive financial information secure, using robust security features to protect their data.

Common Mistakes to Avoid

When using a bill organizer, individuals should avoid common mistakes, including:- Not setting reminders and notifications: Failing to set reminders and notifications can lead to missed payments and late fees.

- Not reviewing and updating regularly: Failing to review and update the bill organizer regularly can lead to inaccurate information and missed payments.

- Not prioritizing payments: Failing to prioritize payments can lead to late fees and penalties.

- Not using budgeting tools: Failing to use budgeting tools can make it difficult to allocate funds more efficiently.

- Not keeping sensitive information secure: Failing to keep sensitive financial information secure can lead to identity theft and financial loss.

Conclusion and Next Steps

In conclusion, a bill organizer is a powerful tool that can help individuals manage their bills, due dates, and payments more effectively. By using a bill organizer, individuals can create a budget, prioritize payments, avoid late fees, improve their credit scores, and reduce stress. To get the most out of a bill organizer, individuals should follow best practices, including setting reminders and notifications, reviewing and updating regularly, prioritizing payments, using budgeting tools, and keeping sensitive information secure. By avoiding common mistakes and using a bill organizer effectively, individuals can take control of their finances, achieving financial stability and peace of mind.

Bill Organizer Image Gallery

What is a bill organizer?

+A bill organizer is a tool that helps individuals manage their bills, due dates, and payments more effectively.

How can a bill organizer help me?

+A bill organizer can help you create a budget, prioritize payments, avoid late fees, improve your credit scores, and reduce stress.

What are the benefits of using a bill organizer?

+The benefits of using a bill organizer include reduced stress and anxiety, improved credit scores, increased financial awareness, and better budgeting.

How can I choose the right bill organizer for me?

+To choose the right bill organizer for you, consider your personal preferences, financial goals, and the features you need, such as reminders and notifications, budgeting tools, and security.

How can I get the most out of my bill organizer?

+To get the most out of your bill organizer, set reminders and notifications, review and update regularly, prioritize payments, use budgeting tools, and keep sensitive information secure.

We hope this article has provided you with valuable insights into the world of bill organizers and how they can help you manage your finances more effectively. Whether you're looking to create a budget, prioritize payments, or simply reduce stress, a bill organizer can be a powerful tool in your financial arsenal. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them take control of their finances and achieve financial stability.