Intro

Boost credit scores with 5 expert-approved credit repair templates, featuring dispute letters, credit reports, and score tracking tools to help fix errors and negotiate settlements, improving credit health and financial stability.

Credit repair is a crucial process for individuals looking to improve their financial health and increase their credit scores. A good credit score can open doors to better loan options, lower interest rates, and even improved job prospects. However, navigating the credit repair process can be daunting, especially for those who are new to the world of personal finance. This is where credit repair templates come in – they provide a structured approach to disputing errors, communicating with creditors, and monitoring progress. In this article, we will delve into the importance of credit repair, explore five essential credit repair templates, and discuss how to use them effectively.

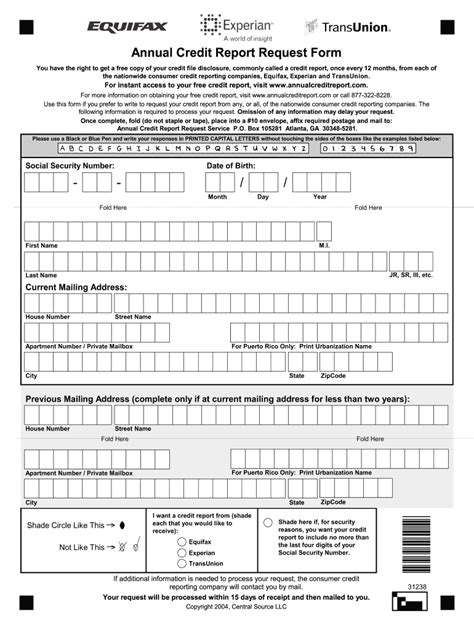

The first step in credit repair is understanding your credit report. This document outlines your credit history, including payments, debts, and public records. By obtaining a copy of your credit report from the three major credit bureaus (Experian, TransUnion, and Equifax), you can identify areas that need improvement. Common issues include inaccurate information, outstanding debts, and high credit utilization ratios. Once you have pinpointed these problems, you can begin using credit repair templates to address them.

Introduction to Credit Repair Templates

Credit repair templates are pre-designed documents that guide you through the credit repair process. They help you draft letters, track progress, and organize your finances. These templates can be found online or created manually, depending on your specific needs. The key is to find templates that are relevant to your situation and easy to use. With the right templates, you can streamline your credit repair efforts and achieve better results.

Benefits of Using Credit Repair Templates

Using credit repair templates offers several benefits. Firstly, they save time and effort by providing a structured approach to credit repair. Secondly, they help ensure that all necessary information is included in your communications with creditors and credit bureaus. This can improve the effectiveness of your disputes and requests. Lastly, templates keep you organized, allowing you to monitor your progress and adjust your strategy as needed.

Common Types of Credit Repair Templates

There are several types of credit repair templates available, each serving a specific purpose:

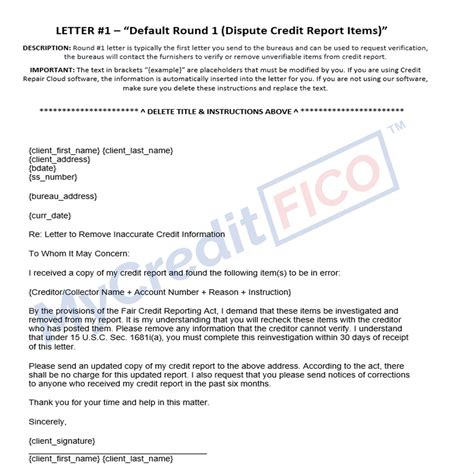

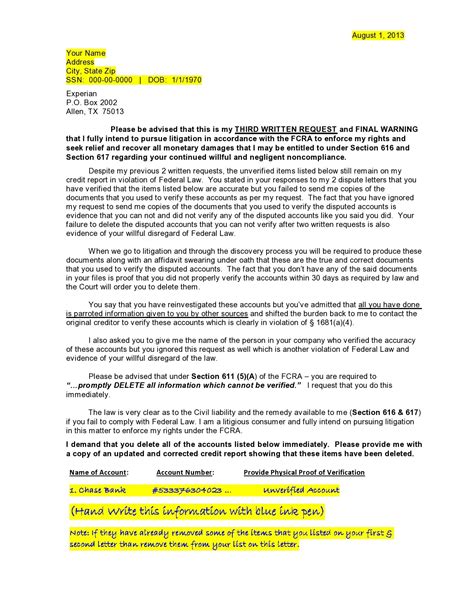

- Dispute letters: Used to challenge inaccuracies on your credit report.

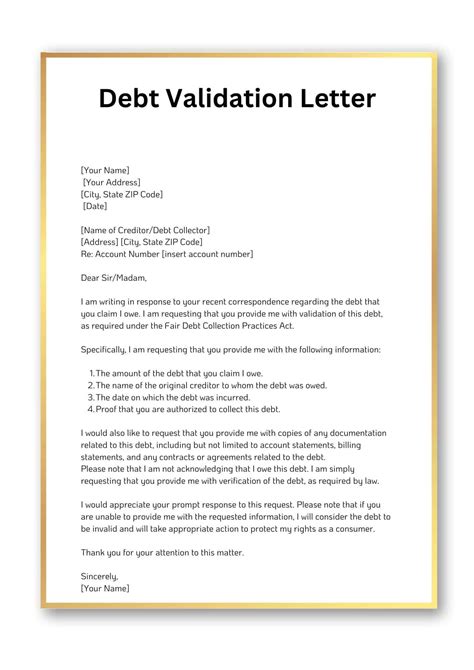

- Debt validation letters: Request proof of debt from creditors.

- Credit report request forms: Help you obtain copies of your credit report from the major credit bureaus.

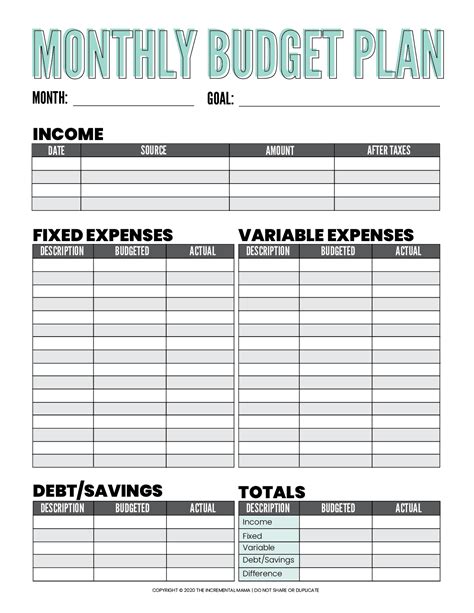

- Budget worksheets: Assist in creating a budget and tracking expenses.

- Progress trackers: Enable you to monitor your credit repair progress over time.

5 Essential Credit Repair Templates

-

Dispute Letter Template: This template is used to dispute inaccuracies found on your credit report. It should include your personal information, the item you are disputing, and a clear request for the error to be corrected.

-

Debt Validation Letter Template: When dealing with debt collectors, it's essential to verify the debt. This template helps you request proof of the debt, ensuring that you are not mistakenly paying off an invalid or outdated debt.

-

Credit Report Request Form Template: Obtaining your credit report is the first step in credit repair. This template guides you in requesting a copy of your report from each of the three major credit bureaus.

-

Budget Worksheet Template: Creating a budget is crucial for managing your finances and improving your credit score. This template helps you track your income, expenses, and savings, making it easier to identify areas for improvement.

-

Progress Tracker Template: Monitoring your credit repair progress is vital for staying motivated and making adjustments to your strategy. This template allows you to track changes in your credit score, updates to your credit report, and the status of your disputes and debt payments.

How to Use Credit Repair Templates Effectively

To get the most out of credit repair templates, follow these steps:

- Identify your goals: Determine what you want to achieve through credit repair, whether it's improving your credit score, reducing debt, or correcting errors on your credit report.

- Choose the right templates: Select templates that align with your goals and situation.

- Customize the templates: Fill in the templates with your personal information and specifics about your credit situation.

- Use them consistently: Regularly use the templates to track your progress, communicate with creditors, and dispute errors.

- Review and adjust: Periodically review your progress and adjust your strategy as needed.

Tips for Credit Repair Success

- Stay Organized: Keep all your documents and correspondence in one place.

- Be Persistent: Credit repair can take time, so it's essential to stay committed to your goals.

- Educate Yourself: Continuously learn about credit repair and personal finance to make informed decisions.

- Seek Professional Help: If you're overwhelmed, consider consulting a credit repair professional.

Gallery of Credit Repair Templates

Credit Repair Templates Image Gallery

What is the first step in credit repair?

+The first step in credit repair is obtaining a copy of your credit report from the three major credit bureaus and reviewing it for inaccuracies or areas of improvement.

How long does credit repair take?

+Credit repair can take several months to a few years, depending on the complexity of the issues and the individual's financial situation.

Can I do credit repair myself?

+Yes, it is possible to do credit repair yourself using credit repair templates and by following the steps outlined in this article. However, seeking professional help can be beneficial for complex cases.

In conclusion, credit repair templates are valuable tools for anyone looking to improve their credit score and financial health. By understanding how to use these templates effectively and combining them with a solid knowledge of credit repair principles, individuals can navigate the credit repair process with confidence. Remember, credit repair is a journey that requires patience, persistence, and the right strategies. With the right approach and tools, you can achieve significant improvements in your credit score and open up new financial opportunities. If you have any questions or experiences with credit repair templates, feel free to share them in the comments below. Your insights can help others on their own credit repair journeys.