Intro

Discover 5 customizable credit card templates, featuring secure payment designs, digital wallet integration, and rewards programs, to simplify financial transactions and enhance user experience with modern credit card solutions.

The world of credit cards has become increasingly complex, with numerous options available to consumers. From rewards cards to cashback cards, and from secured cards to unsecured cards, the choices can be overwhelming. In this article, we will delve into the world of credit card templates, exploring five popular options that can help individuals and businesses manage their finances effectively.

Credit card templates are pre-designed formats that provide a structure for creating and managing credit card accounts. These templates can be used by financial institutions, businesses, and individuals to streamline the credit card application process, track expenses, and make payments. With the rise of digital payments, credit card templates have become an essential tool for anyone looking to manage their finances efficiently.

The importance of credit card templates cannot be overstated. They provide a standardized format for credit card information, making it easier to compare and contrast different credit card options. Additionally, credit card templates can help individuals and businesses keep track of their expenses, identify areas for cost-cutting, and make informed decisions about their financial resources. In this article, we will explore five credit card templates that can help individuals and businesses achieve their financial goals.

Introduction to Credit Card Templates

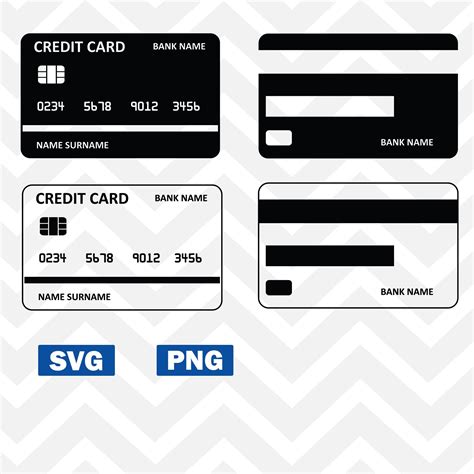

Credit card templates are designed to provide a structured format for credit card information. These templates typically include fields for credit card details, such as the card number, expiration date, and security code. They may also include fields for personal and business information, such as the cardholder's name, address, and contact details. By using a credit card template, individuals and businesses can ensure that they have all the necessary information to manage their credit card accounts effectively.

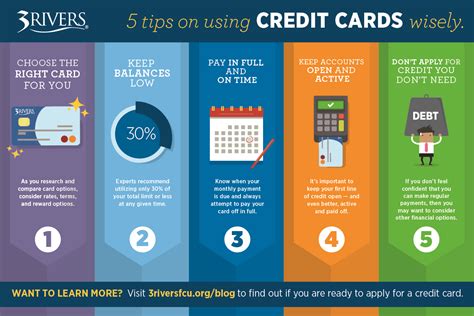

Benefits of Credit Card Templates

The benefits of credit card templates are numerous. They provide a standardized format for credit card information, making it easier to compare and contrast different credit card options. Additionally, credit card templates can help individuals and businesses keep track of their expenses, identify areas for cost-cutting, and make informed decisions about their financial resources. By using a credit card template, individuals and businesses can also reduce the risk of errors and discrepancies in their credit card accounts.

5 Credit Card Templates

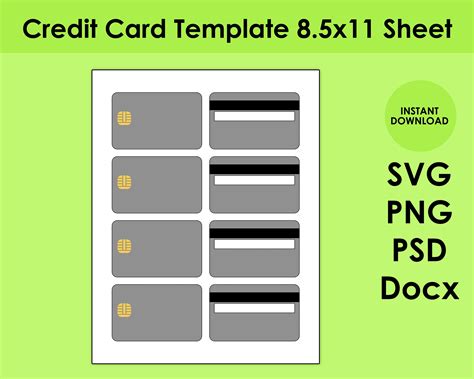

In this section, we will explore five credit card templates that can help individuals and businesses manage their finances effectively. These templates include:

- Template 1: Basic Credit Card Template

- This template provides a simple and straightforward format for credit card information.

- It includes fields for credit card details, such as the card number, expiration date, and security code.

- It also includes fields for personal and business information, such as the cardholder's name, address, and contact details.

- Template 2: Rewards Credit Card Template

- This template is designed for rewards credit cards, which offer points or cashback for purchases.

- It includes fields for rewards program details, such as the rewards rate and redemption options.

- It also includes fields for credit card details, such as the card number, expiration date, and security code.

- Template 3: Business Credit Card Template

- This template is designed for businesses, which need to manage multiple credit card accounts.

- It includes fields for business information, such as the business name, address, and contact details.

- It also includes fields for credit card details, such as the card number, expiration date, and security code.

- Template 4: Secured Credit Card Template

- This template is designed for secured credit cards, which require a security deposit.

- It includes fields for security deposit details, such as the deposit amount and payment terms.

- It also includes fields for credit card details, such as the card number, expiration date, and security code.

- Template 5: Cashback Credit Card Template

- This template is designed for cashback credit cards, which offer a percentage of cashback for purchases.

- It includes fields for cashback program details, such as the cashback rate and redemption options.

- It also includes fields for credit card details, such as the card number, expiration date, and security code.

How to Use Credit Card Templates

Using a credit card template is straightforward. Simply download the template and fill in the required fields with your credit card information. You can then use the template to track your expenses, identify areas for cost-cutting, and make informed decisions about your financial resources. By using a credit card template, you can also reduce the risk of errors and discrepancies in your credit card accounts.

Best Practices for Credit Card Templates

When using a credit card template, there are several best practices to keep in mind. These include:

- Keep your credit card information up-to-date

- Make sure to update your credit card information regularly to ensure that your template remains accurate.

- Use a secure template

- Choose a template that is secure and protected from unauthorized access.

- Monitor your expenses

- Use your template to track your expenses and identify areas for cost-cutting.

- Make informed decisions

- Use your template to make informed decisions about your financial resources.

Gallery of Credit Card Templates

Credit Card Templates Image Gallery

Frequently Asked Questions

What is a credit card template?

+A credit card template is a pre-designed format that provides a structure for creating and managing credit card accounts.

How do I use a credit card template?

+Using a credit card template is straightforward. Simply download the template and fill in the required fields with your credit card information.

What are the benefits of using a credit card template?

+The benefits of using a credit card template include providing a standardized format for credit card information, helping to track expenses, and making informed decisions about financial resources.

Can I customize a credit card template?

+Yes, you can customize a credit card template to suit your specific needs. Simply download the template and modify the fields and format as required.

Are credit card templates secure?

+Yes, credit card templates are secure. Choose a template that is protected from unauthorized access and keep your credit card information up-to-date.

In conclusion, credit card templates are a valuable tool for anyone looking to manage their finances effectively. By providing a standardized format for credit card information, these templates can help individuals and businesses track their expenses, identify areas for cost-cutting, and make informed decisions about their financial resources. Whether you are looking for a basic credit card template or a more specialized template, such as a rewards or business credit card template, there are many options available to suit your needs. By using a credit card template, you can take control of your finances and achieve your financial goals. We encourage you to share your thoughts and experiences with credit card templates in the comments section below.