Intro

Create accurate pay records with a contractor pay stub template, featuring payment details, deductions, and tax withholding, ideal for independent contractors and freelancers managing payroll and invoices efficiently.

As a contractor, managing finances and keeping track of payments is crucial for the success of your business. One essential tool for achieving this is a pay stub template. A pay stub, also known as a paycheck stub, is a document that provides a detailed breakdown of an employee's or contractor's pay, including gross income, deductions, and net pay. In this article, we will delve into the world of contractor pay stub templates, exploring their importance, benefits, and how to create one.

Contractor pay stub templates are vital for contractors who want to maintain accurate and transparent financial records. These templates help contractors to organize their payments, deductions, and other financial information in a clear and concise manner. With a pay stub template, contractors can easily track their income, expenses, and tax deductions, making it easier to manage their finances and make informed business decisions.

Benefits of Using a Contractor Pay Stub Template

The benefits of using a contractor pay stub template are numerous. Some of the most significant advantages include:

- Improved financial organization: A pay stub template helps contractors to keep track of their payments, deductions, and other financial information in a single document.

- Enhanced transparency: Pay stub templates provide a clear and concise breakdown of an contractor's pay, making it easier to understand and manage finances.

- Increased accuracy: Using a pay stub template reduces the risk of errors and inaccuracies in financial calculations.

- Simplified tax preparation: Pay stub templates can help contractors to prepare for tax season by providing a detailed record of income and deductions.

Components of a Contractor Pay Stub Template

A contractor pay stub template typically includes the following components:

- Contractor information: Name, address, and contact details.

- Payment details: Date, payment amount, and payment method.

- Gross income: The total amount earned by the contractor before deductions.

- Deductions: A breakdown of deductions, including taxes, insurance, and other expenses.

- Net pay: The amount of money the contractor takes home after deductions.

- Tax information: A summary of tax deductions and payments.

How to Create a Contractor Pay Stub Template

Creating a contractor pay stub template is a straightforward process. Here are the steps to follow:

- Determine the required components: Identify the information that needs to be included in the pay stub template.

- Choose a template format: Decide on the format of the template, such as a Word document or Excel spreadsheet.

- Design the template: Use a template design tool or software to create the template.

- Add the required components: Include the necessary information, such as contractor details, payment details, and tax information.

- Test the template: Review the template to ensure it is accurate and easy to use.

Best Practices for Using a Contractor Pay Stub Template

To get the most out of a contractor pay stub template, follow these best practices:

- Use the template consistently: Use the template for every payment to ensure accuracy and consistency.

- Keep the template up-to-date: Regularly review and update the template to reflect changes in tax laws or other financial regulations.

- Store the template securely: Keep the template and completed pay stubs in a secure location, such as a locked file cabinet or encrypted digital storage.

Common Mistakes to Avoid When Using a Contractor Pay Stub Template

When using a contractor pay stub template, avoid the following common mistakes:

- Inaccurate information: Ensure that all information, including contractor details and payment amounts, is accurate and up-to-date.

- Incomplete information: Make sure to include all required components, such as tax information and deductions.

- Inconsistent use: Use the template consistently for every payment to avoid errors and inaccuracies.

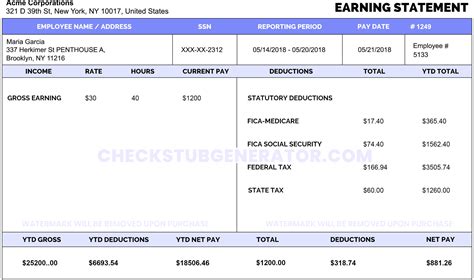

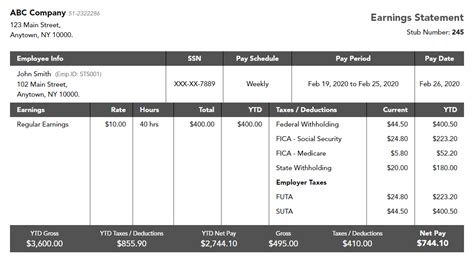

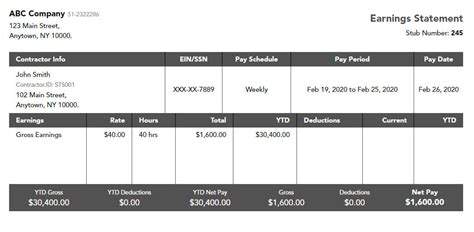

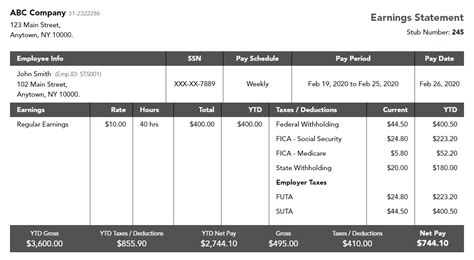

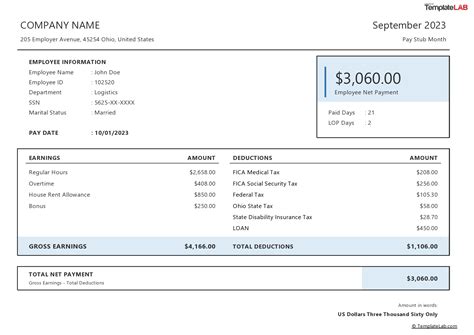

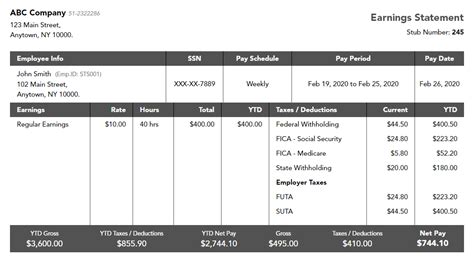

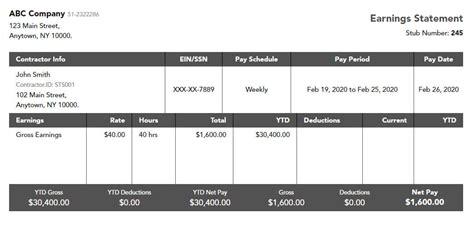

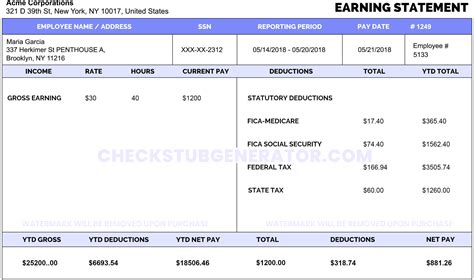

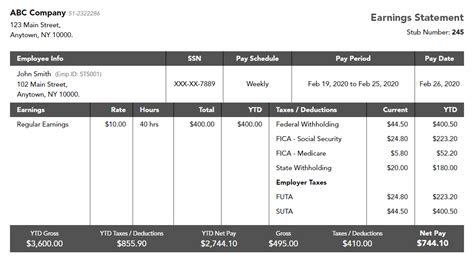

Contractor Pay Stub Template Examples

Here are some examples of contractor pay stub templates:

- Simple pay stub template: A basic template that includes contractor details, payment amount, and tax information.

- Detailed pay stub template: A more comprehensive template that includes additional information, such as deductions and benefits.

- Customizable pay stub template: A template that can be tailored to meet the specific needs of a contractor or business.

Gallery of Contractor Pay Stub Templates

Contractor Pay Stub Templates Image Gallery

What is a contractor pay stub template?

+A contractor pay stub template is a document that provides a detailed breakdown of a contractor's pay, including gross income, deductions, and net pay.

Why do I need a contractor pay stub template?

+A contractor pay stub template helps you to manage your finances, track your income and expenses, and prepare for tax season.

How do I create a contractor pay stub template?

+You can create a contractor pay stub template by using a template design tool or software, and including the necessary components, such as contractor details, payment details, and tax information.

What are the benefits of using a contractor pay stub template?

+The benefits of using a contractor pay stub template include improved financial organization, enhanced transparency, increased accuracy, and simplified tax preparation.

Can I customize a contractor pay stub template?

+Yes, you can customize a contractor pay stub template to meet your specific needs and requirements.

In conclusion, a contractor pay stub template is an essential tool for managing finances and tracking payments. By using a pay stub template, contractors can improve their financial organization, enhance transparency, and simplify tax preparation. With the tips and best practices outlined in this article, contractors can create and use a pay stub template effectively, ensuring accurate and efficient financial management. We encourage you to share your thoughts and experiences with contractor pay stub templates in the comments below, and to share this article with others who may benefit from this valuable information.