Intro

Master budgeting with Excel using 5 effective ways, including budget templates, financial planning, and data analysis to optimize expenses and savings, boosting financial management skills.

Effective budgeting is a crucial aspect of personal finance, allowing individuals to manage their income, prioritize expenses, and achieve long-term financial goals. Among the various tools available for budgeting, Microsoft Excel stands out due to its flexibility, functionality, and the ability to create customized budget templates. Here, we'll explore five ways to use Excel for budgeting, making it easier to track your finances and stay on top of your spending.

Budgeting is essential for several reasons. It helps in understanding where your money is going, ensuring that you're not overspending, and saving for the future. Without a budget, it's easy to fall into debt or miss out on opportunities for wealth creation. Excel, with its spreadsheet capabilities, offers a powerful platform for creating and managing budgets. Its formulas and functions enable automatic calculations, making it simpler to update and adjust your budget as needed.

The importance of budgeting cannot be overstated. It's a fundamental practice that helps in achieving financial stability and security. By allocating your income wisely, you can ensure that you're meeting your necessary expenses, saving for emergencies, and working towards your financial goals, whether that's buying a house, retirement, or funding your children's education. Excel's budgeting templates and tools can be tailored to fit individual needs, making budgeting more accessible and less daunting.

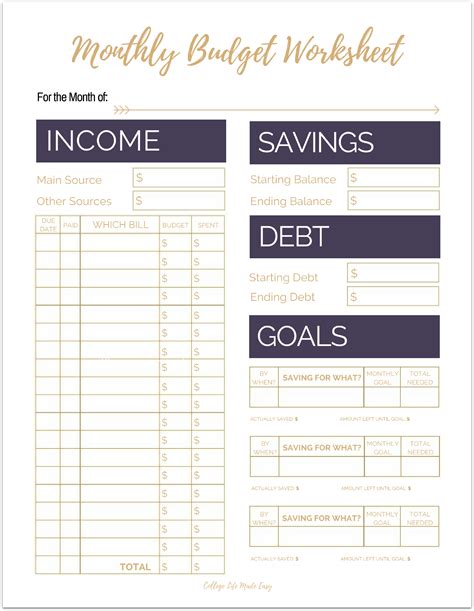

Creating a Basic Budget Template

To start using Excel for budgeting, creating a basic budget template is the first step. This involves setting up a spreadsheet with categories for income and expenses. Income categories might include salary, investments, and any side hustles, while expenses could be divided into necessities like rent, utilities, and groceries, and discretionary spending like entertainment and hobbies. Excel's auto-sum features make it easy to calculate totals for each category, providing a clear picture of your financial situation.

Steps to Create a Budget Template

1. Open a new Excel spreadsheet and give it a title, such as "Personal Budget." 2. Create columns for the budget categories (income and expenses). 3. Use rows to list each type of income and expense. 4. Apply formulas to calculate totals and percentages of income spent in each category. 5. Regularly update the spreadsheet with actual income and expenses to track your budget's performance.Using Budgeting Formulas and Functions

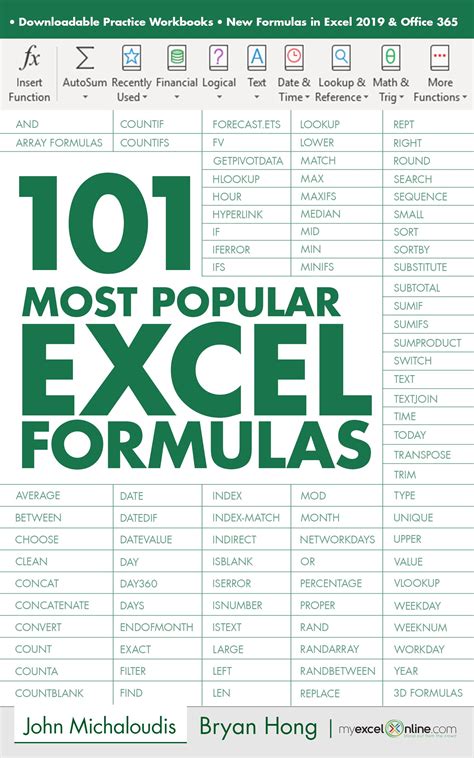

Excel's formulas and functions are powerful tools for budget analysis. The SUM function can add up all your expenses or income, while the AVERAGE function can help you understand your average monthly spending. More complex formulas, such as those using IF statements, can be used to categorize expenses automatically or to highlight when you've exceeded a budget limit. Understanding and leveraging these formulas can make your budgeting process more efficient and insightful.

Essential Budgeting Formulas

- SUM: To add a series of numbers, such as all expenses in a month. - AVERAGE: To find the average of a series of numbers, useful for understanding spending patterns. - IF: To make logical comparisons between values, helpful for setting budget alerts.Tracking Expenses Over Time

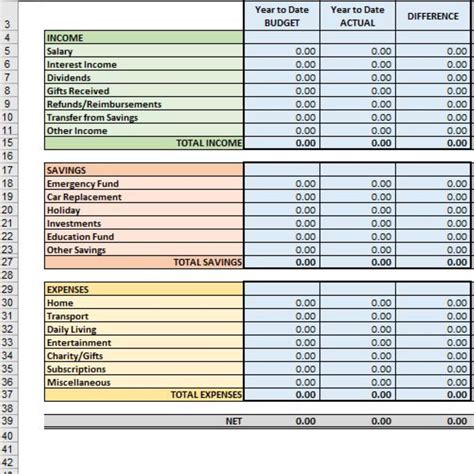

Tracking expenses over time is crucial for identifying spending patterns, areas for reduction, and progress towards financial goals. Excel allows you to create sheets for each month, making it easy to compare spending from one month to the next. By using pivot tables, you can summarize large datasets and focus on specific categories or time frames. This long-term view helps in making informed decisions about future spending and savings.

Benefits of Long-Term Expense Tracking

- Identifies consistent areas of overspending. - Helps in setting realistic financial goals. - Provides data for budget adjustments.Visualizing Your Budget with Charts

Visualizing your budget through charts and graphs can make complex financial data more accessible and understandable. Excel offers a variety of chart types, such as pie charts for showing how your income is allocated among different expenses, and line graphs for tracking changes in spending over time. These visualizations can highlight trends and anomalies, making it easier to understand your financial situation at a glance.

Types of Budget Charts

- Pie Chart: Useful for showing the proportion of income spent on different categories. - Line Graph: Ideal for tracking changes in income or expenses over time. - Bar Chart: Helps in comparing different categories of expenses.Automating Budget Updates

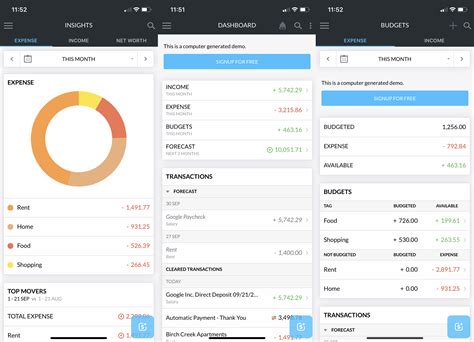

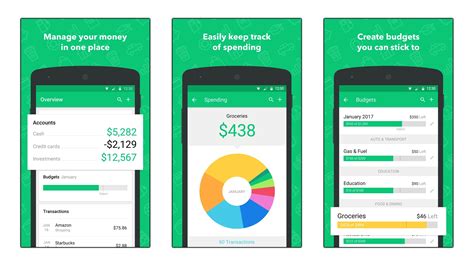

Finally, automating budget updates can save time and ensure that your budget remains accurate and up-to-date. Excel's automated features, such as formulas that update totals when new data is entered, can streamline the budgeting process. Additionally, linking your budget spreadsheet to your bank accounts or using budgeting apps that integrate with Excel can automate the entry of income and expenses, reducing the chance of human error and making budgeting more efficient.

Ways to Automate Budgeting

- Use Excel formulas to update totals automatically. - Link your budget to digital banking for automatic transaction import. - Utilize budgeting apps that integrate with Excel for streamlined data entry.Excel Budgeting Image Gallery

What is the importance of budgeting in personal finance?

+Budgeting is crucial for managing income, prioritizing expenses, and achieving long-term financial goals. It helps in understanding where your money is going, ensuring you're not overspending, and saving for the future.

How can Excel be used for budgeting?

+Excel can be used to create customized budget templates, track expenses, calculate totals and averages, and visualize budget data through charts and graphs. Its formulas and functions make budget analysis more efficient.

What are the benefits of tracking expenses over time?

+Tracking expenses over time helps in identifying spending patterns, areas for reduction, and progress towards financial goals. It provides valuable data for making informed decisions about future spending and savings.

In conclusion, leveraging Excel for budgeting offers a powerful and flexible way to manage your finances. By creating a basic budget template, utilizing budgeting formulas and functions, tracking expenses over time, visualizing your budget with charts, and automating budget updates, you can gain a clearer understanding of your financial situation and make progress towards your financial goals. Whether you're looking to save money, pay off debt, or build wealth, Excel's budgeting capabilities can be a valuable tool in your financial journey. We invite you to share your experiences with Excel budgeting, ask questions, or explore more topics related to personal finance and budgeting. Together, we can work towards achieving financial stability and security.