Intro

Get the Colorado 104 tax form printable and learn about state income tax returns, tax deductions, and filing requirements with related forms and instructions.

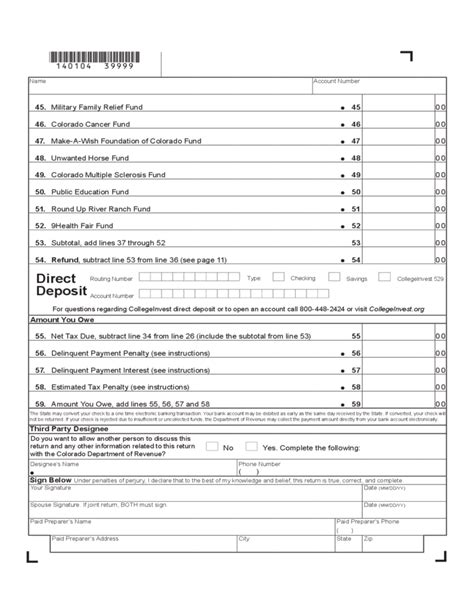

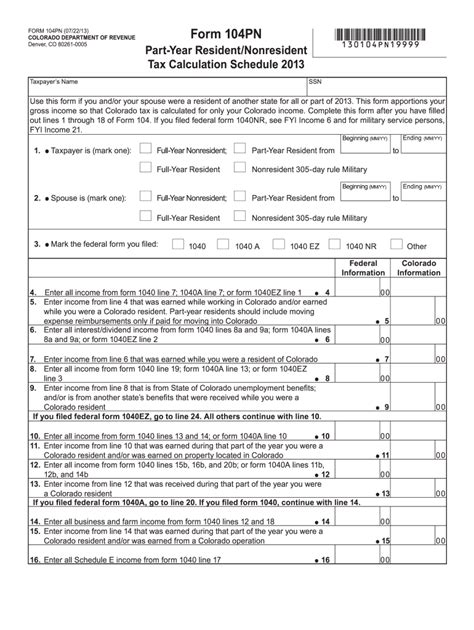

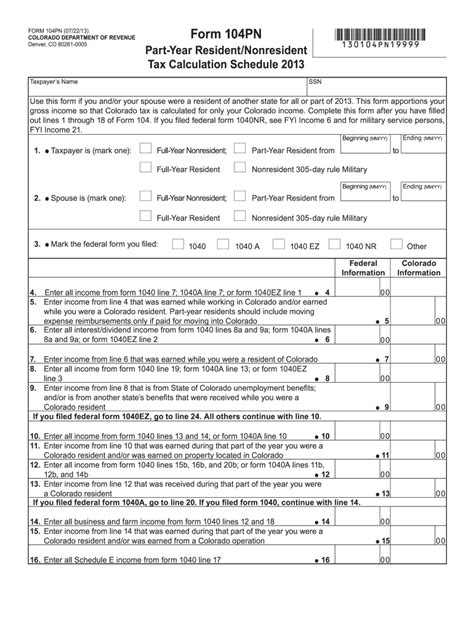

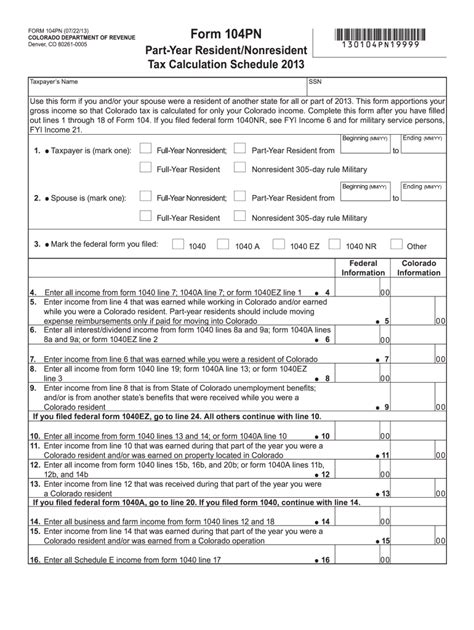

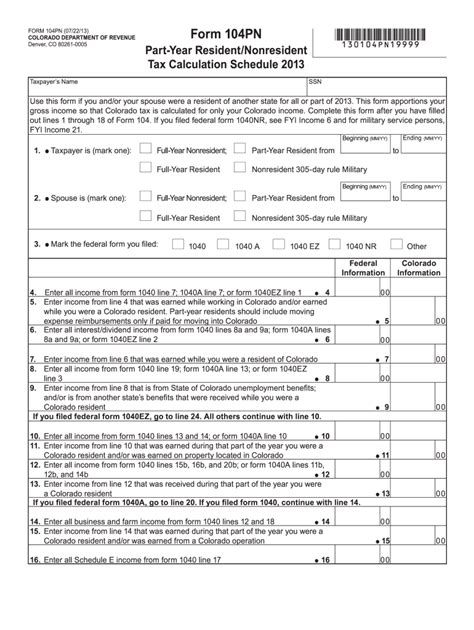

The Colorado 104 tax form is a crucial document for residents of the state, as it is used to file individual income tax returns. Understanding the ins and outs of this form can help taxpayers navigate the filing process with ease and accuracy. In this article, we will delve into the details of the Colorado 104 tax form, its importance, and provide guidance on how to access and utilize the printable version.

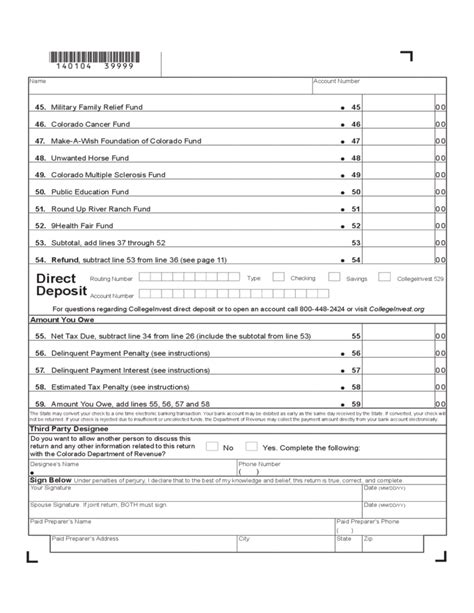

The Colorado 104 tax form is designed to facilitate the filing of state income tax returns, allowing residents to report their income, claim deductions and credits, and pay any tax owed to the state. The form is typically filed on an annual basis, with the deadline for submission usually falling on April 15th. It is essential for taxpayers to familiarize themselves with the form's requirements and instructions to ensure accurate and timely filing.

For those seeking to file their state income tax returns, accessing a printable version of the Colorado 104 tax form can be a convenient option. The printable form can be downloaded from the official website of the Colorado Department of Revenue or obtained from local tax offices. Taxpayers can then complete the form manually, using a pen or pencil, and submit it to the state via mail or in-person.

Introduction to Colorado 104 Tax Form

Benefits of Using the Printable Colorado 104 Tax Form

Some of the key benefits of using the printable Colorado 104 tax form include:

- Convenience: The printable form can be accessed and completed from anywhere, at any time, as long as there is an internet connection.

- Accessibility: The form is available in a format that can be easily read and completed by individuals with disabilities.

- Accuracy: The printable form helps reduce errors, as taxpayers can review and verify their information before submitting it.

- Record-keeping: The completed form can be saved and stored for future reference, providing a record of filing history.

Steps to Complete the Colorado 104 Tax Form

Common Mistakes to Avoid When Completing the Colorado 104 Tax Form

To avoid these mistakes, taxpayers should:

- Carefully review and verify all information provided

- Ensure all calculations are accurate and complete

- Sign and date the form, and attach all required supporting documentation

- Submit the completed form on time, allowing for processing and potential delays

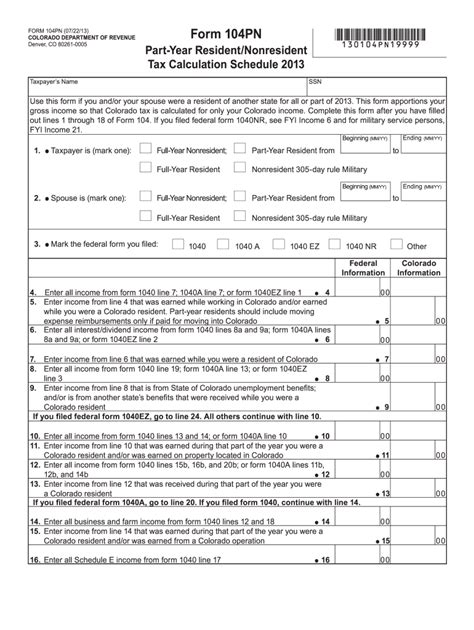

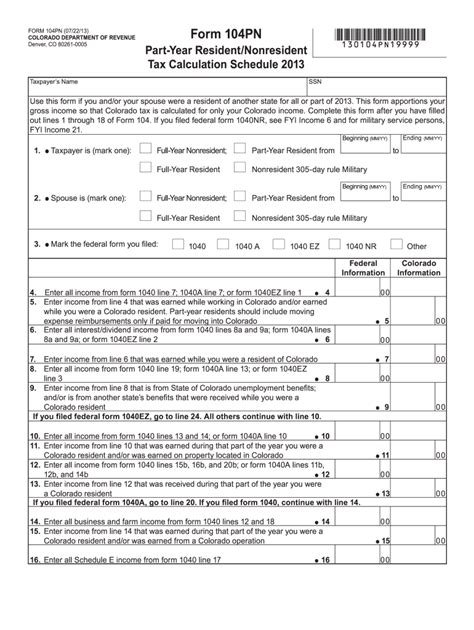

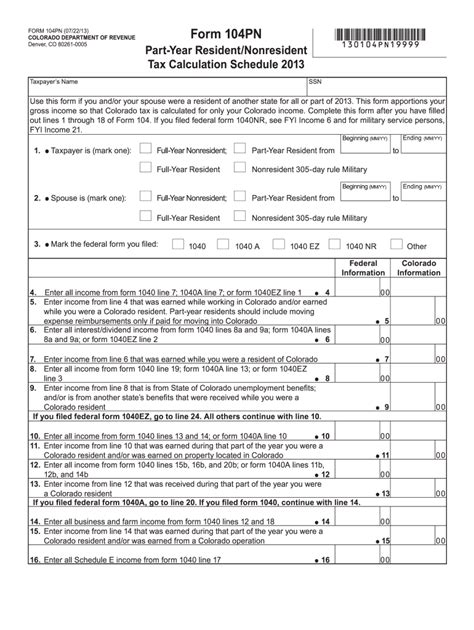

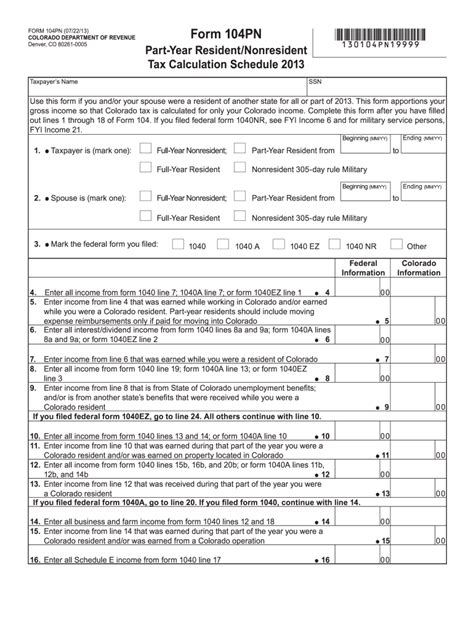

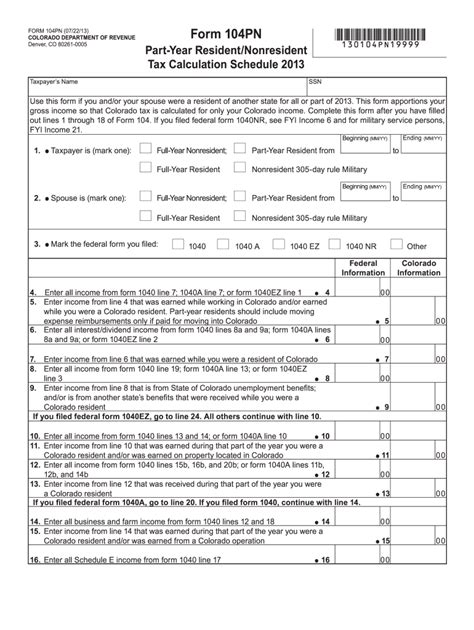

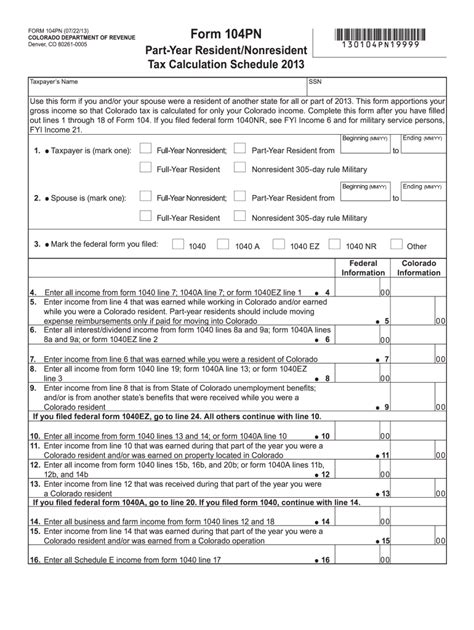

Colorado 104 Tax Form Printable Gallery

Colorado 104 Tax Form Image Gallery

Frequently Asked Questions

What is the deadline for filing the Colorado 104 tax form?

+The deadline for filing the Colorado 104 tax form is typically April 15th.

How do I access the printable Colorado 104 tax form?

+The printable Colorado 104 tax form can be accessed from the official website of the Colorado Department of Revenue or obtained from local tax offices.

What are the consequences of missing the deadline for filing the Colorado 104 tax form?

+Missing the deadline for filing the Colorado 104 tax form may result in penalties, fines, and interest on any tax owed.

Can I file the Colorado 104 tax form electronically?

+Yes, the Colorado 104 tax form can be filed electronically through the Colorado Department of Revenue's website or through a tax preparation software.

What documentation do I need to support my Colorado 104 tax form filing?

+Supporting documentation may include W-2 forms, 1099 forms, and any other relevant income statements.

In conclusion, the Colorado 104 tax form is an essential document for residents of the state, and understanding its requirements and instructions can help taxpayers navigate the filing process with ease and accuracy. By accessing the printable version of the form, taxpayers can complete and submit their state income tax returns in a convenient and accessible manner. Remember to review and verify all information provided, ensure accurate calculations, and submit the completed form on time to avoid any potential penalties or fines. If you have any questions or concerns about the Colorado 104 tax form, do not hesitate to reach out to the Colorado Department of Revenue or a tax professional for guidance and support. Share this article with friends and family to help them understand the importance of timely and accurate tax filing, and encourage them to take advantage of the resources and tools available to make the process as smooth as possible.