Intro

Streamline cost of investment tracking with 5 COI templates, utilizing ROI analysis, expense monitoring, and budgeting tools to optimize financial performance and maximize returns on investment.

The importance of tracking and managing certificates of insurance (COIs) cannot be overstated, especially for businesses that rely heavily on contractors, vendors, or subcontractors. A certificate of insurance is a critical document that verifies the existence of insurance coverage for a specific entity, providing assurance that they have the necessary insurance policies in place to protect against potential risks and liabilities. Managing these documents efficiently is key to mitigating risks and ensuring compliance with contractual and regulatory requirements. This is where COI tracking templates come into play, offering a structured approach to organizing, monitoring, and updating certificates of insurance.

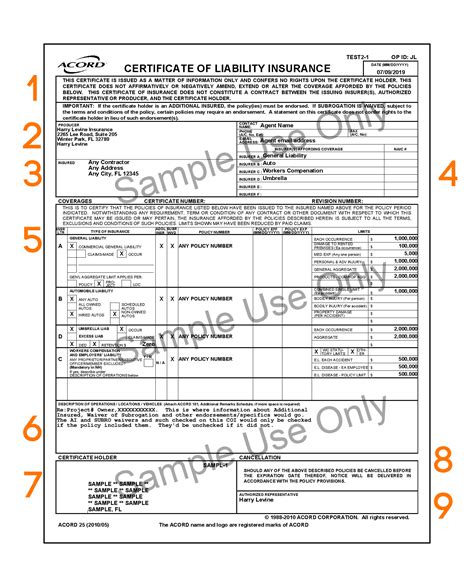

In today's fast-paced business environment, manually tracking COIs can be cumbersome and prone to errors. The use of templates specifically designed for COI tracking can significantly streamline this process, allowing businesses to focus on their core operations while ensuring that all necessary insurance compliance measures are met. These templates are typically designed to capture essential details about each certificate, including the name of the insured, policy numbers, coverage types, policy limits, and expiration dates. By having all this information readily available and organized, companies can quickly identify which certificates are about to expire, which ones need to be updated, and whether there are any gaps in coverage that need to be addressed.

Effective COI tracking is not just about maintaining a database of insurance certificates; it's also about ensuring that all certificates comply with the specific requirements outlined in contracts or agreements. For instance, a contractor hired for a construction project may need to provide proof of workers' compensation insurance, general liability insurance, and perhaps professional liability insurance, depending on the nature of the work. A COI tracking template can help in verifying that each of these requirements is met, thereby protecting the hiring company from potential liabilities in case the contractor fails to maintain the required insurance coverage.

Benefits of Using COI Tracking Templates

The benefits of utilizing COI tracking templates are multifaceted, contributing to enhanced risk management, improved compliance, and increased operational efficiency. One of the primary advantages is the reduction in administrative burdens associated with manually tracking and updating insurance certificates. By automating much of the tracking process, businesses can allocate more resources to strategic initiatives and core business activities. Additionally, these templates help in minimizing the risk of non-compliance with regulatory or contractual requirements, which can lead to legal issues, financial penalties, or damage to a company's reputation.

Another significant benefit of COI tracking templates is their ability to provide real-time visibility into the status of all tracked certificates. This feature is particularly useful for identifying potential issues before they become major problems, such as a certificate nearing its expiration date without a renewal in place. By staying on top of these details, companies can proactively address any discrepancies or lapses in coverage, ensuring continuous protection against potential risks and liabilities.

Key Features of Effective COI Tracking Templates

When selecting or designing a COI tracking template, there are several key features to consider to ensure that it meets the specific needs of your business. First and foremost, the template should be easy to use and understand, even for those without extensive experience in insurance or risk management. It should provide clear fields for entering all relevant details about each certificate, including policy numbers, coverage dates, and types of insurance.

Another crucial feature is the ability to set reminders and notifications for upcoming expiration dates or other important milestones related to the tracked certificates. This automated alert system helps ensure that no critical deadlines are missed, reducing the risk of unintended gaps in coverage.

Furthermore, an effective COI tracking template should offer robust reporting and analytics capabilities. This allows businesses to generate detailed reports on their COI portfolio, analyze trends, and make informed decisions about risk management and insurance compliance strategies.

Implementing COI Tracking Templates in Your Business

Implementing a COI tracking template within your organization involves several steps, starting with the selection or design of the template itself. If you're opting for a pre-designed template, choose one that is customizable to fit your specific business needs and insurance tracking requirements. If designing your own, consider involving stakeholders from various departments to ensure the template captures all necessary information and is user-friendly for all potential users.

Once the template is ready, the next step is to populate it with existing data on certificates of insurance. This may involve a significant upfront effort, especially if your business has a large number of contractors, vendors, or subcontractors. However, this initial investment of time and resources will pay off in the long run through improved efficiency and reduced risk.

It's also important to establish clear procedures for updating the template and ensuring that all relevant personnel are trained on its use. Regular audits and reviews of the tracked certificates should be conducted to verify compliance and identify any areas for improvement in the tracking process.

Best Practices for COI Tracking

Adhering to best practices in COI tracking can further enhance the effectiveness of your risk management and compliance strategies. One key practice is to centralize the tracking process, designating a specific individual or team to oversee the management of all certificates of insurance. This helps ensure consistency and accuracy in tracking and reduces the likelihood of errors or oversights.

Another best practice is to automate as much of the tracking process as possible. This can include setting up automated reminders for expiring certificates, using software to track and manage certificates, and integrating the COI tracking system with other business applications to streamline data sharing and reduce manual entry.

Regular communication with contractors, vendors, and subcontractors is also crucial. Clearly outline your expectations for insurance coverage and the process for submitting and updating certificates of insurance. This open communication can help prevent misunderstandings and ensure that all parties are aware of their responsibilities regarding insurance compliance.

Conclusion and Future Directions

In conclusion, COI tracking templates are invaluable tools for businesses seeking to enhance their risk management capabilities and ensure compliance with insurance requirements. By leveraging these templates, companies can streamline the process of tracking and managing certificates of insurance, reduce administrative burdens, and minimize the risk of non-compliance.

As technology continues to evolve, we can expect to see even more sophisticated solutions for COI tracking emerge, including advanced software platforms and integrated systems that offer real-time monitoring, automated reporting, and enhanced analytics. Embracing these innovations will be key for businesses looking to stay ahead of the curve in managing risk and ensuring compliance in an increasingly complex regulatory environment.

Gallery of COI Tracking Templates

COI Tracking Templates Image Gallery

What is a Certificate of Insurance (COI)?

+A Certificate of Insurance (COI) is a document that provides proof of insurance coverage for a specific entity, outlining the types of insurance, policy numbers, and coverage limits.

Why is COI tracking important?

+COI tracking is crucial for ensuring that all contractors, vendors, or subcontractors have the necessary insurance coverage, thereby protecting the hiring company from potential liabilities and risks.

What features should a COI tracking template include?

+A COI tracking template should include fields for policy numbers, coverage dates, types of insurance, and contact information for the insured. It should also offer features like automated reminders for expiring certificates and the ability to generate reports.

We hope this comprehensive guide to COI tracking templates has provided you with valuable insights and practical advice for managing certificates of insurance within your organization. Whether you're looking to enhance your risk management strategies, improve compliance with regulatory requirements, or simply streamline your administrative processes, leveraging COI tracking templates can be a significant step forward. Feel free to share your experiences or ask questions about implementing COI tracking systems in the comments below.