Intro

Manage finances with a Google Sheets Checkbook Template, featuring budgeting tools, expense tracking, and account balancing, for efficient personal finance management and financial planning.

Managing personal finances effectively is crucial in today's fast-paced world. One of the simplest and most effective ways to keep track of your expenses and income is by using a checkbook register. With the advent of digital tools, traditional paper checkbook registers have evolved into more versatile and accessible formats, such as Google Sheets templates. These digital checkbook templates offer a range of benefits, including ease of use, automatic calculations, and real-time updates across all your devices. In this article, we will delve into the world of Google Sheets checkbook templates, exploring their importance, how they work, and the steps to create or use one.

The importance of maintaining a checkbook register, whether in physical form or digitally through Google Sheets, cannot be overstated. It provides a clear, detailed record of all your transactions, helping you stay on top of your finances. This is particularly useful for budgeting, identifying unnecessary expenses, and ensuring that you never overdraft your account. Traditional checkbook registers require manual entry and calculation of each transaction, which can be time-consuming and prone to errors. Google Sheets checkbook templates, on the other hand, automate these processes, making financial management more efficient and less susceptible to mistakes.

Introduction to Google Sheets Checkbook Templates

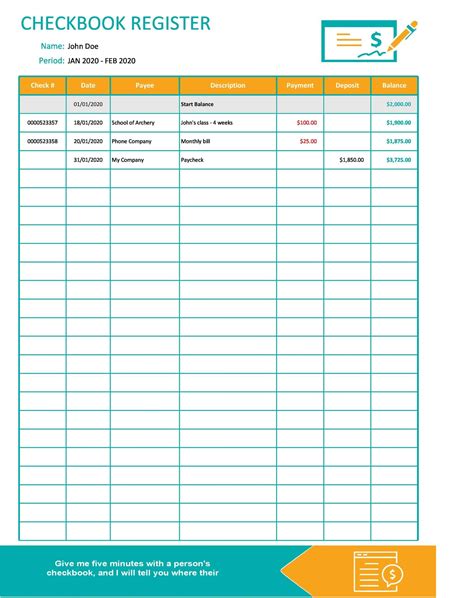

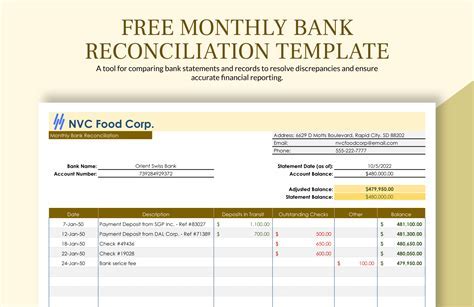

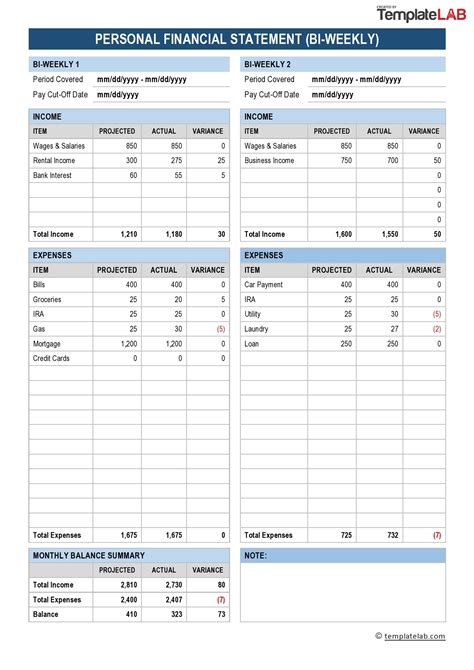

Google Sheets is a powerful tool for creating and managing spreadsheets. It's free, web-based, and offers real-time collaboration features, making it an ideal platform for personal and professional use. A Google Sheets checkbook template is a pre-designed spreadsheet that you can use to track your checking account transactions. These templates usually include columns for date, transaction description, debit, credit, and balance, among others. They are customizable, allowing you to tailor them to your specific needs, such as adding categories for income and expenses or setting up formulas for automatic calculations.

Benefits of Using Google Sheets Checkbook Templates

The benefits of using Google Sheets for your checkbook register are numerous. Firstly, accessibility is a significant advantage. Since Google Sheets is cloud-based, you can access your checkbook register from any device with an internet connection, at any time. This mobility is particularly useful for keeping your finances up to date, as you can log transactions immediately after they occur. Additionally, Google Sheets allows for real-time collaboration, which means you can share your checkbook template with a spouse or financial advisor, facilitating joint financial management.

Another benefit is the automation of calculations. With formulas, you can set up your spreadsheet to automatically calculate your current balance after each transaction, eliminating the risk of human error. Google Sheets also offers a range of functions and add-ons that can help with budgeting, investment tracking, and even forecasting future financial trends based on your historical data.

How to Create a Google Sheets Checkbook Template

Creating a Google Sheets checkbook template from scratch is relatively straightforward. Here are the basic steps:

- Open Google Sheets and start a new spreadsheet.

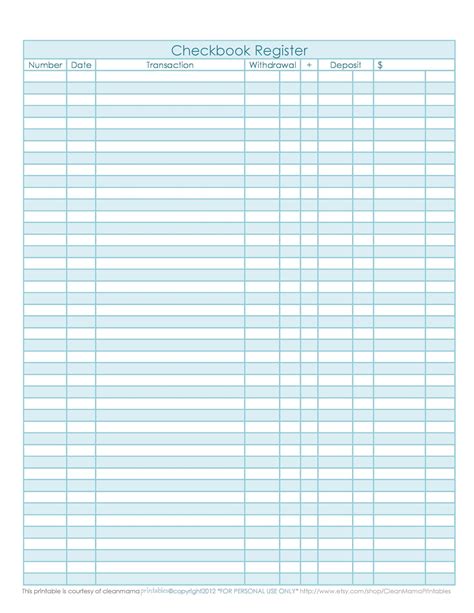

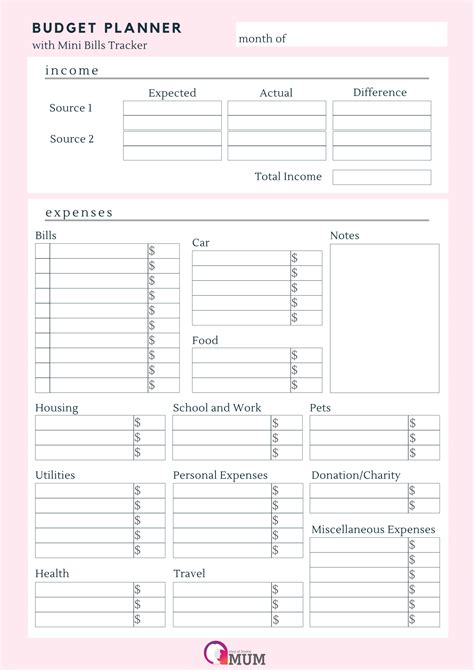

- Set up your columns. Typically, you'll want columns for Date, Description, Debit, Credit, and Balance.

- Input your starting balance in the Balance column for your first transaction.

- Use formulas to automate calculations. For example, you can use the SUM function to calculate your total debits and credits and then subtract the total debits from the total credits plus your starting balance to get your current balance.

- Customize your template as needed. You might want to add columns for categories (e.g., groceries, entertainment) or use conditional formatting to highlight transactions over a certain amount.

Using Pre-designed Google Sheets Checkbook Templates

For those who prefer not to start from scratch, there are many pre-designed Google Sheets checkbook templates available. These can be found through Google's template gallery or by searching online. Pre-designed templates offer a quick and easy way to get started with tracking your finances. They often include sophisticated formulas and formatting that can enhance your financial tracking experience. When using a pre-designed template, make sure to review and understand all the formulas and settings, and customize them according to your needs.

Steps to Customize a Pre-designed Template

Customizing a pre-designed template involves several steps: - **Review the Template:** Go through each column and row to understand what information is being tracked and how calculations are performed. - **Adjust Columns and Rows:** Add or remove columns and rows as necessary to fit your specific financial tracking needs. - **Modify Formulas:** If you find any formulas that don't quite fit your situation, adjust them. This might involve changing the range of cells being summed or altering the conditional formatting rules. - **Personalize Appearance:** Change colors, fonts, and formatting to make the template more visually appealing and easier to read.Practical Examples and Statistical Data

To illustrate the effectiveness of Google Sheets checkbook templates, consider the following example:

- A person starts with a balance of $1,000 and uses their template to track monthly expenses, categorizing them into necessities (rent, utilities, groceries) and discretionary spending (entertainment, hobbies).

- By the end of the month, they've spent $800, with $500 going towards necessities and $300 towards discretionary spending.

- The template automatically calculates their new balance as $200, and through conditional formatting, highlights that they've exceeded their budget for discretionary spending.

Statistically, individuals who regularly track their finances are more likely to achieve their financial goals, whether it's saving for a down payment on a house, paying off debt, or building an emergency fund. Google Sheets checkbook templates provide a powerful tool for this tracking, offering insights into spending habits and areas for improvement.

Gallery of Google Sheets Checkbook Templates

Checkbook Template Image Gallery

Frequently Asked Questions

What is a Google Sheets checkbook template?

+A Google Sheets checkbook template is a pre-designed spreadsheet used for tracking checking account transactions, offering a structured format for organizing financial data.

How do I access Google Sheets checkbook templates?

+You can access Google Sheets checkbook templates through Google's template gallery or by searching for them online. Simply open Google Sheets, click on "Template Gallery," and search for "checkbook register" or related terms.

Can I customize a pre-designed Google Sheets checkbook template?

+Yes, pre-designed templates are fully customizable. You can add or remove columns, modify formulas, and change the formatting to fit your specific financial tracking needs.

What are the benefits of using Google Sheets for financial tracking?

+The benefits include accessibility from any device, automatic calculations, real-time collaboration, and the ability to customize templates to fit your needs. These features make financial management more efficient and less prone to errors.

Is Google Sheets secure for storing financial information?

+Google Sheets is a secure platform for storing financial information. Google implements robust security measures, including encryption and two-factor authentication, to protect user data. However, it's always a good practice to use strong passwords and be cautious when sharing your spreadsheets.

In conclusion, embracing the use of Google Sheets checkbook templates can significantly enhance your financial management capabilities. Whether you're looking to create a budget, track expenses, or simply keep a closer eye on your checking account, these templates offer a flexible, accessible, and powerful tool. By understanding the benefits, learning how to create or customize a template, and exploring the various features Google Sheets has to offer, you can take the first steps towards achieving better financial health and stability. We invite you to share your experiences with Google Sheets checkbook templates, ask questions, or provide tips on how you've customized your templates to better suit your financial tracking needs. Your input can help others navigate the world of digital financial management more effectively.