Intro

Discover 5 ways to order Chase checks, including online banking, mobile app, and phone services, with tips on check designs, fees, and security features for seamless banking transactions.

Ordering checks can be a tedious process, but with the advancement of technology, it has become easier and more convenient. Chase checks are one of the most popular types of checks used by individuals and businesses alike. In this article, we will explore the different ways to order Chase checks, the benefits of using them, and some tips to keep in mind.

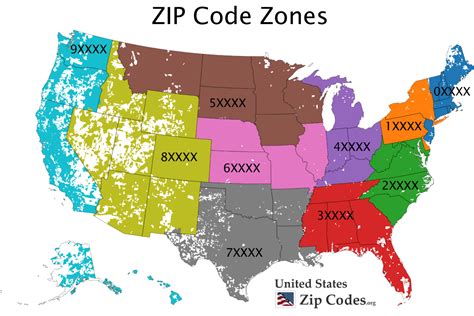

Chase checks are a type of check that is offered by JPMorgan Chase Bank, one of the largest banks in the United States. These checks are designed to provide a secure and convenient way to make payments, and they are accepted by most businesses and financial institutions. With Chase checks, you can make payments online, by phone, or in person, making it a versatile payment option.

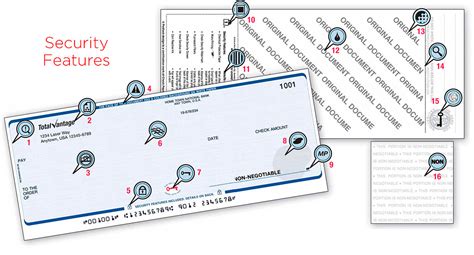

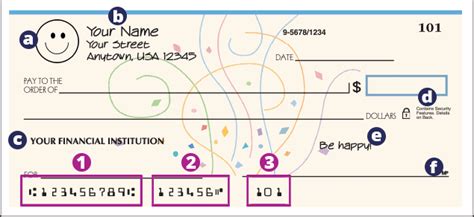

There are several benefits to using Chase checks, including the ability to track your payments, set up automatic payments, and receive alerts when a payment is made. Additionally, Chase checks are designed with security features such as watermarks, microprinting, and chemical-sensitive paper to prevent counterfeiting.

Now, let's dive into the 5 ways to order Chase checks.

Online Ordering

Phone Ordering

Bank Branch Ordering

Mobile App Ordering

Mail Ordering

In addition to these methods, there are several benefits to using Chase checks. Some of the benefits include:

- Convenience: Chase checks can be used to make payments online, by phone, or in person.

- Security: Chase checks have several security features, including watermarks, microprinting, and chemical-sensitive paper, to prevent counterfeiting.

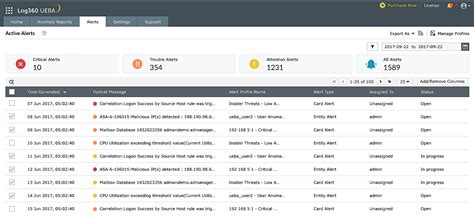

- Tracking: You can track your payments and set up automatic payments with Chase checks.

- Alerts: You can receive alerts when a payment is made with Chase checks.

Here are some tips to keep in mind when ordering Chase checks:

- Make sure to order checks from a reputable supplier to avoid counterfeit checks.

- Keep your checks in a safe place to prevent loss or theft.

- Use a secure method to order your checks, such as online or phone ordering.

- Review your check order carefully before submitting it to ensure that all the information is correct.

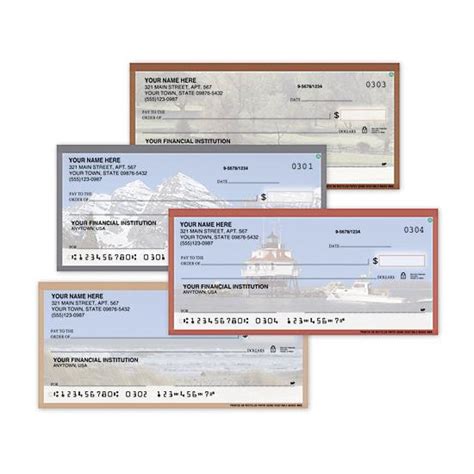

Check Designs

Check Security

Check Ordering Tips

Gallery of Chase Checks

Chase Checks Image Gallery

What is the best way to order Chase checks?

+The best way to order Chase checks is online, as it is convenient and available 24/7.

How long does it take to receive Chase checks?

+It typically takes a few business days to receive Chase checks after ordering them.

Can I track my Chase check orders?

+Yes, you can track your Chase check orders online or by contacting Chase customer service.

Are Chase checks secure?

+Yes, Chase checks have several security features, including watermarks, microprinting, and chemical-sensitive paper, to prevent counterfeiting.

Can I customize my Chase checks?

+Yes, you can customize your Chase checks with your name and address, as well as choose from a range of check designs and styles.

In summary, ordering Chase checks is a convenient and secure process that can be done in a variety of ways, including online, phone, bank branch, mobile app, and mail ordering. With Chase checks, you can make payments online, by phone, or in person, and track your payments and set up automatic payments. Additionally, Chase checks have several security features to prevent counterfeiting, including watermarks, microprinting, and chemical-sensitive paper. By following the tips outlined in this article, you can ensure that your Chase check ordering experience is smooth and hassle-free. We invite you to share your experiences with Chase checks, ask questions, or provide feedback on this article in the comments section below.