Intro

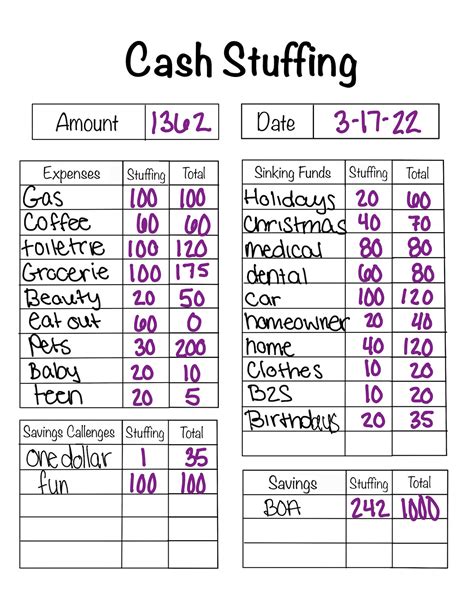

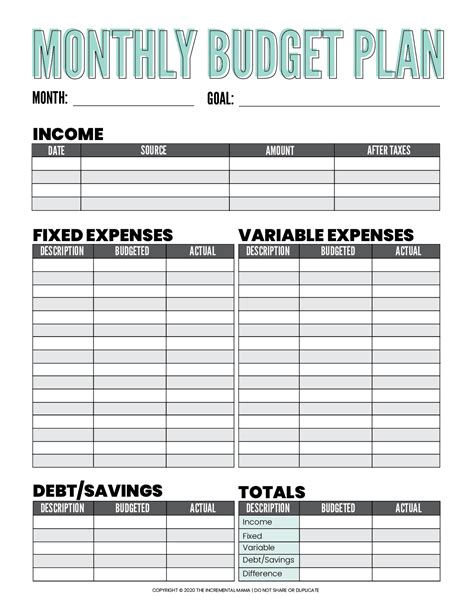

Discover easy cash stuffing printables and templates to organize your finances, featuring budgeting worksheets, expense trackers, and savings planners for efficient money management.

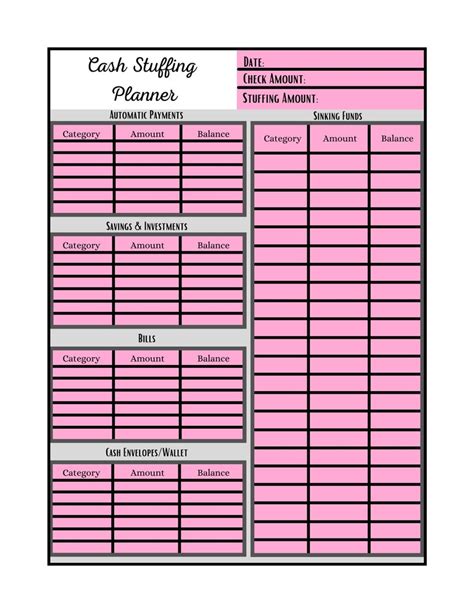

The concept of cash stuffing has gained popularity in recent years, especially among individuals seeking to manage their finances more effectively. Cash stuffing involves dividing one's expenses into categories and allocating a specific amount of cash for each category, thereby helping individuals stick to their budgets and avoid overspending. For those looking to implement this method, having the right tools can make all the difference. This is where cash stuffing printables come into play, offering a straightforward and organized way to manage finances.

Cash stuffing printables are essentially templates that can be printed out and used to track expenses, categorize spending, and set financial goals. These printables can be customized to fit individual needs, making them a versatile tool for anyone looking to take control of their finances. With the rise of digital platforms, it's easier than ever to find and download cash stuffing printables that cater to various financial situations and goals. Whether you're a student trying to manage a tight budget or a family looking to save for a big purchase, there's a printable out there that can help.

The importance of using cash stuffing printables lies in their ability to provide a tangible and visual representation of one's finances. By seeing exactly how much money is allocated to each category, individuals can make more informed decisions about their spending habits. This method also helps in avoiding the pitfalls of digital payments, where it's easy to lose track of expenses. With cash stuffing printables, every transaction is accounted for, and individuals can ensure they're staying within their means. Moreover, the process of physically handling cash and categorizing expenses can have a psychological impact, making individuals more mindful of their spending habits.

Benefits of Using Cash Stuffing Printables

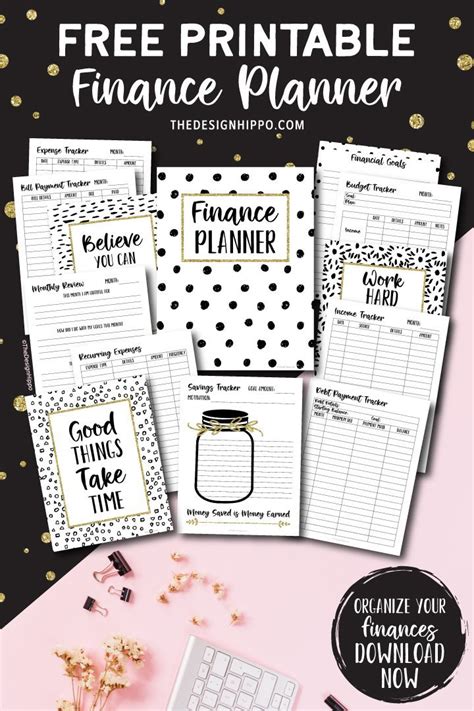

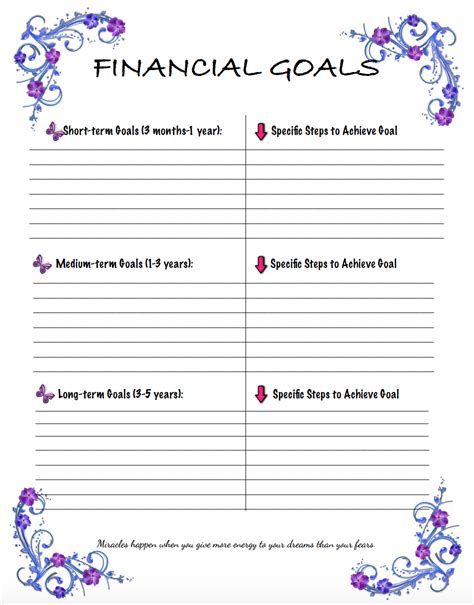

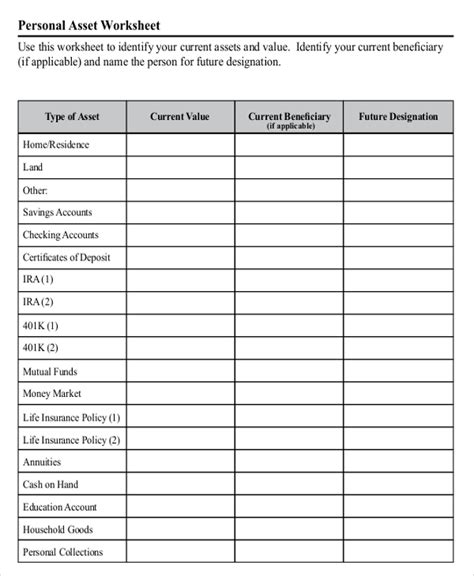

The benefits of using cash stuffing printables are numerous. Firstly, they provide a clear and organized system for managing finances, which can lead to reduced stress and anxiety related to money matters. Secondly, by categorizing expenses and allocating specific amounts of cash, individuals can ensure they're prioritizing their spending based on their financial goals. This could mean saving for a emergency fund, paying off debt, or building up savings for a specific purpose. Cash stuffing printables also encourage a habit of regular financial review, helping individuals identify areas where they can cut back on unnecessary expenses and optimize their budget.

Customizing Your Cash Stuffing Printables

One of the key advantages of cash stuffing printables is their customizability. Depending on individual needs, these printables can be tailored to include specific categories, goals, and even motivational quotes to keep users on track. For instance, a family might create a printable that includes categories for groceries, entertainment, and savings, while an individual might focus on categories like rent, utilities, and personal spending. The ability to customize these printables ensures that they remain relevant and effective for each user's unique financial situation.

How to Use Cash Stuffing Printables Effectively

To use cash stuffing printables effectively, it's essential to start with a clear understanding of your financial goals and current spending habits. This might involve tracking your expenses for a month to get a realistic picture of where your money is going. Once you have this information, you can begin to categorize your expenses and allocate specific amounts of cash for each category. It's also important to review and adjust your printables regularly, as financial situations and goals can change over time. Consistency and patience are key, as the benefits of cash stuffing printables become more apparent with continued use.

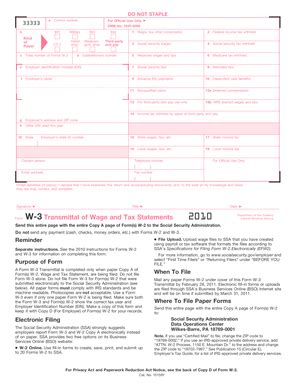

Common Categories for Cash Stuffing Printables

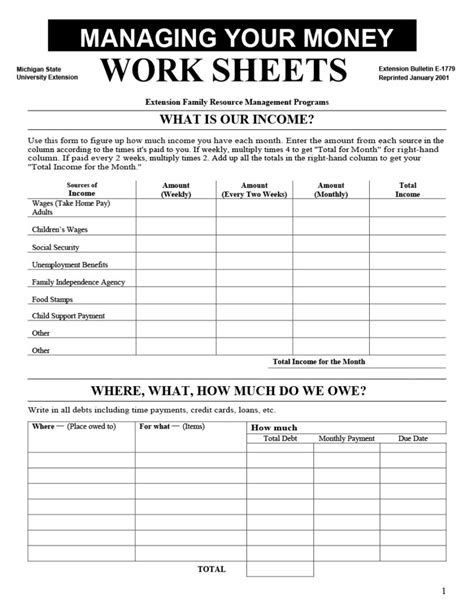

Some common categories that people include in their cash stuffing printables are housing (rent/mortgage, utilities), transportation (car payment, insurance, gas), food (groceries, dining out), insurance (health, life, disability), debt repayment (credit cards, loans), entertainment (movies, hobbies), and savings (emergency fund, retirement). These categories can be adjusted based on individual circumstances, such as adding a category for childcare expenses or pet care. The goal is to ensure that every aspect of your financial life is accounted for and managed effectively.

Steps to Create Your Own Cash Stuffing Printables

Creating your own cash stuffing printables can be a straightforward process. Here are the steps to follow:

- Identify your financial goals and categories.

- Determine the layout and design of your printable. You can use a spreadsheet program or a graphic design tool for this.

- Include spaces for categorizing expenses, allocating cash, and tracking spending.

- Add any additional features you find useful, such as a notes section or a progress tracker.

- Print out your design and start using it.

- Review and adjust your printable as needed to ensure it continues to meet your financial management needs.

Tips for Maximizing the Use of Cash Stuffing Printables

To maximize the use of cash stuffing printables, consider the following tips:

- Be consistent in using your printables. Make it a habit to update them regularly.

- Review your budget and categories regularly to ensure they still align with your financial goals.

- Don't be too hard on yourself if you slip up. The key is to learn from your mistakes and adjust your strategy accordingly.

- Consider combining cash stuffing with other financial management techniques, such as the 50/30/20 rule, to create a comprehensive financial plan.

- Keep your printables in a safe and accessible place, such as a binder or a folder, to ensure you can refer to them easily.

Gallery of Cash Stuffing Printables

Cash Stuffing Printables Gallery

What are cash stuffing printables?

+Cash stuffing printables are templates used to manage finances by categorizing expenses and allocating specific amounts of cash for each category.

How do I create my own cash stuffing printables?

+To create your own cash stuffing printables, identify your financial goals and categories, determine the layout and design, and include spaces for tracking expenses and allocating cash.

What are the benefits of using cash stuffing printables?

+The benefits include a clear and organized system for managing finances, reduced stress and anxiety related to money matters, and the ability to prioritize spending based on financial goals.

Can I customize my cash stuffing printables?

+Yes, cash stuffing printables can be customized to fit individual needs, including specific categories, goals, and additional features such as a notes section or progress tracker.

How often should I review and adjust my cash stuffing printables?

+It's recommended to review and adjust your cash stuffing printables regularly, such as monthly or quarterly, to ensure they continue to meet your financial management needs and align with your financial goals.

In conclusion, cash stuffing printables offer a practical and effective way to manage finances, providing a clear and organized system for tracking expenses, categorizing spending, and setting financial goals. By understanding the benefits, customizing your printables, and using them consistently, you can take control of your financial situation and work towards achieving your goals. Whether you're just starting out with budgeting or looking for a more hands-on approach to financial management, cash stuffing printables are definitely worth considering. So, why not give them a try? Start creating your own cash stuffing printables today and see the difference they can make in your financial journey. Don't forget to share your experiences and tips with others, and feel free to comment below with any questions or suggestions you might have. Together, we can make managing finances easier and more accessible for everyone.