Intro

Master financial stability with 5 tips to balance your sheet, ensuring accurate accounting, cash flow management, and asset optimization for a healthy financial statement.

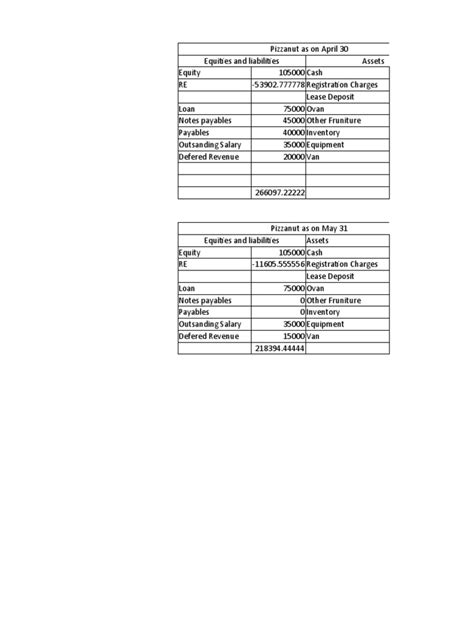

Maintaining a balanced financial life is crucial for individuals and businesses alike. A balance sheet, which provides a snapshot of an entity's financial position at a given point in time, is a fundamental tool in achieving this balance. It summarizes assets, liabilities, and equity, offering insights into financial health and guiding decision-making. Here are five tips to help you balance your sheet effectively, ensuring your financial foundation is solid and poised for growth.

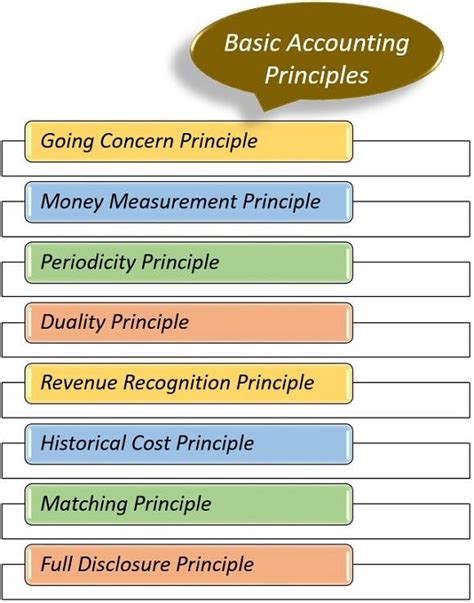

Understanding the Basics of a Balance Sheet

Tracking Assets Efficiently

Liabilities Management

Liabilities are obligations that the entity is expected to settle in the future. Like assets, liabilities can be current (short-term) or non-current (long-term). Effective management of liabilities involves ensuring that the entity has sufficient funds to meet its short-term obligations (liquidity) and planning for the payment of long-term debts. Strategies such as debt restructuring or refinancing can be employed to manage liabilities more efficiently.

Equity and Its Importance

Regular Review and Analysis

Regularly reviewing the balance sheet is essential for identifying trends, assessing financial performance, and making informed decisions. This involves analyzing ratios such as the current ratio (current assets / current liabilities), debt-to-equity ratio (total liabilities / total equity), and return on equity (net income / total equity). These ratios provide insights into liquidity, leverage, and profitability, helping to pinpoint areas for improvement.

Implementing Changes for Balance

Seeking Professional Advice

Given the complexity of financial management, seeking advice from professionals such as accountants or financial advisors can be beneficial. They can provide personalized strategies based on the entity's specific situation, help in navigating regulatory requirements, and offer insights into best practices for maintaining a balanced financial position.

Technology and Financial Management

Education and Continuous Learning

The financial landscape is constantly evolving, with changes in regulations, technologies, and market trends. Continuous learning is essential for staying abreast of these developments and for making informed financial decisions. This can involve attending seminars, participating in online courses, or reading financial literature to enhance knowledge and skills in financial management.

Conclusion and Next Steps

Balance Sheet Management Image Gallery

What is the primary purpose of a balance sheet?

+The primary purpose of a balance sheet is to provide a snapshot of an entity's financial position at a specific point in time, detailing its assets, liabilities, and equity.

How often should a balance sheet be reviewed and updated?

+A balance sheet should be reviewed and updated regularly, ideally at the end of each accounting period, to ensure that financial decisions are based on the most current and accurate information.

What are some common ratios used in balance sheet analysis?

+Common ratios include the current ratio, debt-to-equity ratio, and return on equity, which provide insights into liquidity, leverage, and profitability.

We hope this comprehensive guide has provided you with valuable insights and practical tips for managing your balance sheet effectively. Whether you're an individual looking to improve your personal finances or a business seeking to enhance its financial health, understanding and applying these principles can lead to greater stability and success. Feel free to share your thoughts, ask questions, or explore more topics related to financial management and balance sheet analysis. Your engagement and feedback are invaluable in our mission to provide informative and helpful content.