Intro

Streamline asset accounting with a Capital Lease Amortization Excel Template, simplifying lease accounting, amortization schedules, and financial reporting with ease.

Capital lease amortization is a crucial aspect of accounting for businesses that enter into lease agreements for assets such as equipment, vehicles, or property. Understanding how to calculate and record capital lease amortization is essential for accurately reflecting a company's financial position and performance. In this article, we will delve into the importance of capital lease amortization, its calculation, and how to create a useful Excel template for managing and tracking these leases.

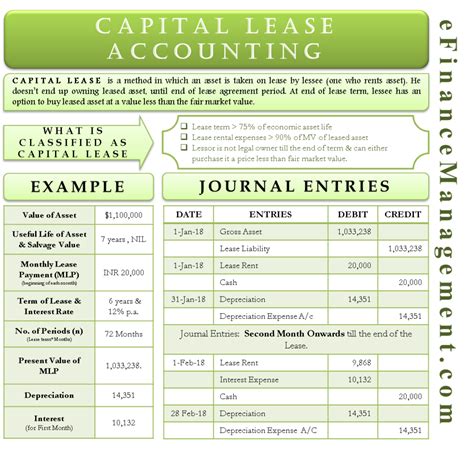

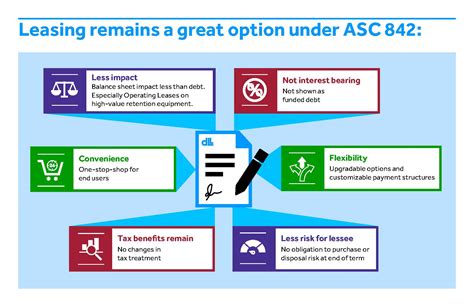

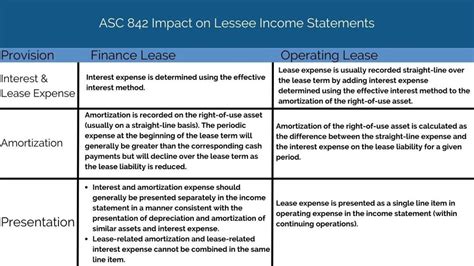

Capital lease amortization refers to the process of allocating the cost of a leased asset over its useful life. This is in contrast to operating leases, where the lessee does not recognize the asset on their balance sheet and instead treats lease payments as operating expenses. For capital leases, the lessee records the asset and the corresponding lease liability on their balance sheet, with the asset being depreciated and the liability being amortized over the lease term.

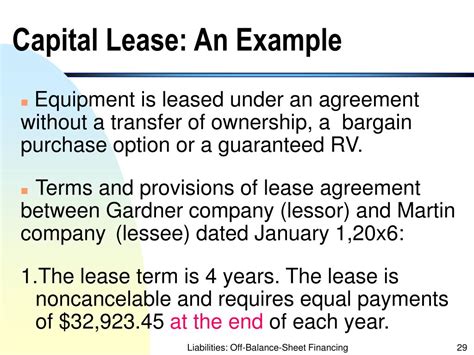

The distinction between capital and operating leases is critical because it affects how companies report their financials. The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have provided guidelines to differentiate between these two types of leases. Generally, a lease is considered a capital lease if it meets one or more of the following criteria: the lease transfers ownership of the asset to the lessee by the end of the lease term, the lease contains a bargain purchase option, the lease term is for a major part of the asset's remaining economic life, or the present value of the minimum lease payments equals or exceeds substantially all of the fair value of the asset.

Given the complexity and the financial implications of capital leases, having a systematic approach to tracking and amortizing these leases is vital. An Excel template can be an invaluable tool for this purpose, allowing companies to organize their lease data, calculate amortization schedules, and ensure compliance with accounting standards.

Understanding Capital Lease Amortization

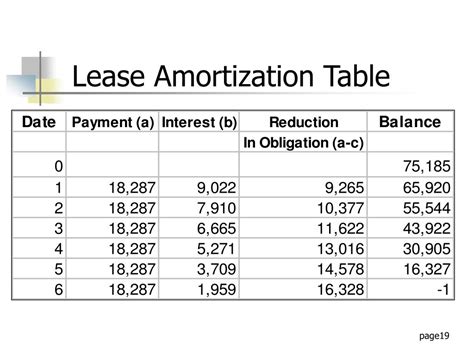

To understand capital lease amortization, it's essential to grasp the key components involved in its calculation. These include the leased asset's cost (or fair value at the inception of the lease), the lease term, the implicit interest rate (if not given, the lessee's incremental borrowing rate may be used), and the residual value of the asset at the end of the lease term. The amortization of the lease liability and the depreciation of the leased asset are calculated based on these components.

Components of Capital Lease Amortization

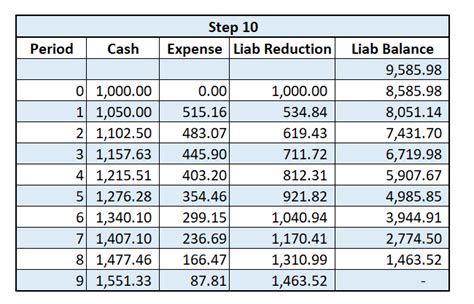

The calculation of capital lease amortization involves several steps: - Determining the present value of the minimum lease payments, which is the amount that will be recognized as the asset and the lease liability on the balance sheet. - Calculating the depreciation of the leased asset over its useful life. - Amortizing the lease liability over the lease term, which involves calculating the interest expense and the reduction of the lease liability each period.Creating a Capital Lease Amortization Excel Template

An Excel template for capital lease amortization can be designed to simplify the process of tracking and calculating the amortization of lease liabilities and the depreciation of leased assets. Here are the steps to create such a template:

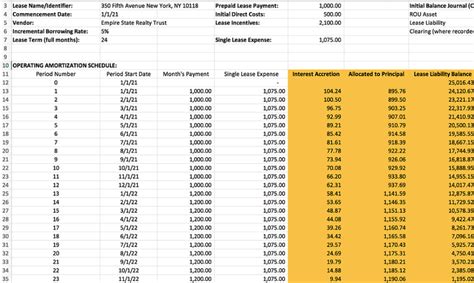

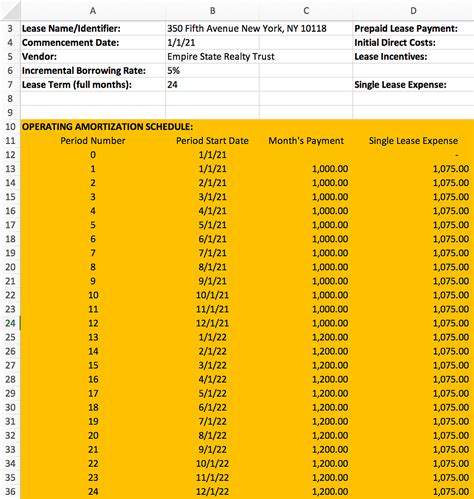

- Input Section: Create a section where users can input the lease details, such as the lease start date, lease term, interest rate, residual value, and the cost of the leased asset.

- Amortization Schedule: Use Excel formulas to calculate the amortization schedule based on the inputs provided. This includes calculating the monthly payments, interest expense, and principal reduction for each period.

- Depreciation Calculation: Implement a formula to calculate the depreciation of the leased asset over its useful life, using the chosen depreciation method (e.g., straight-line).

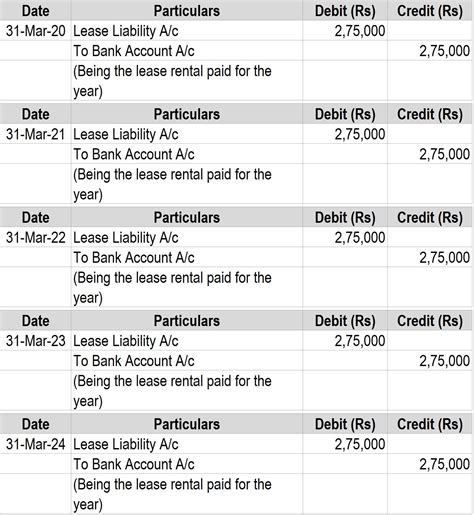

- Financial Statement Impact: Include sections to display how the capital lease affects the company's balance sheet and income statement, such as the asset value, lease liability, interest expense, and depreciation expense.

Benefits of Using an Excel Template

Using an Excel template for capital lease amortization offers several benefits, including: - **Accuracy**: Reduces the chance of human error in complex calculations. - **Efficiency**: Saves time by automating the calculation process. - **Flexibility**: Allows for easy adjustments to lease terms or assumptions. - **Transparency**: Provides a clear and organized view of lease obligations and asset values.Implementing and Managing Capital Leases

Effective management of capital leases involves not only the initial setup and calculation of amortization schedules but also ongoing monitoring and adjustments as necessary. This includes reviewing lease agreements for any changes, updating the accounting records to reflect the current financial position, and ensuring compliance with accounting standards and regulatory requirements.

Best Practices for Lease Management

Best practices for managing capital leases include: - Regularly reviewing lease agreements and terms. - Maintaining accurate and detailed records of all leases. - Ensuring compliance with accounting standards and regulatory requirements. - Periodically assessing the financial impact of leases on the company's financial statements.Gallery of Capital Lease Amortization Examples

Capital Lease Amortization Image Gallery

What is the difference between a capital lease and an operating lease?

+A capital lease is treated as a purchase for accounting purposes, with the asset and the corresponding lease liability recorded on the balance sheet, whereas an operating lease is treated as a rental, with lease payments expensed as they are incurred.

How do you calculate the present value of minimum lease payments for a capital lease?

+The present value of minimum lease payments is calculated using the lease term, the implicit interest rate (or the lessee's incremental borrowing rate if the implicit rate is not readily determinable), and the future lease payments.

What are the benefits of using an Excel template for capital lease amortization?

+The benefits include increased accuracy, efficiency, flexibility, and transparency in managing and tracking capital leases, which can lead to better financial decision-making and compliance with accounting standards.

In conclusion, managing capital leases effectively is crucial for businesses to ensure accurate financial reporting, compliance with accounting standards, and informed decision-making. By understanding the principles of capital lease amortization and utilizing tools like Excel templates, companies can streamline their lease management processes, reduce errors, and improve their overall financial management. Whether you are an accountant, a financial analyst, or a business owner, having a comprehensive grasp of capital lease amortization and its applications can provide significant benefits in navigating the complex world of lease accounting. We invite you to share your experiences, ask questions, or provide feedback on this topic, and we look forward to continuing the conversation on how to best manage capital leases in an ever-changing financial landscape.