Intro

Streamline finances with 5 Excel budget templates, featuring personalized budgeting, expense tracking, and financial planning tools for efficient money management and budget control.

Creating and managing a budget is an essential aspect of personal finance and business operations. It helps in tracking income and expenses, making informed financial decisions, and achieving long-term financial goals. Microsoft Excel, with its comprehensive set of tools and features, is an ideal platform for creating budget templates. Excel budget templates are pre-designed spreadsheets that simplify the process of budgeting by providing a structured format for organizing financial data. In this article, we will delve into the world of Excel budget templates, exploring their benefits, how to use them, and providing examples of different types of templates that cater to various financial needs.

Excel budget templates offer a myriad of benefits, including ease of use, customization, and the ability to perform complex financial calculations with ease. They are particularly useful for individuals who are new to budgeting, as they provide a clear and structured approach to managing finances. Moreover, Excel's formulas and functions enable users to create dynamic budgets that automatically update as new data is entered, making it easier to track financial progress over time. Whether you're managing personal finances, running a small business, or overseeing the financial operations of a large corporation, there's an Excel budget template that can help streamline your budgeting process.

Introduction to Excel Budget Templates

Benefits of Using Excel Budget Templates

Types of Excel Budget Templates

How to Use Excel Budget Templates

Customizing Excel Budget Templates

Examples of Excel Budget Templates

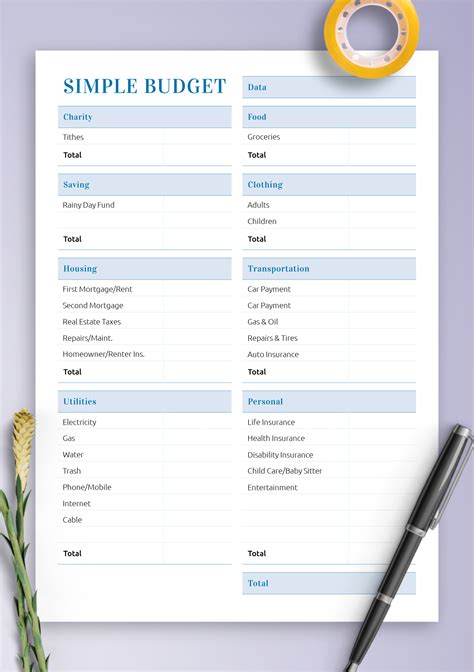

Personal Budget Template

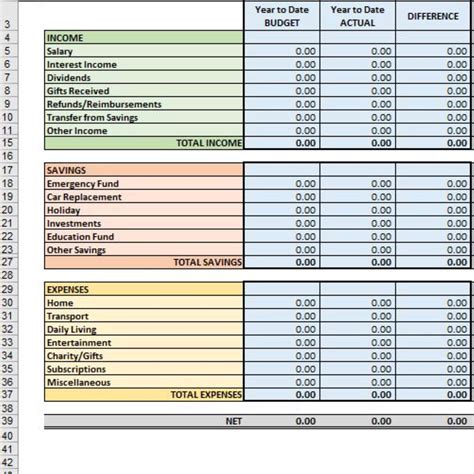

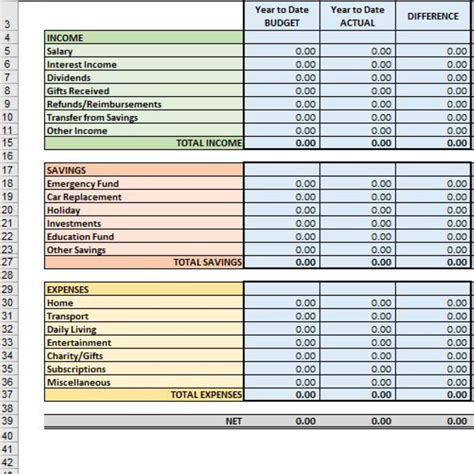

A personal budget template is designed for individuals looking to manage their household finances. It typically includes categories for income, fixed expenses, variable expenses, and savings. This type of template is ideal for creating a budget that tracks personal spending and helps achieve financial goals such as saving for a down payment on a house or paying off debt.Business Budget Template

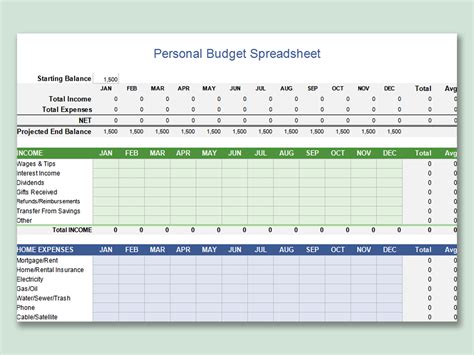

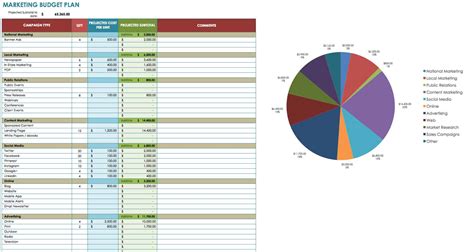

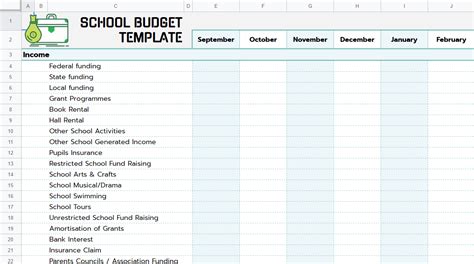

A business budget template is suited for companies needing to track operational expenses and revenue. It includes categories such as revenue, operational costs, marketing expenses, and capital expenditures. This type of template is essential for businesses looking to manage their finances effectively, make informed financial decisions, and achieve long-term financial goals.Event Budget Template

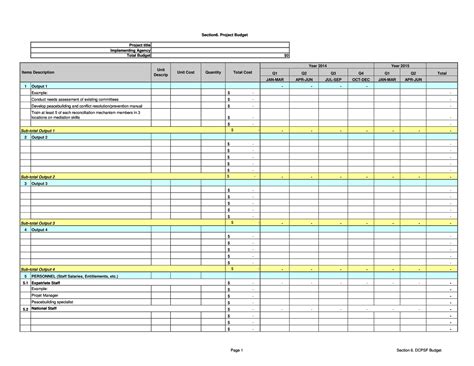

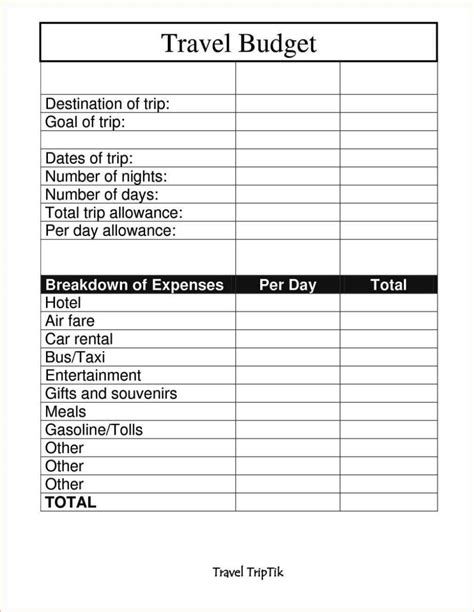

An event budget template is designed for individuals or organizations planning events such as weddings, conferences, or festivals. It includes categories for venue rental, catering, entertainment, and decorations. This type of template helps in creating a detailed budget for the event, ensuring that all expenses are accounted for and that the event stays within budget.Project Budget Template

A project budget template is ideal for individuals or teams working on projects that require careful financial management. It includes categories for materials, labor, equipment, and miscellaneous expenses. This type of template is essential for ensuring that the project is completed within budget and that all financial aspects of the project are well-managed.Startup Budget Template

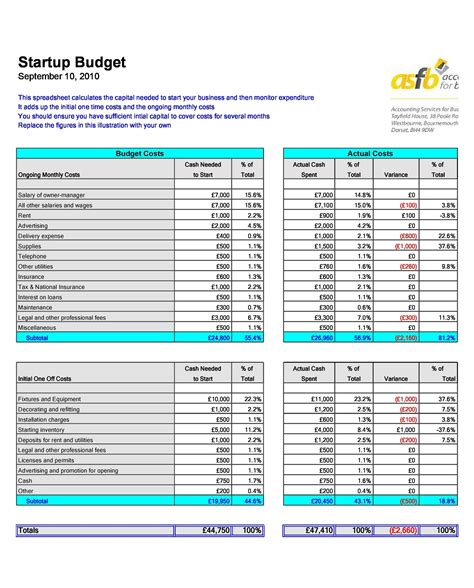

A startup budget template is designed for new businesses that are looking to manage their initial finances effectively. It includes categories for operational costs, marketing expenses, capital expenditures, and revenue projections. This type of template is crucial for startups, as it helps in creating a comprehensive budget that outlines all the necessary expenses and revenue streams, ensuring the financial stability and success of the business.Excel Budget Templates Image Gallery

What is an Excel budget template?

+An Excel budget template is a pre-designed spreadsheet that helps in creating and managing a budget. It provides a structured format for organizing financial data and performs complex financial calculations with ease.

Why use Excel budget templates?

+Excel budget templates are beneficial because they are easy to use, customizable, and can perform complex financial calculations. They provide a clear and structured approach to managing finances, making them ideal for both personal and business use.

How do I choose the right Excel budget template?

+The right Excel budget template depends on your financial needs and goals. Consider what you want to achieve with your budget and select a template that includes the necessary categories and features to help you meet those goals.

Can I customize an Excel budget template?

+Where can I find Excel budget templates?

+Excel budget templates can be found online through Microsoft's official website, or through third-party websites that offer free and paid templates. You can also create your own template from scratch using Excel's comprehensive set of tools and features.

In conclusion, Excel budget templates are powerful tools for managing finances, whether personal or business. They offer a structured approach to budgeting, are highly customizable, and can perform complex financial calculations with ease. By understanding the benefits and types of Excel budget templates available, individuals and businesses can make informed decisions about their financial management, leading to better financial stability and success. We invite you to explore the world of Excel budget templates further, to find the one that best suits your financial needs and goals. Share your experiences with Excel budget templates, ask questions, or provide tips on how you use these templates to manage your finances effectively. Together, let's navigate the realm of personal and business finance with the aid of these versatile and indispensable tools.