Intro

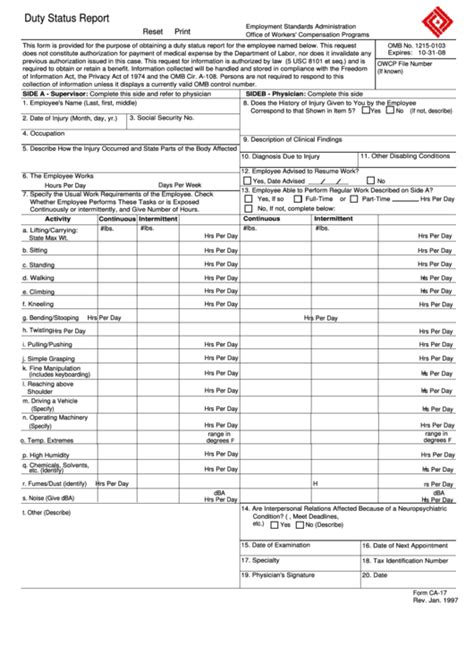

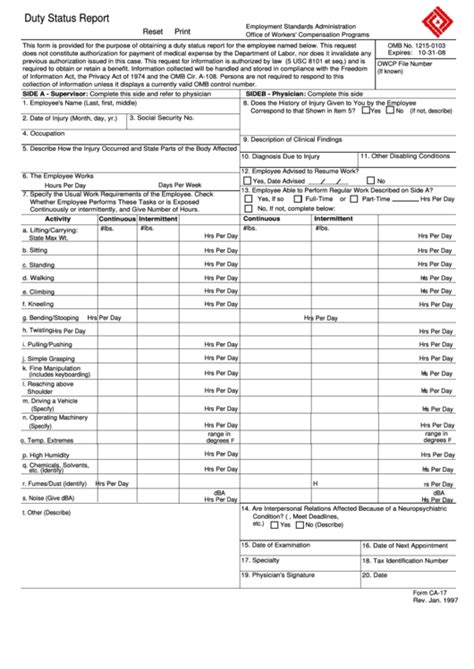

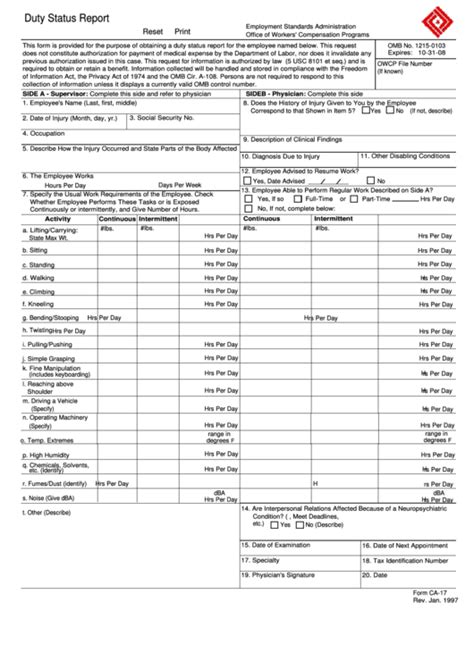

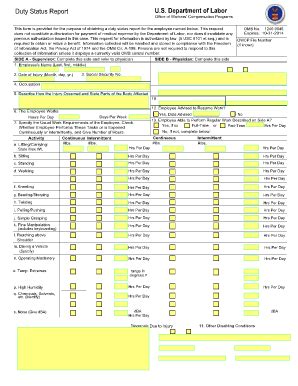

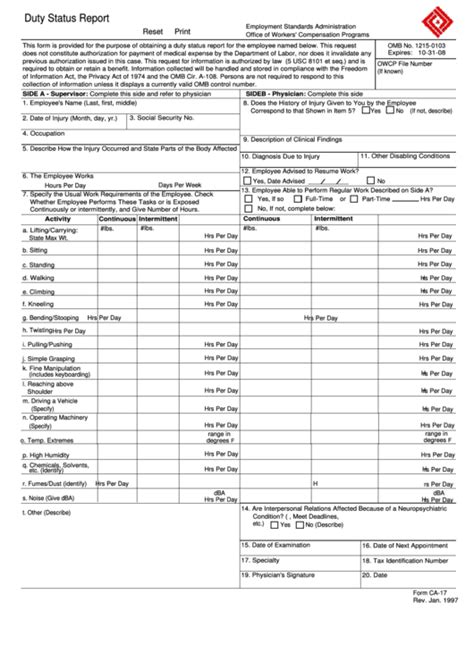

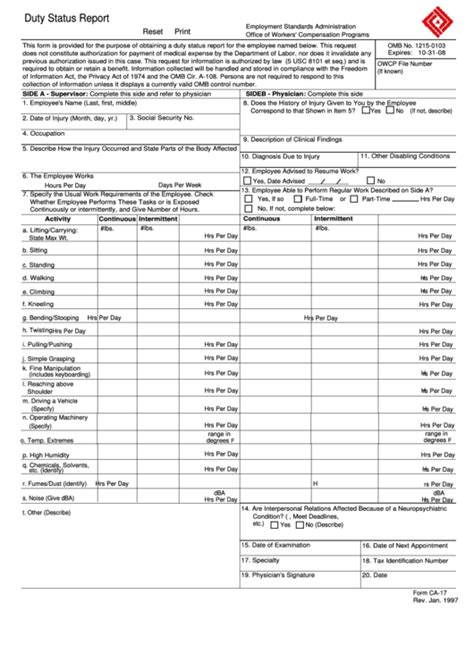

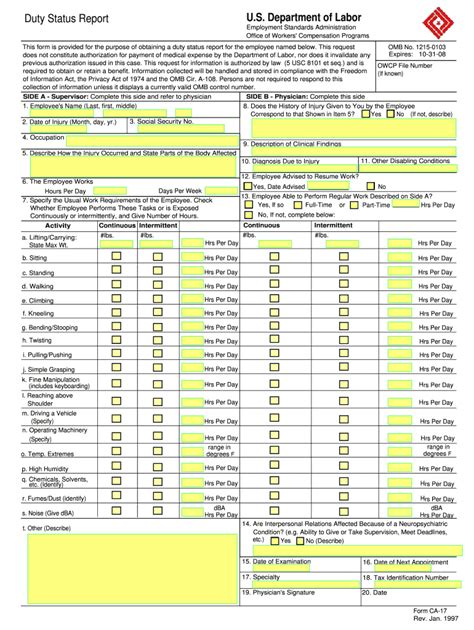

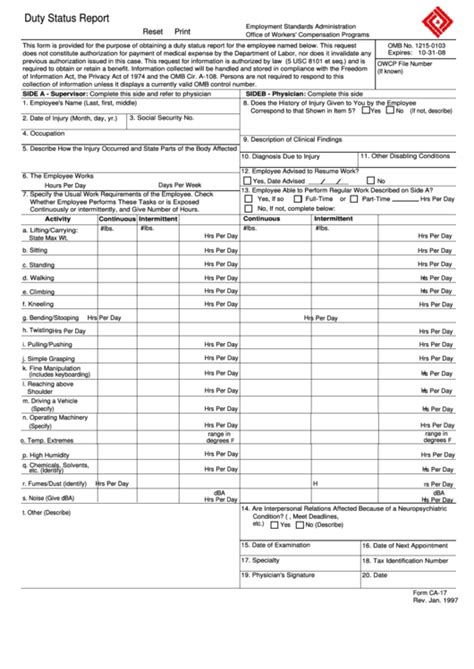

Download the CA 17 printable form for cancer antigen reporting. Get instant access to the CA 17 template, sample, and instructions for medical professionals, including tumor marker and diagnostic test information.

The CA 17 printable form is a crucial document for individuals who need to report income and taxes to the relevant authorities. In this article, we will delve into the importance of the CA 17 form, its components, and the steps to fill it out accurately. We will also provide tips and best practices for managing taxes and financial records.

The CA 17 form is a standard template used by individuals to report their income and taxes. It is essential to understand the purpose and significance of this form to ensure compliance with tax laws and regulations. The form is typically used to report income from various sources, including employment, investments, and self-employment. It is crucial to fill out the form accurately and submit it on time to avoid penalties and fines.

The CA 17 form consists of several sections, including personal details, income information, and tax deductions. It is essential to fill out each section carefully and accurately to ensure that the form is processed correctly. The form also requires supporting documents, such as receipts and invoices, to verify the income and expenses reported.

Understanding the CA 17 Form

To fill out the CA 17 form, individuals need to gather all the necessary documents and information. This includes income statements, receipts, and invoices. It is also essential to understand the tax laws and regulations that apply to the individual's situation. The form can be downloaded from the official website or obtained from a tax professional.

Components of the CA 17 Form

The CA 17 form consists of the following components:

- Personal details: This section requires the individual's name, address, and contact information.

- Income information: This section requires the individual to report their income from various sources, including employment, investments, and self-employment.

- Tax deductions: This section allows individuals to claim tax deductions for eligible expenses, such as charitable donations and medical expenses.

- Supporting documents: This section requires individuals to attach supporting documents, such as receipts and invoices, to verify the income and expenses reported.

Steps to Fill Out the CA 17 Form

To fill out the CA 17 form, individuals can follow these steps:

- Gather all the necessary documents and information.

- Download the CA 17 form from the official website or obtain it from a tax professional.

- Fill out the personal details section carefully and accurately.

- Report income from various sources, including employment, investments, and self-employment.

- Claim tax deductions for eligible expenses, such as charitable donations and medical expenses.

- Attach supporting documents, such as receipts and invoices, to verify the income and expenses reported.

- Review the form carefully to ensure that it is complete and accurate.

- Submit the form on time to avoid penalties and fines.

Tips and Best Practices

To manage taxes and financial records effectively, individuals can follow these tips and best practices:

- Keep accurate and detailed records of income and expenses.

- Understand tax laws and regulations that apply to the individual's situation.

- Claim tax deductions for eligible expenses, such as charitable donations and medical expenses.

- Review and update financial records regularly to ensure accuracy and completeness.

- Seek professional advice from a tax expert or accountant if needed.

Common Mistakes to Avoid

When filling out the CA 17 form, individuals should avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to report income from all sources

- Incorrect tax deductions

- Missing or incomplete supporting documents

- Late submission of the form

Gallery of CA 17 Forms

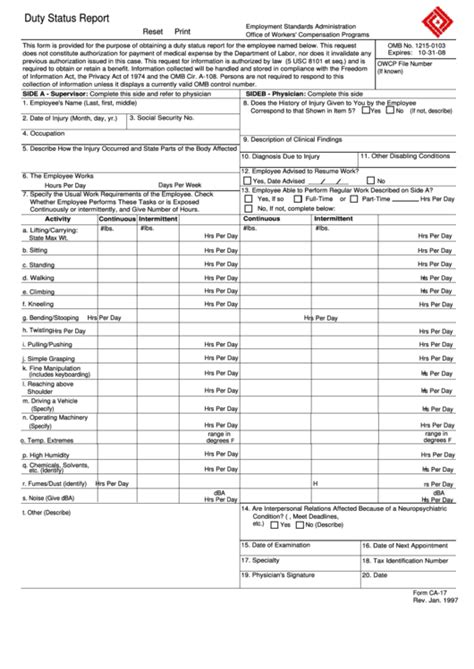

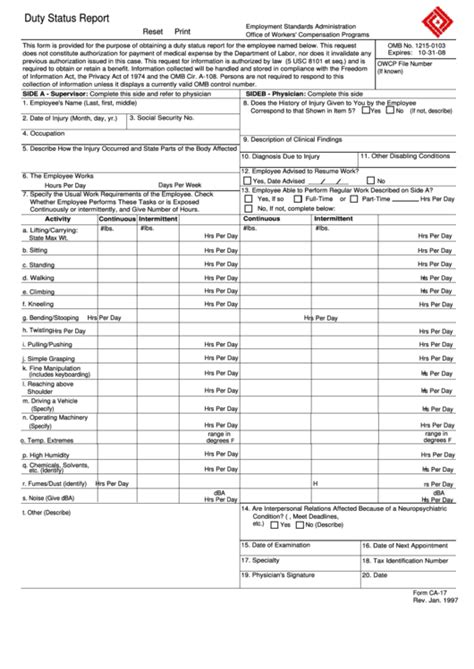

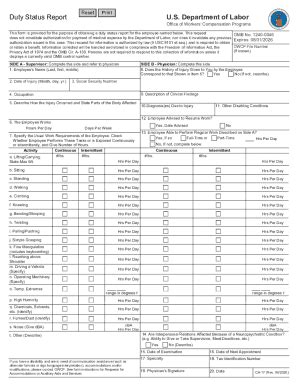

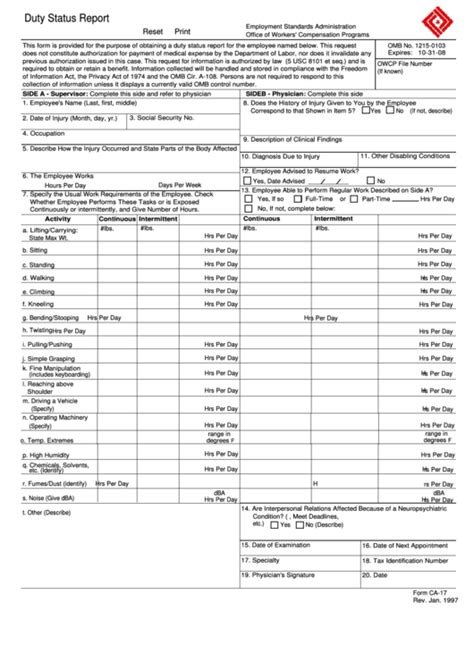

CA 17 Form Image Gallery

Frequently Asked Questions

What is the purpose of the CA 17 form?

+The CA 17 form is used to report income and taxes to the relevant authorities.

How do I fill out the CA 17 form?

+To fill out the CA 17 form, gather all the necessary documents and information, download the form, fill out the personal details section, report income from various sources, claim tax deductions, and attach supporting documents.

What are the common mistakes to avoid when filling out the CA 17 form?

+Common mistakes to avoid include inaccurate or incomplete information, failure to report income from all sources, incorrect tax deductions, missing or incomplete supporting documents, and late submission of the form.

Where can I find more information about the CA 17 form?

+More information about the CA 17 form can be found on the official website or by consulting a tax professional.

How can I avoid penalties and fines when filling out the CA 17 form?

+To avoid penalties and fines, fill out the form accurately and completely, report income from all sources, claim tax deductions correctly, and submit the form on time.

In conclusion, the CA 17 printable form is a crucial document for individuals who need to report income and taxes to the relevant authorities. By understanding the purpose and significance of the form, filling it out accurately and completely, and avoiding common mistakes, individuals can ensure compliance with tax laws and regulations. We hope this article has provided valuable information and insights to help individuals manage their taxes and financial records effectively. If you have any further questions or concerns, please do not hesitate to comment or share this article with others.