Intro

Boost productivity with 5 Google Sheets Ledger Tips, featuring budgeting templates, financial tracking, and data analysis for efficient accounting and expense management.

Using Google Sheets for ledger management can significantly streamline financial record-keeping and analysis. Google Sheets offers a versatile and collaborative platform for creating and maintaining ledgers, making it an excellent tool for both personal and business financial management. Here are some tips to help you get the most out of using Google Sheets for your ledger needs.

Google Sheets provides real-time collaboration, automatic saving, and access from any device with an internet connection, making it a powerful tool for ledger management. Whether you're managing personal finances, running a small business, or handling financial records for a larger organization, Google Sheets can be tailored to meet your specific needs. Its flexibility and the ability to integrate with other Google apps make it a popular choice for financial record-keeping.

The importance of maintaining accurate and organized financial records cannot be overstated. For individuals, it helps in budgeting and saving, while for businesses, it's crucial for financial reporting, tax compliance, and strategic decision-making. Google Sheets, with its user-friendly interface and robust features, makes it easier to create, manage, and analyze financial data. From simple budgeting spreadsheets to complex financial models, Google Sheets can handle a wide range of ledger management tasks.

Setting Up Your Ledger in Google Sheets

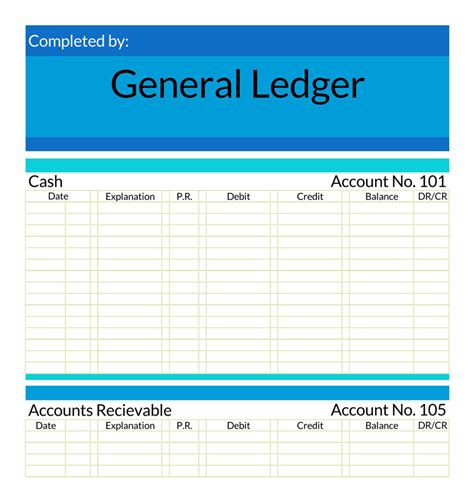

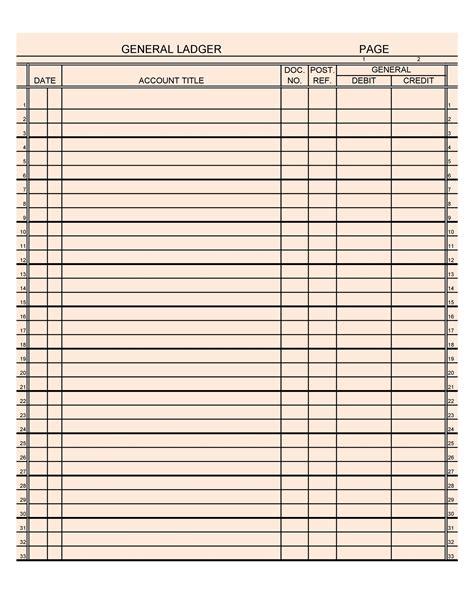

Setting up a ledger in Google Sheets involves creating a spreadsheet that is structured to record and categorize financial transactions. This can include income, expenses, assets, liabilities, and equity for businesses, or income and expenses for personal finance. The first step is to create a new spreadsheet and set up tabs or sheets for different categories of transactions. For example, you might have one sheet for income, another for expenses, and another for a balance sheet.

Organizing Your Ledger

Organizing your ledger is crucial for easy data entry, analysis, and reporting. Each sheet should have columns for date, transaction description, debit, credit, and balance. For a personal budget, you might also include categories for the type of expense (housing, transportation, food, etc.) to make tracking and analyzing spending easier. Google Sheets formulas can be used to automatically calculate totals and balances, reducing the risk of error and saving time.Using Formulas for Automated Calculations

One of the powerful features of Google Sheets is its ability to perform calculations automatically using formulas. For ledger management, formulas can be used to calculate totals, balances, and even to categorize transactions based on certain criteria. The SUMIF and SUMIFS functions are particularly useful for totaling transactions by category, while the IF function can be used to automatically assign categories based on the transaction description.

Utilizing Conditional Formatting

Conditional formatting is another feature in Google Sheets that can enhance your ledger management. It allows you to highlight cells based on specific conditions, such as transactions over a certain amount or negative balances. This visual tool can help draw attention to important transactions or potential issues, such as overspending in a particular category, making it easier to monitor and control finances.Securing and Sharing Your Ledger

Security and accessibility are key considerations when managing financial records. Google Sheets allows you to control who can view or edit your spreadsheet, making it possible to share your ledger with accountants, business partners, or family members while maintaining privacy and security. You can set permissions to view-only or editing, and even specify which parts of the spreadsheet individuals can access.

Regular Backups and Version History

Google Sheets automatically saves your work and maintains a version history, allowing you to revert to previous versions of your spreadsheet if needed. However, for added security, especially with critical financial documents, consider making regular backups of your ledger. You can download your spreadsheet as an Excel file, PDF, or other formats, and store these backups securely.Advanced Ledger Management Techniques

For more advanced users, Google Sheets offers a range of techniques to further enhance ledger management. This includes using pivot tables to analyze large datasets, creating custom charts and graphs to visualize financial trends, and even integrating with other Google apps like Google Forms for automated data entry. Scripts can also be used to automate repetitive tasks, such as monthly reporting or transaction categorization.

Integrating with Other Tools

Google Sheets can be integrated with a variety of other tools and services to streamline financial management. For example, you can connect your bank accounts or credit cards to automatically import transactions, or use add-ons like Zapier to integrate with accounting software. This integration can reduce manual data entry, improve accuracy, and provide a more comprehensive view of your financial situation.Best Practices for Ledger Management

Following best practices for ledger management in Google Sheets can help ensure your financial records are accurate, up-to-date, and secure. This includes regularly reviewing and reconciling transactions, maintaining clear and consistent categorization, and ensuring all users understand how to correctly enter and manage data. Regular backups and security audits are also crucial to protect against data loss or unauthorized access.

Continuous Learning and Improvement

The capabilities of Google Sheets are continually evolving, with new features and functions being added regularly. Staying updated with the latest developments and best practices can help you optimize your ledger management system. Online tutorials, forums, and Google's official support resources are valuable tools for learning new skills and troubleshooting issues.Google Sheets Ledger Management Image Gallery

What are the benefits of using Google Sheets for ledger management?

+The benefits include real-time collaboration, automatic saving, access from any device, and the ability to integrate with other Google apps, making it a versatile and powerful tool for financial record-keeping.

How do I set up a ledger in Google Sheets?

+To set up a ledger, create a new spreadsheet, set up tabs for different categories of transactions, and use columns for date, transaction description, debit, credit, and balance. Utilize Google Sheets formulas for automated calculations.

Can I secure my ledger in Google Sheets?

+How can I automate tasks in my Google Sheets ledger?

+You can automate tasks by using Google Sheets formulas, creating custom scripts, and integrating with other apps and services to streamline data entry and analysis.

What are some best practices for managing a ledger in Google Sheets?

+Best practices include regularly reviewing and reconciling transactions, maintaining clear and consistent categorization, ensuring all users understand data entry and management, and making regular backups and security audits.

In conclusion, utilizing Google Sheets for ledger management offers a flexible, collaborative, and powerful solution for both personal and business financial record-keeping. By understanding how to set up and manage a ledger, use formulas for automated calculations, secure and share your data, and follow best practices, you can optimize your financial management and make informed decisions. Whether you're just starting out or looking to enhance your existing ledger system, Google Sheets provides the tools and features to help you achieve your financial goals. We invite you to share your experiences, tips, and questions about using Google Sheets for ledger management in the comments below, and don't forget to share this article with anyone who might benefit from learning more about this versatile and indispensable tool.