Intro

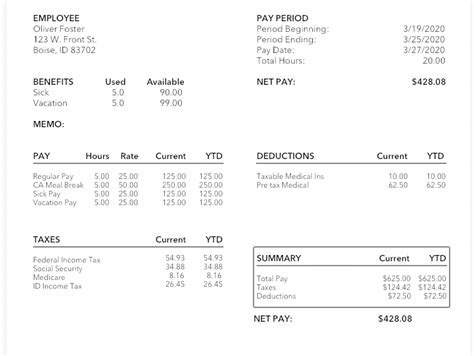

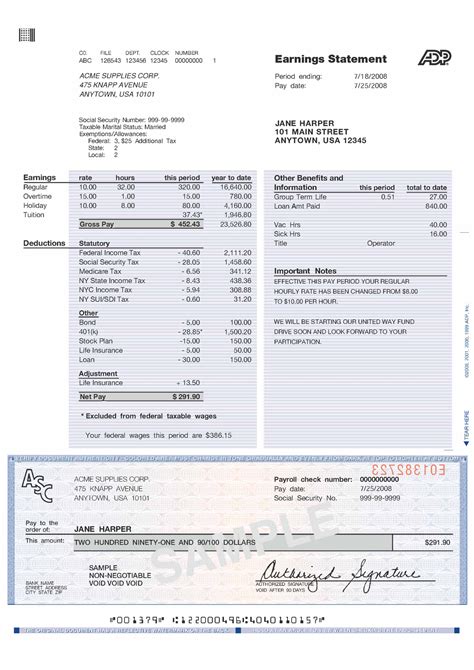

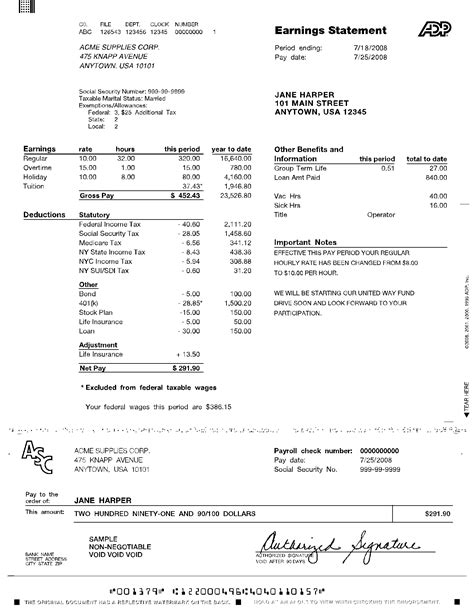

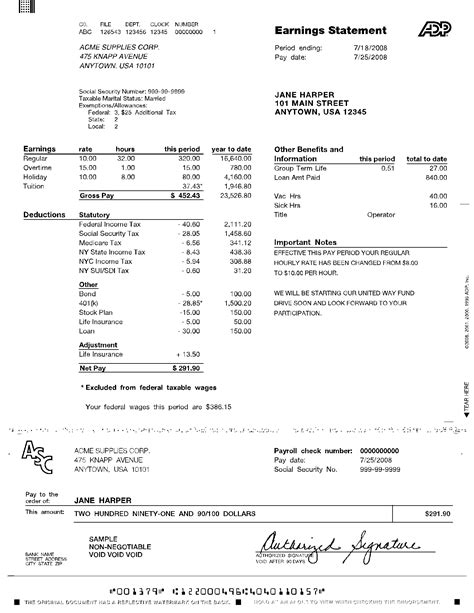

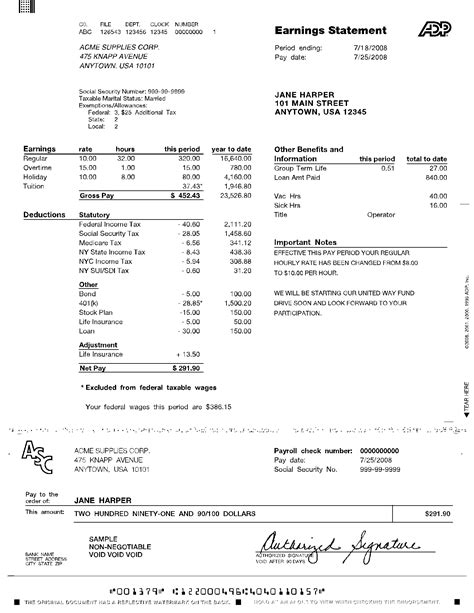

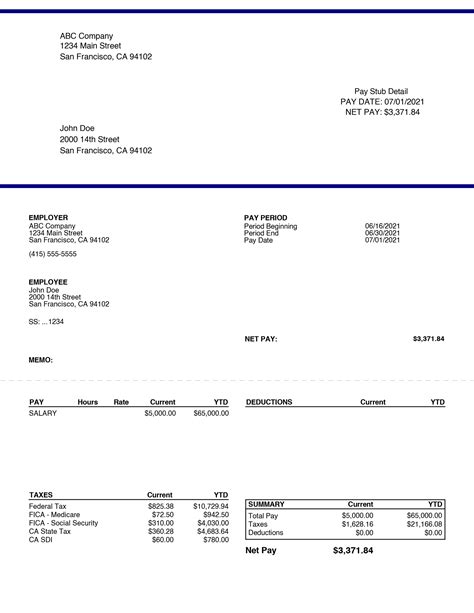

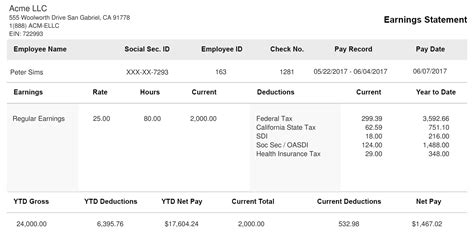

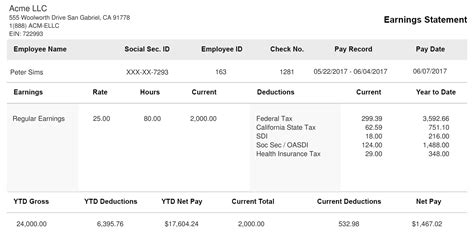

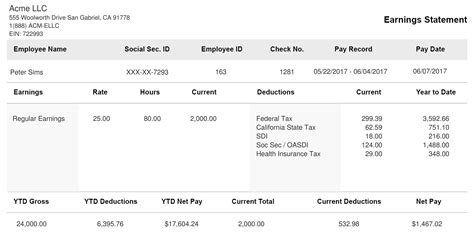

Get a free ADP pay stub template blank for easy payroll management, featuring employee details, payment info, and deductions, perfect for small businesses and HR professionals.

Pay stubs are essential documents that provide employees with a detailed breakdown of their earnings and deductions for a specific pay period. They serve as a vital tool for employees to track their income, verify their pay, and manage their finances effectively. For employers, pay stubs are a crucial aspect of payroll management, as they help ensure compliance with labor laws and regulations. In this article, we will delve into the world of pay stubs, exploring their importance, components, and the benefits of using a blank ADP pay stub template.

A pay stub, also known as a paycheck stub or pay slip, is a document that accompanies an employee's paycheck or direct deposit. It contains a wealth of information about the employee's pay, including their gross earnings, taxes, deductions, and net pay. Pay stubs are typically provided by employers to their employees on a regular basis, such as bi-weekly or monthly. They can be distributed in paper form or electronically, depending on the employer's payroll system and preferences.

The importance of pay stubs cannot be overstated. For employees, pay stubs provide a clear and transparent record of their earnings, allowing them to verify their pay and detect any errors or discrepancies. They also help employees track their income, manage their finances, and plan for the future. For employers, pay stubs are essential for maintaining accurate payroll records, complying with labor laws, and providing employees with a clear understanding of their compensation package.

Components of a Pay Stub

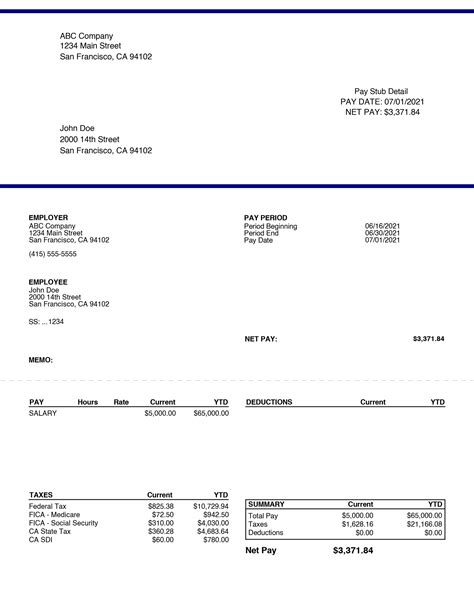

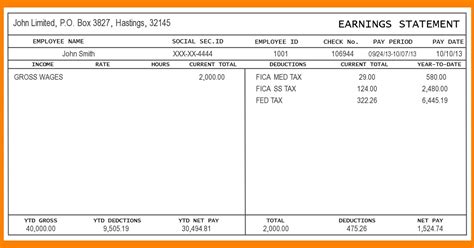

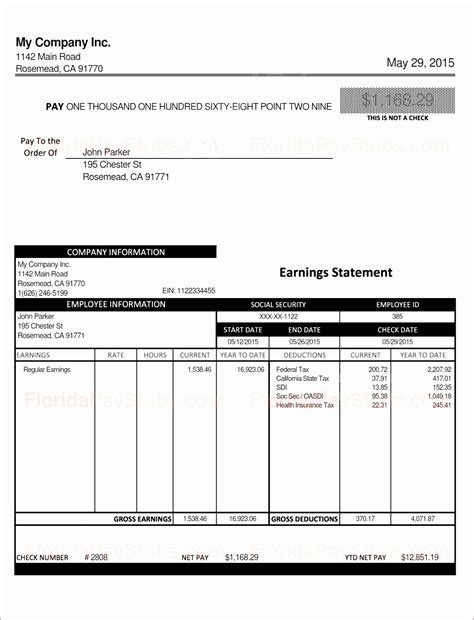

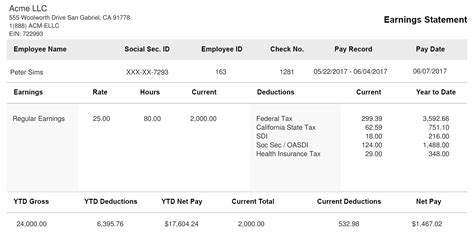

A typical pay stub contains a range of information, including:

- Employee details: name, address, and employee ID number

- Pay period: the dates covered by the pay stub

- Gross earnings: the total amount earned by the employee before taxes and deductions

- Taxes: federal, state, and local taxes withheld from the employee's pay

- Deductions: amounts deducted from the employee's pay for benefits, such as health insurance, 401(k), and life insurance

- Net pay: the employee's take-home pay after taxes and deductions

- Pay rate: the employee's hourly or salary rate

- Hours worked: the number of hours worked by the employee during the pay period

Benefits of Using a Blank ADP Pay Stub Template

Using a blank ADP pay stub template can offer several benefits for employers and employees alike. Some of the advantages include:

- Convenience: a blank template can be easily customized to suit the employer's payroll system and branding

- Accuracy: a template helps ensure that all necessary information is included, reducing the risk of errors or omissions

- Efficiency: a template can save time and effort in creating pay stubs, allowing employers to focus on other aspects of payroll management

- Compliance: a template can help employers comply with labor laws and regulations, such as the Fair Labor Standards Act (FLSA)

Creating a Blank ADP Pay Stub Template

Creating a blank ADP pay stub template is a relatively straightforward process. Employers can use a variety of tools and software, such as Microsoft Word or Excel, to design and customize their template. The template should include all the necessary components, such as employee details, pay period, gross earnings, taxes, deductions, and net pay. Employers can also add their company logo and branding to the template to create a professional and cohesive look.

Best Practices for Using a Blank ADP Pay Stub Template

To get the most out of a blank ADP pay stub template, employers should follow best practices, such as:

- Customizing the template to suit their payroll system and branding

- Ensuring that all necessary information is included and accurate

- Using a clear and concise format to make it easy for employees to understand their pay stub

- Providing employees with access to their pay stubs in a timely and secure manner

- Maintaining accurate and up-to-date payroll records to ensure compliance with labor laws and regulations

Common Mistakes to Avoid When Using a Blank ADP Pay Stub Template

When using a blank ADP pay stub template, employers should be aware of common mistakes to avoid, such as:

- Omitting necessary information, such as employee details or pay period

- Including incorrect or inaccurate information, such as incorrect pay rates or deductions

- Failing to provide employees with access to their pay stubs in a timely and secure manner

- Not maintaining accurate and up-to-date payroll records to ensure compliance with labor laws and regulations

Gallery of Pay Stub Templates

Pay Stub Template Gallery

Frequently Asked Questions

What is a pay stub?

+A pay stub is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period.

Why are pay stubs important?

+Pay stubs are important because they provide employees with a clear and transparent record of their earnings, allowing them to verify their pay and detect any errors or discrepancies.

What information should be included on a pay stub?

+A pay stub should include employee details, pay period, gross earnings, taxes, deductions, and net pay, as well as any other relevant information, such as pay rate and hours worked.

Can I use a blank ADP pay stub template for my business?

+How can I create a blank ADP pay stub template?

+You can create a blank ADP pay stub template using a variety of tools and software, such as Microsoft Word or Excel, and customize it to suit your payroll system and branding.

In conclusion, pay stubs are a vital aspect of payroll management, providing employees with a clear and transparent record of their earnings and deductions. Using a blank ADP pay stub template can offer several benefits, including convenience, accuracy, and efficiency. By following best practices and avoiding common mistakes, employers can ensure that their pay stubs are accurate, compliant, and easy to understand. We hope this article has provided you with a comprehensive understanding of pay stubs and the benefits of using a blank ADP pay stub template. If you have any further questions or comments, please do not hesitate to reach out to us. We would be happy to hear from you and provide any additional information or support you may need.