Intro

Discover 5 budget templates to manage finances effectively, featuring expense tracking, income planning, and savings goals, with customizable spreadsheets and worksheets for personal and business use.

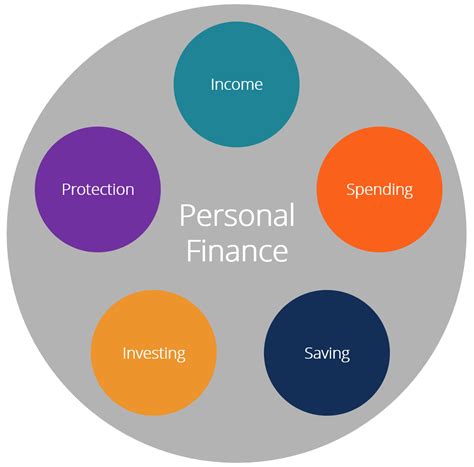

Creating a budget is an essential step in managing personal finances effectively. It helps in tracking income and expenses, making smart financial decisions, and achieving long-term financial goals. With the numerous budgeting templates available, individuals can choose the one that best suits their financial situation and preferences. Here, we will explore five budget templates that cater to different needs and financial goals.

Budgeting is crucial because it allows individuals to prioritize their spending, save for emergencies, and make progress towards their financial objectives. Without a budget, it's easy to overspend and accumulate debt, which can lead to financial stress and instability. By using a budget template, individuals can take control of their finances, make informed decisions, and enjoy peace of mind.

Effective budgeting involves understanding one's income and expenses, setting financial goals, and making adjustments as needed. It requires discipline, patience, and a willingness to learn and adapt. With the right budget template, individuals can streamline their budgeting process, reduce financial stress, and achieve financial stability.

Introduction to Budget Templates

Budget templates are pre-designed spreadsheets or worksheets that help individuals create and manage their budgets. They typically include categories for income, fixed expenses, variable expenses, savings, and debt repayment. By using a budget template, individuals can easily track their expenses, identify areas for improvement, and make adjustments to achieve their financial goals.

There are various types of budget templates available, ranging from simple to complex, and catering to different financial situations and goals. Some budget templates are designed for individuals, while others are suitable for families, businesses, or specific financial situations, such as debt consolidation or retirement planning.

Types of Budget Templates

The following are five budget templates that cater to different needs and financial goals:

- Zero-Based Budget Template: This template involves allocating every dollar of income towards a specific expense or savings goal. It's ideal for individuals who want to track every single transaction and make the most of their income.

- 50/30/20 Budget Template: This template allocates 50% of income towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment. It's suitable for individuals who want a simple and balanced approach to budgeting.

- Envelope Budget Template: This template involves dividing expenses into categories and allocating a specific amount of cash for each category. It's ideal for individuals who prefer a tactile approach to budgeting and want to avoid overspending.

- Priority-Based Budget Template: This template involves identifying and prioritizing financial goals, such as saving for a down payment on a house or paying off debt. It's suitable for individuals who want to focus on achieving specific financial objectives.

- Hybrid Budget Template: This template combines elements of different budgeting approaches, such as zero-based and 50/30/20. It's ideal for individuals who want a customized approach to budgeting that suits their unique financial situation and goals.

Benefits of Using Budget Templates

Using budget templates offers several benefits, including:- Simplified budgeting process

- Improved financial organization

- Enhanced financial awareness

- Increased savings and debt repayment

- Reduced financial stress and anxiety

By using a budget template, individuals can take control of their finances, make informed decisions, and achieve their financial goals.

How to Choose a Budget Template

Choosing the right budget template depends on individual financial needs and goals. Here are some factors to consider:

- Complexity: Choose a template that's easy to understand and use.

- Customization: Select a template that allows for customization to suit your unique financial situation.

- Categories: Ensure the template includes categories that align with your expenses and financial goals.

- Automation: Consider a template that automates calculations and tracking to save time and reduce errors.

By considering these factors, individuals can choose a budget template that helps them achieve financial stability and success.

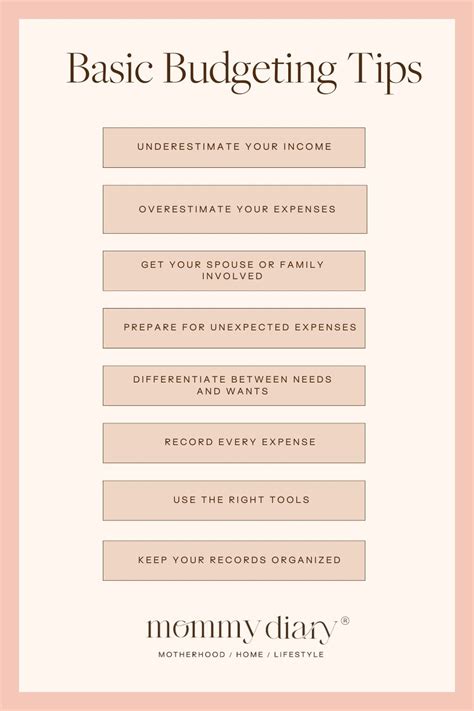

Common Budgeting Mistakes

Common budgeting mistakes include:- Failing to track expenses

- Overspending

- Not saving enough

- Not prioritizing financial goals

- Not reviewing and adjusting the budget regularly

By avoiding these mistakes and using a budget template, individuals can create a effective budget that helps them achieve their financial objectives.

Best Practices for Budgeting

Here are some best practices for budgeting:

- Track expenses regularly

- Prioritize needs over wants

- Save for emergencies and long-term goals

- Pay off high-interest debt

- Review and adjust the budget regularly

By following these best practices and using a budget template, individuals can create a budget that helps them achieve financial stability and success.

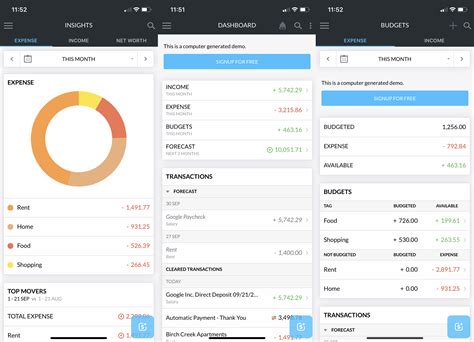

Budgeting Tools and Resources

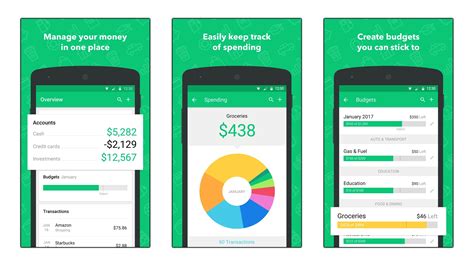

There are various budgeting tools and resources available, including:- Spreadsheets and budgeting software

- Mobile apps

- Online budgeting platforms

- Financial advisors and planners

By utilizing these tools and resources, individuals can streamline their budgeting process, reduce financial stress, and achieve their financial goals.

Conclusion and Next Steps

In conclusion, budgeting is an essential step in managing personal finances effectively. By using a budget template, individuals can simplify their budgeting process, improve financial organization, and achieve their financial goals. Remember to choose a template that suits your unique financial situation and goals, and don't be afraid to seek help from financial advisors or planners if needed.

Budgeting Image Gallery

What is budgeting and why is it important?

+Budgeting is the process of creating a plan for how to allocate your income towards different expenses, savings, and debt repayment. It's essential for managing personal finances effectively, achieving financial stability, and reducing financial stress.

How do I choose the right budget template for my needs?

+Choose a budget template that's easy to understand and use, and includes categories that align with your expenses and financial goals. Consider factors such as complexity, customization, and automation to find the best template for your needs.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes include failing to track expenses, overspending, not saving enough, not prioritizing financial goals, and not reviewing and adjusting the budget regularly. Avoid these mistakes by using a budget template, tracking expenses regularly, and prioritizing needs over wants.

We hope this article has provided you with valuable insights and information on budget templates and budgeting best practices. Remember to choose a budget template that suits your unique financial situation and goals, and don't be afraid to seek help from financial advisors or planners if needed. Share your thoughts and experiences with budgeting in the comments below, and don't forget to share this article with friends and family who may benefit from it.