Intro

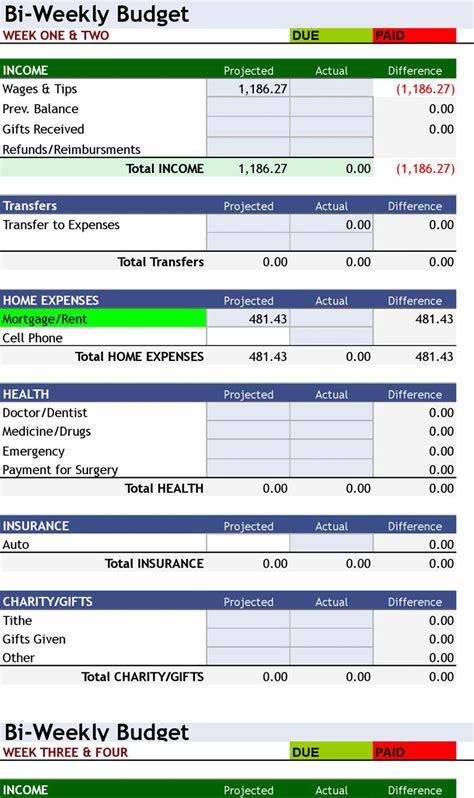

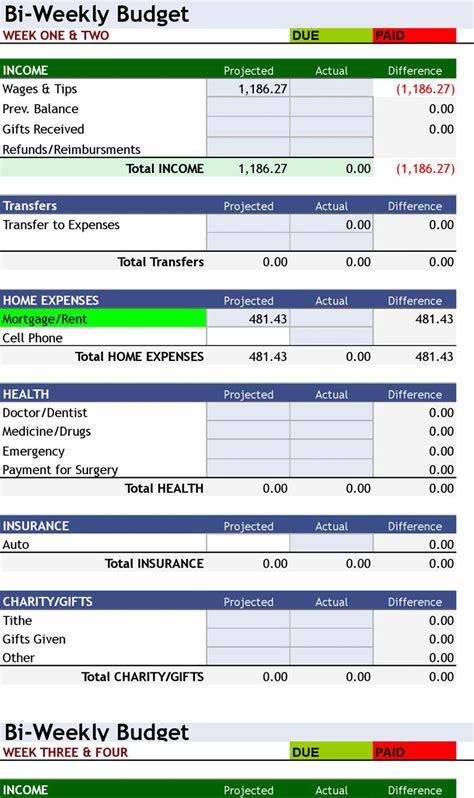

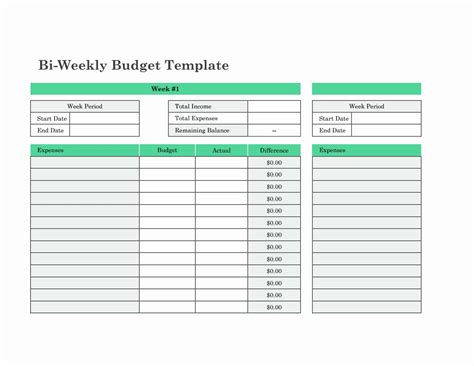

Streamline finances with a biweekly budget template Excel, featuring customizable spreadsheets for expense tracking, income management, and financial planning, ideal for personal and small business budgeting needs.

Creating a budget is an essential step in managing one's finances effectively. A biweekly budget template in Excel can be a valuable tool for individuals who get paid every other week and want to keep track of their income and expenses. In this article, we will explore the importance of budgeting, how to create a biweekly budget template in Excel, and provide tips on how to use it effectively.

Budgeting is crucial for achieving financial stability and security. It helps individuals understand where their money is going, identify areas for cost-cutting, and make informed decisions about their financial resources. A biweekly budget template can be particularly useful for those who receive a paycheck every other week, as it allows them to plan and manage their finances over a shorter period.

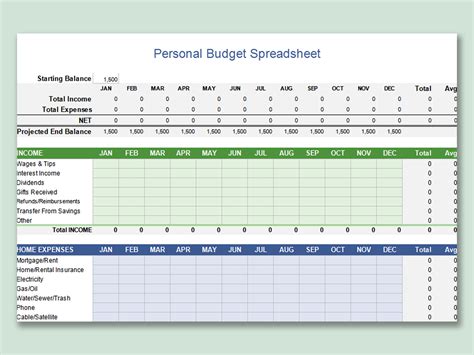

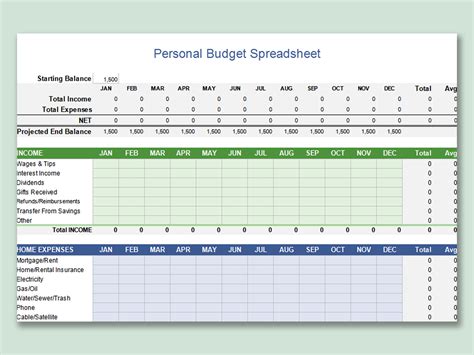

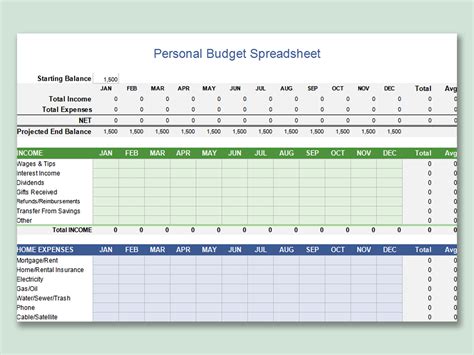

To create a biweekly budget template in Excel, you can start by setting up a spreadsheet with the following columns: date, income, fixed expenses, variable expenses, savings, and debt repayment. You can then add rows for each biweekly period, and fill in the respective amounts for each category. It's also a good idea to include a column for notes or comments, where you can record any changes or adjustments to your budget.

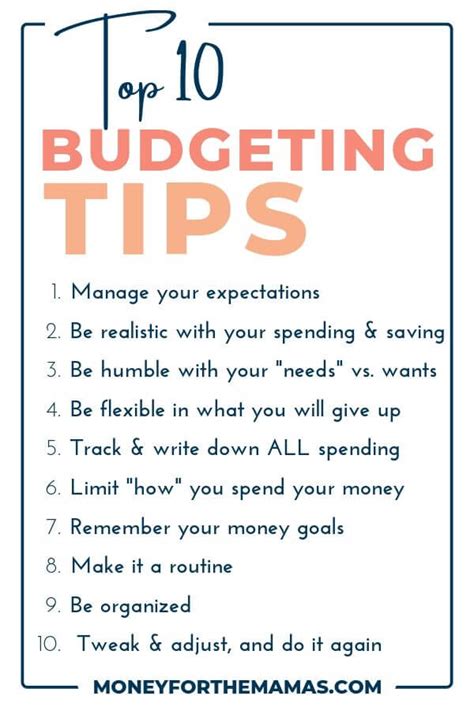

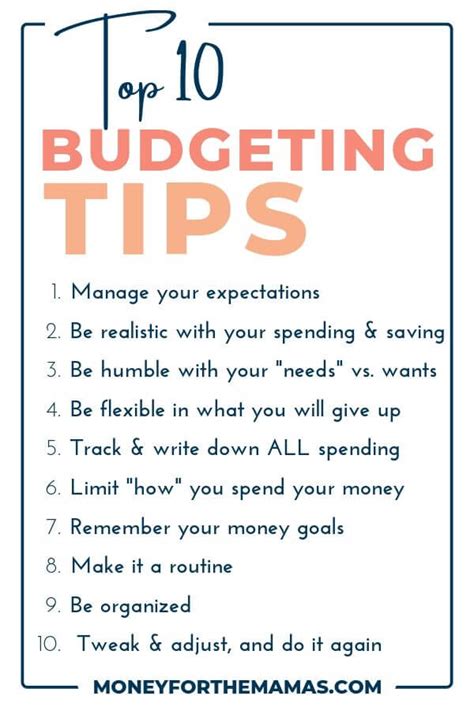

Benefits of Using a Biweekly Budget Template

Using a biweekly budget template can have several benefits, including:

- Improved financial planning and management

- Increased awareness of income and expenses

- Better control over spending and saving

- Enhanced ability to achieve financial goals

- Reduced stress and anxiety related to finances

To get the most out of a biweekly budget template, it's essential to regularly review and update it. This can help you identify areas for improvement, make adjustments as needed, and stay on track with your financial goals.

Steps to Create a Biweekly Budget Template in Excel

Here are the steps to create a biweekly budget template in Excel:

- Open a new Excel spreadsheet and set up the following columns: date, income, fixed expenses, variable expenses, savings, and debt repayment.

- Add rows for each biweekly period, and fill in the respective amounts for each category.

- Include a column for notes or comments, where you can record any changes or adjustments to your budget.

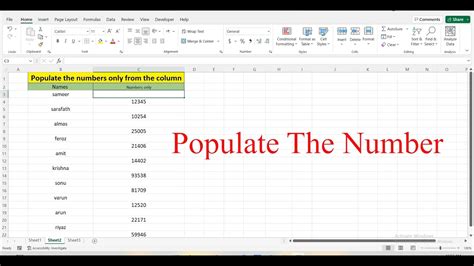

- Use formulas to calculate totals and percentages, and to track progress over time.

- Customize the template to fit your individual needs and preferences.

Some other features you may want to consider adding to your biweekly budget template include:

- A column for income taxes, to help you estimate and plan for tax payments

- A column for retirement savings, to help you prioritize and track your long-term savings goals

- A column for emergency funds, to help you build and maintain a cushion against unexpected expenses

Working Mechanisms of a Biweekly Budget Template

A biweekly budget template works by providing a framework for tracking and managing your income and expenses over a shorter period. By breaking down your finances into smaller, more manageable chunks, you can gain a better understanding of where your money is going and make more informed decisions about how to allocate your resources.

Some key mechanisms of a biweekly budget template include:

- Income tracking: The template allows you to record and track your income over each biweekly period, helping you understand how much money you have coming in and when.

- Expense categorization: The template provides categories for fixed and variable expenses, helping you distinguish between essential and discretionary spending.

- Savings and debt repayment: The template includes columns for savings and debt repayment, helping you prioritize and track your progress towards long-term financial goals.

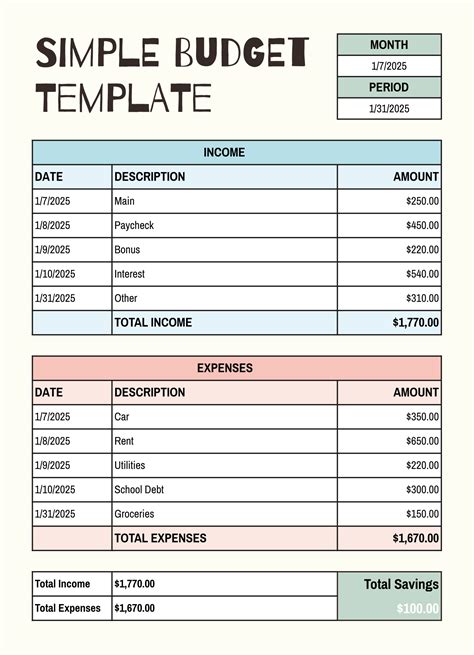

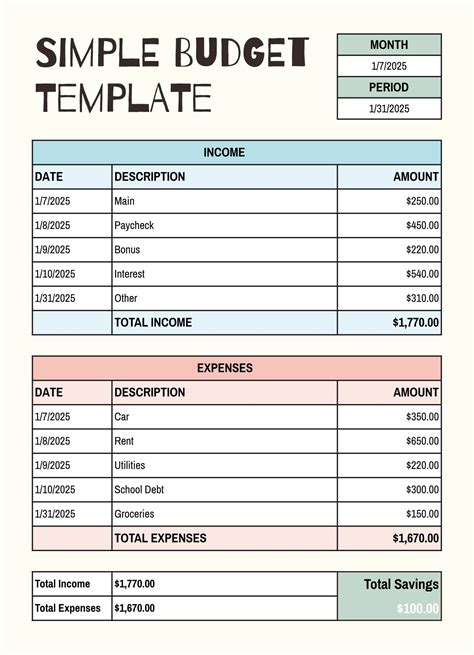

Practical Examples of Biweekly Budget Templates

Here are some practical examples of biweekly budget templates:

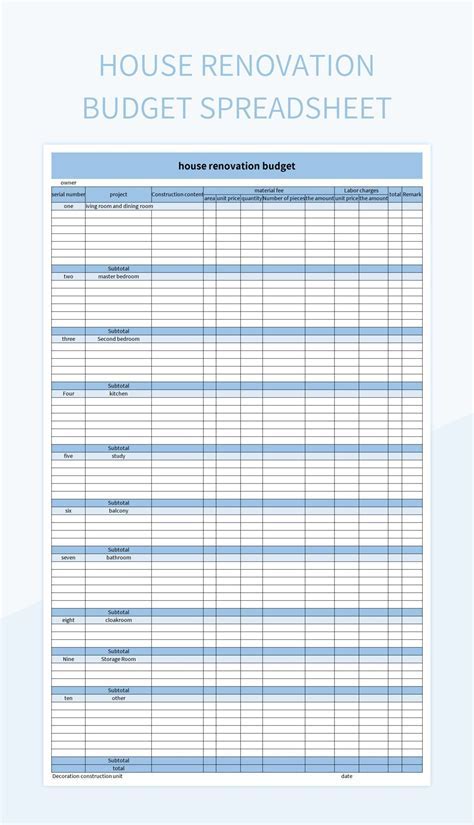

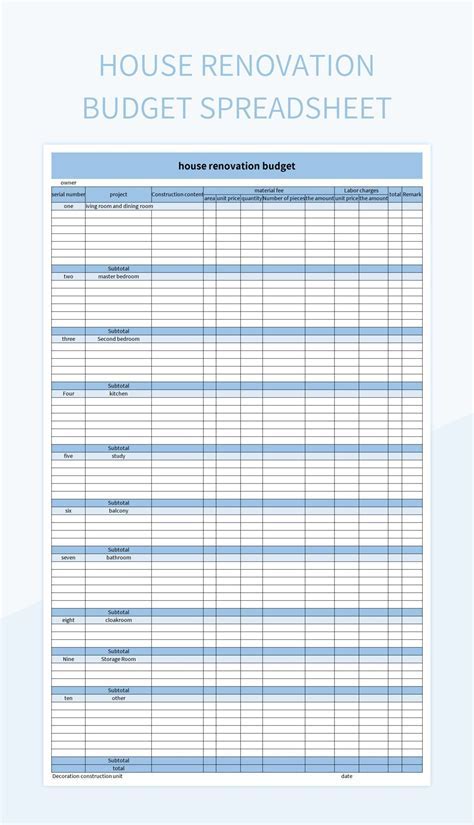

- A template for a single person, with columns for income, fixed expenses, variable expenses, savings, and debt repayment.

- A template for a couple, with columns for joint income, shared expenses, individual expenses, savings, and debt repayment.

- A template for a family, with columns for income, fixed expenses, variable expenses, savings, debt repayment, and childcare costs.

Some other examples of biweekly budget templates include:

- A template for students, with columns for income, tuition, room and board, textbooks, and other educational expenses.

- A template for freelancers, with columns for income, business expenses, taxes, and benefits.

- A template for retirees, with columns for income, fixed expenses, variable expenses, savings, and healthcare costs.

Gallery of Biweekly Budget Templates

Biweekly Budget Templates

Frequently Asked Questions

What is a biweekly budget template?

+A biweekly budget template is a tool used to track and manage income and expenses over a shorter period, typically every other week.

How do I create a biweekly budget template in Excel?

+To create a biweekly budget template in Excel, set up a spreadsheet with columns for income, fixed expenses, variable expenses, savings, and debt repayment, and add rows for each biweekly period.

What are the benefits of using a biweekly budget template?

+The benefits of using a biweekly budget template include improved financial planning and management, increased awareness of income and expenses, and better control over spending and saving.

Can I customize a biweekly budget template to fit my individual needs?

+Yes, you can customize a biweekly budget template to fit your individual needs and preferences, including adding or removing columns and rows, and using formulas to calculate totals and percentages.

How often should I review and update my biweekly budget template?

+You should regularly review and update your biweekly budget template, ideally every few months, to ensure it remains accurate and effective in helping you achieve your financial goals.

In conclusion, a biweekly budget template can be a powerful tool for managing your finances and achieving financial stability. By following the steps outlined in this article, you can create a customized template that meets your individual needs and helps you stay on track with your financial goals. Remember to regularly review and update your template, and don't hesitate to seek help if you need it. With the right tools and mindset, you can take control of your finances and build a brighter financial future.

We hope this article has been helpful in providing you with the information and resources you need to create and use a biweekly budget template. If you have any further questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from it, and consider bookmarking it for future reference. Thank you for reading!