Intro

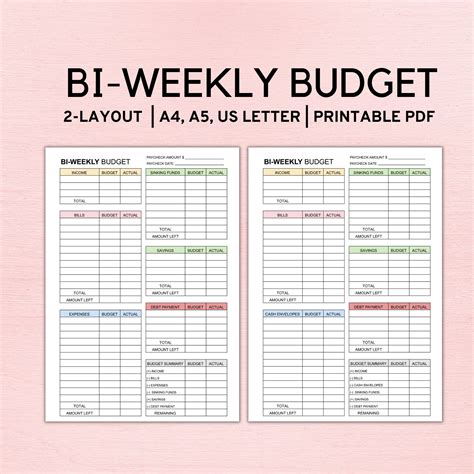

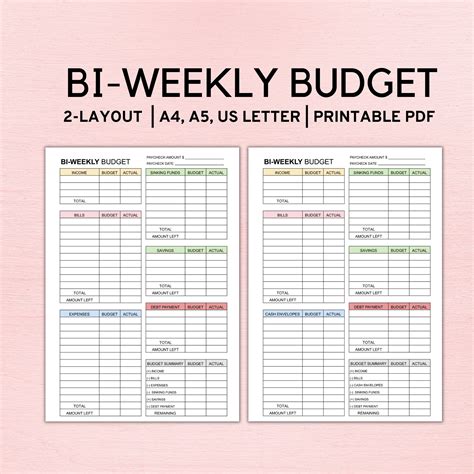

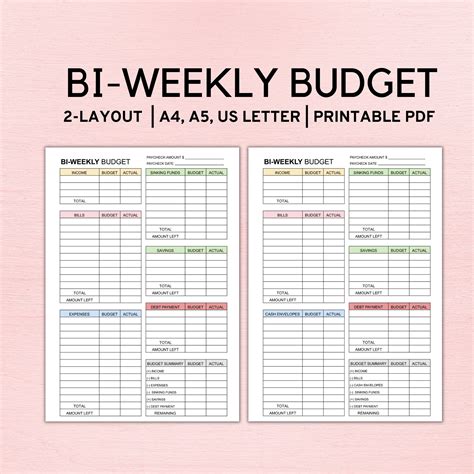

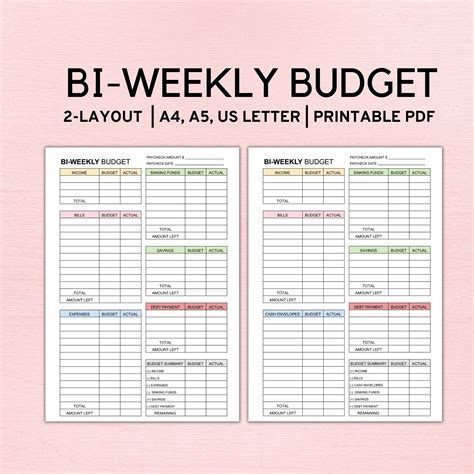

Manage finances with a bi-weekly paycheck budget Excel template, featuring income tracking, expense categorization, and savings goals, for effective financial planning and budgeting strategies.

Creating a budget can be a daunting task, especially when you're trying to manage your finances on a bi-weekly paycheck schedule. However, with the right tools and a little bit of planning, you can create a budget that works for you. In this article, we'll explore the importance of budgeting, how to create a bi-weekly paycheck budget using an Excel template, and provide tips and tricks for sticking to your budget.

Budgeting is essential for managing your finances effectively. It helps you track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your money. Without a budget, it's easy to overspend and accumulate debt, which can lead to financial stress and anxiety. By creating a budget, you can take control of your finances, achieve your financial goals, and enjoy peace of mind.

A bi-weekly paycheck budget is particularly useful for individuals who receive their paychecks every other week. This type of budget takes into account the irregularity of bi-weekly paychecks and helps you plan your expenses accordingly. With a bi-weekly paycheck budget, you can ensure that you have enough money to cover your expenses, even when your paychecks are not evenly spaced.

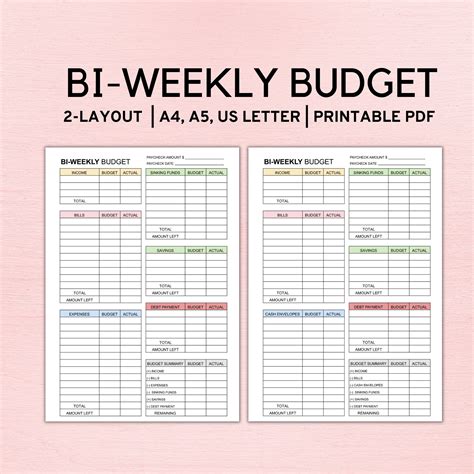

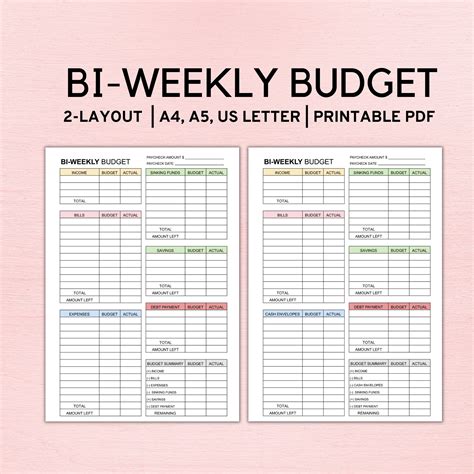

Benefits of Using an Excel Template for Bi-Weekly Paycheck Budgeting

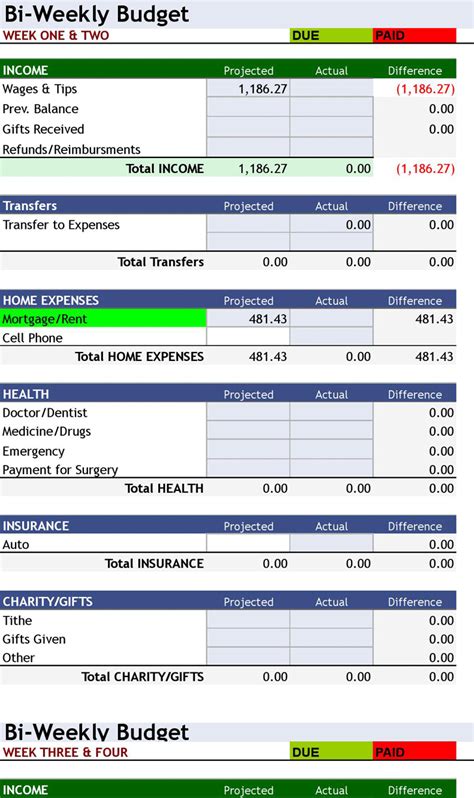

Using an Excel template for bi-weekly paycheck budgeting offers several benefits. Firstly, it's easy to use and customize, even if you're not familiar with Excel. The template provides a pre-designed layout that you can fill in with your own data, making it simple to get started. Secondly, an Excel template allows you to track your income and expenses in real-time, making it easier to identify areas where you can cut back. Finally, an Excel template is highly flexible, allowing you to make changes and adjustments as needed.

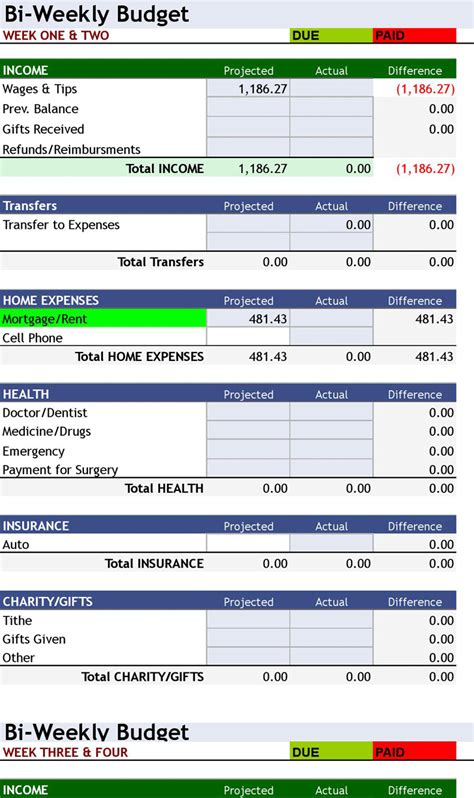

Key Features of a Bi-Weekly Paycheck Budget Excel Template

A good bi-weekly paycheck budget Excel template should have the following key features: * A separate sheet for tracking income and expenses * A calendar view to help you plan your expenses around your bi-weekly paychecks * Automatic calculations to help you track your spending and stay within your budget * Customizable categories to help you track your expenses in detail * A summary sheet to provide an overview of your budget and help you identify areas for improvementHow to Create a Bi-Weekly Paycheck Budget Using an Excel Template

Creating a bi-weekly paycheck budget using an Excel template is relatively straightforward. Here are the steps to follow:

- Download a bi-weekly paycheck budget Excel template from a reputable source.

- Enter your income and expenses into the template, using the pre-designed layout to guide you.

- Customize the template to fit your needs, adding or removing categories as necessary.

- Use the calendar view to plan your expenses around your bi-weekly paychecks.

- Review your budget regularly, making adjustments as needed to stay on track.

Tips and Tricks for Sticking to Your Bi-Weekly Paycheck Budget

Sticking to your bi-weekly paycheck budget requires discipline and commitment. Here are some tips and tricks to help you stay on track: * Track your expenses regularly, using the Excel template to monitor your spending. * Prioritize your expenses, focusing on essential expenses such as rent, utilities, and food. * Cut back on non-essential expenses, such as dining out or entertainment. * Use the 50/30/20 rule, allocating 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. * Review your budget regularly, making adjustments as needed to stay on track.Common Mistakes to Avoid When Creating a Bi-Weekly Paycheck Budget

When creating a bi-weekly paycheck budget, there are several common mistakes to avoid. These include:

- Failing to account for irregular expenses, such as car maintenance or property taxes.

- Not prioritizing essential expenses, such as rent or utilities.

- Overestimating income or underestimating expenses.

- Failing to review and adjust the budget regularly.

- Not using a budgeting template or tool to help track expenses and stay organized.

Best Practices for Managing Your Bi-Weekly Paycheck Budget

To get the most out of your bi-weekly paycheck budget, it's essential to follow best practices for managing your finances. These include: * Using a budgeting app or spreadsheet to track your expenses and stay organized. * Setting financial goals, such as saving for a down payment on a house or paying off debt. * Prioritizing needs over wants, focusing on essential expenses such as rent and utilities. * Building an emergency fund to cover unexpected expenses. * Reviewing and adjusting your budget regularly to stay on track.Conclusion and Next Steps

Creating a bi-weekly paycheck budget using an Excel template is a great way to take control of your finances and achieve your financial goals. By following the steps outlined in this article and avoiding common mistakes, you can create a budget that works for you. Remember to review and adjust your budget regularly, prioritizing essential expenses and building an emergency fund to cover unexpected expenses.

Final Thoughts

In conclusion, a bi-weekly paycheck budget Excel template is a powerful tool for managing your finances. By using this template and following best practices for budgeting, you can achieve financial stability and security. Don't be afraid to experiment and try new things – and don't hesitate to seek help if you need it. With the right tools and a little bit of discipline, you can create a budget that works for you and achieve your financial goals.Bi-Weekly Paycheck Budget Image Gallery

What is a bi-weekly paycheck budget?

+A bi-weekly paycheck budget is a type of budget that takes into account the irregularity of bi-weekly paychecks. It helps individuals plan their expenses around their paychecks, ensuring that they have enough money to cover essential expenses.

How do I create a bi-weekly paycheck budget using an Excel template?

+To create a bi-weekly paycheck budget using an Excel template, simply download a template from a reputable source, enter your income and expenses, and customize the template to fit your needs. Use the calendar view to plan your expenses around your bi-weekly paychecks.

What are the benefits of using an Excel template for bi-weekly paycheck budgeting?

+The benefits of using an Excel template for bi-weekly paycheck budgeting include ease of use, flexibility, and automatic calculations. The template provides a pre-designed layout that you can fill in with your own data, making it simple to get started.

We hope this article has provided you with a comprehensive guide to creating a bi-weekly paycheck budget using an Excel template. By following the steps outlined in this article and avoiding common mistakes, you can create a budget that works for you and achieve financial stability and security. Don't hesitate to reach out if you have any questions or need further assistance. Share your thoughts and experiences with bi-weekly paycheck budgeting in the comments below, and don't forget to share this article with your friends and family who may benefit from it.