Intro

Discover top Excel budget templates for personal finance, expense tracking, and financial planning, featuring customizable spreadsheets and formulas for effective money management and budgeting.

Creating a budget is an essential step in managing personal or business finances effectively. It helps in tracking income and expenses, making informed financial decisions, and achieving long-term financial goals. Microsoft Excel is a powerful tool that can be used to create a budget, thanks to its flexibility and the ability to perform complex calculations. Excel budget templates are pre-designed spreadsheets that simplify the budgeting process by providing a structured format for organizing financial data. Here, we will explore the 5 best Excel budget templates that can help individuals and businesses manage their finances efficiently.

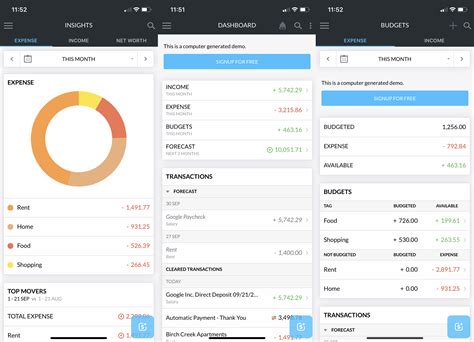

Excel budget templates offer a variety of benefits, including ease of use, customization, and the ability to automate calculations. They can be used for personal budgeting, business budgeting, or even for specific financial projects. With an Excel budget template, users can easily input their income and expenses, categorize transactions, and generate reports to analyze their financial situation. This helps in identifying areas where costs can be reduced, making it easier to stick to a budget and achieve financial stability.

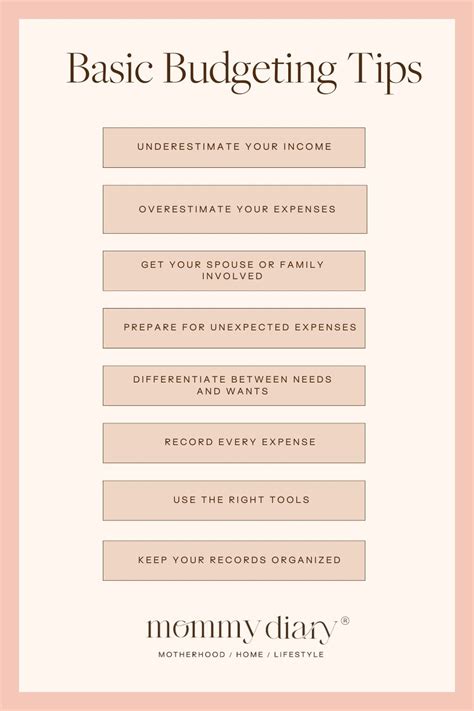

For individuals, creating a budget is crucial for managing daily expenses, saving for the future, and paying off debts. A well-structured budget helps in prioritizing needs over wants, ensuring that essential expenses are covered before discretionary spending. Businesses also benefit from budgeting, as it enables them to forecast revenue, manage operational costs, and make strategic financial decisions. Whether you are managing personal finances or overseeing a company's financial operations, using an Excel budget template can streamline the budgeting process and provide valuable insights into financial performance.

Personal Budget Template

Business Budget Template

Zero-Based Budget Template

50/30/20 Budget Template

Event Budget Template

Benefits of Using Excel Budget Templates

Using Excel budget templates offers several benefits, including: - Ease of use: Templates are pre-designed, making it easy for users to input their financial data without needing to create a budget from scratch. - Customization: Excel templates can be modified to fit specific financial needs, whether personal or business. - Automation: Formulas within the templates automate calculations, reducing the risk of errors and saving time. - Flexibility: Templates can be used for various financial planning purposes, from personal budgeting to business financial planning. - Analysis: The data entered into the templates can be used to generate reports and charts, helping in the analysis of financial performance and decision-making.How to Choose the Right Excel Budget Template

Choosing the right Excel budget template depends on several factors, including the purpose of the budget, the complexity of financial data, and personal or business financial goals. Here are some steps to follow: 1. **Identify Needs**: Determine what the budget is for (personal, business, event) and what features are required (e.g., investment tracking, budgeting for specific expenses). 2. **Search for Templates**: Look for templates that match the identified needs. Microsoft and other reputable sources offer a wide range of free and paid templates. 3. **Evaluate Flexibility**: Choose a template that can be easily customized to fit specific financial situations. 4. **Consider Automation**: Opt for templates with built-in formulas to automate calculations and reduce errors. 5. **Review and Test**: Before committing to a template, review its structure and test it with sample data to ensure it meets all requirements.Excel Budget Templates Image Gallery

What is the best way to choose an Excel budget template?

+The best way to choose an Excel budget template is to identify your specific financial needs, search for templates that match those needs, and evaluate their flexibility, automation, and reviews before making a selection.

How can I customize an Excel budget template?

+You can customize an Excel budget template by adding or removing categories, modifying formulas, and changing the layout to fit your specific financial situation and goals.

What are the benefits of using Excel for budgeting?

+The benefits of using Excel for budgeting include ease of use, customization, automation of calculations, and the ability to generate reports and charts for financial analysis and decision-making.

Can Excel budget templates be used for both personal and business finances?

+Yes, Excel budget templates can be used for both personal and business finances. There are templates specifically designed for personal budgeting, business budgeting, and even for managing the finances of specific events or projects.

How often should I review and update my budget?

+

In conclusion, Excel budget templates are invaluable tools for managing finances, whether for personal or business purposes. They offer a structured approach to budgeting, allowing for easy tracking of income and expenses, categorization of transactions, and analysis of financial performance. By choosing the right template and customizing it to fit specific needs, individuals and businesses can make informed financial decisions, achieve their financial goals, and ensure long-term financial stability. We invite readers to share their experiences with Excel budget templates, ask questions, and explore the gallery of images provided for more insights into effective budgeting practices.