Intro

Discover expert beneficiary planner tips to secure your legacy, including estate planning, inheritance strategies, and tax optimization techniques for a smooth wealth transfer process.

As we navigate the complexities of estate planning, beneficiary designations often become a crucial aspect that requires careful consideration. The process of selecting and managing beneficiaries can be daunting, especially when considering the long-term implications of our decisions. However, with the right approach and a clear understanding of the key principles involved, individuals can ensure that their assets are distributed according to their wishes. In this article, we will delve into the world of beneficiary planning, exploring the essential tips and strategies that can help you make informed decisions about your estate.

The importance of beneficiary planning cannot be overstated. It is a critical component of estate planning that allows individuals to specify who should receive their assets in the event of their passing. This can include retirement accounts, life insurance policies, and other assets that are subject to beneficiary designations. By taking control of beneficiary planning, individuals can avoid unnecessary complications and ensure that their loved ones are protected. Whether you are just starting to consider your estate planning options or are looking to review and update your existing designations, understanding the beneficiary planning process is essential.

Effective beneficiary planning involves more than just naming a beneficiary; it requires a thorough understanding of the rules and regulations that govern beneficiary designations. For instance, the beneficiary designations for retirement accounts and life insurance policies are governed by federal law, which can sometimes conflict with state laws. Moreover, the tax implications of beneficiary designations can be significant, and failing to consider these implications can result in unintended consequences. By educating yourself on the intricacies of beneficiary planning, you can make informed decisions that align with your overall estate planning goals.

Understanding Beneficiary Designations

To create an effective beneficiary plan, it is essential to understand the different types of beneficiary designations and how they work. Beneficiaries can be classified into primary and secondary beneficiaries. Primary beneficiaries are the first in line to receive the assets, while secondary beneficiaries, also known as contingent beneficiaries, will receive the assets if the primary beneficiary predeceases the account owner. Understanding the distinction between these two types of beneficiaries is crucial in ensuring that your assets are distributed according to your wishes.

Types of Beneficiaries

When selecting beneficiaries, individuals have several options to consider. These can include spouses, children, other relatives, friends, and even charitable organizations. The choice of beneficiary will depend on the individual's personal circumstances and estate planning goals. For example, a married couple may choose to name each other as the primary beneficiary, with their children serving as secondary beneficiaries. Alternatively, an individual may choose to name a trust as the beneficiary, which can provide additional control and flexibility in the distribution of assets.Beneficiary Planner Tips

Here are five beneficiary planner tips to consider:

- Review and update your beneficiary designations regularly to ensure they remain consistent with your estate planning goals.

- Consider naming a trust as the beneficiary to provide additional control and flexibility in the distribution of assets.

- Be aware of the tax implications of beneficiary designations and plan accordingly to minimize tax liabilities.

- Ensure that your beneficiary designations are consistent across all relevant accounts and policies.

- Seek professional advice from an estate planning attorney or financial advisor to ensure that your beneficiary plan aligns with your overall estate planning strategy.

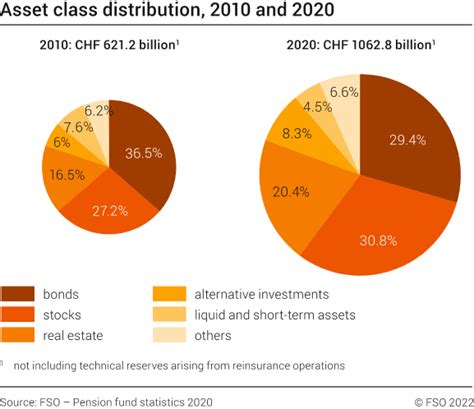

Minimizing Tax Liabilities

One of the critical aspects of beneficiary planning is minimizing tax liabilities. The tax implications of beneficiary designations can be significant, and failing to consider these implications can result in unintended consequences. For example, the distribution of retirement accounts to beneficiaries can be subject to income tax, which can erode the value of the assets. By understanding the tax rules that govern beneficiary designations, individuals can plan accordingly to minimize tax liabilities and ensure that their beneficiaries receive the maximum amount possible.Common Mistakes to Avoid

When creating a beneficiary plan, there are several common mistakes to avoid. These can include:

- Failing to name a beneficiary or naming a minor as the beneficiary without proper planning.

- Not reviewing and updating beneficiary designations regularly.

- Not considering the tax implications of beneficiary designations.

- Not ensuring that beneficiary designations are consistent across all relevant accounts and policies.

- Not seeking professional advice from an estate planning attorney or financial advisor.

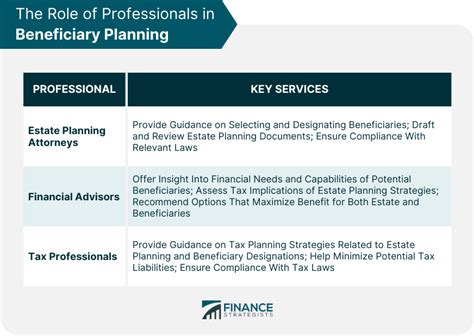

Seeking Professional Advice

Given the complexity of beneficiary planning, seeking professional advice from an estate planning attorney or financial advisor is essential. These professionals can provide valuable guidance and help individuals create a beneficiary plan that aligns with their overall estate planning strategy. They can also help individuals avoid common mistakes and ensure that their beneficiary designations are consistent with their wishes.Case Studies and Examples

To illustrate the importance of beneficiary planning, let's consider a few case studies and examples. For instance, a married couple with two children may choose to name each other as the primary beneficiary, with their children serving as secondary beneficiaries. Alternatively, an individual may choose to name a trust as the beneficiary, which can provide additional control and flexibility in the distribution of assets. By examining these case studies and examples, individuals can gain a better understanding of the beneficiary planning process and how it can be applied in different scenarios.

Best Practices for Beneficiary Planning

When creating a beneficiary plan, there are several best practices to follow. These can include: * Reviewing and updating beneficiary designations regularly. * Considering the tax implications of beneficiary designations. * Ensuring that beneficiary designations are consistent across all relevant accounts and policies. * Seeking professional advice from an estate planning attorney or financial advisor. * Naming a trust as the beneficiary to provide additional control and flexibility in the distribution of assets.Gallery of Beneficiary Planning

Beneficiary Planning Image Gallery

Frequently Asked Questions

What is beneficiary planning?

+Beneficiary planning is the process of selecting and managing beneficiaries for your assets, such as retirement accounts and life insurance policies.

Why is beneficiary planning important?

+Beneficiary planning is important because it allows you to specify who should receive your assets in the event of your passing, ensuring that your wishes are carried out and your loved ones are protected.

How do I create a beneficiary plan?

+To create a beneficiary plan, you should review and update your beneficiary designations regularly, consider the tax implications of beneficiary designations, and seek professional advice from an estate planning attorney or financial advisor.

What are the common mistakes to avoid in beneficiary planning?

+The common mistakes to avoid in beneficiary planning include failing to name a beneficiary, not reviewing and updating beneficiary designations regularly, and not considering the tax implications of beneficiary designations.

How can I ensure that my beneficiary designations are consistent across all relevant accounts and policies?

+To ensure that your beneficiary designations are consistent across all relevant accounts and policies, you should review and update your beneficiary designations regularly and seek professional advice from an estate planning attorney or financial advisor.

As we conclude our exploration of beneficiary planning, it is essential to remember that this process is an ongoing one. Beneficiary designations should be reviewed and updated regularly to ensure that they remain consistent with your estate planning goals. By following the tips and strategies outlined in this article, individuals can create a beneficiary plan that provides peace of mind and ensures that their assets are distributed according to their wishes. We invite you to share your thoughts and experiences with beneficiary planning in the comments section below. Whether you have questions about the process or would like to share your own tips and strategies, we encourage you to engage with our community and help others navigate the complex world of estate planning.