Intro

Discover Barbara ONeills legacy in her obituary, honoring her life, achievements, and impact, with condolences, funeral details, and memories shared by loved ones, family, and friends, celebrating her passing and remembering her spirit.

Barbara O'Neill was a renowned expert in the field of personal finance and financial planning. Her work had a significant impact on the lives of many individuals and families, providing them with the knowledge and tools necessary to manage their finances effectively. With a career spanning several decades, O'Neill dedicated herself to helping people achieve financial stability and security.

Throughout her career, Barbara O'Neill was a prolific writer and educator, authoring numerous books, articles, and online courses on personal finance and financial planning. Her work was widely acclaimed, and she was recognized as one of the leading experts in her field. O'Neill's approach to financial planning was holistic, taking into account not just the financial aspects but also the emotional and psychological factors that influence an individual's relationship with money.

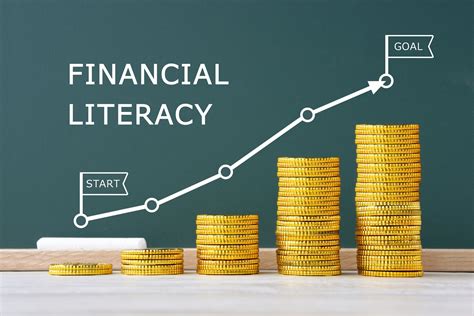

O'Neill's contributions to the field of personal finance were numerous, and her legacy continues to inspire and educate people around the world. Her work emphasized the importance of financial literacy, budgeting, saving, and investing, as well as the need to avoid debt and build emergency funds. She also stressed the importance of having a long-term perspective when it comes to financial planning, encouraging individuals to set goals and work towards achieving them.

Early Life and Career

As her career progressed, O'Neill became increasingly involved in education and research, recognizing the need for accessible and engaging financial education. She developed curricula and educational materials for various audiences, from high school students to retirees, aiming to empower them with the knowledge necessary to navigate the complex world of personal finance.

Contributions to Financial Education

O'Neill's work extended beyond traditional educational settings. She was a frequent guest on television and radio programs, using these platforms to reach a wider audience and discuss topics ranging from budgeting and saving to investing and retirement planning. Her ability to simplify complex financial concepts made her a sought-after commentator and advisor.

Awards and Recognition

O'Neill's awards and recognitions included prestigious honors from financial planning associations, awards for excellence in financial education, and community service awards. She was also named among the most influential people in the financial planning industry, a testament to her influence and the respect she commanded among her peers.

Legacy and Impact

Her impact extends beyond the professional community to the countless individuals and families whose lives she touched through her work. By providing them with the tools and knowledge necessary to manage their finances effectively, O'Neill helped people achieve financial stability, security, and peace of mind. Her legacy continues to grow as her work inspires new initiatives and programs in financial education and planning.

Key Principles of Financial Planning

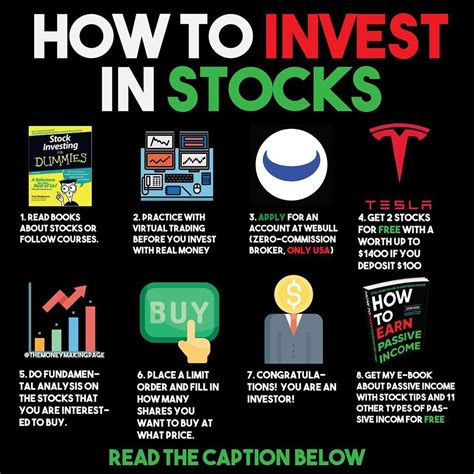

Some of the key principles of financial planning that Barbara O'Neill advocated for include: - **Budgeting:** Creating a budget that accounts for all income and expenses to understand where money is going and to make informed financial decisions. - **Saving:** Building an emergency fund to cover unexpected expenses and saving for long-term goals, such as retirement or buying a home. - **Investing:** Investing wisely to grow wealth over time, considering risk tolerance and financial goals. - **Debt Management:** Avoiding high-interest debt and managing existing debt to minimize its impact on financial well-being. - **Financial Literacy:** Continuously learning about personal finance and staying informed about changes in the financial landscape.Practical Applications of Financial Planning

O'Neill's approach to financial planning was not just about managing money; it was about creating a fulfilling life. She believed that financial security and stability are foundational to achieving personal and professional goals. By applying the principles she outlined, individuals can work towards achieving financial independence and living a more secure and satisfying life.

Challenges in Financial Planning

Barbara O'Neill's work addressed these challenges by providing accessible and actionable advice. She emphasized the importance of starting small, being consistent, and seeking professional advice when needed. O'Neill also recognized the role of technology in financial planning, advocating for the use of financial tools and apps to track spending, save money, and invest wisely.

Future of Financial Planning

As technology continues to advance, we can expect to see more personalized and accessible financial planning tools. Artificial intelligence, machine learning, and data analytics will play increasingly important roles in providing tailored financial advice and automating financial tasks. However, despite these technological advancements, the human element of financial planning—understanding individual goals, values, and circumstances—will remain essential.

Gallery of Financial Planning Images

Financial Planning Image Gallery

Frequently Asked Questions

What is the importance of financial planning?

+Financial planning is crucial for achieving financial stability and security. It involves creating a comprehensive plan to manage your finances, including budgeting, saving, investing, and managing debt, to meet your short-term and long-term goals.

How do I start financial planning?

+To start financial planning, begin by assessing your current financial situation, including your income, expenses, assets, and debts. Then, set clear financial goals, both short-term and long-term, and develop a strategy to achieve them. This may involve creating a budget, starting a savings plan, investing, and managing debt.

Why is financial literacy important?

+Financial literacy is essential because it empowers individuals with the knowledge and skills necessary to make informed decisions about their financial lives. It helps in managing finances effectively, avoiding debt, and building wealth over time. Financial literacy is crucial for achieving financial stability and security.

In reflection, Barbara O'Neill's life and work serve as a testament to the power of dedication, expertise, and passion. Her legacy in the field of personal finance and financial planning continues to inspire and educate, reminding us of the importance of financial literacy, planning, and responsibility. As we move forward, embracing the principles she advocated for, we honor her memory and work towards creating a more financially stable and secure future for ourselves and for generations to come. We invite you to share your thoughts, experiences, and questions about financial planning and literacy, and to explore the resources and tools available to help you achieve your financial goals. Together, we can build a community that values financial education and supports each other in the pursuit of financial well-being.