Intro

Boost profitability with 5 Bar P&L tips, including revenue growth, cost control, and expense management strategies to maximize earnings and minimize losses in your bar business.

Understanding and managing a 5 Bar P&L (Profit and Loss statement) is crucial for businesses, especially those in the financial and trading sectors. A 5 Bar P&L provides a concise overview of a company's or a trader's financial performance over a specific period, typically based on the last five trading days or bars. This tool is essential for assessing profitability, identifying trends, and making informed decisions. In this article, we will delve into the importance of a 5 Bar P&L, its components, and provide actionable tips on how to use it effectively for better financial management and trading strategies.

The 5 Bar P&L is a snapshot of the financial health of a business or trading account, reflecting revenues, costs, and net income over five trading bars. Each bar represents a trading day or a specific time frame, and the P&L statement for each bar includes revenues, direct costs, and operating expenses to calculate the net profit or loss. This tool is invaluable for traders and businesses alike, as it helps in identifying profitable trends, managing risks, and adjusting strategies to maximize returns.

Effective use of a 5 Bar P&L requires a deep understanding of its components and how they impact the overall financial performance. The statement typically includes gross profit, operating income, and net income, providing a clear picture of where the business is generating its profits and where costs can be optimized. By analyzing the 5 Bar P&L regularly, businesses and traders can quickly respond to changes in market conditions, customer behavior, or operational efficiency.

Understanding the 5 Bar P&L Structure

To maximize the benefits of a 5 Bar P&L, it's essential to understand its structure. The statement is divided into several key sections: revenues, cost of goods sold (COGS), gross profit, operating expenses, operating income, and net income. Each section provides critical information about the financial performance and health of the business or trading account. By closely examining these sections over the five-bar period, users can identify patterns, trends, and areas for improvement.

Key Components of the 5 Bar P&L

The revenues section outlines the total income generated over the five trading bars. This can include sales, commissions, or any other form of income relevant to the business or trading strategy. The COGS section details the direct costs associated with generating the revenues, such as production costs or the cost of purchasing the goods sold. The gross profit, calculated by subtracting COGS from revenues, gives an initial indication of profitability. Operating expenses, which include salaries, rent, and marketing expenses, are then subtracted from the gross profit to determine the operating income. Finally, net income is calculated by adjusting the operating income for taxes and other non-operating items.5 Bar P&L Tips for Enhanced Financial Management

- Regular Analysis: Regularly review the 5 Bar P&L to identify trends, both positive and negative. This helps in making timely decisions to capitalize on profitable trends and mitigate losses.

- Cost Optimization: Use the 5 Bar P&L to identify areas where costs can be optimized. By reducing unnecessary expenses, businesses and traders can improve their profitability.

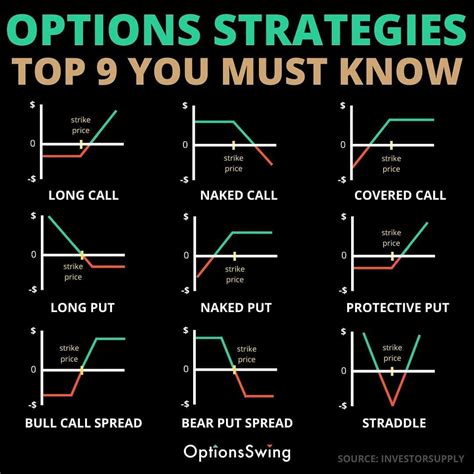

- Risk Management: The 5 Bar P&L can help in assessing risk. By analyzing the volatility of profits and losses over the five trading bars, users can adjust their risk management strategies to protect their capital.

- Strategy Adjustment: Based on the insights gained from the 5 Bar P&L, adjust trading or business strategies. This might involve changing product offerings, marketing strategies, or trading instruments to improve profitability.

- Performance Benchmarking: Use the 5 Bar P&L as a tool for benchmarking performance against industry peers or internal targets. This helps in evaluating the effectiveness of current strategies and identifying areas for improvement.

Implementing the 5 Bar P&L in Trading Strategies

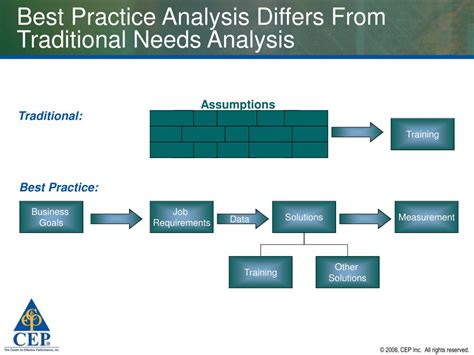

For traders, the 5 Bar P&L can be a powerful tool for evaluating and refining trading strategies. By analyzing the profit and loss over five trading bars, traders can assess the effectiveness of their entry and exit points, position sizing, and risk management techniques. This analysis can help in identifying profitable trading setups and minimizing losses.Best Practices for 5 Bar P&L Analysis

- Consistency: Ensure that the analysis is conducted consistently, using the same criteria and time frames for each 5 Bar P&L review.

- Accuracy: Verify the accuracy of the data used in the 5 Bar P&L. Small discrepancies can lead to significant errors in analysis and decision-making.

- Contextual Understanding: Consider the broader market and economic context when analyzing the 5 Bar P&L. External factors can significantly impact financial performance and should be taken into account when making decisions.

Common Mistakes to Avoid in 5 Bar P&L Analysis

Common mistakes include failing to consider external factors, not adjusting strategies based on 5 Bar P&L insights, and neglecting to review the statement regularly. By avoiding these pitfalls, businesses and traders can maximize the benefits of the 5 Bar P&L and improve their financial performance.Advanced 5 Bar P&L Strategies

For more sophisticated users, advanced strategies can be employed to further leverage the 5 Bar P&L. This includes integrating the 5 Bar P&L with other financial tools and indicators, using it to forecast future performance, and developing automated systems to analyze and act upon 5 Bar P&L data.

Future of 5 Bar P&L in Financial Management

The future of the 5 Bar P&L in financial management is promising, with advancements in technology and data analysis expected to enhance its utility. As businesses and traders become more adept at using data-driven insights, the 5 Bar P&L will play an increasingly critical role in strategic decision-making.Gallery of 5 Bar P&L Examples

5 Bar P&L Image Gallery

What is a 5 Bar P&L?

+A 5 Bar P&L is a profit and loss statement that provides a snapshot of financial performance over five trading bars, helping in identifying trends and making informed decisions.

How is the 5 Bar P&L used in trading?

+The 5 Bar P&L is used in trading to evaluate the effectiveness of trading strategies, identify profitable trends, and manage risks.

What are the key components of a 5 Bar P&L?

+The key components include revenues, cost of goods sold, gross profit, operating expenses, operating income, and net income.

In conclusion, the 5 Bar P&L is a vital tool for both businesses and traders, offering insights into financial performance, trends, and areas for improvement. By understanding its structure, implementing best practices, and avoiding common mistakes, users can leverage the 5 Bar P&L to enhance their financial management and trading strategies. As the financial landscape continues to evolve, the importance of data-driven decision-making will only grow, making the 5 Bar P&L an indispensable resource for achieving success. We invite our readers to share their experiences with the 5 Bar P&L, ask questions, and explore how this tool can be tailored to meet their specific needs in the ever-changing world of finance and trading.